Real Estate Market Intelligence August 2023

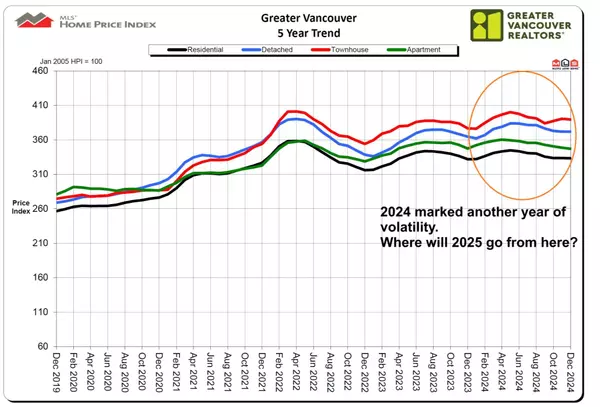

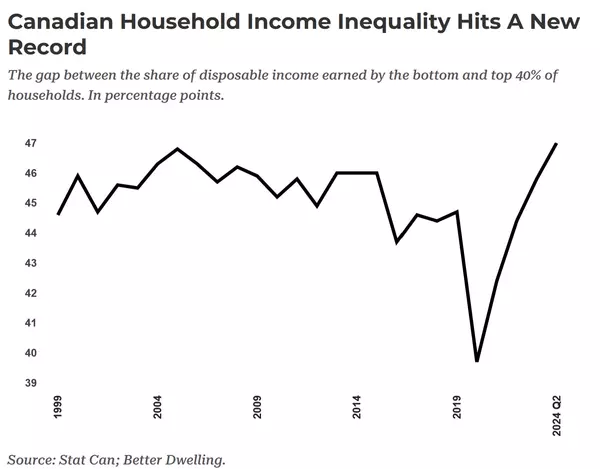

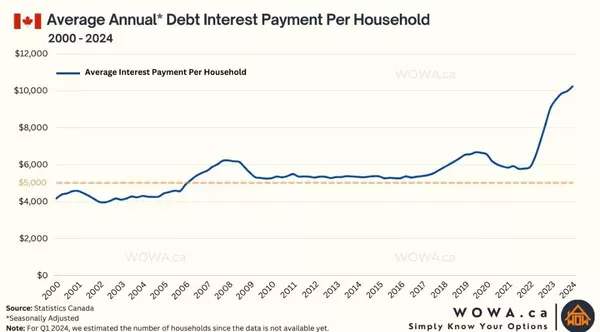

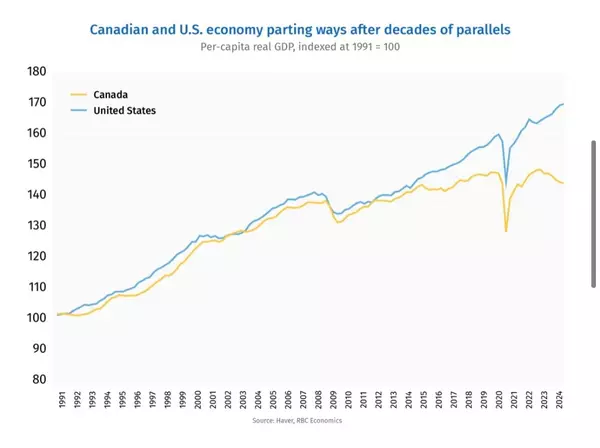

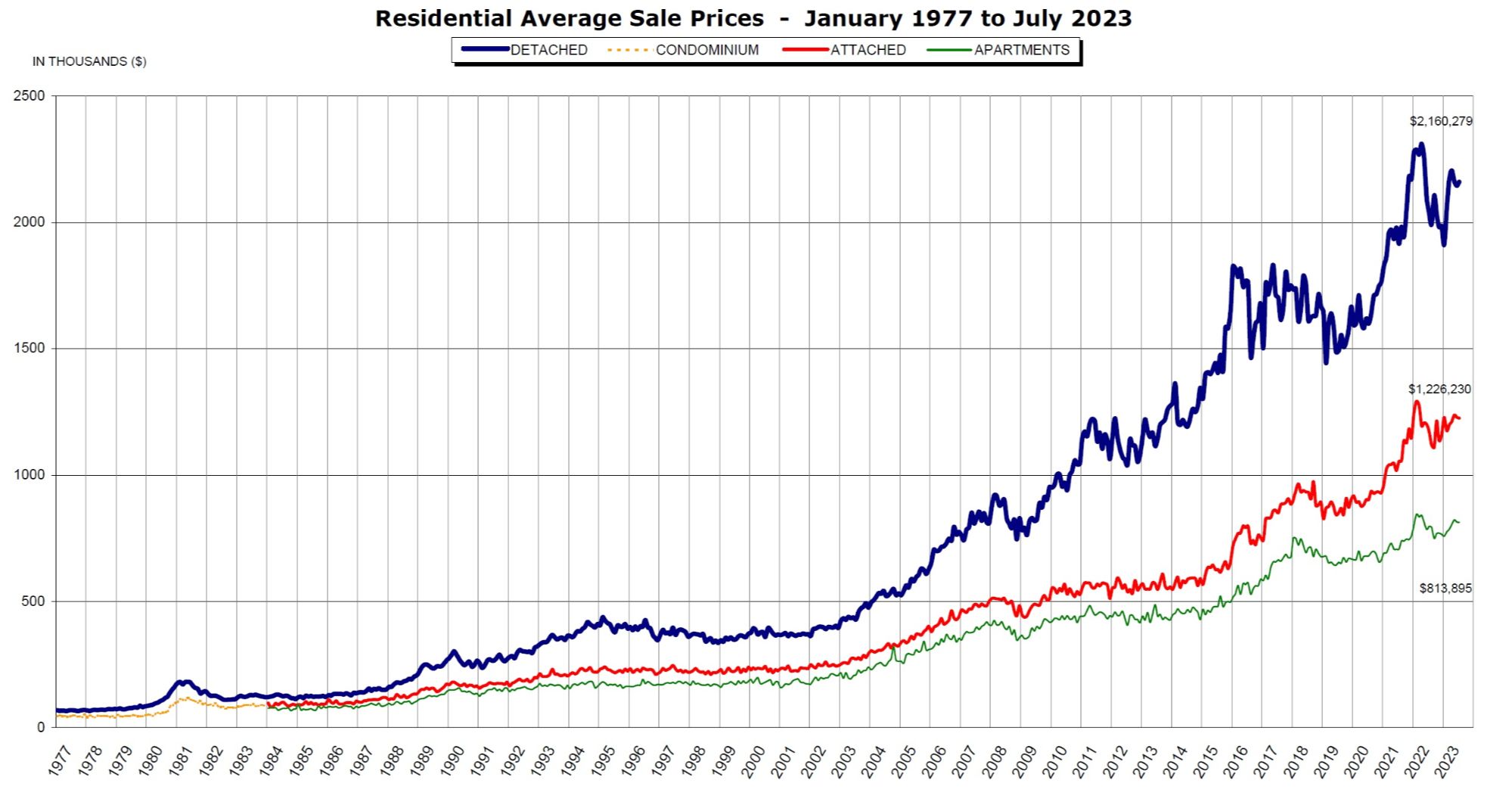

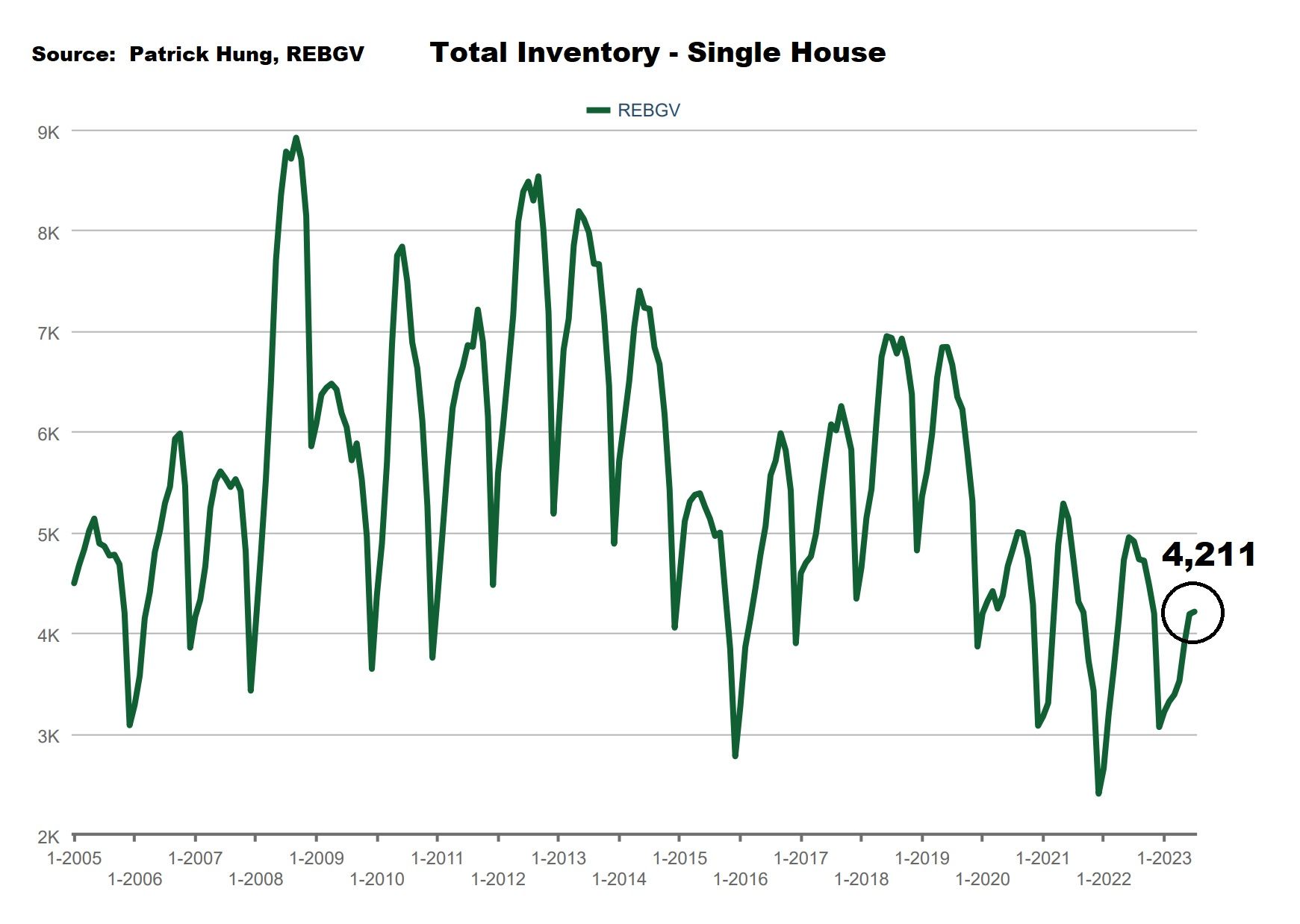

Mid-Summer is here, and with more time with family, friends and vacations means a typical slower real estate market. This July was no different, but so far, the market has been a story of two halves, where buyers and sellers views and opinions are polarizing. Buyers seem to have paused or ghosted the market, while Sellers continue to hold firm on price. Good news is that inventory is slowly rising, but supply is still at a 18 year low. I've noticed some interesting news headlines reporting last July's year-over-year sales has increased +28.9% year-over-year from July 2022. Please be cautious of the base effect, where July 2022 was an exceptionally slow month, when the Bank of Canada last year had the jumbo +1% rate hike, which sent chills down the market. Ironically, this past July, the rates are DOUBLE of last year (July 2022 rate was 2.5%, compared to July 2023 at 5%), but the transaction has INCREASED +28.9% from last year! Something just doesn't add up, right? Well, if we look closely, last year's summer was the "beginning" of rate hike cycle, and the uncertainty and the suspense were killing the Buyers demand, resulting in plummeting sales. This summer, we are near the end of the rate hike cycle, resulting in more optimism. The diminishing housing supply (still near 20 year low) also fuelled the price jump of +8.6% since the beginning of this year. Compound that with over $1.2 million new immigrants, and it's easy to see where the market is heading. For now, the seasonal summer dull drum combined with renewed fears of highest interest rates in 20 years has cooled the market. The Greater Vancouver reported 2,455 sales in July, which is still 15.6% BELOW the 10 year average. One of the key factors I've noticed is the strong underlying demand in the market. For example, in one of my recent single house listing in Richmond is a Court Order sale, and thus was listed at an attractive price of $400k below government assessment. The open house had generated over 70+ groups, and with that we have received multiple offers. I've spoken with other top producing agents and they are reporting similar trends, where Buyers are now snooping around and scouting for good deals, instead of taking immediate action like they did in the Spring. The strange part is, once they've found a good deal, they start having second thought and doubting the market: "Is this listing too good to be true?" or "Do I want to go into a bidding war?" This is a far cry from what happened three months ago, when Buyers were going all-in and pitted against each other for a similar listing. In the current rapidly evolving market, Buyers continue to find it more difficult to purchase, and Seller continue to find it more difficult to own. As the cloud still hovers around the upcoming rate announcement on Sept 7, the market will like continue to polarize. Expect this trend to continue into early Autumn. Meanwhile, enjoy the rest of the summer.

Some of the unique trends I've been observing:

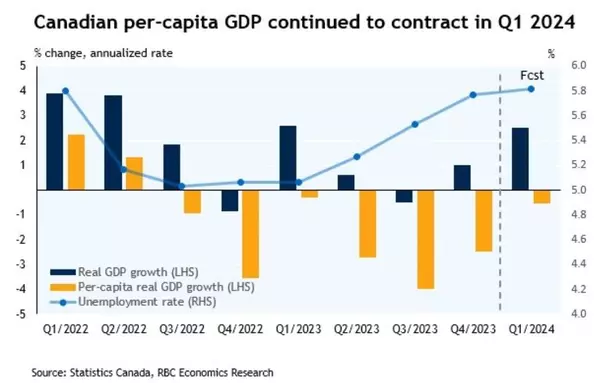

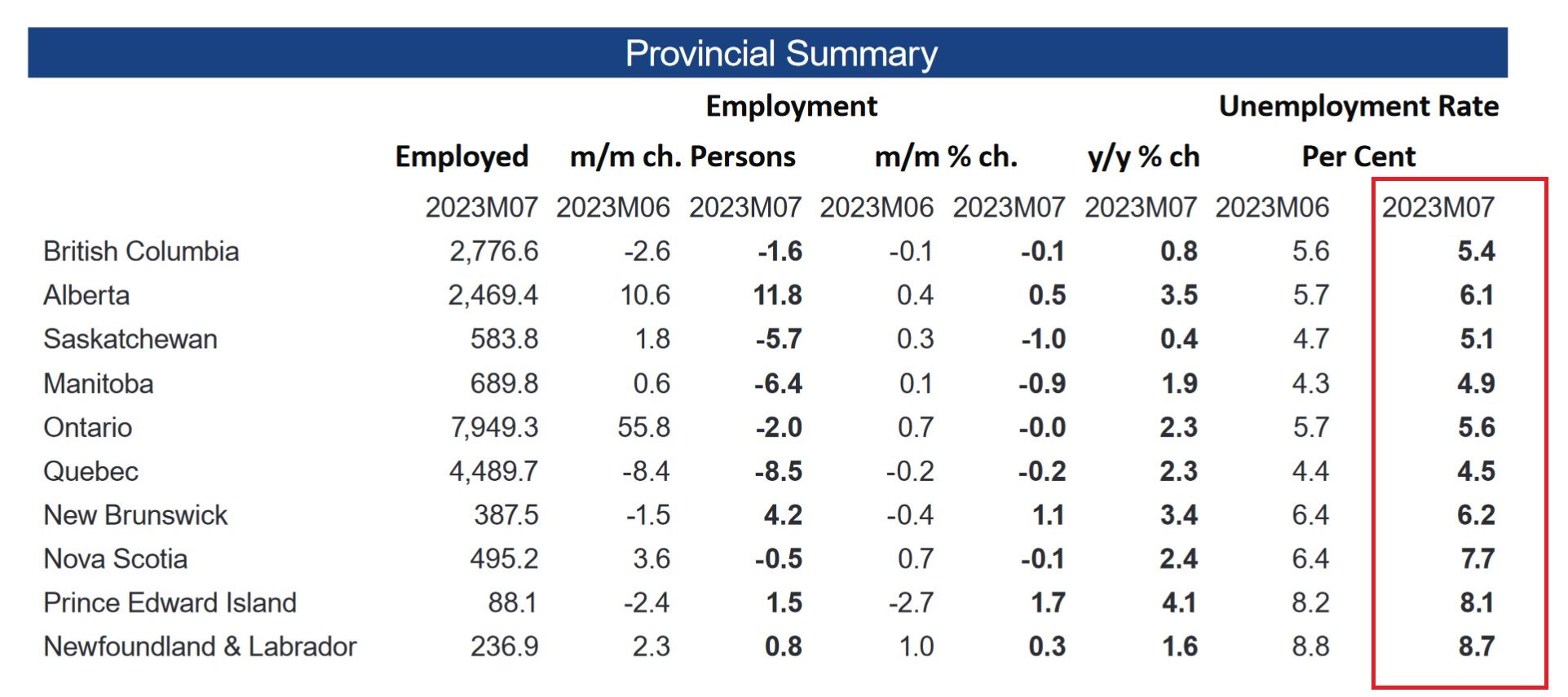

1. Canada's July inflation rose to 3.3% (compared to June's 2.8%), mainly due to increased gas prices. BC's inflation is performing a bit better at 3%. It remains to be seen how the Bank of Canada would interpret this going into the next rate announcement.

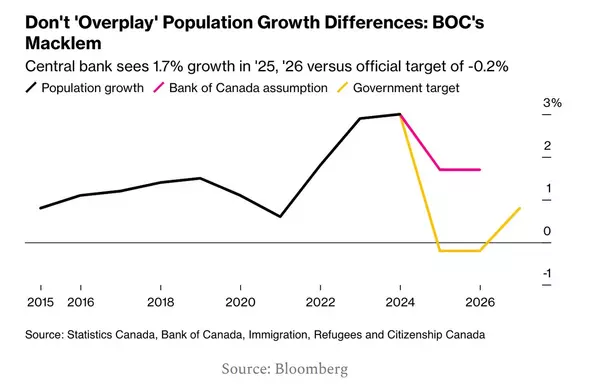

2. Sean Fraser, the newly appointed Canadian Minister of Housing, was ALSO the former Minister of Immigration. In a recent interview, Sean reiterates that immigration numbers will be either maintained at $1.2m or surpass the currently level. At the same time, Canadian new housing supply fell 10% in July. More immigrants, less housing. More demand, less supply. How is the real estate market not burning on both ends?

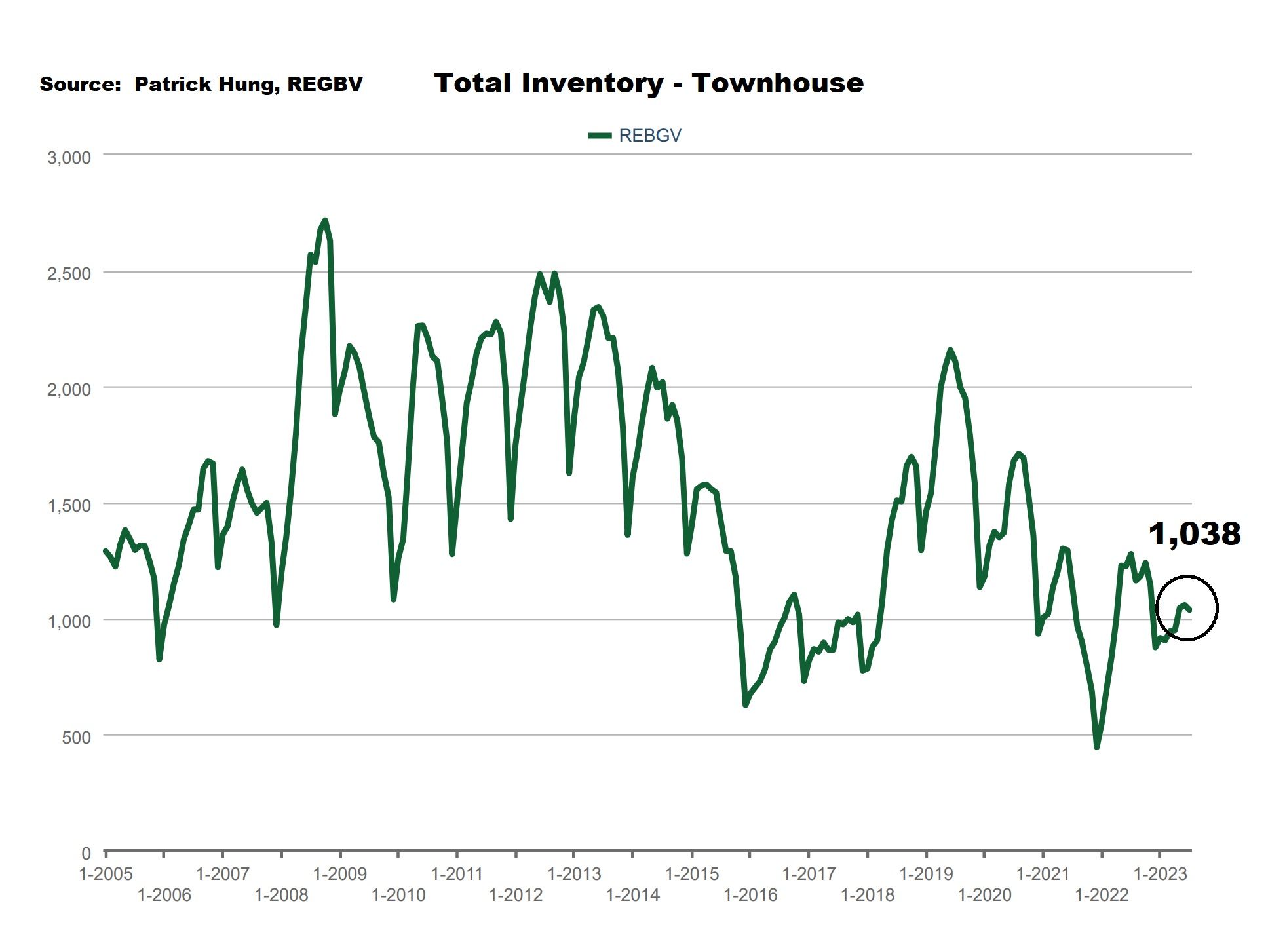

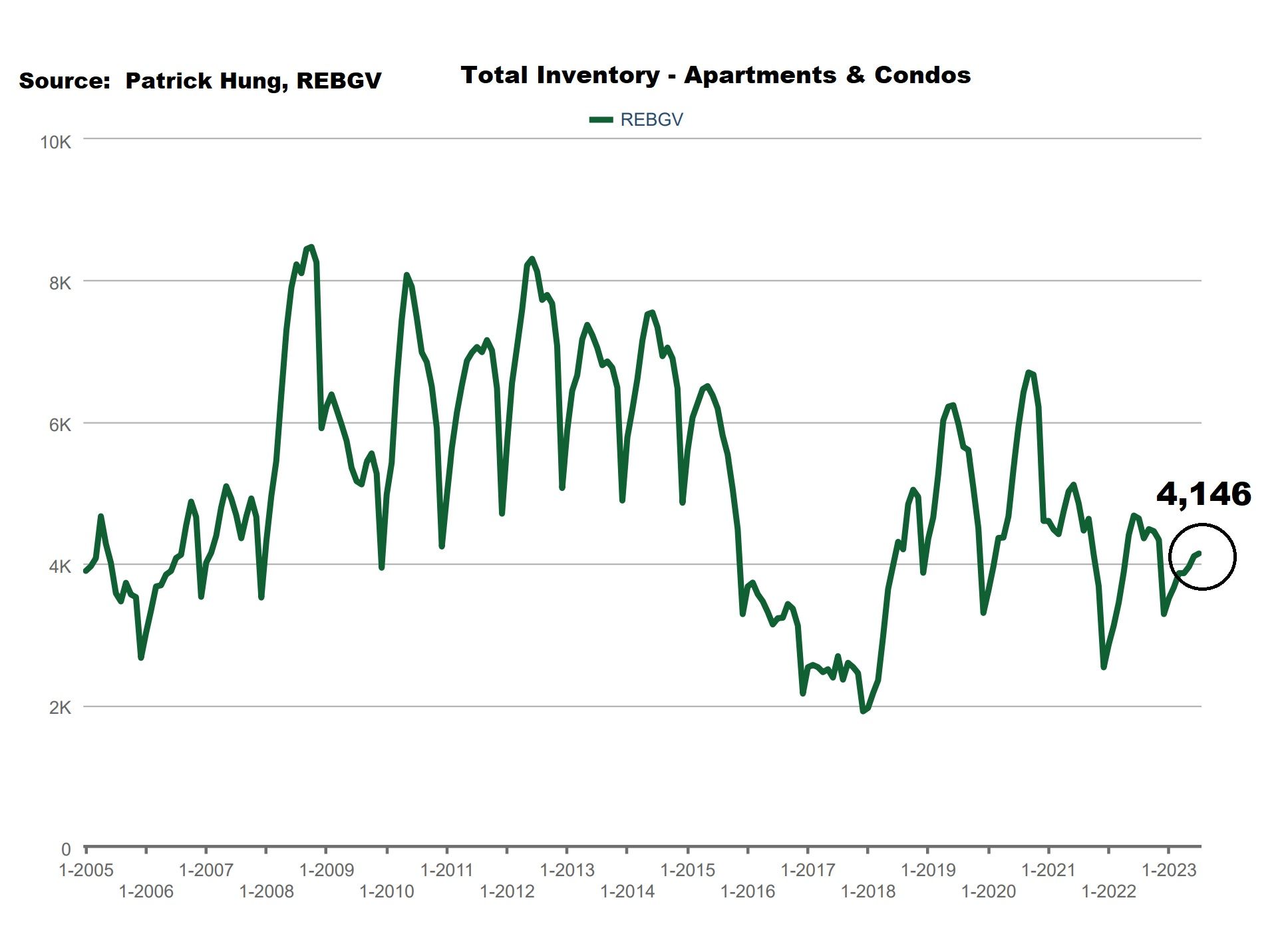

3. Buyers are ghosting the summer real estate market in July and August. Demand is still there, but just a strong pause button has been hit. Sales are -15.6% below the 10-year average, while inventory remains near 18 year low.

4. Bidding and multiple offers are few and far between, with rare occasions when the listing is competitively priced 10% below the market value.

5. Calgary real estate market is still going wild. Perhaps that's only place in Canada where it is still affordable and young families can have enough space.

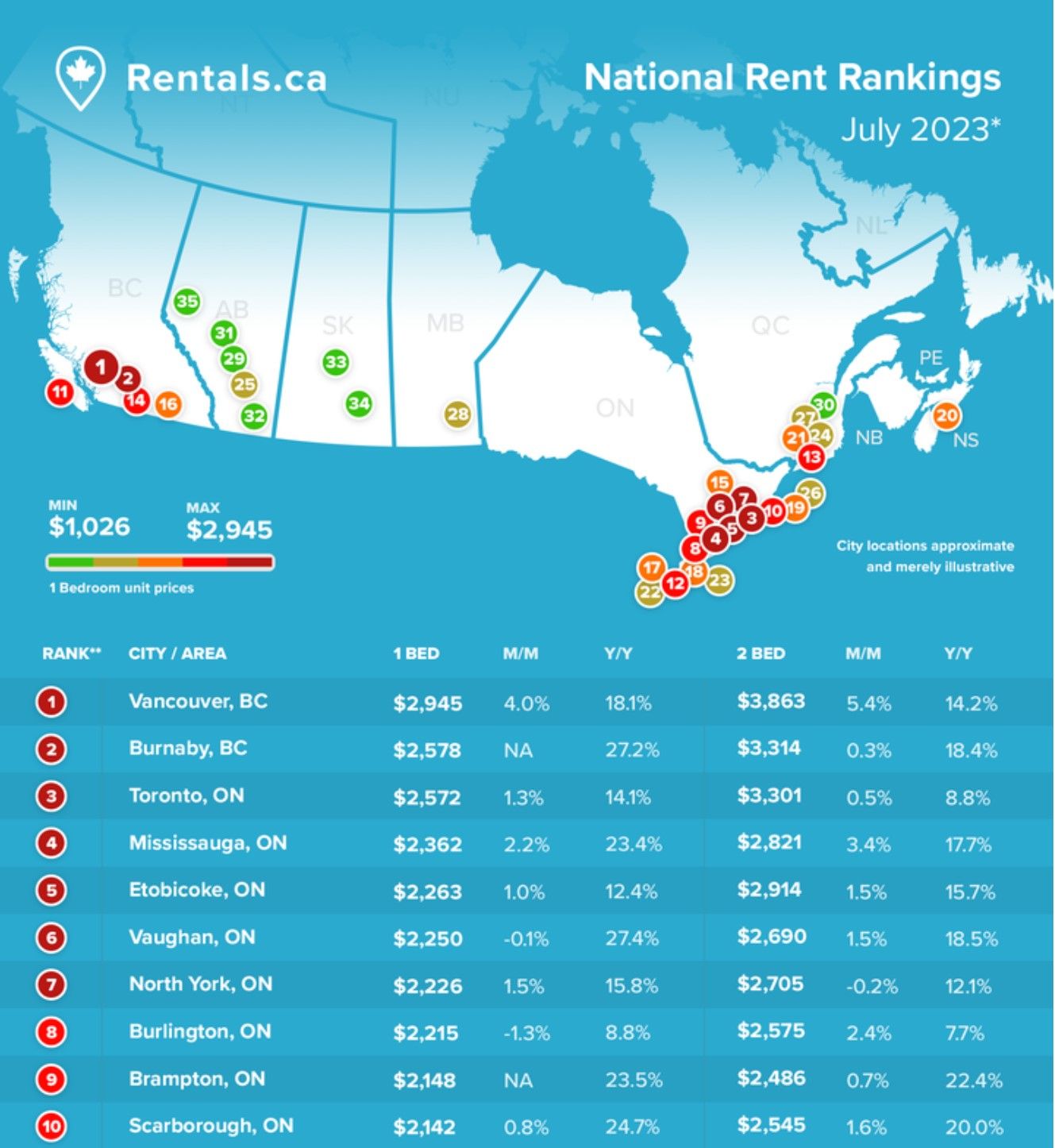

6. The summer rental market continue to rise in Canada, averaging $2,078, or a year-over-year increased of 21% from July 2022. This was mainly due to the return of international students housing, and prospective buyers forced to keep renting due to elevated interest rate. Vacancy rate remains near historically low at less than 1%. Vancouver again takes the rental crown, with average 1 bedroom monthly rent at $2,945, or 4% increase from previous month.

Here are the 3 highlights for July:

- Sales are slightly below the 10 year average, while total inventory is still at 18-year low.

- Supply is coming, albeit slowly. Single house market is entering into balanced market, while townhouse and apartment remain a Seller's market.

- Monthly price is near flat, with July's monthly increased at +0.6%. (June's was +1.3%).

Here are the in-depth statistics of the July:

- Last month's sales were -15.6% below the 10 year July's sales average.

- Month by month residential home sales dropped by a -22.1% compared to June 2023.

- Month by month new home listings decreased by -15.1% compared to June 2023.

- Last month's price adjustment was +0.6% compared to June 2023.

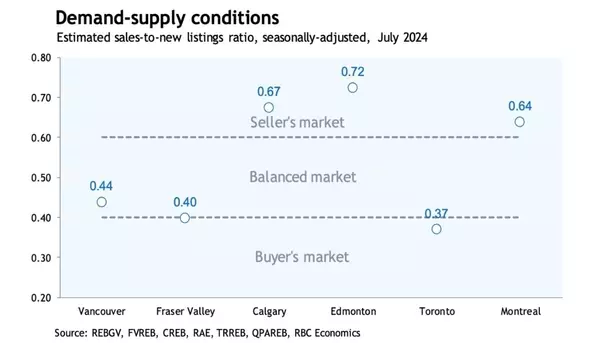

- Sales-to-listing (or % of homes sold) ratio is 31.4%. By property type, the ratio is 16.5% for single houses, 32% for townhouses, and 30.6% for apartments/condos.

Similar to last year when the rates starts to climb, the single house market again heads to a balanced market with July's 16.5% sales ratio (compared to 20.5% in June). This shouldn't come as a surprise as buyers, especially those looking to upsize to a house, finds it increasingly difficult due to the recent rate hikes. Thus, many single house upsizers have hit the pause button, causing the sales to dip. On the other handed, supply remains very tight, causing prices to hold firm. Noteworthy is that the single house Buyers are only sidelined but have NOT left the market. Demand remains robust, but just the urgency has faded. This remains the problem as we had seen similar situation last December, when the limited inventory caused such pent-up demand, which was released altogether this Spring creating multiple offer and bidding war. Single house Buyers can take a breather, at least for now. For the month of July, the areas with the most price gains are all in the outskirts in Bowen Island, Whistler and Sunshine Coast, at +4.7, +4.5% and +3.3% respectively. Conversely, the neighborhoods registered minor price drops and the least gains are Tssawwassen, Richmond, and West Vancouver, with -2.2%, 0% and +0.5% respectively. The detached home market shifts from a Seller market to a Balanced market, with average days on market dropping to 29 days (compared to 25 days last month), and month-to-month average price are up +1.1% (compared to +1.9% last month). Sales-to-listing ratio (% of homes sold) has increased dropped to 16.5% (compared to 20.9% last month).

Townhouse market, similar to the single house market, is starting to lose steam for the summer months. Inventory has dropped slight but overall remains flat, which is frustrating for most prospective Buyers. Hot commodities, such as $800-$900k entry level townhouse in Fraser Valley, are still getting lots of traffic and sells in usually two weeks. As for Greater Vancouver, townhouses under $1.6m are getting a lot of attention in both Vancouver West and Eastside. As for Burnaby and Ricmond, the sweet spot remains to below $1.2m. Since the recent rate hikes, it has become apparent that most Buyers refuses to go into multiple offers, and the townhouse market is no different. A good deal may go without an offer for the first 10 days, as Buyers continue the wait and see approach. Expect this trend to continue into early September before a traditionally busier Autumn. In July, the areas with the most townhouse price growths are Burnaby South, Burnaby East and Richmond, with all areas at +2% each. Conversely, the neighborhoods with the most significant price drops are in the outskirts at Maple Ridge, Sunshine Coast and Whistler, at -2%, -1.5% and -1.1% respectively. The townhouse market remains in the Sellers market, with average days on market remaining at 18 days (compared to 19 days last month). Month-to-month sale price has dropped slightly by +0.5% (compared to +1.5% increase last month). Sale-to-listing (% homes sold) ratio also slipped slightly as well to 32% (compared to 38.5% last month).

The apartment market was on an absolute tear, seeing prices matching of all time high two months ago. However, since the summer, we are starting to see a lot more collapsed sales. It is uncertain whether that was due to Buyer's remorse or financing difficulties due to rising rates. Either way, this is a sign that the apartment market is normalizing. What is unique about this particular segment is that the rental market continues to create upward pressure on apartment prices, especially the entry level 1 bedroom apartments. The Greater Vancouver rent continues to soar in the summer months, with heightened activities from To put it into perspective, an average 1-bedroom rent is now $2,945, and even having shared accommodation aka having a roommate costs $1,455 in Vancouver! It is hard to see how this trend will fade, especially when immigration continues to ramp up, while the new construction continue to slow down. This has recently become such a severe national issue that it is being actively debate in parliaments. As we know, housing supply doesn't replenish overnight as it takes months and months of oversupply to bring the current market back into balance. In the near future, expect this trend to get worst before it gets better. For the month of July, the best performing neighborhoods for apartments are all in the outskirts of Squamish, Whistler, and Sunshine Coast, posting +2.3%, +2.0% and +1.8% gains respectively. Conversely, the areas with the price drops were Burnaby North, North Vancouver and Maple Ridge, with -0.9%, -0.6%, and -0.5% respectively. The apartment and condo market remains a Seller's market, with average days on market increasing slight to 23 days (compared to 22 days last month). Month-to-month sale price is nearly flat at +0.6% (compared to +0.8% last month). Sale-to-listing (% homes sold) ratio dropped to 30.6% (compared to 39.4% last month).

Here are the Three Trends I'm Observing:

1. Rocketing Rent

BC again takes the crown in Canadian rental for both the highest rent ($2,945/month) and the highest monthly gain (+4%), with a year-over-year rent jumped by +18.1%. Even becoming a roommate at $1450/month is becoming unmanageable for some. (Source: Rentals.ca)

|

2. Burning At Both Ends

3. Incoming

|

Recent Posts