Real Estate Market Intelligence February 2023

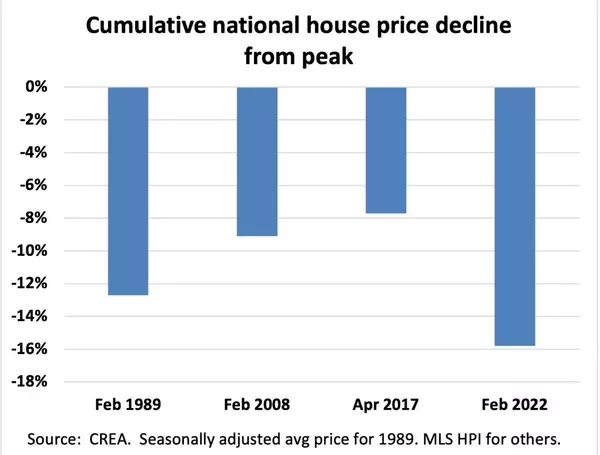

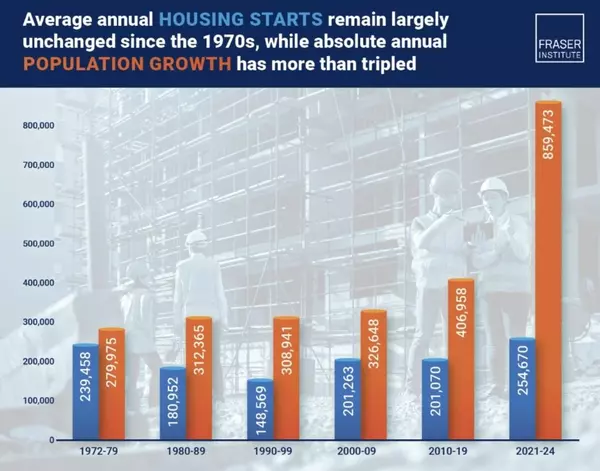

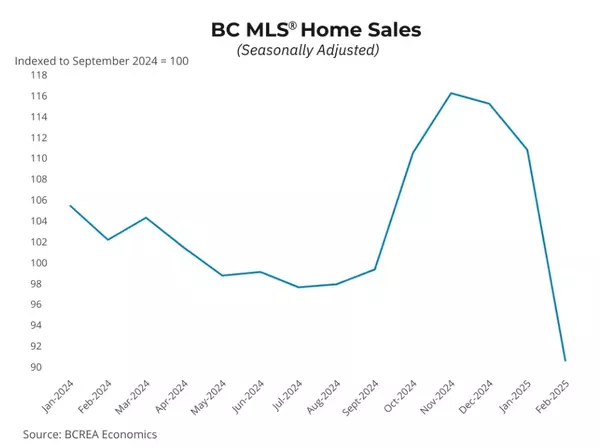

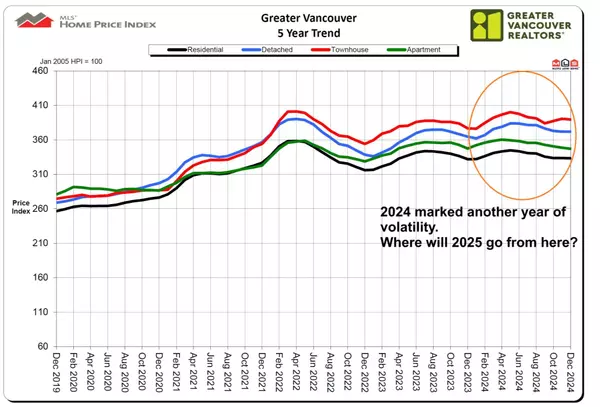

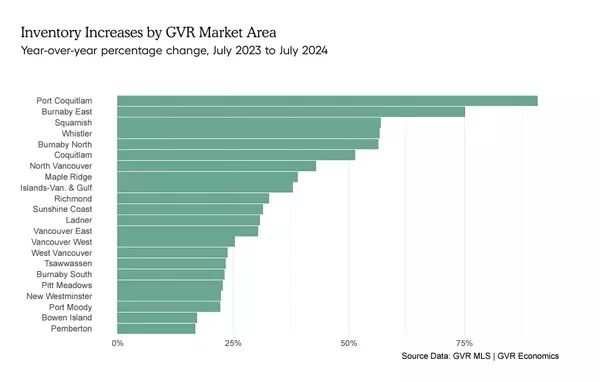

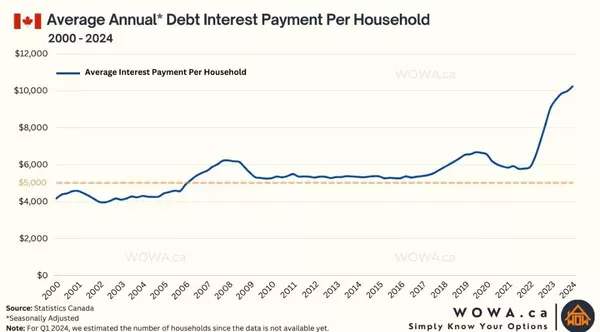

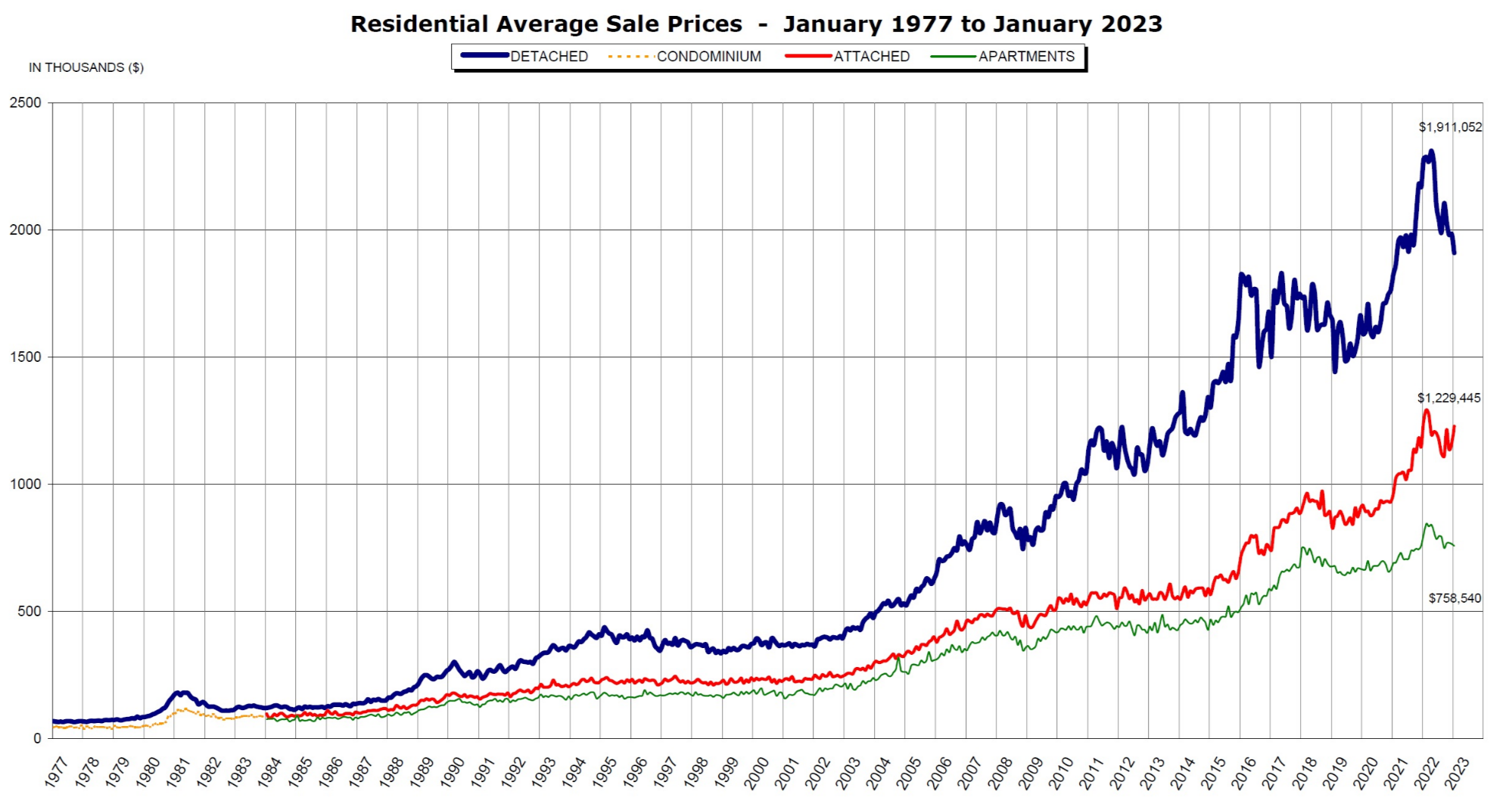

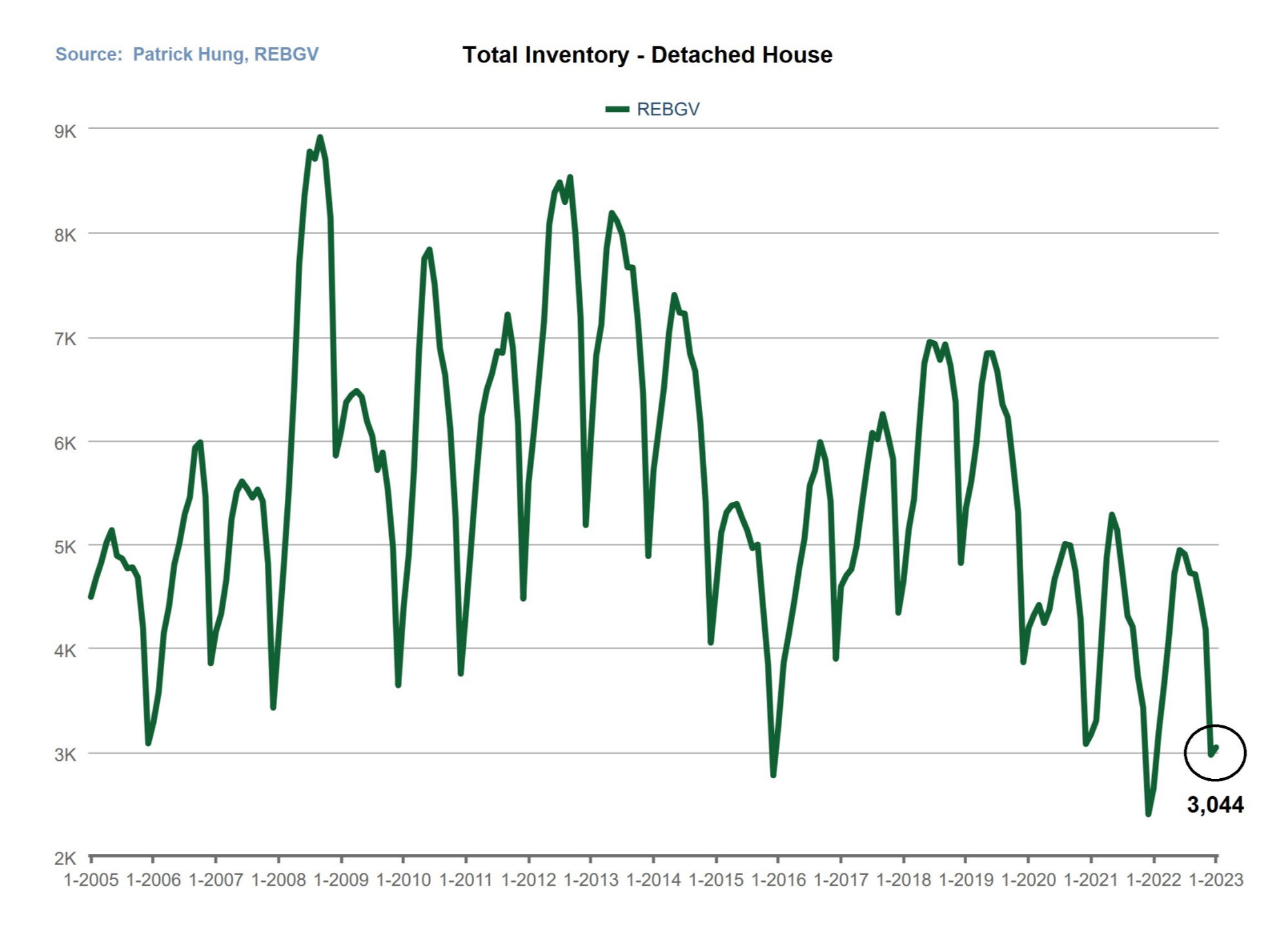

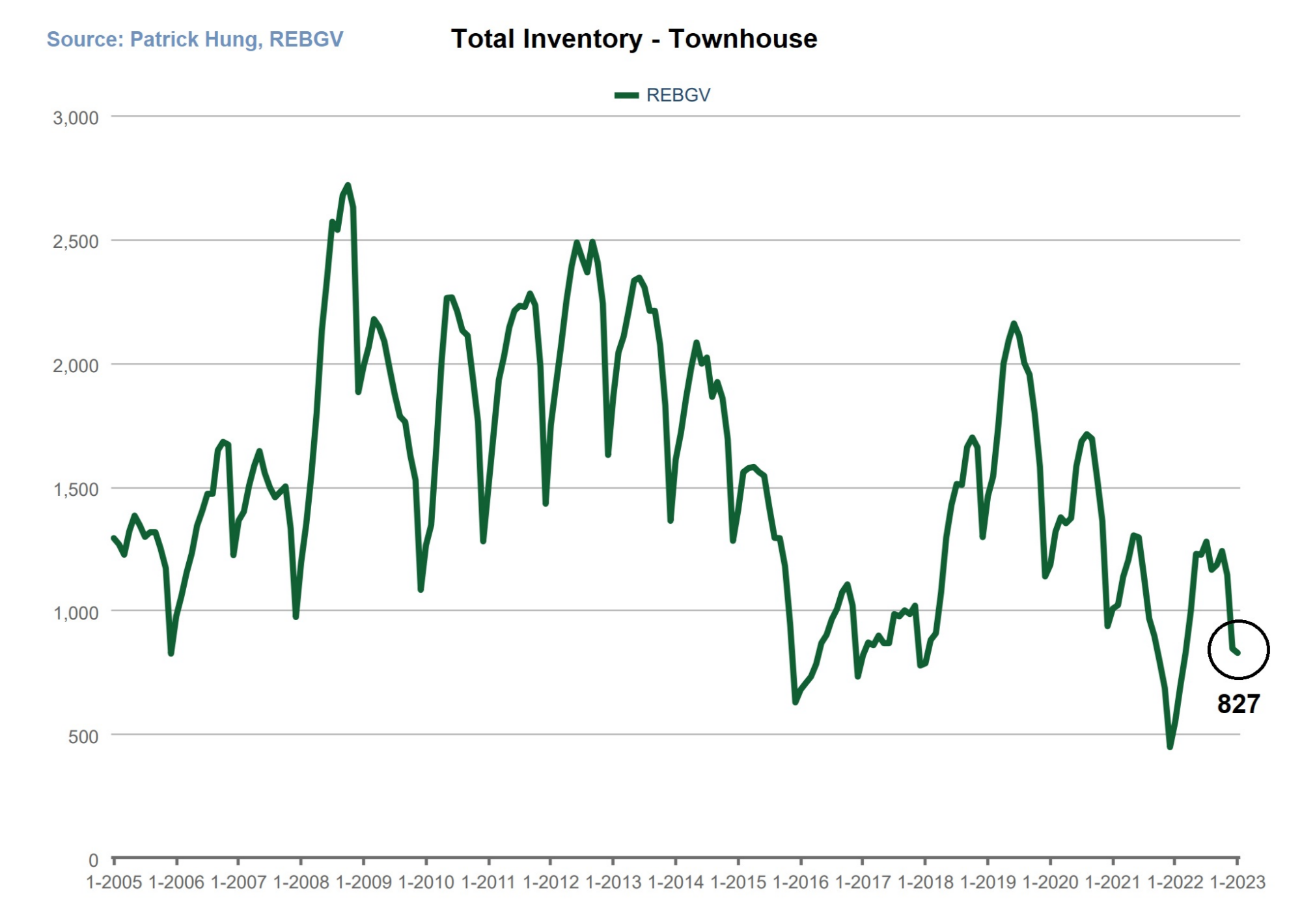

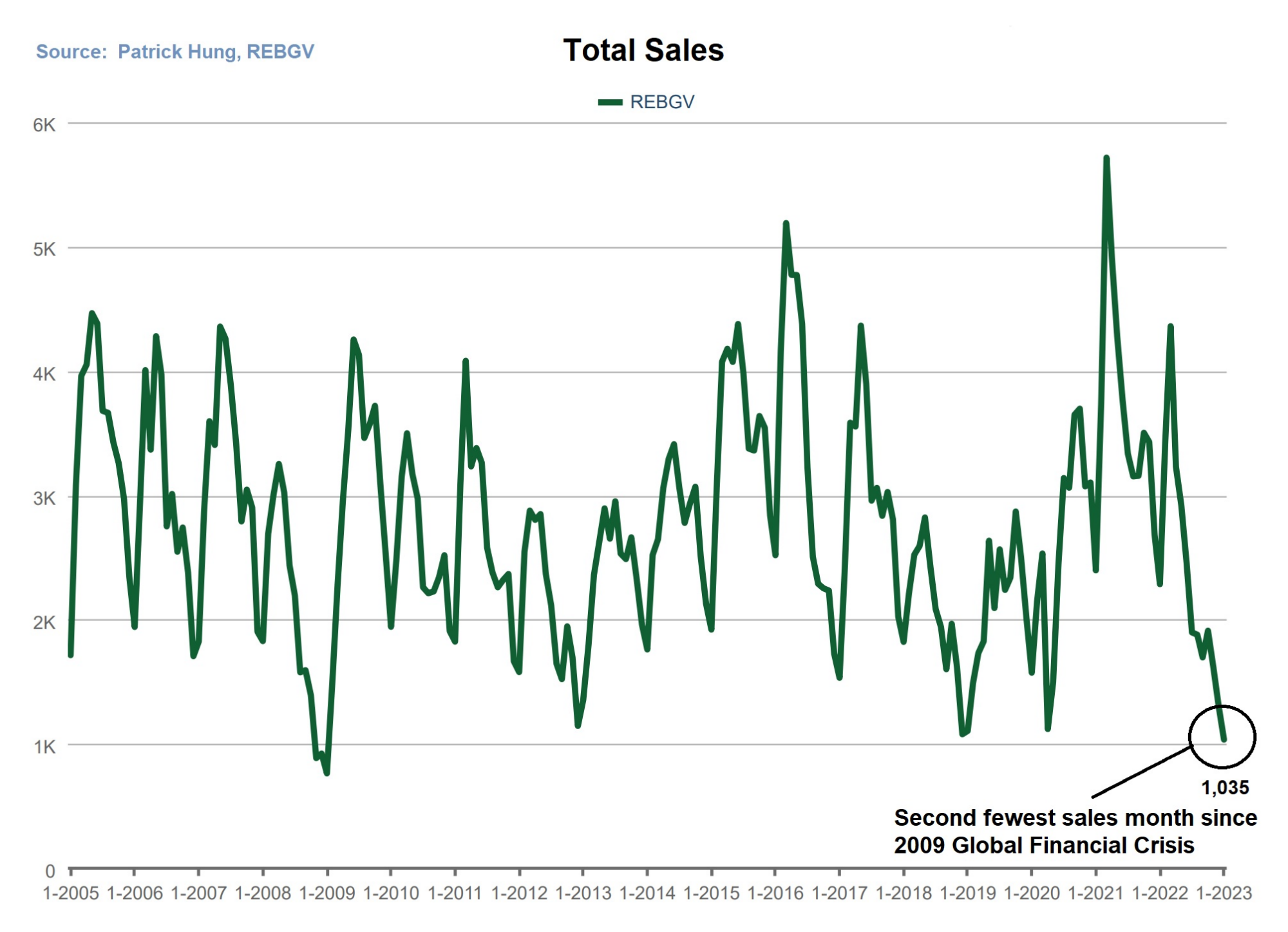

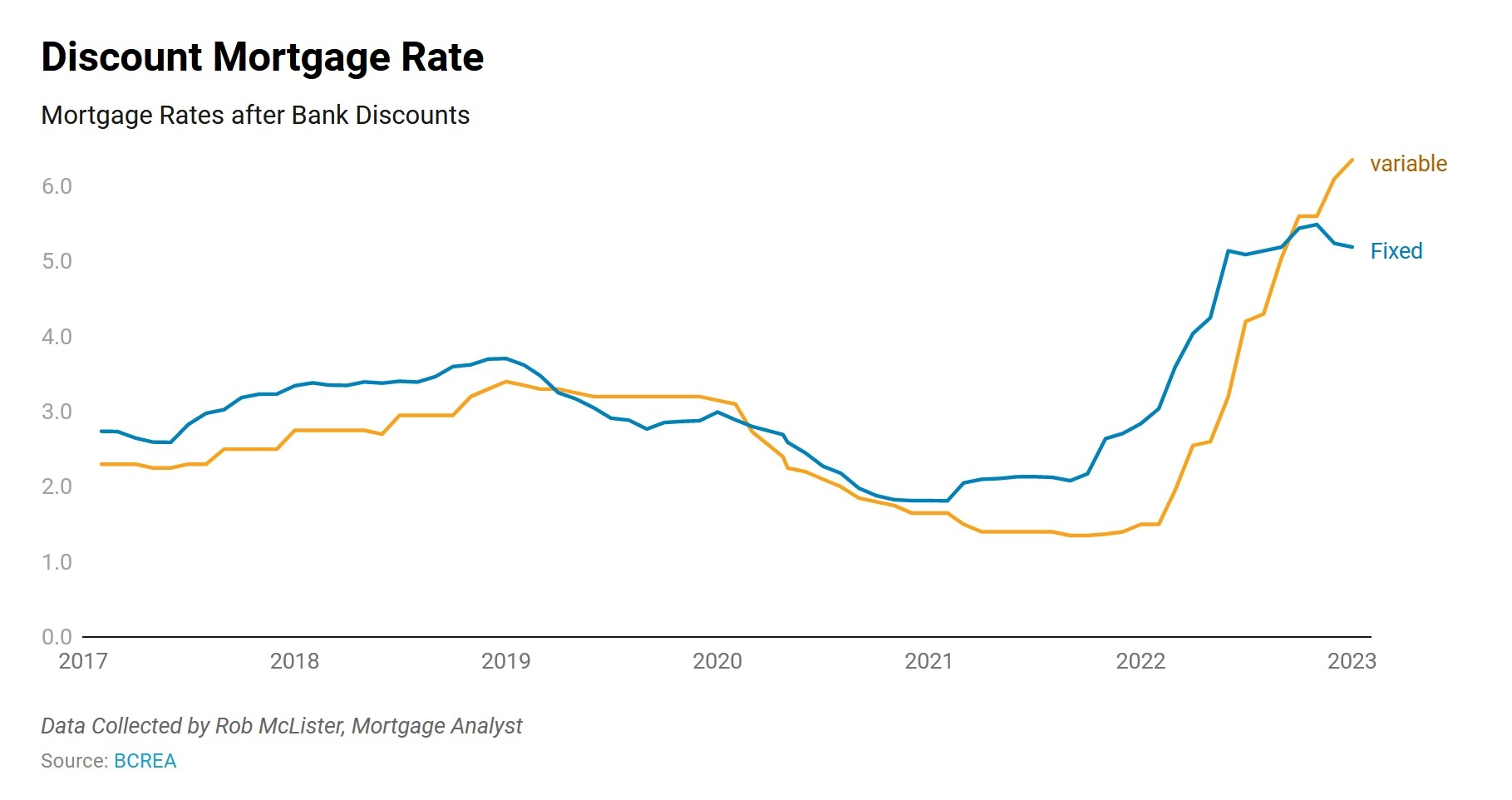

The 2023 real estate market kicked off the year in historical terms, with monthly sales record low that haven't been seen since the financial crisis since 2009, and at 42.9% below the 10 years average (see graph below). What is equally astonishing is that January new listings are ALSO near 25 years low. The market is becoming even more polarized with less sales and less inventory and buyers and sellers not seeing eye to eye. Since the Bank of Canada announced the latest rate hike of 0.25% and signalled that "could" be the ceiling, the market is finally taking a breather. The Big 5 banks already slashed their 5-year fixed mortgage rate twice in January in anticipation of rate drops by end of this year. While that may be too early to celebrate, we have seen for the the last week of January with increased activity with more traffic at open house, and with the return of multiple offers in some reasonably priced homes. Some buyers, whom have been waiting on the sidelines since for a few months, have decided to make that step forward. Sales prices, too, seem to have slowed the drop last month, registering only -0.3% decrease (compared to December's -1.8%). Noteworthy is that since the peak of March/April of 2022, we have seen the Greater Vancouver average home price plunge -13%. However, this time around the adjustment is bit different. Current home prices are remaining above pre-pandemic levels, and rates are at a 15 year high, PLUS we still have a low inventory. The difference from the last plunge in 2009 is that we are not seeing any mass panic selling. Homeowner have built up enough equity over time in their homes may decide to simply stay put. With the US Federal Reserve still looking to hike the rates further, let's see how Canada and the US operate on a different inflation and rate path. As we see Buyers' confidence starting to come out of hibernation, the wild card would be supply. As Spring is typically the busiest time of the year with the heightened activity, would there be enough supply if demand returns? This is low-demand, low-supply trend here to stay? Let's see.

Some of the unique trends I've been observing:

1. Buyer are starting to come out of hibernation after the past two months of record low sales and activity. Market is suddenly picking up at the end of January after the rate hike announcement.

2. Unemployment remains low, with BC's near all time low at 4.2%. Bank of Canada's stance of trigger a soft landing without slashing jobs would be a monumental task.

3. There are early indications that inflation may come down faster than expected. Bank of Canada will sure monitor that closely and consider dropping rates by end of 2023 or early 2024. The Big 5 Banks have already dropped their 5 year fixed rate in anticipation of that.

4. As Asia reopens, factory shutdowns and supply chain issues should be eased. This should also help with the inflation.

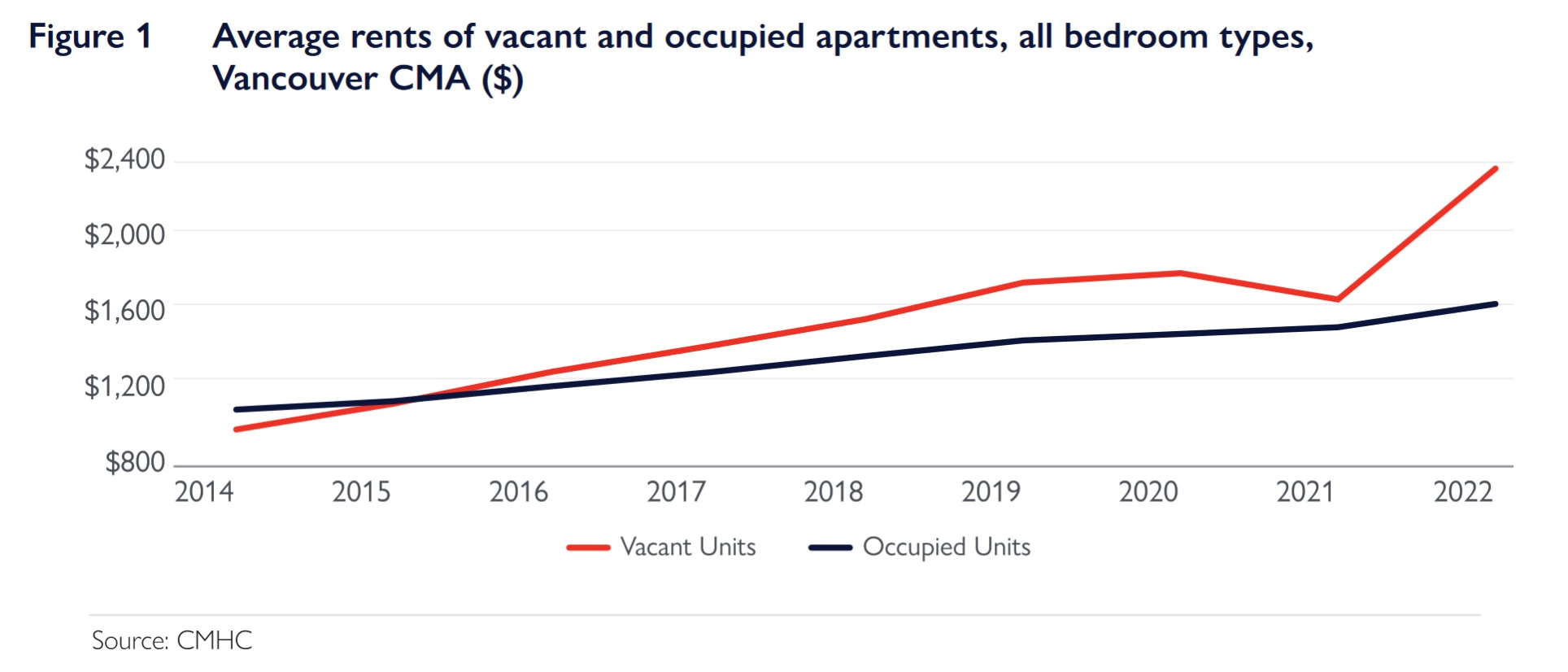

5. Rental rates in Greater Vancouver has levelled, while rental demand remain elevated with vacancy rate below 1%. Higher interest rates has kept would-be buyers in the rental market.

Here are the 3 highlights for January:

- One of the slowest January on record since the 2009 global financial crisis.

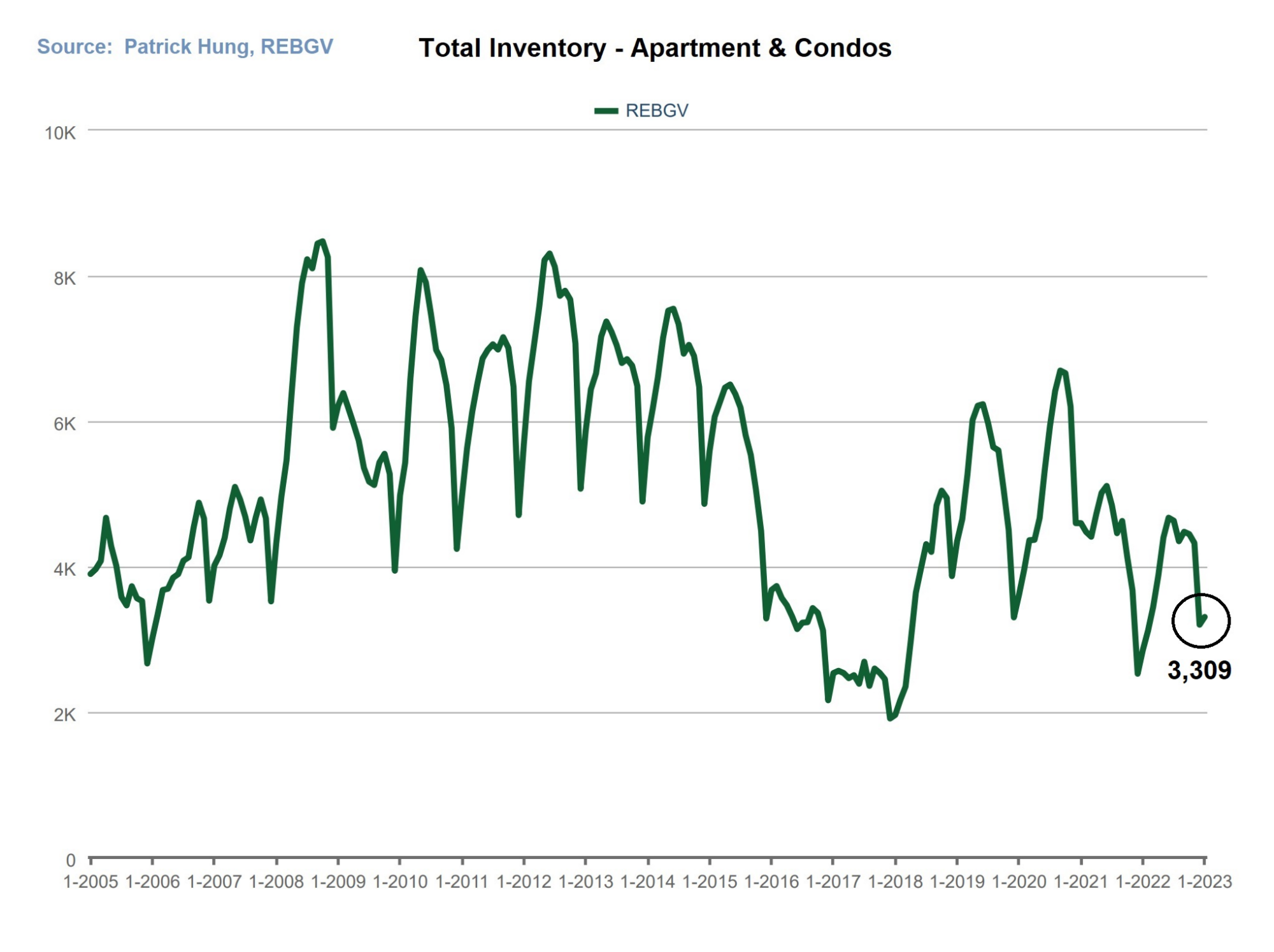

- Inventory remains low, with January new listings at a 25 year low.

- Minor market price adjustment last month, with January's monthly decline (-0.3%) slightly below the past 6 month's decline rate (-1.4% per month).

Here are the in-depth statistics of the November:

- Last month's sales were -42.9% below the 10 year January sales average

- Month by month residential home sales decreased by -21.1% compared to December 2022.

- Month by month home listings slightly increased by +1.3% compared to December 2022.

- Last month's price adjustment was -0.3% compared to December 2022.

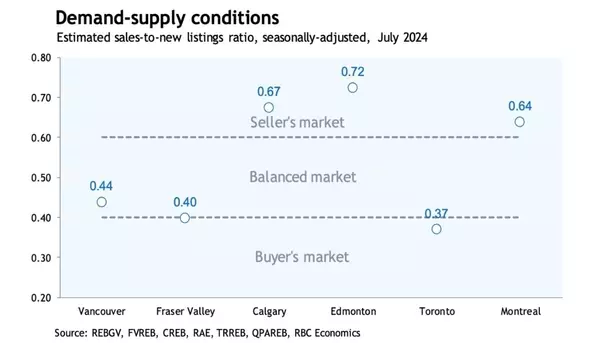

- Sales-to-listing (or % of homes sold) ratio is 13.7%. By property type, the ratio is 10.2% for single houses, 13.4% for townhouses, and 16.7% for apartments/condos.

Detached House Market

Detached houses, as expect, was the first property type to enter the Buyers market. In the beginning of the January, there were very little traffic and offers. However, towards the end of the month and after the latest rate hike announcement, we began to see activity return. There was quite a bit of buzz when a single house listing in Surrey, which had a very low asking price of $1m, attracted hundreds of groups to view (as expected). They ended up with 48 offers, and selling at $1.29m, which was at a market price. This is sign that buyers are cautious and conscious in their offers, and the mere multiple listing strategy to drive up the selling price is not working as well as intended. As the high interest rate is here to stay in the short term, downward price pressure will remain in detached home market. Months-of-Inventory for detached houses has reach 10 months, signifying buyers market is in full effect. Low number of new listing has been a key factor in slowing sharp price drops, and single houses under $1.75m in Greater Vancouver remain to be the most attractive, with very little new listing and existing inventory. There are hardly any panic sales, and if there were, they were most sold within the same day. Another sign that potential buyers and investors are still out there, just some remaining in the holding pattern. For the month of January, the areas with the least price reductions are Port Moody, Port Coquitlam and Maple Ridge, at +1%, +0.2% and -0.1% respectively. Conversely, the neighborhoods with the most significant price drops are West Sunshine Coast, Burnaby North, and Pitt Meadows, with -3.8%, -3.3% and -2.7% respectively. The detached home market has officially entered into the Buyers market, with average days on market at 51 days (compared to 49 days from last month), and month-to-month average price are down -1.3% (compared to -1.9% last month). Sales-to-listing ratio (% of homes sold) has dropped to 10.2% (compared to 12.3% last month).

The townhouse market has been relatively quiet, and the price this sector's for January has been holding on fairly well. Having said that, last month's sales, albeit slight up +0.8% from December, is still near a historic low. At the same time, new listing and inventory have increased. Reasonably priced townhouses are still selling, such as a Richmond townhouse that listed for $929k and attracted 8 offers, and ultimately sold for $965k, which is also in line with the market price. Currently, the benchmark price for townhouse is at 1.02m, and it is very likely that will dip below the $1m mark in the next few months. Noteworthy is the the price polarity for townhouses continues. For example, we have Ladner townhouses going +5.3% in price growth, while Whistler going the other way at -5.0%. This is definitely sending mixed signals to buyers. In January, the areas with the strongest townhouse price growths are in Ladner, Tsawwassen and Vancouver West, gaining +5.3%, +4.5%, and +2.6% respectively. Conversely, the neighborhoods with the most significant price declines are Pitt Meadows, Maple Ridge, and Vancouver East, with -5%, -1.9% and -1.7% respectively. The townhouse market remains to be in a balanced market, with average days on market increasing to 43 days (compared to 37 days last month). Month-to-month sale price has increased by +0.8% (compared to -1.5% increase last month). Sale-to-listing (% homes sold) ratio has retreated to 13.4% (compared to 19.5% last month).

The apartment and the condo market remain to be the balancing factor, registering a surprising +0.8% price gain last month. Why would that be? Isn't there too much apartment supply? Simple answer is: apartments and condos remain the primary choice for first time home buyers and young families. The high interest rate and budget squeeze for buyers seem to have increased the demand for apartments. Combine that with record high rent, low vacancy rate (less than 1%), and an ambitious immigration policy, it's not hard to tell why demand for this sector is the strongest among all property types. Some may argue that with so much pre-sale, supply is right around the corner. In fact, residential building permits have decreased, and some developers have slowed their construction process so that they don't create oversupply. Noteworthy is there were a slight uptick on the pre-sale scene in January, where two projects, one near Brentwood Mall and another one at North Surrey, has had overwhelming response. Some investors elect to go with the pre-sale route to bypass the current high interest rate market, and hope that by the time their project completes in 3-5 years, they would reap the profits. On the flip side, we are starting to see more assignments of pre-sale being offered, with some buyers and investors who cannot complete or secure financing taking a heft loss. I''m positive we would be seeing more of these throughout the year. For the month of January, the best performing neighborhoods for apartments are Whistler, Squamish, and Sunshine Coast, posting +7.5%, +7.4% and +7.1% gains respectively. Conversely, the areas with most downward price adjustments were Burnaby East, Maple Ridge, and North Vancouver, with -1.1%, -0.9% and -0.9% respectively. The apartment and condo market remains in a balanced market, with average days on market at 42 days (compared to 26 days last month). Month-to-month sale price is +0.8% (compared to -0.9% last month). Sale-to-listing (% homes sold) ratio has dropped to 16.7% (compared to 21.7% last month).

Here are the Three Trends I'm Observing:

1. Rapidly Shifting

With January total sales reaching the second lowest since 2009 global financial crisis, one would think the market would tank. However, that was also match by record low inventory. Buyers and Sellers may not be seeing eye to eye, but there early signs of Buyers coming out of hibernation in the last two weeks with more activities and sales. Market is rapidly shifting. (Source: Patrick Hung, REBGV)

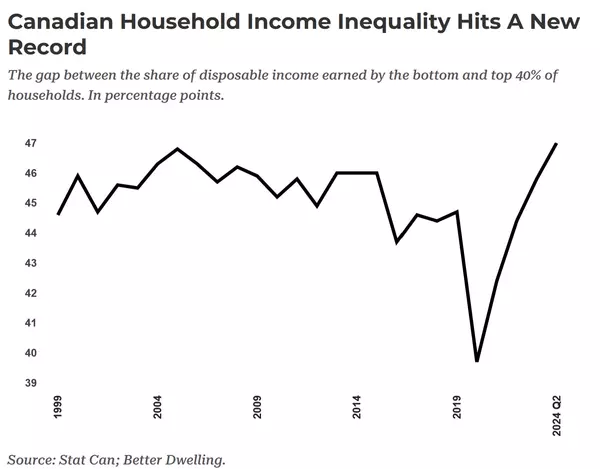

2. Widening Gap

Average rent between vacant rental apartments and occupied apartments in the Greater Vancouver area has a whooping difference of 43%. Existing tenants pay close to $1600, while new tenants pay close to $2400 for similar unit. The gap may grow bigger with new immigrants seeking to rent first before buying. (Source: CMHC)

3. A Bump or A Trend?

Canada's major banks are dropping their 5 year fixed rates since late January, in anticipation of Bank of Canada's rate cuts later this year or early next year. Could this be just a bump, or a trend? (Source: Rob McLister, BCREA)

Recent Posts