Real Estate Market Intelligence November 2024

Real Estate Market Intelligence

November 2024

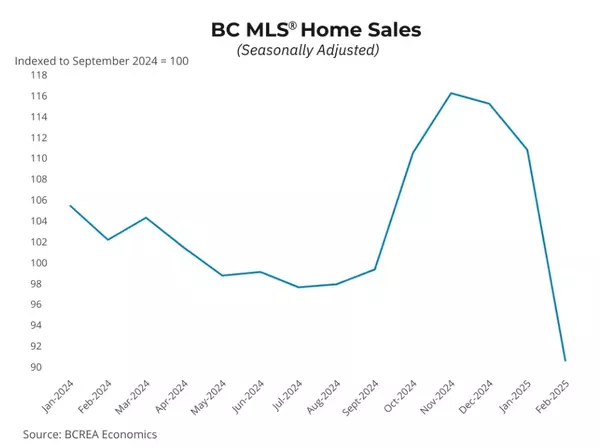

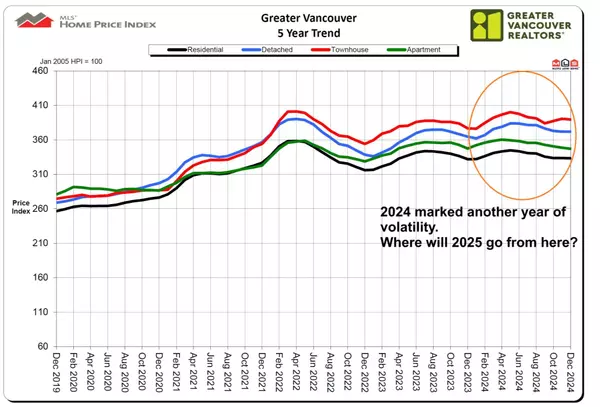

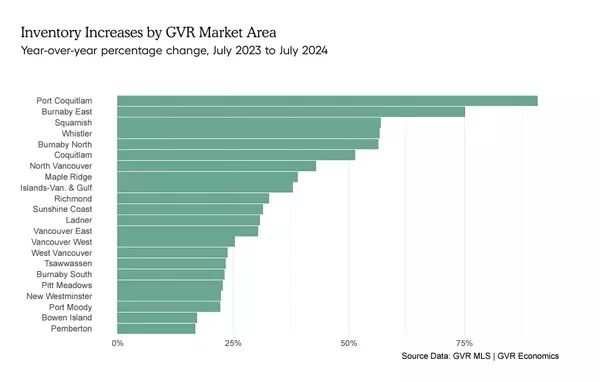

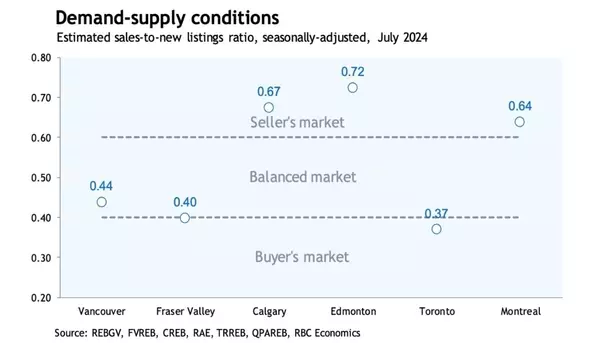

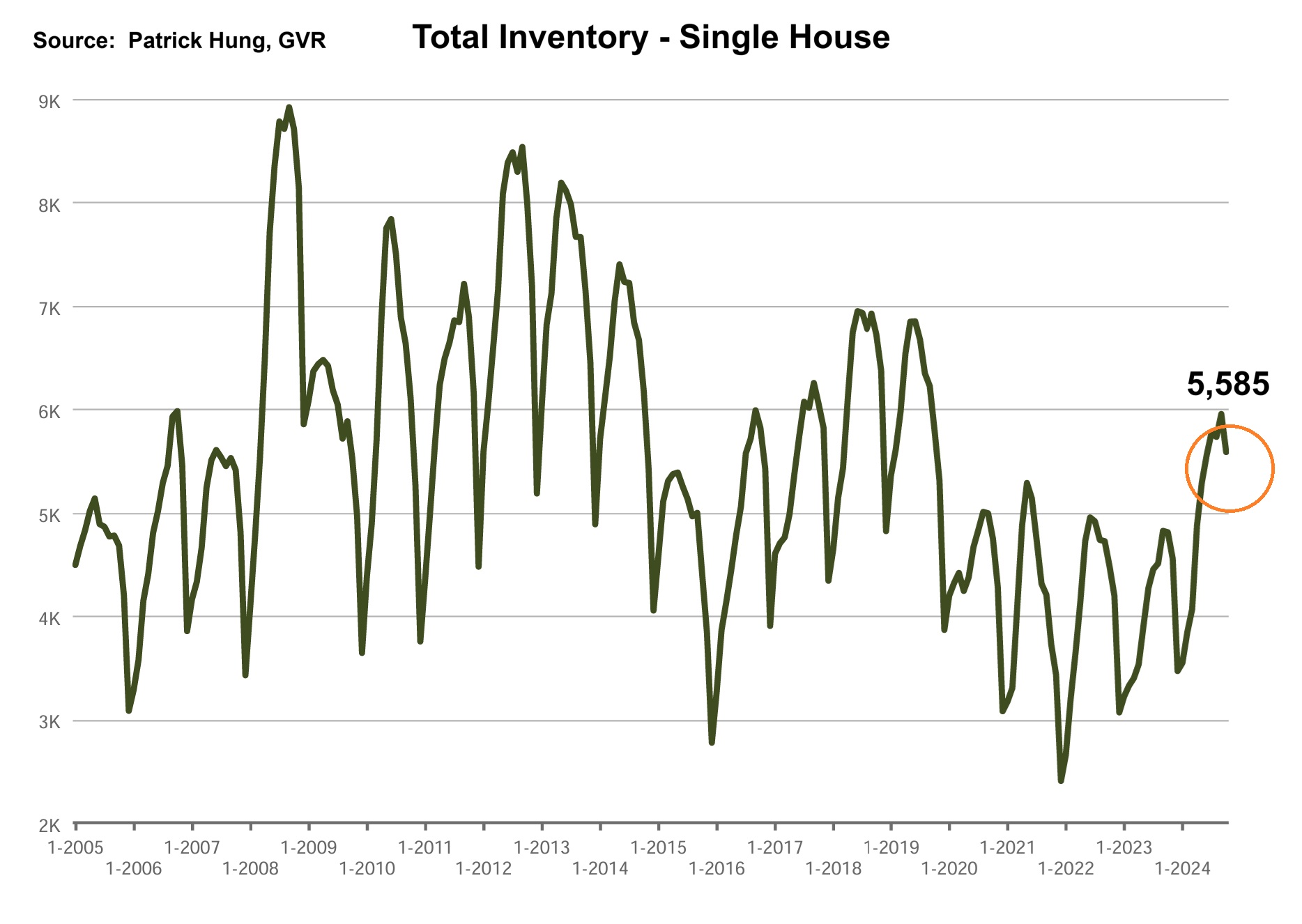

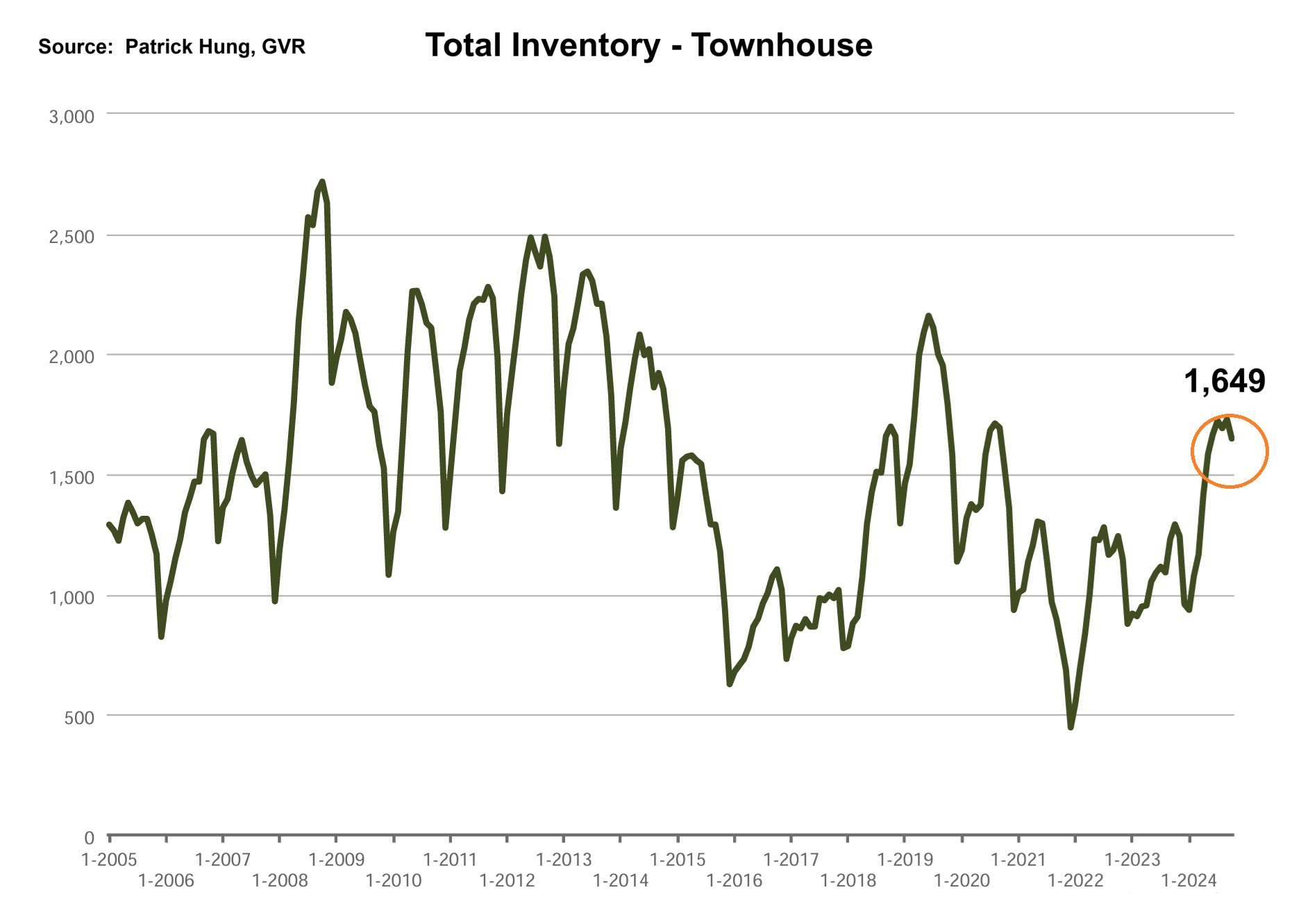

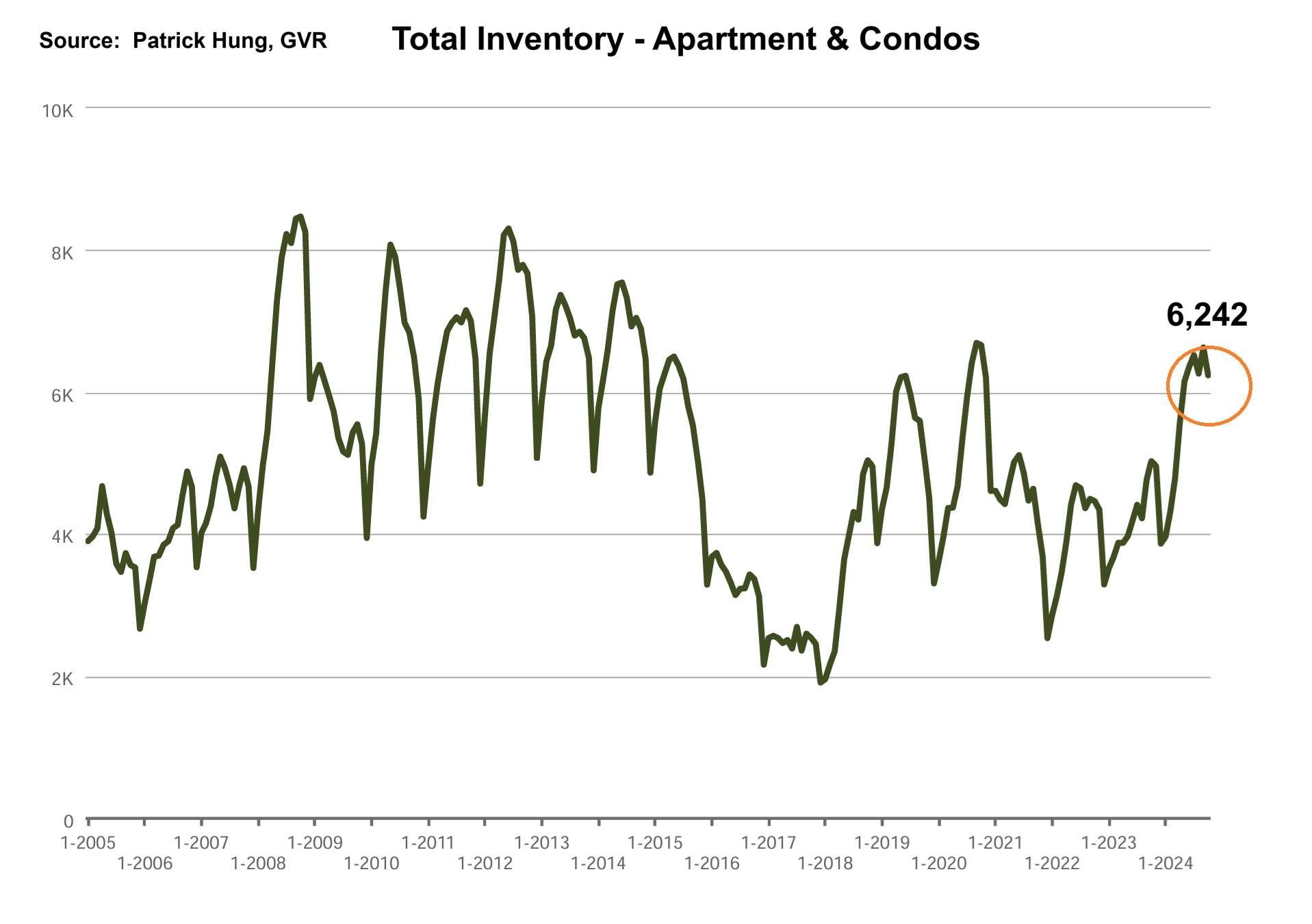

Winter was off to a wild start: jumbo rate cuts, BC provincial election, US election, and Canadian dollar depreciation. The past few weeks was certain filled with surprises (whether pleasant or not), and the Vancouver real estate market was in for the ride too. In what is a non-seasonal trend, October's real estate sales shot up significantly as Buyers suddenly turned optimistic (possibly due to the jumbo rate cut and pent-up demand). In fact, last month registered +31.9% more sales than the previous month, and is the 3rd highest monthly sales volume for 2024 only behind April and May. So have we finally turned a corner and heading towards recovery? One month doesn't make a trend, but we are starting to see stale listings (i.e homes that's been on the market for many months) that are getting sold, and lowball offers are vanishing. These could be signs that a market recovery is on the way, but with caution. Note that the October sale has increased, but it is still -5.5% below the 10 year average. Also, the total inventory is still +26.2% over the 10 year average. What this means is, some segments have shifted from a Buyers market back into a Balanced market, and from Balanced to a Sellers market, and we are still in an environment where supply is outpacing demand.

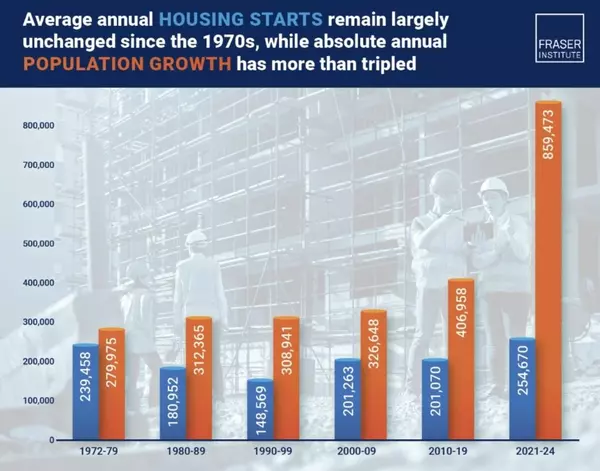

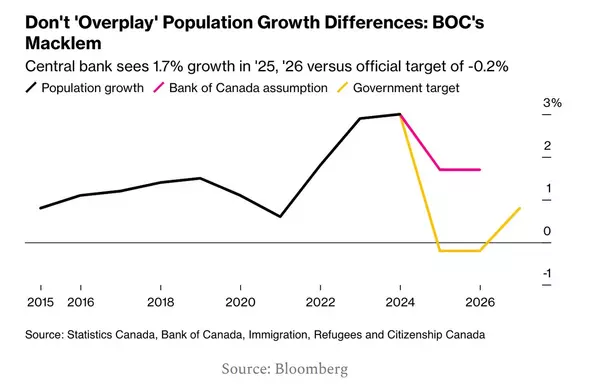

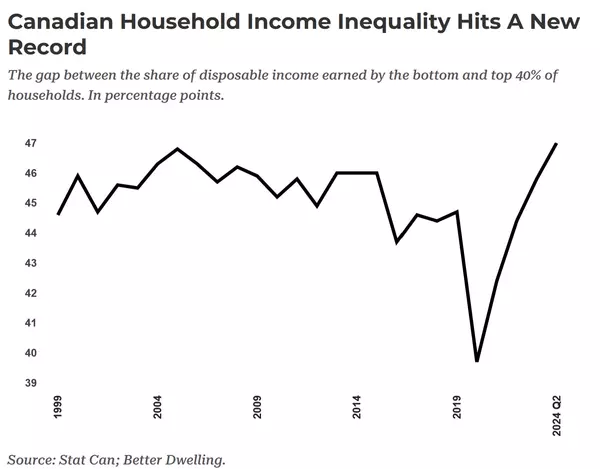

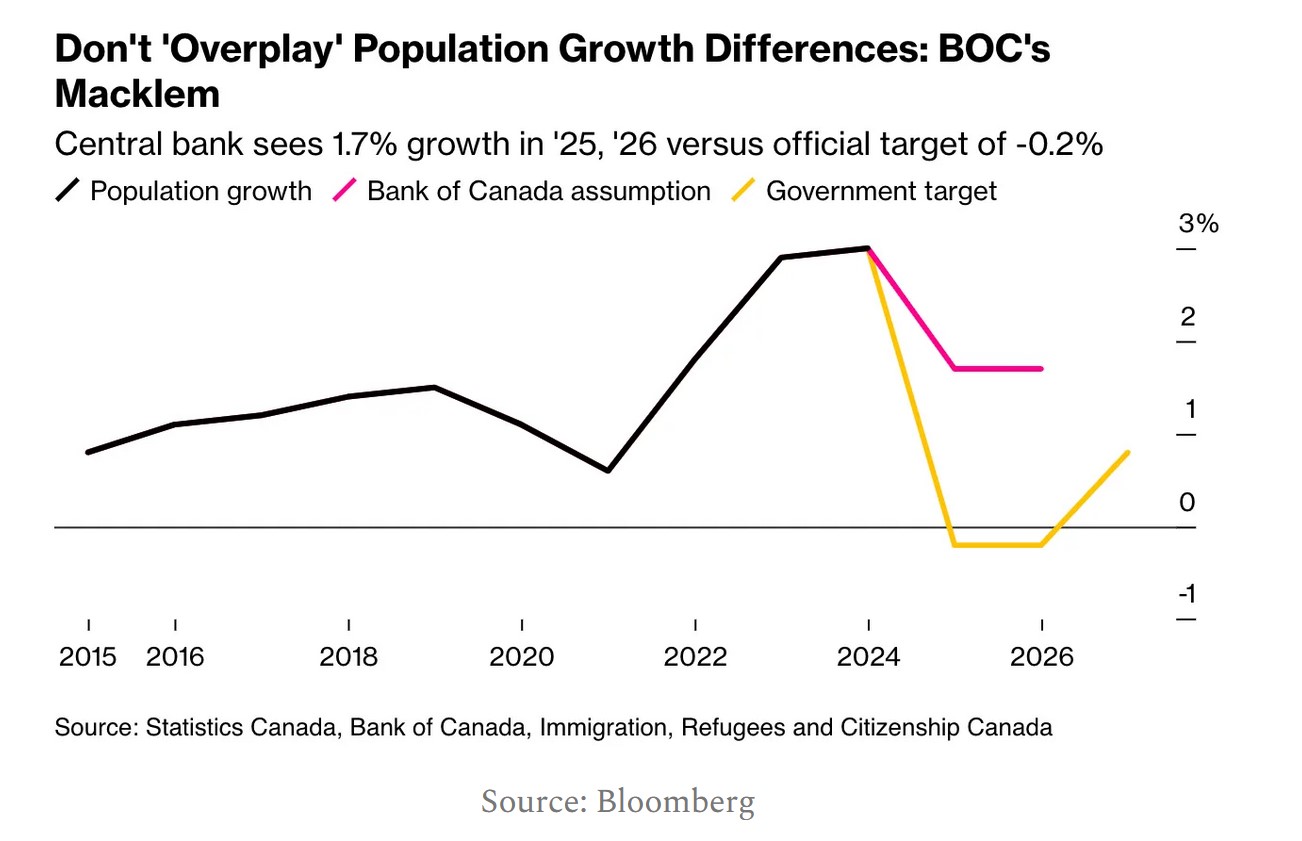

The theme for the this year has been the weak Canadian economy, with rising unemployment and negative growth for per capital GDP (less productive per person). As mentioned before, if Canadian are worried about their jobs, if they get fired, if their work hours are reduced, or if they get get a bonus, then real estate is really just an after thought. The recent reform in immigration policy, where we were initially projected to have 500,000 permanent residents and "unlimited" temporary workers, has been cut to 390,000 permanent residents and hitting the brakes on the temporary workers together from 2025-2027. Canadian government has projected there will be -0.2% population growth in the next two years. Whether we like it or not, this complete U-turn in immigration will have a major aefect on the Canadian economy. In my opinion, had it not been for the immigrants to artificially prop up the Canadian economy in the past 2 years, we would've been in much deeper recession than we are now. Having said that, the provinces that gets hurt the most will be BC and Ontario, with the most temporarily workers representing 9.3% and 8.5% respective of the entire Canada. With the possibility of net outflow of people (the most significant in BC and Ontario), we should see rental rates drop further. When that happens, would the landlords, seeing less return on their investment condos in these two provinces, decide to liquidate their investments and possibly flood the market in next 2 years? Keep in mind that there are also plenty of pre-sale projects that will be completing in the next 2 years. Thus, we should be seeing the condo/apartment segment having an abundant supply in the future. Simply look at Toronto now, which is the epicentre of the condo market crash, and one can observe the rise and fall of an over-leveraged and over-supplied condo market.

Moving forward, there is simply too much market volatility to even predict what's going to happen even three months from now. One thing for certain is that the Canadian economy is going to need time to recover and to stay competitive. With more imminent rate drops, the Canadian dollar (compared to the USD) has further tanked to its lowest point in the past 4 years, and we may see further dips. As such, Canada's biggest trade partner, the US and their economy, will be heading in the other direction and out-performing many other nations. With the economic and production gap widening between the two countries, Canada will try to avoid to importing the inflation from the US. If your investments portfolio is highly invested in Canadian funds, it would be highly advisable to explore alternatives aboard. Meanwhile, let's buckle our seats: there will be more turbulence ahead.

Some of the unique trends I've been observing:

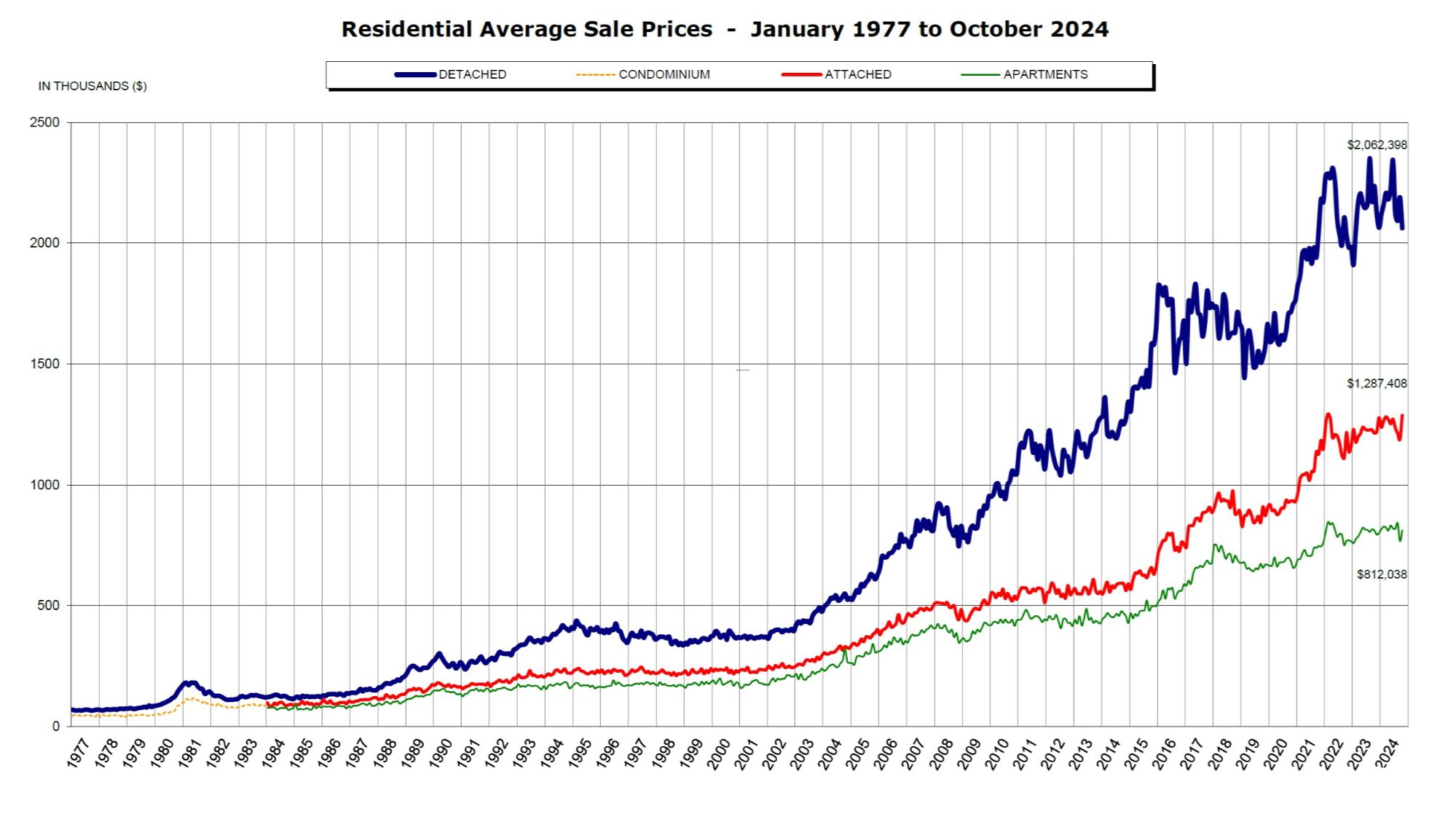

1. Last month's Vancouver Real Estate saw a pleasant uptick in sales (+31.9% over September), and is the third highest transactional month since April and May. However, sales still remain -5.5% below the 10 year average. Also, total inventory remains elevated at +26.2% above the 10 year average. Some products are shifting from a Buyer's market back into a Balanced market. However, there remains downward price pressure, with last month's average price dropping -0.6%. Single house was the under performer, registering monthly loss at -1%. On the flip side, townhouse was the outlier with the price gain at +0.9%. Apartment was the mid pack at -0.6%.

2. Facing more political pressure, the Trudeau government made a complete U-turn on the immigration policy. In short, there will be a stoppage in importing temporarily workers, and there will also be a net outflow of immigrants. The projected Canadian population growth will be -0.2% in the 2025-2027, which is a first negative population growth for Canada outside of the pandemic. An interest fact was that this announcement was made in October, but three months earlier in July, Statistic Canada has shown that permanent resident application had already fallen by 57%. In other words, potential immigrants were already NOT considering coming to Canada, possibly due to the high standard of living, the lack of housing affordability and the weak economy. The recent revision by Immigration Canada was just to reaffirm that fact. Either way, Canada is no longer an ideal immigration country anymore.

3. According to a report by Desjardins, Canada's budget deficit could balloon to $46.5 billion in 2024-2025. On a provincial level, the Metro Vancouver Board has approved a +25.3% increase to regional tax bill. In other words, British Colombians are whooped both on a federal or provincial level. As more and more taxes are ready to be piled into the Canadian families to "solve the problem", just how are they suppose to improve the living standards of Canadians? In fact, studies have shown that more taxes are counter-productive and would further drive away innovations, investors and business start-ups. I can only imagine what our next generation's tax burdens would be like.

4. With Trump winning the election, the attention now turns to his policies, namely the tariff he promised to imposed. As such, Canada does 77% of it's trade with the US, and imposing a 10% tariff would translate into a $30 billion per year impact as report by the Canadian Chamber of Commerce.

5. If lower rates were a drug, then the consumers are the addicts: Canadian consumer confidence is now at a 30 month high. Cautiously optimistic, anyone?

6. Buyer sentiments is a funny thing. Even when the Bank of Canada had the jumbo rate cut of -0.5%, one will have to understand that actually had no effect on the fixed rates. Keep in mind that only variable rates are affected in the event of a rate cut/hike, but not for fixed rates. In fact, the 5 year fixed rates (which is determined by the 5 year Canada bond yields), have risen by +0.4% in October. In other words, fixed rates gone UP, variable rates gone DOWN, which means, in some case, borrowing costs have gone higher! Buyers coming off the sidelines with the sole belief that mortgage rates are "cheaper", may only be in for a rude awakening. It is very possible that we may see fixed rates remain the same in the near term.

Here are the 4 highlights for October:

- Total inventory of 14,477 units has remain nearly the same as last month. It is still the highest for the month of October since 2014.

- After months of dismal sales, the October sales saw a pleasant surprise uptick of 2,632 units, which is +30.2% over September. Some of the stale listings actually sold last month.

- The jumbo rate cut may have got some Buyers off the sidelines, but keep in mind that one month doesn't make a trend. Could November be another month of surprise?

- October home monthly price drop slowed to -0.6% (compared to September's -1.4%). Further rate cut may see the negative price growth level off, and possibly head into a flat territory in the next few months. The two key factors are: would sales keep up, and would inventory level remain elevated.

Here are the in-depth statistics of the October:

- Last month's sales were -5.5% below the 10 year September's sales average.

- Month by month residential home sales surged to +30.2% from September 2024.

- Month by month new home listings dropped by -12.7% compared to September 2024.

- Last month's price dropped slowed to -0.6%, compared to -1.4% from September.

- Sales-to-listing (or % of homes sold) ratio is rose significantly to 18.8%. (compared 12.8% in September). By property type, the ratio is 13.4% for single houses, 22.5% for townhouses, and 22.2% for apartments/condos.

Download October 2024 Greater Vancouver Real Estate Report

Last month, the single house market was a mixed bag. The welcoming news was that month-over-month sales was up significantly by +25.6%., bu on the other hand, the single house monthly price drop at -1%. This mixed signal shares the same polarizing views of the Sellers and Buyers. Even with the recent uptick in sales, we are simply going from a slow market to a normal market. It was far from crazy and with hardly any bidding wars. The most noticeable effect was that Buyers sentiments have returned after having ghosted for nearly the entire summer. The Sellers, who are serious and motivated, was able to get their home sold before the new year. Even though there is a rise in showing requests, the open house traffic is still sub-par. Key is, the single house market have shifted back to a balanced market after spending the past 3 months in the Buyer's market. This shift has caused some uneasiness and adjustment with the Buyers, as their low ball offers (which was plentiful in the summer) is no longer considered now by many Sellers. Noteworthy is the single house inventory in back in a balanced market, and what remains to be seen is if it can stay there. The historical trend for the recent years for single house Sellers mainly support the theory they are focused on the supply side of the equation. Theoretically, this has put a price floor for this market. However, this year was different as inventory was plentiful (for the summer). Pockets of neighorhood, such as North Vancouver and Cloverdale, are seeing hot trends of sales-to-listing ratio (% of homes sold) at 25% and 31% respectively (Seller's market), even though we saw North Vancouver monthly price dropped -3.4%. On the flip side, West Vancouver and Vancouver Westside have sales-to-listing ratio at 6% and 10% respectively (Buyer's market). It does look like the average single house neighborhoods (under $1.6m) are performing fine, while the premium home neigborhoods ($3m+) market remain subdued. Would the recent uninsured mortgage limit increase from $1m to $1.5m further boost the single house segment? I'm a bit skeptical on that. Questions is, can a regular Canadian family can stomach the hefty monthly mortgage payments of these high (95%) loan-to-value ratio Buyers, in the face of a Canadian economic downturn?

For the month of September, the neighorhoods that registered most price growth were Pitt Meadows, Burnaby South, and Port Coquitlam at +5.4%, +4.1% and +2.7% respectively. Conversely, the neighborhoods registered the most significant price drops were Tsawwassen, Port Moody, and North Vancouver, with -4.8%, -4.1% and -3.4% respectively. The single house market have moved back into a Balanced market, with average days on market nearly flat at 38 days (compared to 39 days in September), and month-to-month average price continue to slip at -1% (compared to -1.3% in September). Sales-to-listing ratio (% of homes sold) edged up to 13.4%. (compared to 9.1% in September).

The townhouse market is the only segment that saw a price growth of +0.9% last month (compared to single house -1% and apartment -0.6% respectively). Not surprisingly, the townhouse market likely benefited from the upswing in apartment sales. When an apartment owner who just sold and is looking to upsize, the most sensible choice to climb up the property ladder would be buying a townhouse. By the same token, this ripple effect "should" also tickle into the single house market, but in that segment the effects are lessened. Much like the single house segment, the townhouses that was stale (listed for over 45 days) were also starting to sell. Meanwhile, monthly total inventory was holding steady -4.6% (given seasonal adjustments). This has shifted the townhouse segment from a Balanced market to Sellers market. As I've mentioned before, townhouses has a history of being the easiest to adjust to market upswings due to its nature of the "next best thing" in terms of affordability to a single house. When we combine that with historically limited townhouse supply and elevated brand new townhouse prices, again this has created a price floor for resale townhouses. Noteworthy is that price is always a lagging indicator, and when there are more sales and less inventory, price tend to firm up quickly, but may not reflect so until 2-3 months from now. With boots on the ground, I am seeing Seller's getting firmer and firmer on their prices. Again, entry level townhouses priced under $1m in core Burnaby, Richmond, and North Vancouver are getting much more action and selling faster than other products. As for Fraser Valley such as Surrey and Langley, their newer townhouses (less than 5 years old) that priced under $900k are also moving fast. There are signs that some Buyers want to be ahead of the curve and get in before the new year. Would townhouses be the first segment to recover? In my opinion: highly likely.

In October, the areas with the most townhouse price growths were North Vancouver, East Vancouver and Whistler, registering +7.4%, +5.5% and 4.2% respectively. Conversely, the neighborhoods with the negative price growth are Coquitlam, Maple Ridge, Pitt Meadows, at -3.5% and -2.2% (tied for 2nd & 3rd) respectively. The townhouse market shifted from a Balanced market to a Sellers market, with average days on market remaining dropping slightly at 28 days (compared to 29 days in September). Month-to-month sale price improved by +0.9% (compared to -1.8% in September). Sale-to-listing (% homes sold) ratio remain the best among all segments and edged up significantly to 22.5% (compared to 16.9% September).

Apartment and Condo Market

The apartment market saw a huge spike in sales in October, posting a monthly +32.7% gain, which is the best in all segments. Most of the first time home buyers, who have waited for a good part of the summer, has finally come off the sidelines and landed on their home. As we mentioned, Buyer sentiment is a funny thing. Even when the Bank of Canada has dropped rates by 0.5%, the major bank's rates have actually gone UP. So in fact, Buyers who purchased did not get a cheaper rate, and the "rush" was largely psychological and more in the line with the herd mentality. Either way, it was definitely a positive change of winds for the much needed apartment scene. The reasonably priced apartments under $500-$600k are showing signs of increased traffic and offers. However, collapsed offers are still happening. Some Buyers, whether they are overstretching beyond their financial means or simply decided to hold off till Spring, are causing elevated inventory level at it's highest month of October in since 2020. Noteworthy is that are a tidal wave of pre-sale apartment pending to be completed in 2025. As such, these newly finished apartments will inject even more supply into the market. Worst yet is that many of the pre-sale Buyers & investors will still face a higher interest rate than they'd like. The math just doesn't work for them to rent out (bleeding negative cash flow monthly) or to cut their losses (take a minimum $100k loss and walk out). Keep in mind that in either case, these investors confidence are shaken and they will not be returning anytime soon. Thus, I think the pre-sale scene would face an uphill battle for at least the next 2 years. Overall, the apartment market should hoover around a balanced market in the near future.

For the month of October, the best performing neighbourhoods for apartments are Pitt Meadows, Maple Ridge and Tsawwassen, at +6% & +5.6% (tied for 2nd and 3rd) respectively. Conversely, the areas with the most significant price drops were New Westminster, Vancouver East and Sunshine Coast, with -3.2% (tied for 1st and 2nd) and -2% respectively. The apartment and condo segment has popped back up into a Sellers market, with average days dropping slightly to 33 days (compared to 31 days in September). Month-to-month sale price maintained the slightly negative trend at -0.6% (compared to -0.8% in September). Sale-to-listing (% homes sold) ratio shot up significantly to 22.2% (compared to 14.6% in September).

Here are the Three Trends I'm Observing:

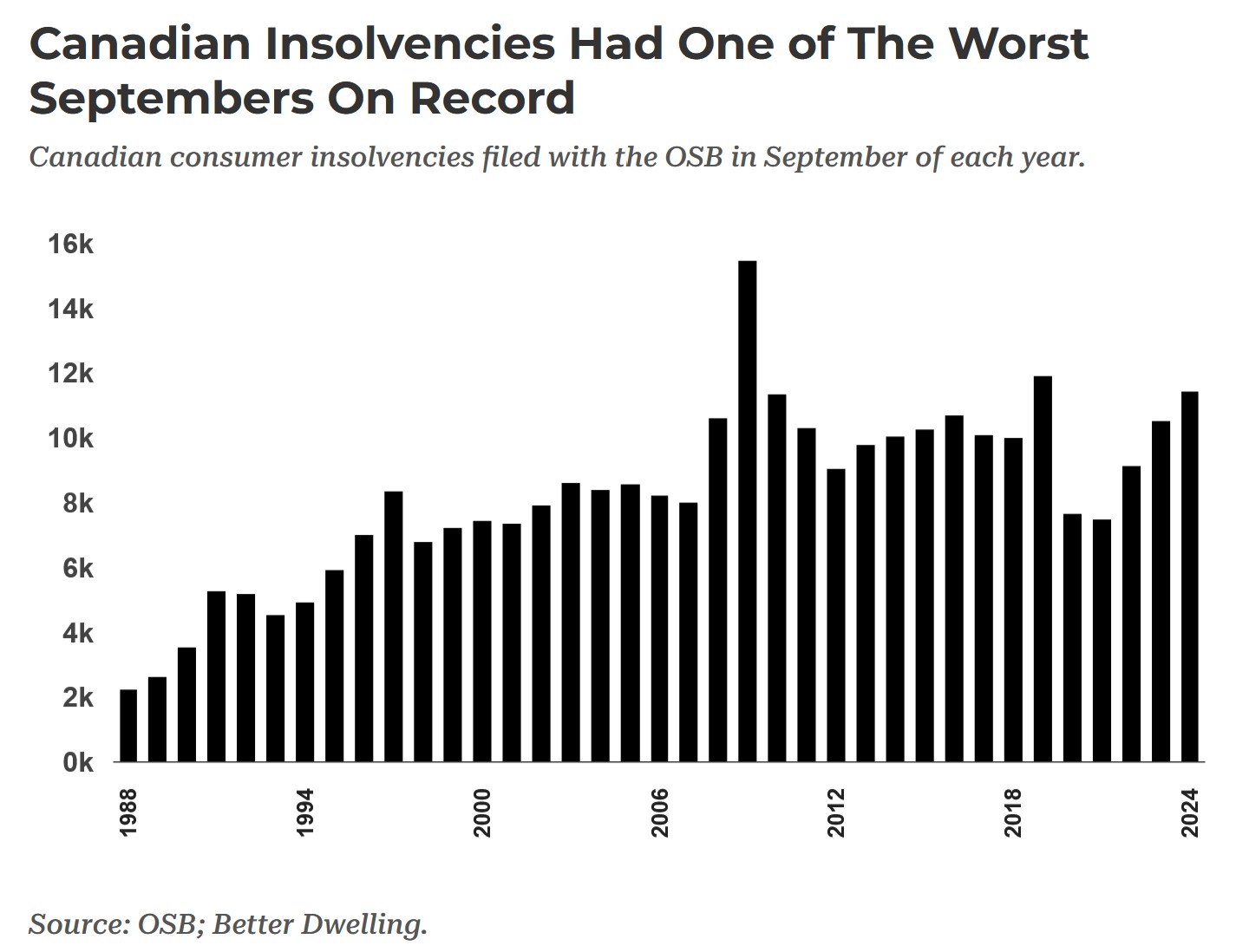

1. Grand Closing

Canadian businesses are struggling, and it really shows in the latest report that September had the third highest business insolvency in the past 40 years. From higher unemployment rate to restaurants going out business, this downward spiral is hurting the Canadian middle class the most. Behind every job or business loss is a hurting family scrambling for food on the table to missing a mortgage payment. What's worrying is that this may get worst before it gets better. (Source: OSB, Better Dwelling)

2. Reverse Psychology

Canadians breathed a sigh of relief that Bank of Canada had a jumbo rates cut of 0.5% last month. Real estate Buyers were eager to move into the market because of the rate drop, right? In reality, one needs to understand the difference between Overnight rate (set by Bank of Canada) and bank rates (set by the major banks). Simply put, banks look at bond yields to determine their fixed mortgage rates. As such, the most popular 5 year Canadian bond yields have actually gone up +.30% since the beginning of October. Thus, contrarily to the common belief, the bank rates have edged UP, while overnight rate has gone DOWN. The truth is that it costed the Buyer MORE to buy in November than in October (yes it sounds odd). Regardless of these fact, we know that buying is mainly psychological. If real estate Buyers thinks rates are cheaper (but in fact they're not) but it's a good time to buy, then they'll just dive right in, which is what happened last month in Canadian real estate. (Source: CNBC)

3. Sorry Not Sorry

In a nearly unbelievable turn of events, Trudeau's government made a complete U-turn on the immigration policy, seeking to drastically reduce immigrants and will be seeing a negative population growth of -0.2% in 2025-2027. So Canada will have less people, lower rent, less consumption, while there will be more pre-sale apartments to be completed soon. All this spells dis-inflationary. Perhaps this makes a good case for Bank of Canada to further lower interest rate? (Source: Bloomberg)

Recent Posts