|

Variable #1: Inflation and Unemployment

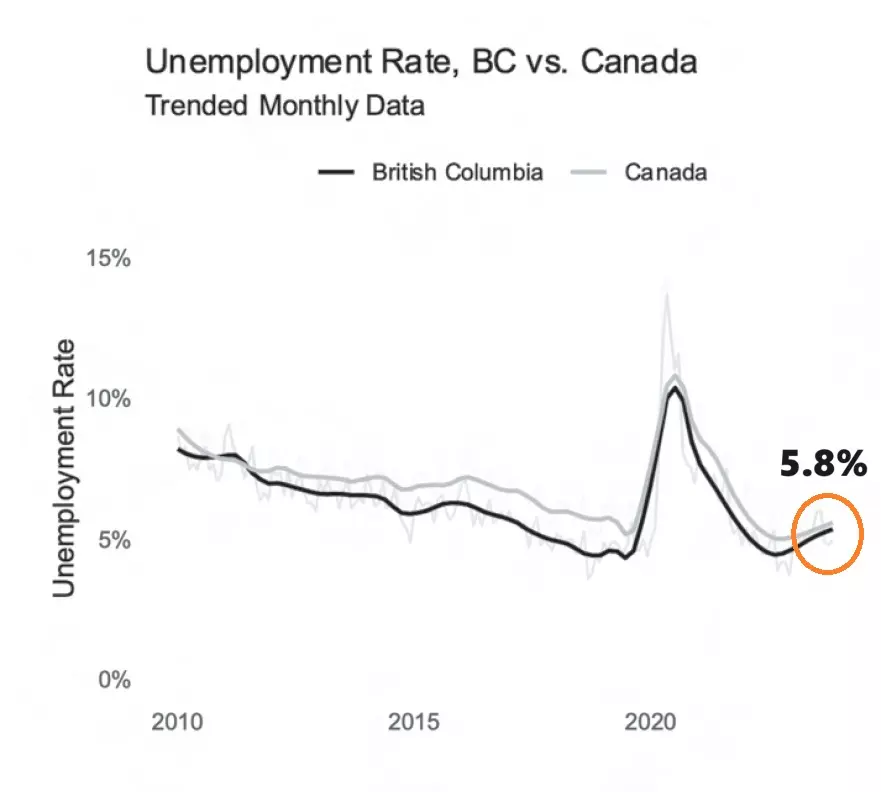

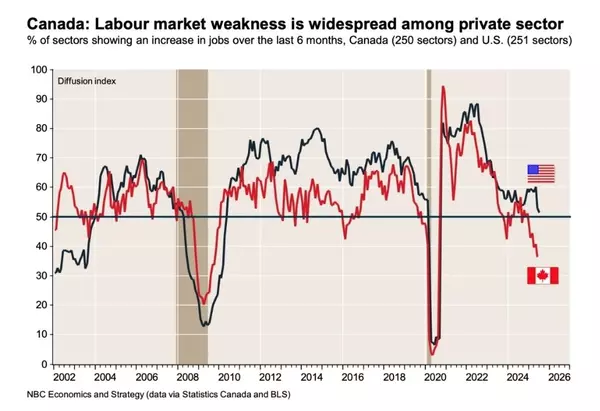

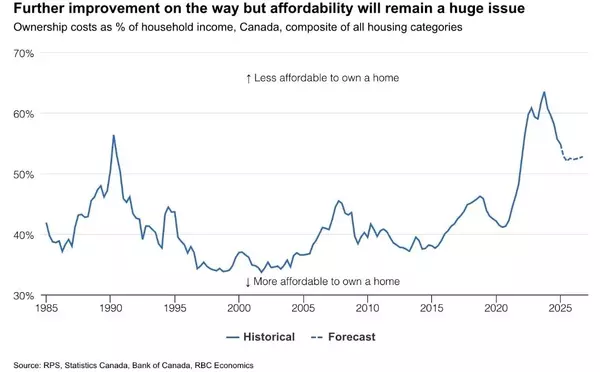

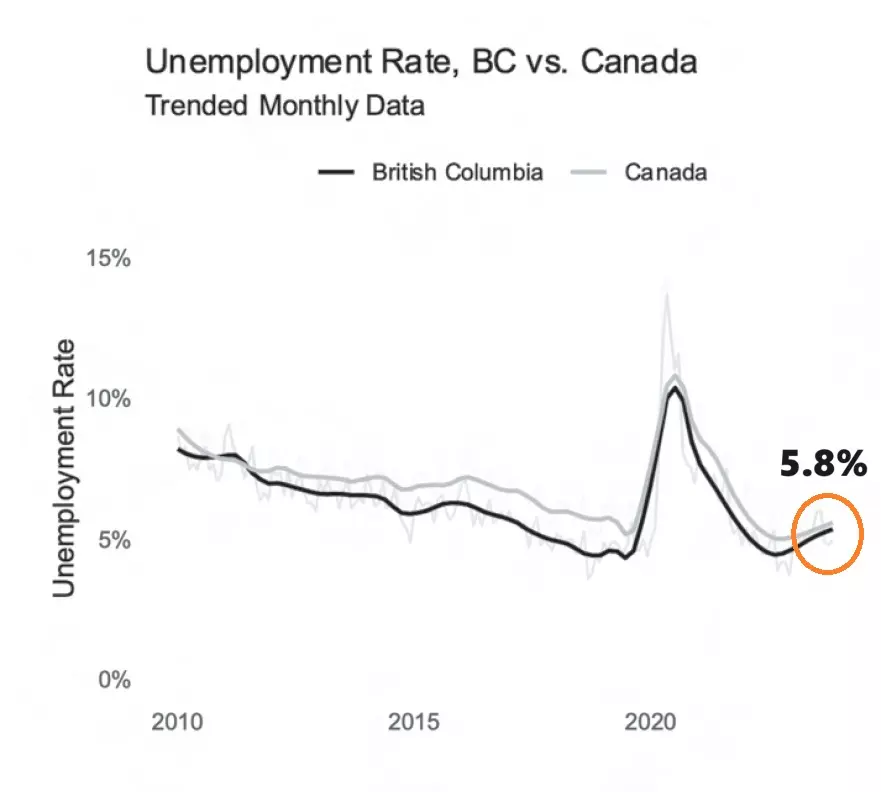

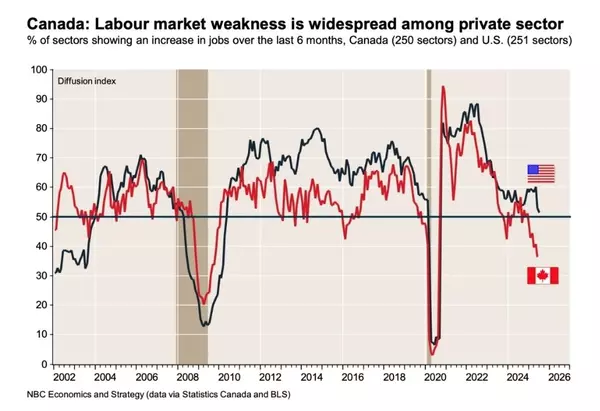

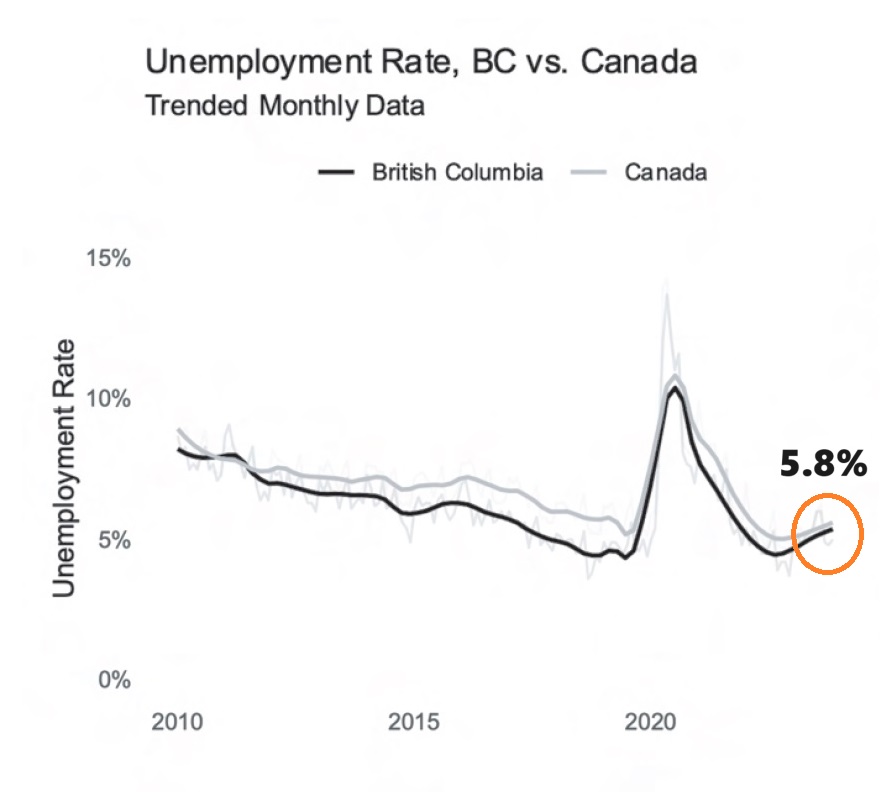

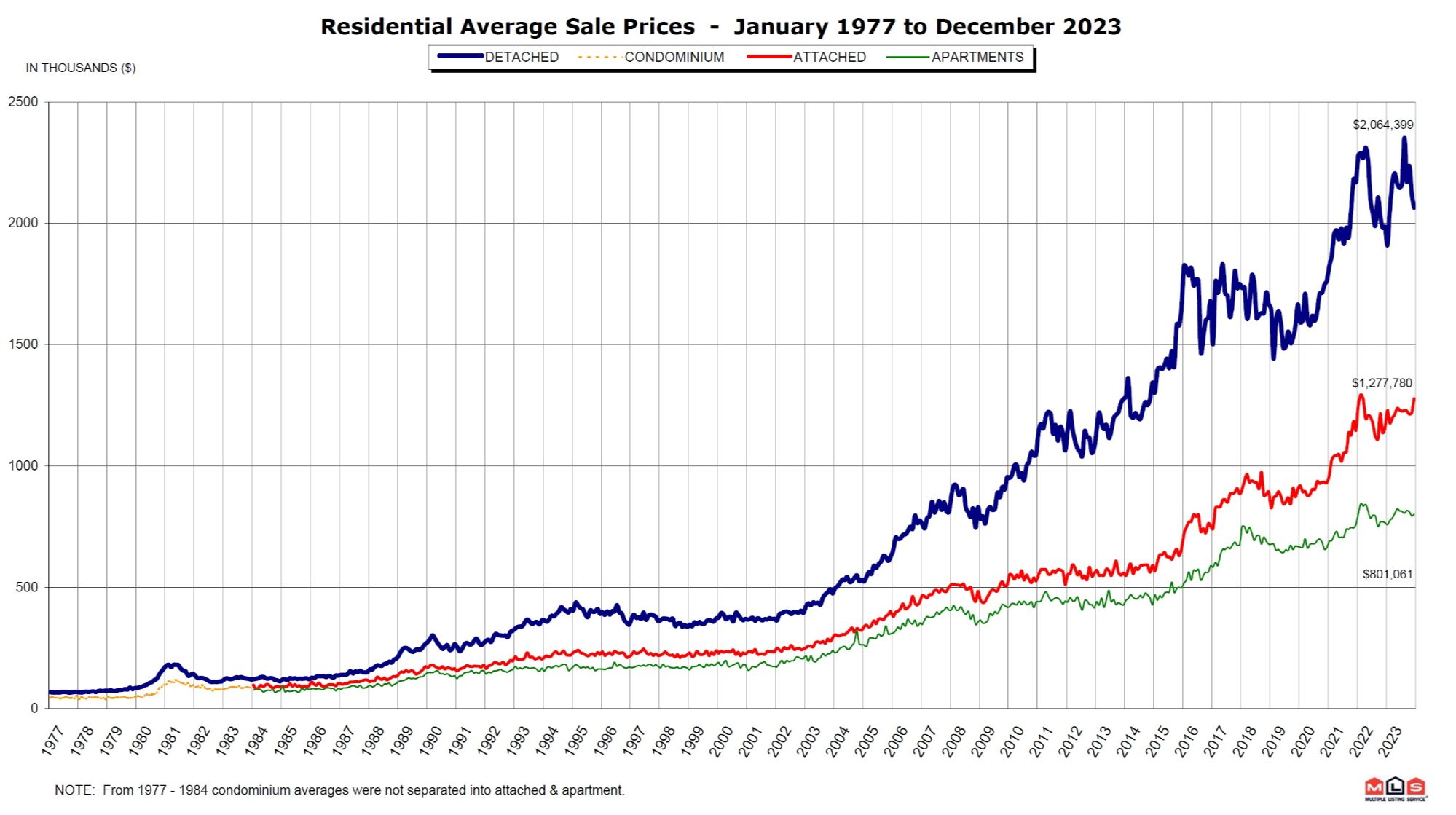

Most economist predicts that the Bank of Canada (BoC) will cut rate around mid-2024, and I believe that is highly dependent on Canada's economic data and its strength, such as inflation and unemployment. As much as inflation is starting to come down, the key question is: "How can Canadian households continue to withstand the high standards of living?" Keep in mind that Canada has the highest household debt in the G7 nations. What's scarier is that Canada's household debt is greater than Canada's entire GDP! Our neighbours in the south, US, is faring much better economically than us. We may see a slower overall economic recovery compared to other nations because of the double whammy: high debt ratio and higher home prices.

Variable #2: Bond Rate, Mortgage Rate, Interest Rate (4-5%)

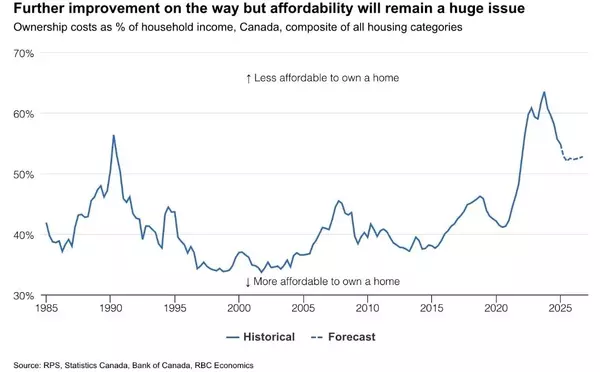

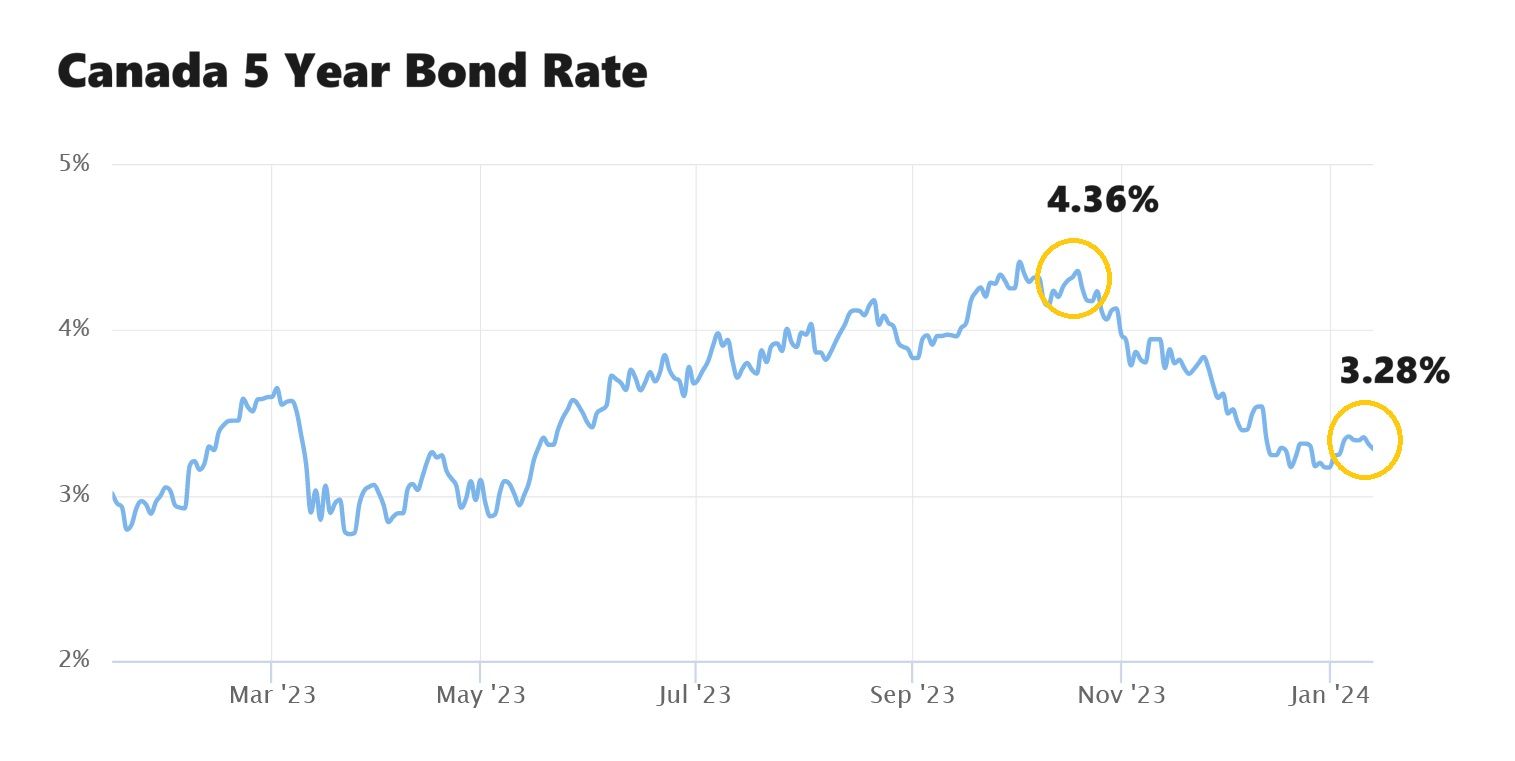

In order for real estate to "wake up", the mortgage rate would have to be at least between 4-5%. Noted that mortgage rates are highly linked to bond rate and overnight interest rates. For example, the benchmark 5 Year Canada bond rate has been highly volatile in the last 3 months, going from 4.36% (Oct 19, 2023) to 3.3%. Even if the BoC holds rates, don't be surprised if major banks will start slashing their rates if bond yields continues it's downward trajectory. Looking back at spring of 2023, when mortgage rates were hoovering around 4.5% to 5%, the market came roaring back, causing the multiple offer frenzy. Market has shown that Buyers acknowledge that the ultra-low 2% interest rate days are long gone, and are willing to accept a range between 4-5%.

Variable #3: Supply

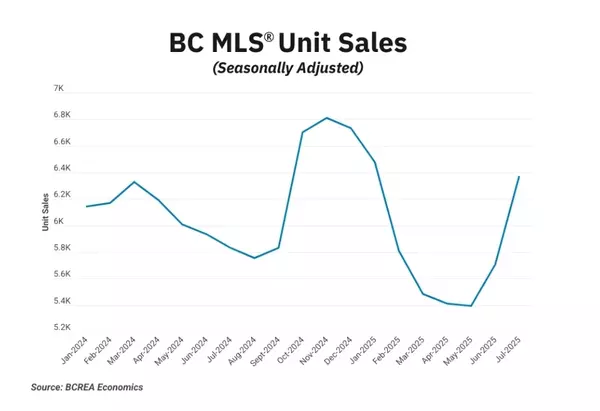

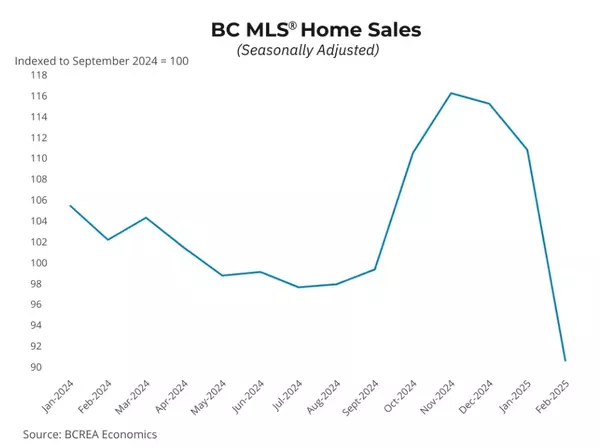

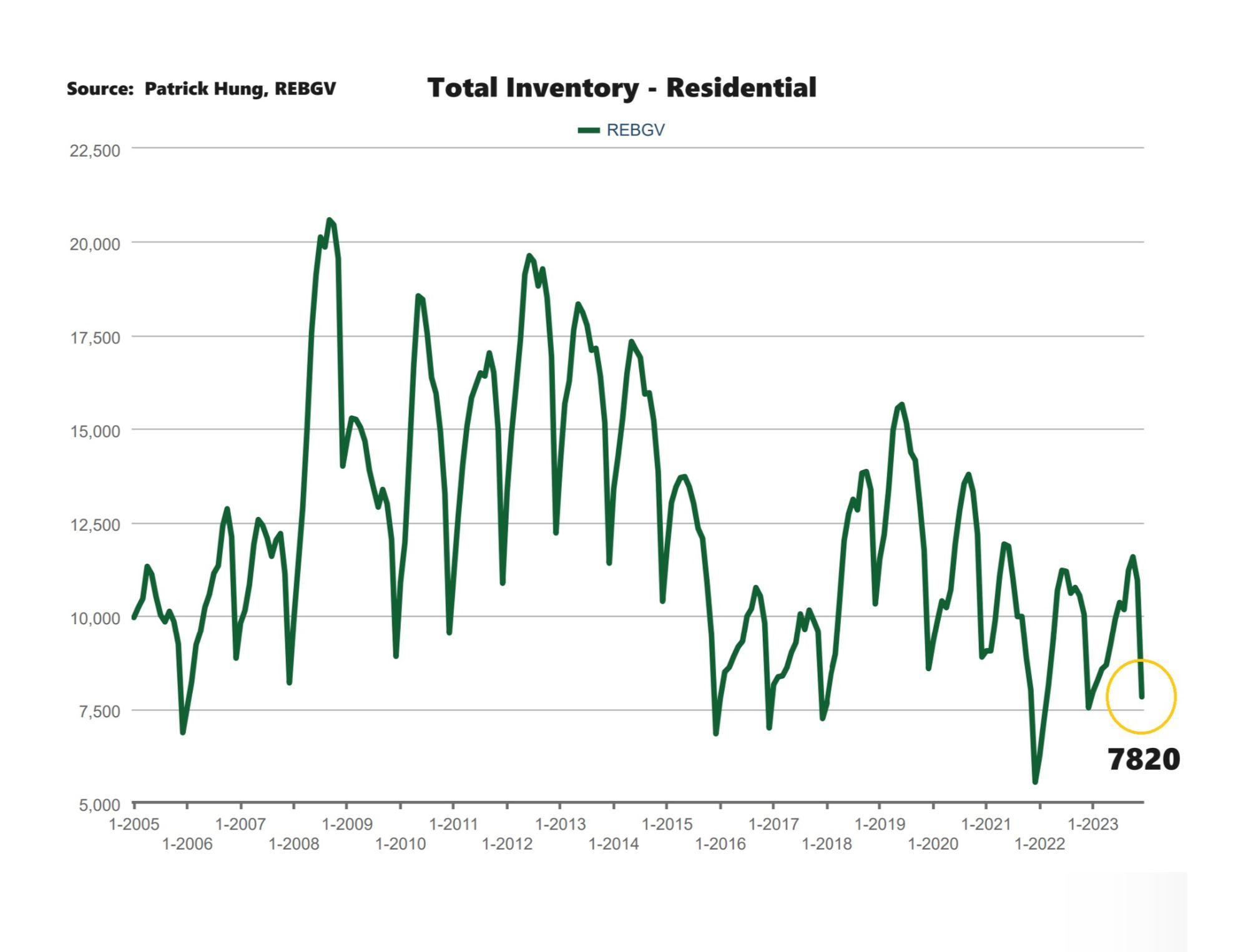

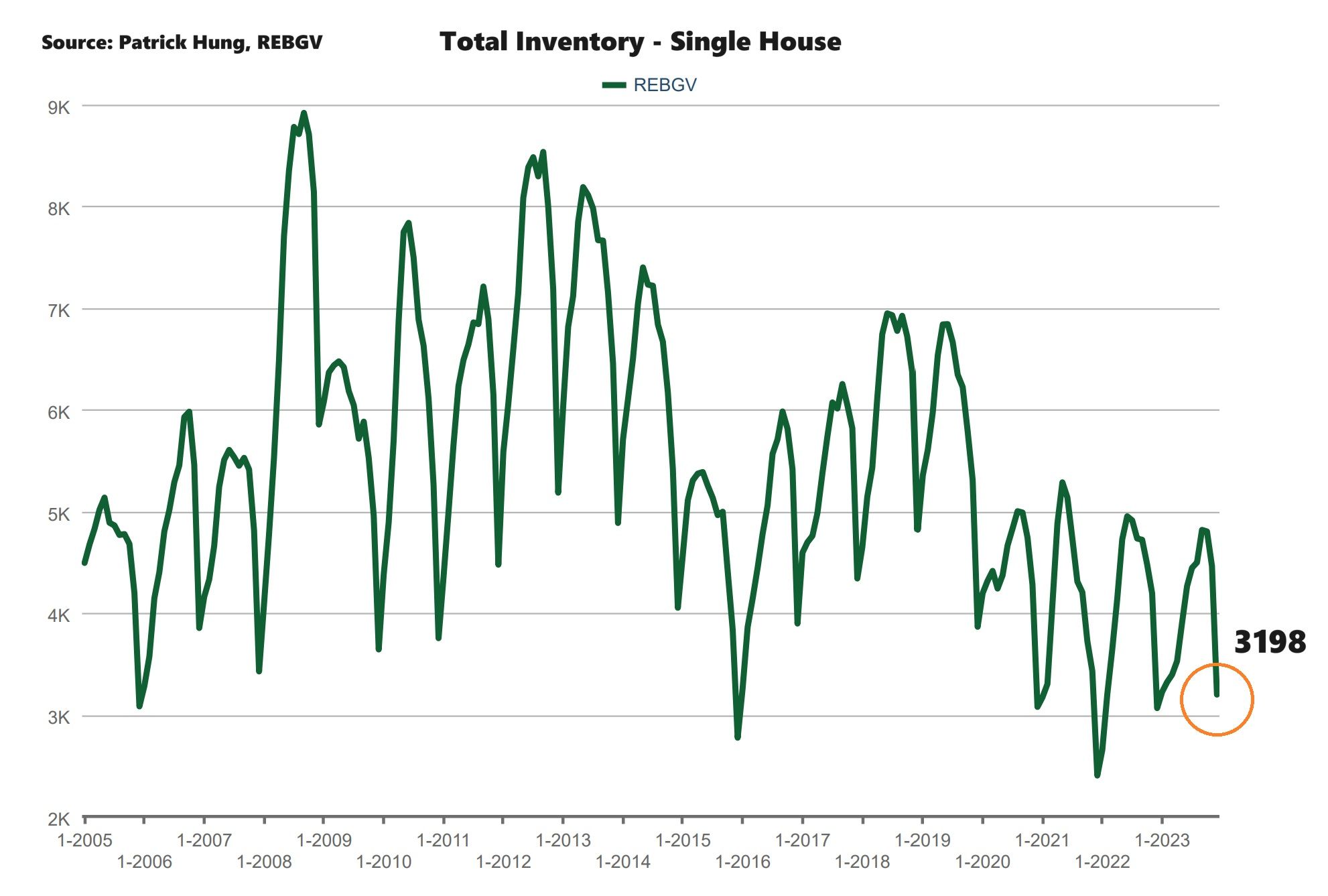

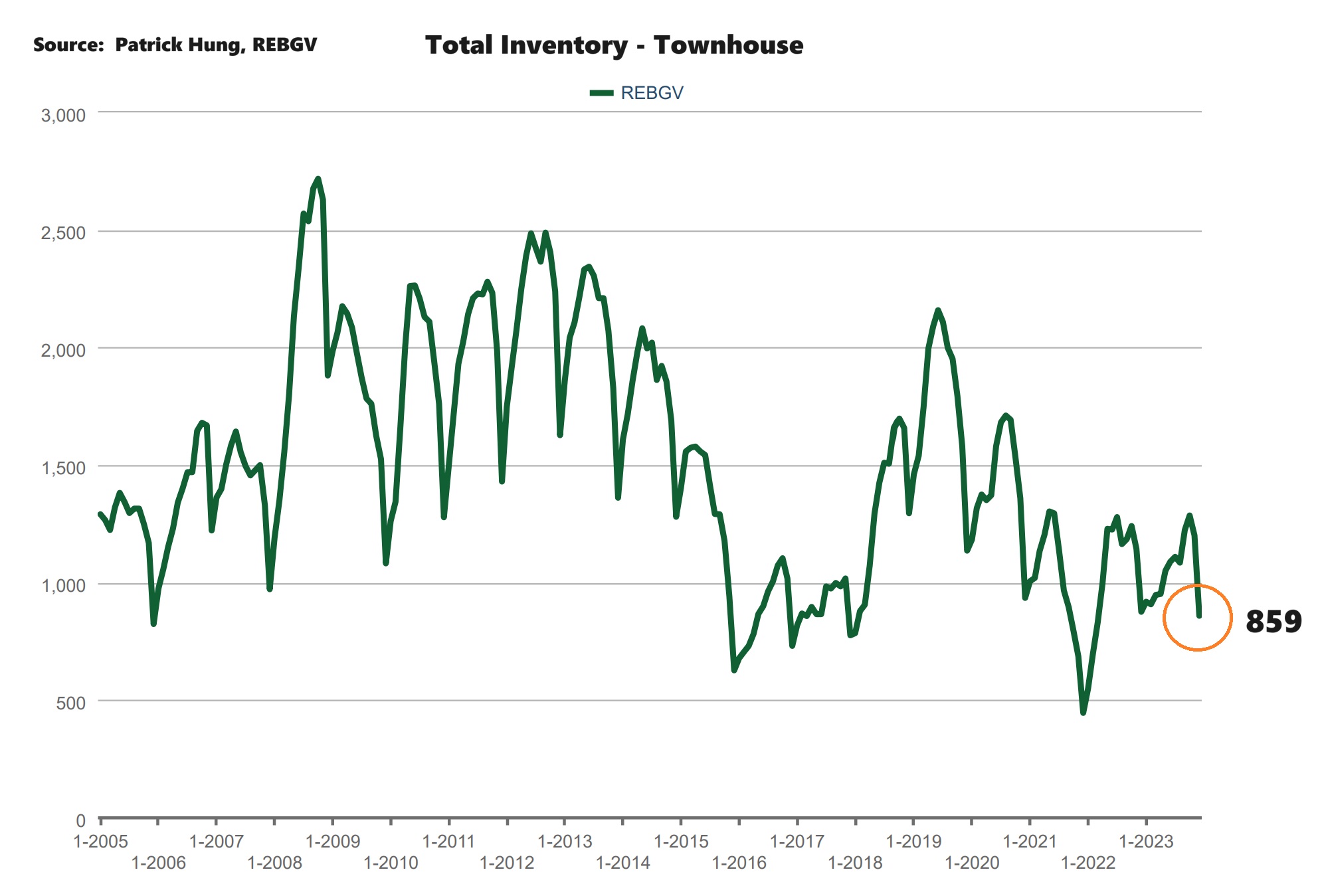

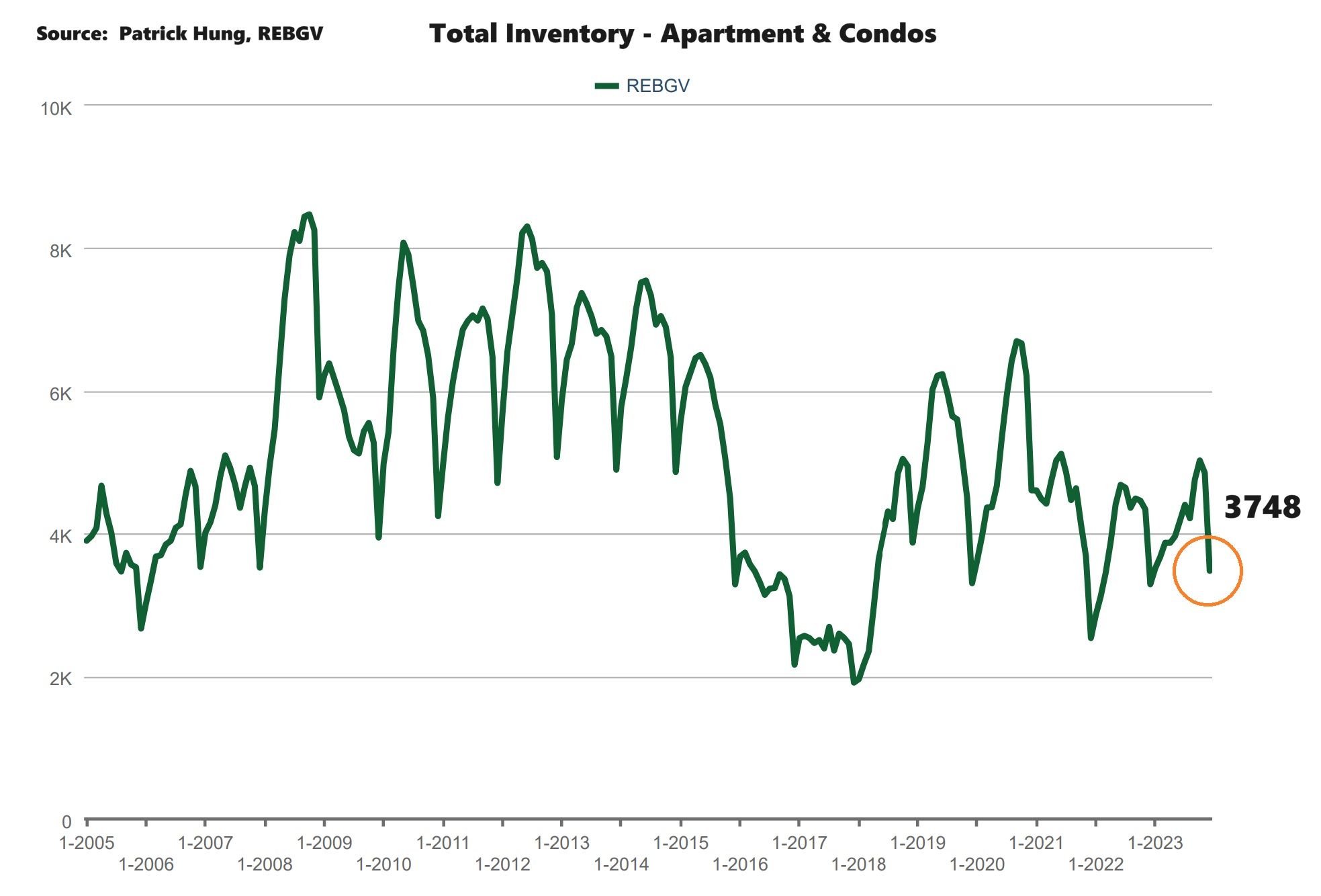

Since the Summer of 2023, we have been seeing Sellers coming off the sidelines. This has been a pleasant surprise and brings balance back into the market as Sellers have been holding off their plans for mainly 2022. With signs of high interest rate is taking hold of the economy in summer 2023, the ugly truth is that that the BoC needs more Canadians to lose their jobs, cut their spendings, and in some occasions, sell their homes, in order to bring the market back in line. In the first half of 2024, we should see Greater Vancouver real estate continue to be in a balanced territory, with some exceptions in highly desirable neighbourhoods like North Vancouver. Once the rate drop announcement is out, Buyers would come flooding back into the market. Keep in mind that we are still in a historically low inventory environment. Thus, a slightly increase in demand would tip the market back into the Sellers market and drive the prices right back up.

Variable #4: Market Sentiment

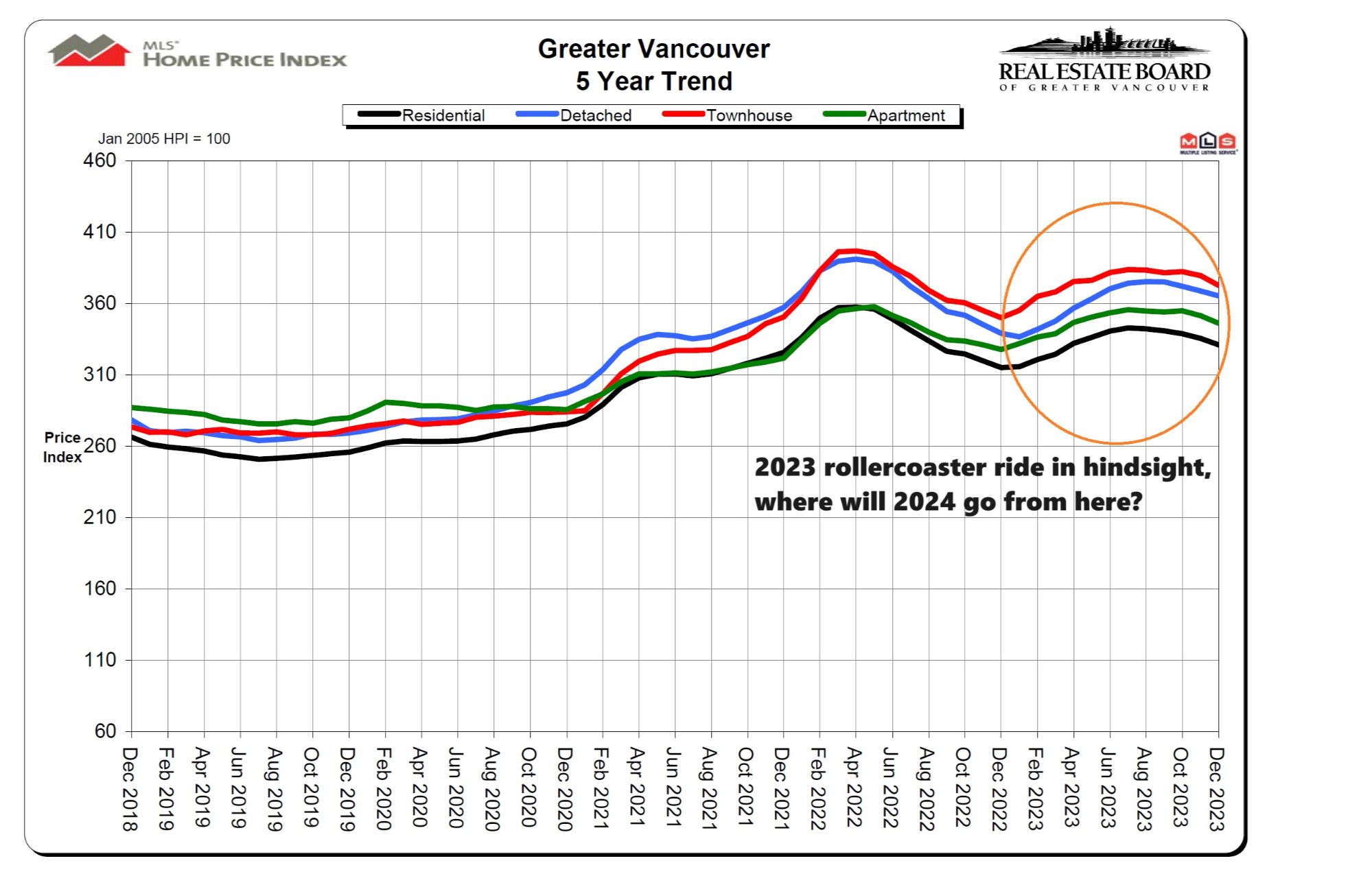

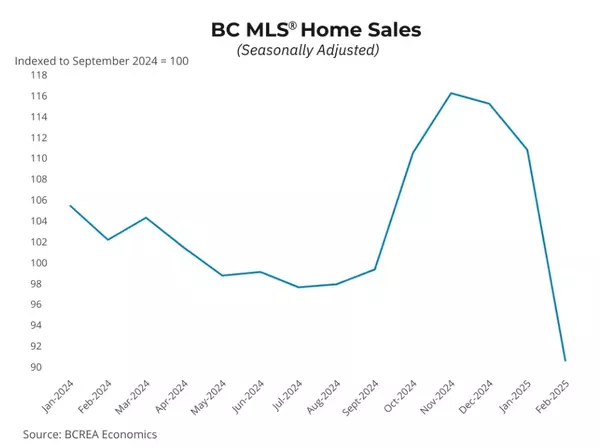

Market sentiment is a combination of anticipation and supply. In the scenario of spring 2023 when rate drop anticipation was high (and 5 year bond rates were as as low as 2.7%, and mortgage rates were around 5%), the Buyers sentiments shifted rapidly as they poured into the market. That quickly faded in the Summer when the winds changed and rates were hiked, even by a merely .25% by BoC. That just shows how quickly the Vancouver market can turn. Thus, looking for signs and the time of the rate drop announcement would mean that market's turning point.

Wildcard: Mortgage Renewals & Immigration

In 2024-2025, about 2.2 million mortgages in Canada will come up for renewal. That represents 45% of all mortgages in Canada. It's hard to gauge the effects of such will have on real estate. Would some of these home owners be forced to sell? Will they turn into renters, causing the rental pool to tighten further? Would we see more supply on the market? Such mortgage renewal is a broad brush to paint, and it may affect some areas of Canada (i.e Calgary) more than others (i.e Vancouver/Toronto). As mentioned before that 50% of all homes in Vancouver do NOT carry a mortgage. Such homeowners (i.e elderly who have paid off their mortgage) are not facing the same constrains as young families carrying a mortgage. Again, such sellers sell when they want to , not because they have to.

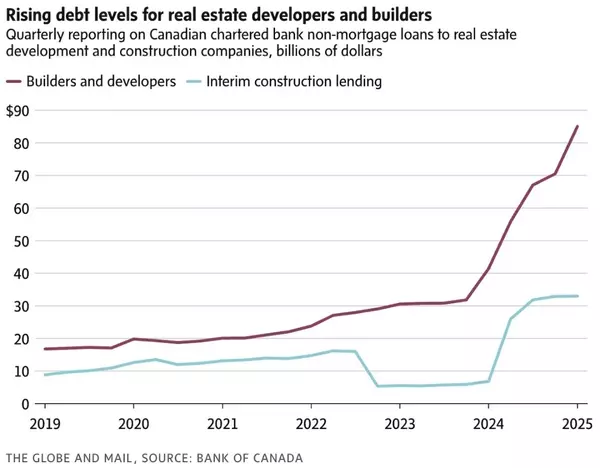

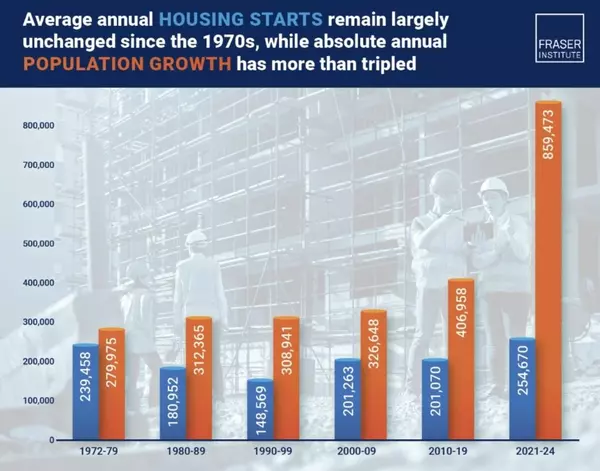

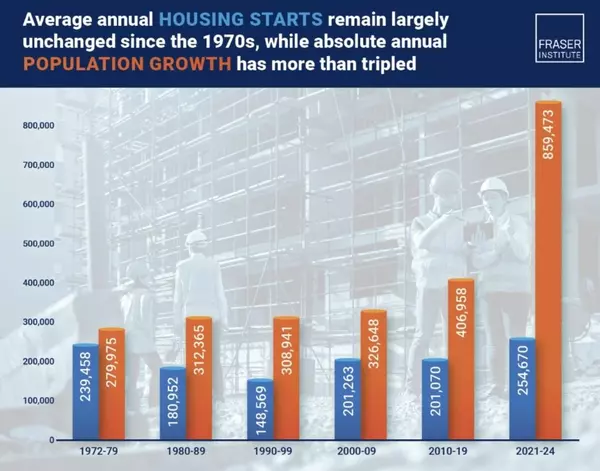

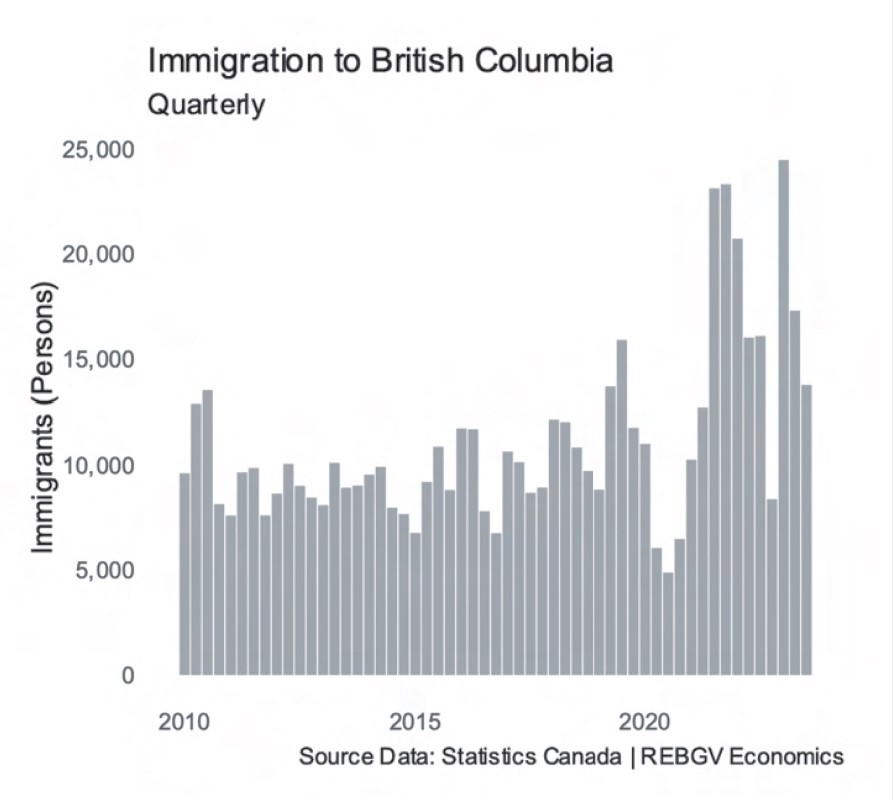

On the other hand, the drastic increase in immigration (and mainly non-residents such as international students and work permits) has created the pent up demand that some Canadian are resenting. Statistically, immigration projection for permanent resident remain above 500,000 till 2026. However, the wild card is the intake of non-residents, such as the international students and permit workers. Marc Miller, the Canadian immigration minister, has recently came out and said he is looking to cap the intake of international students in 2024. I have been saying all along that international students are a huge cash cow for Canada: a program that has been exploited on both federal and private level. In 2023 alone, non-residents have exceeded 500,000, and the total number of immigrants are over 1 million, which equates to 2.5% of the entire Canadian population of 40 million. It doesn't take a math genius to figure that if we don't build 2.5% more homes, and have 2.5% more invested in infrastructure, we would NOT be able to keep up. As long as the immigration doors remain wide open, the Canadian real estate will remain under supplied, at least in the next 5-8 years.

Here are the in-depth statistics for the year 2023:

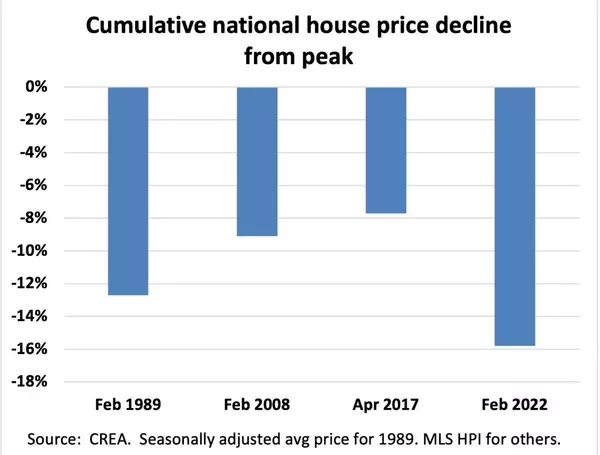

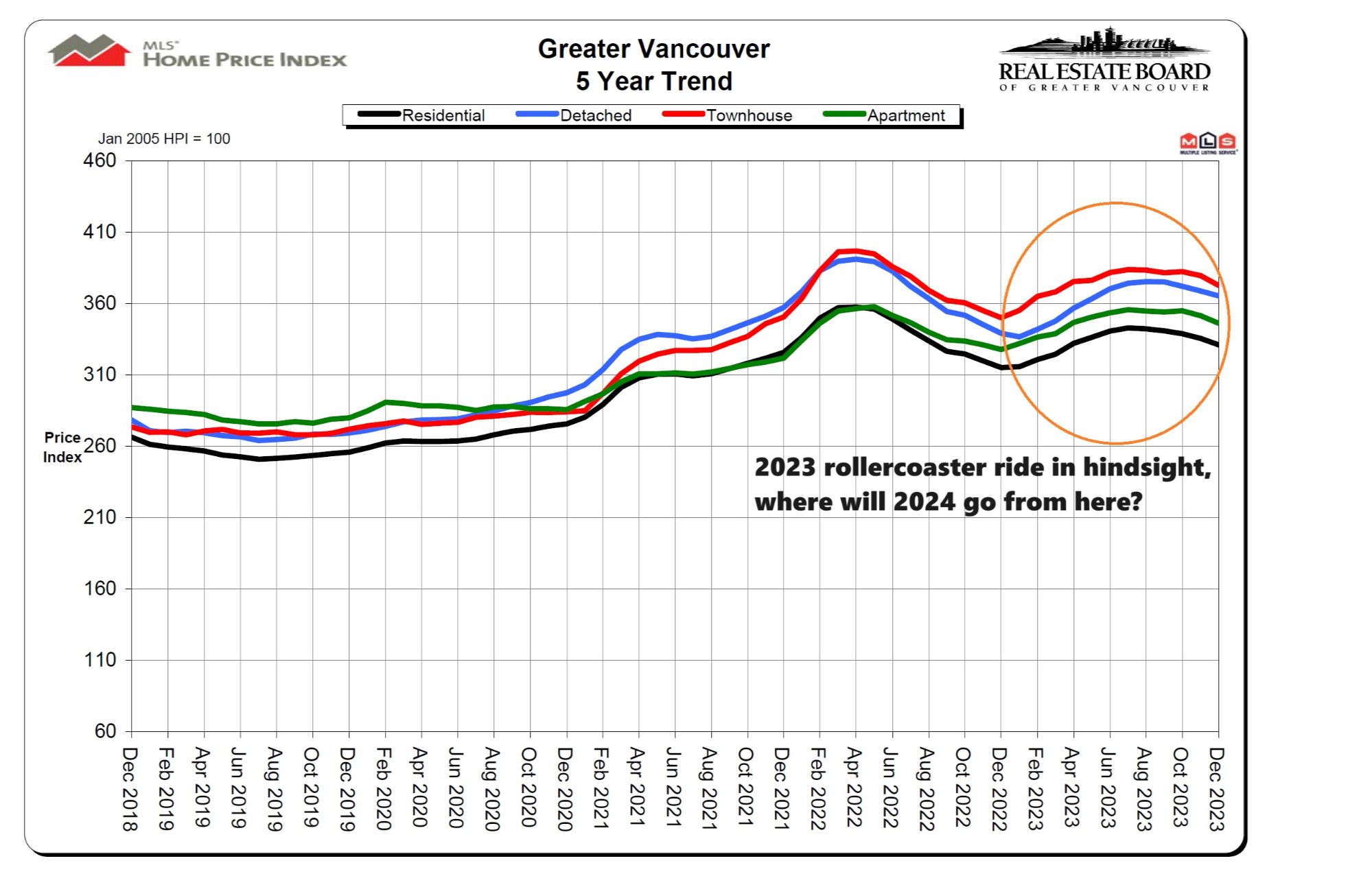

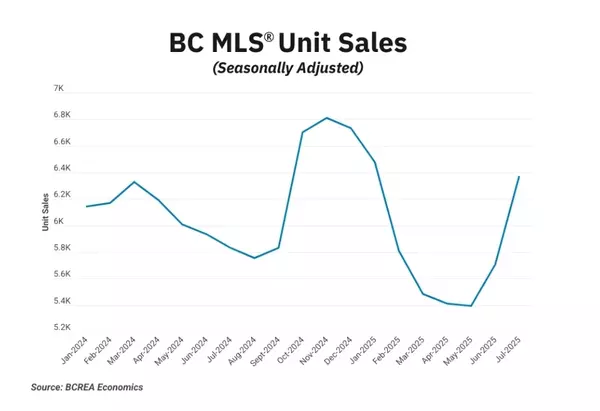

- Prices has jumped +5% for the year, with the first half of the year registering +7.8%, before declining -2.8% to close out the year.

- Total sales for the year was 26,249 units, down -10.3% from 2022.

- Last year's sale total was 23.4% below the 10 year annual sales average.

- Total number of properties listed was 56,868 units, which was 10.5% below the 10 year annual average. |

|

|

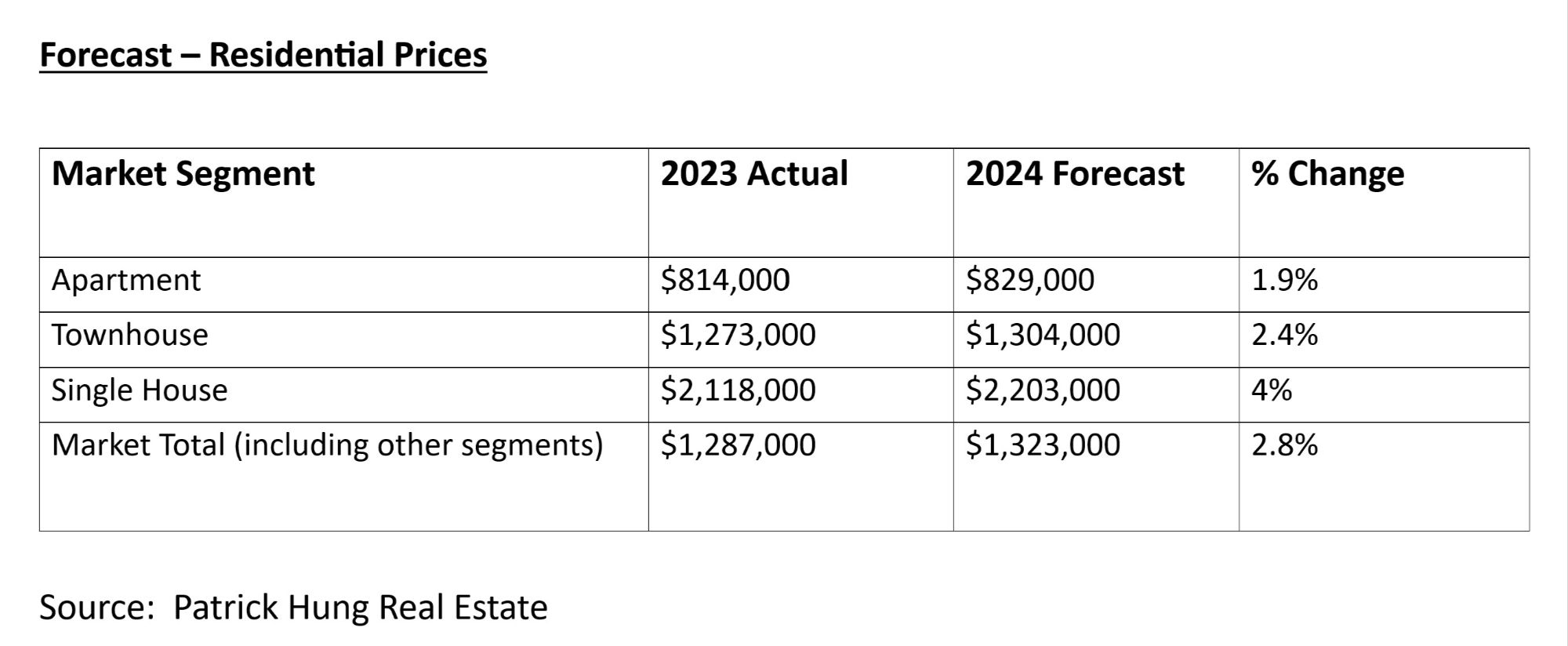

Forecast for 2024

The chorus for this year would be rate cut. As mentioned, we are still in a historically low inventory environment. A slightly increase in demand would shift the market back to the Seller's side, and price increase would follow. Vancouver real estate has and will remain resilient. My views is that the price gains for 2024 should be around +2.8% (see chart below). This is still less than half of what the past 5 year annual growth of +6% (+29.9% growth in the last 5 years).

Some of the notable risk associated that would affect the market are:

Downside Risk:

Sales would slow more than usual if the economy heads in to a hard recession. Unemployment increases and and reducing the pool of potential Buyers.

Upside Risk:

Sales and prices can elevate quickly if the economy recovers from a recession quickly, or unemployment remains low. Borrowing costs could drop more than usual (-2% from the current level of 5-6%) and drive Buyers right back into the market.

Download December 2023 Greater Vancouver Real Estate Report

|

|

|

Single House Market

The single house market is the hardest to predict this year, not because of the market volatility, but of the rezoning policy (4-plex & 6- plex) that the BC government mandates all municipalities to following by June 30, 2024. This is an absolutely game changer, and it waits to be seen how each municipality will react to this new change. For example, in the City of Vancouver, which is the pioneer of this program, we have seen 19 applications already submitted for the rezoning. Each municipality's policy will have a direct impact on that area's prices. We have been seeing mico-trends such as Burnaby single houses with bigger frontage (60+ ft) and larger land (7000+ sf) has been selling like hot cakes in the past 3 months, potentially by developers for land grabbing. The average single house under $2m will continue to dominate the market, as that bar of entry continues to get pushed up. What is an unknown is the luxury market of homes over $3m. When the wealthy buyers are not as constrained by the higher interest rate, would they move into the market if the rate drops? Another wildcard is supply, which in the last half of 2023 seen a surprise increase. If such were to persist, then the single house market will remain in a balance market. My prediction is single house market would remain in a balance market before the rate drop announcement, and should flip to a Seller's market afterwards. Last year, single house has an annual price growth of +7.8%. Of all the segments, I believe single house would outpace others in terms of price gains in 2024, with a modest 4% annual growth.

|

|

|

Townhouse Market

The townhouse market remain the most popular property type among upsizing buyers and growing families. I believe this trend will continue until the new 4-plex and 6-plex products are being delivered around 2025-2026. Townhouse demand will remain strong, and supply will continue to be low in Greater Vancouver. Areas in Fraser Valley such as Surrey and Langley are ahead in the townhouse supply game, but the back-to-office mandate in 2023 has most Buyers shifting their focus back to the Vancouver core. This segment, similar to single house, is the most sensitive to increase demand due to its lower supply. I believe this spring will be a busy one for townhouses. If the inventory remains steady, we should see this segment hoovering around Balance/Seller market. Multiple offers for townhouses may be a common sighting when the rate starts dropping. Last year, the townhouses had an annual price growth of +6%. For 2024, I see a conservative annual price gain of 2.4% for townhouses.

Apartment and Condo Market

Of all the segments, apartment markets should see the least price growth this year. Why? It's mainly due to the nature of the Buyers demand and the supply. Apartment market has a higher concentration of first time home buyers and investors, and they are the most sensitive to rates. In the current high interest environment, these two types of Buyers are hurt the most. First time home buyers remain constrained due to their budget, and when unemployment rises, they may delay their plans. As for the investors, they would likely take a hard pass on real estate investment if such investments cannot beat the bank's guaranteed return rate of 4-5% (i.e 1 year GIC). Investor may still turn to the pre-sale sector as that market is slowly seeing increased traffic and sales. Also, supply of apartments have always been the most abundant with a wide range of selections, and this will put a lid on the price growth as well. With rate drops on the horizon, some first time home Buyer who have delayed their plans from last year to this year will definitely jump in. Thus, this sector should see a greater uptick in sales compared to other segments. Last year, the apartment segment registered +5.7% price growth. My prediction for apartment in 2024 will be a very modest price growth of +1.9%. Apartment rental will remain strong as immigration continues to filter through the Canadian economy.

|

|

|