Real Estate Market Intelligence February 2024

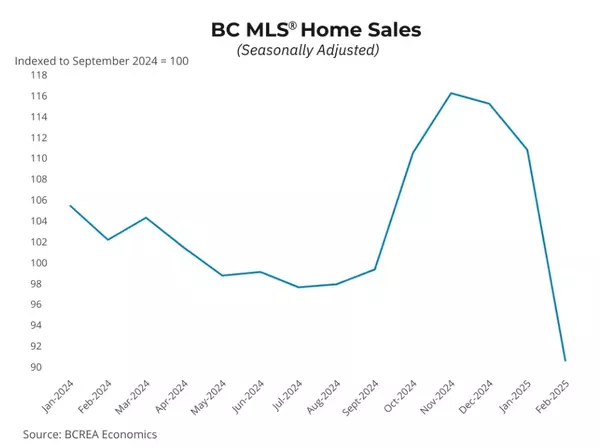

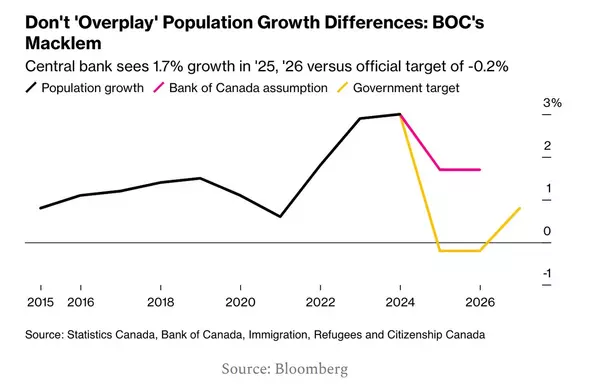

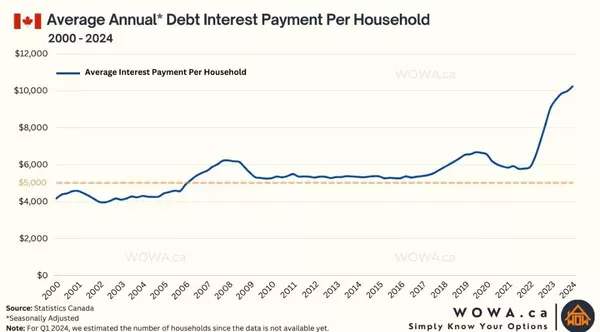

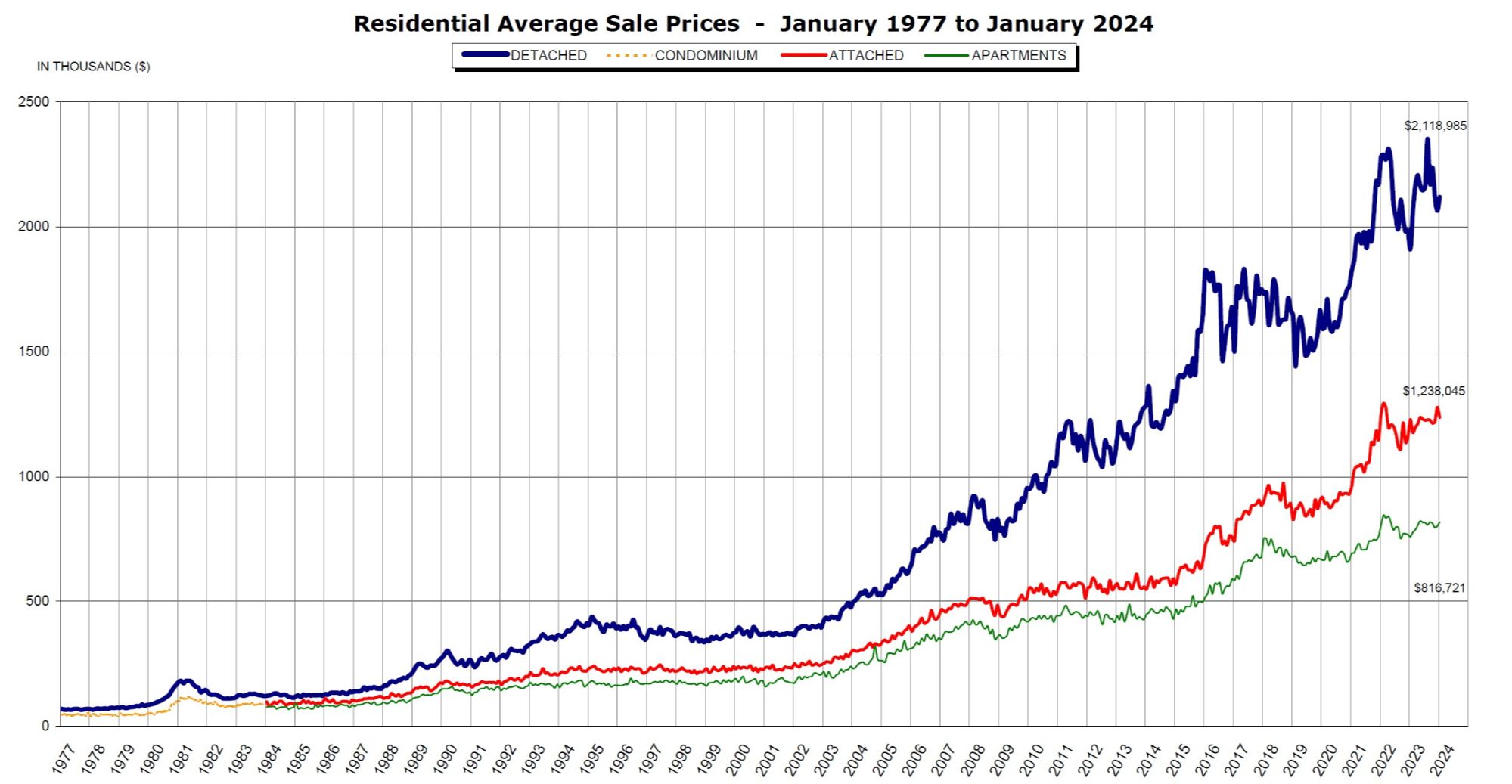

Spring is around the corner, and the Vancouver real estate market has officially come out of hibernation. January started off with a bang and buyers are getting active again. In short, sales are up but prices are down. Open house traffic is increasing and multiple offers on some good homes are starting to resurface. So what is happening? Well, it's evident that some Buyers are trying to stay ahead of the curve and get in before the typical busy spring market. In January, there are reported more sales in 2024 compared to a year ago (+38.5% January year-over-year). However, keep in mind that last year 2023 was the slowest year in 25 years, so there is a strong base effect in play. The big picture is, January sales is still -20.2% below the 10 year average. So the Buyers are stepping off the sidelines, but we not near the average yet. Why? Firstly, the rates remain elevated, but the market anticipate of rate drop is real. We still need 4-5% mortgage rates in order to convince the Buyers to return. On the economic side, the inflation CPI surprised many by going up to 3.4% in December (compared to 3.1% in November). The miracle mile to the elusive 2% inflation seems the be the hardest battle fought, and this latest data will give Bank of Canada more reason to further postpone any possible rate cuts. I wouldn't be surprised if the rate cuts would come later than sooner, possibly in summer over spring. Also, there may be less rate cuts than some anticipated.

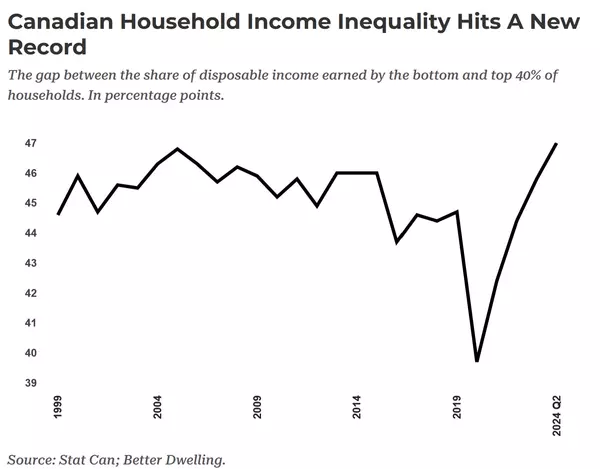

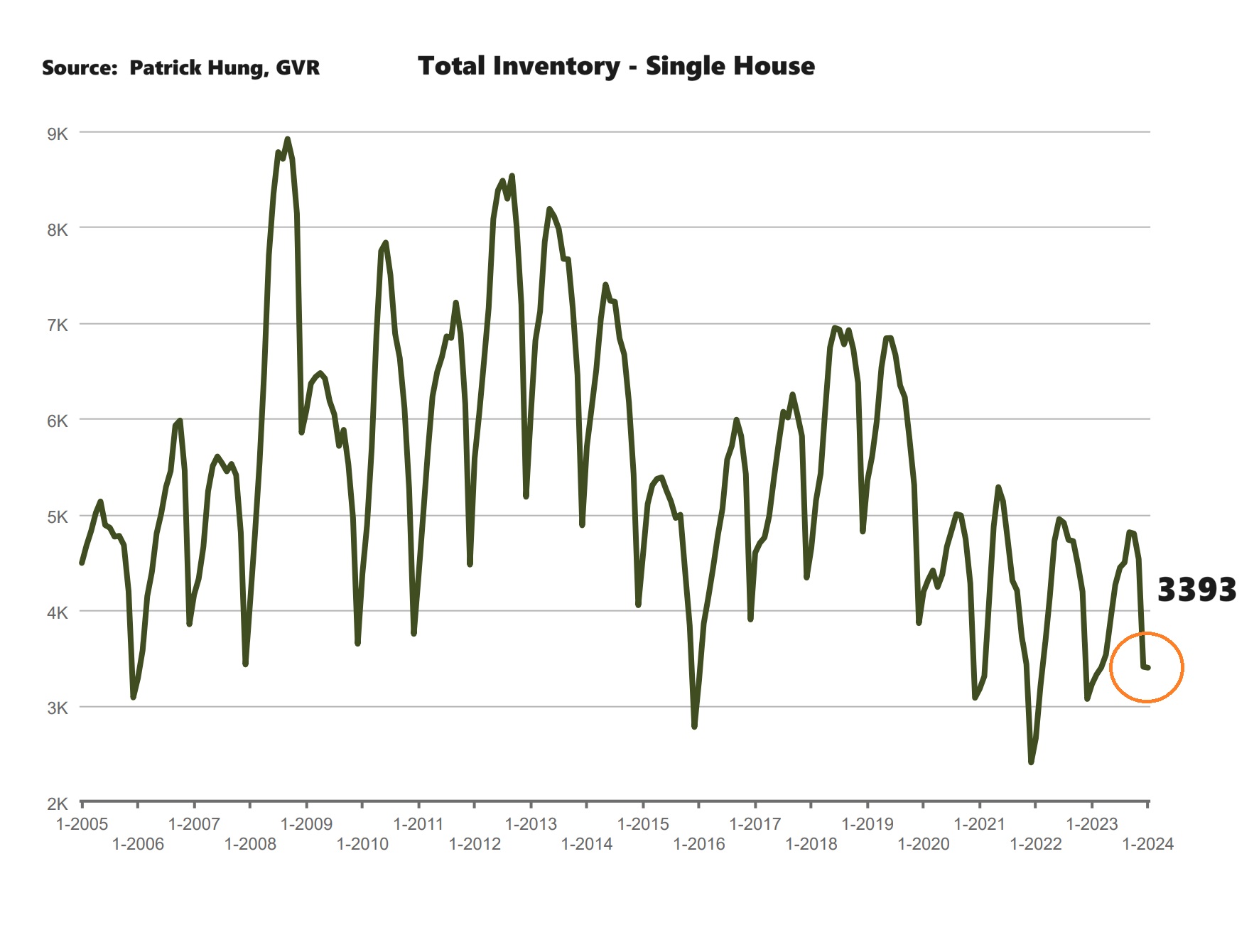

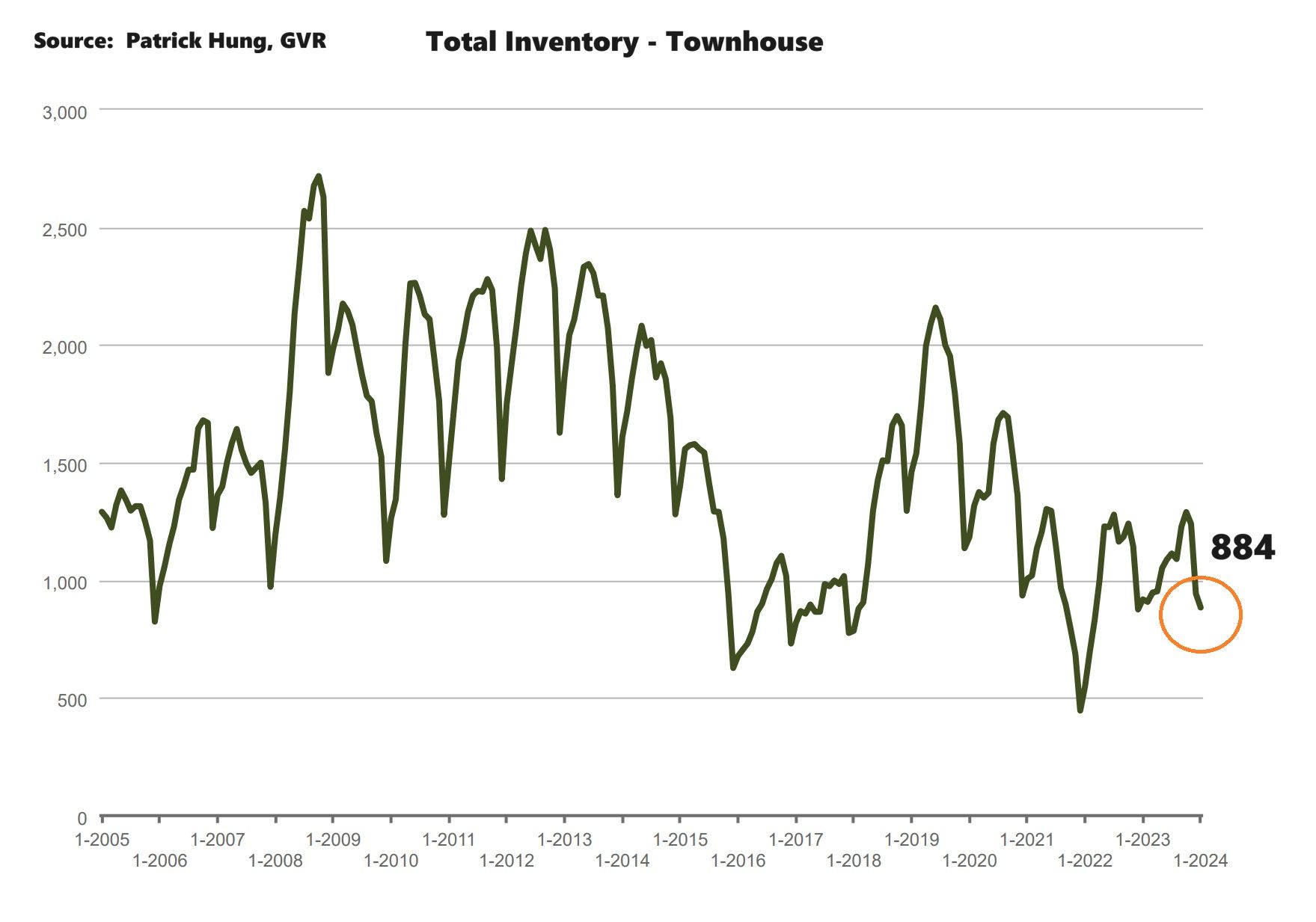

Buyer confidence is a funny thing, and even when two months ago when the pre-sale scene was all quiet and crickets, now there's a surge or excitement in the air. For example, the recent launch of a pre-sale, Parkway 2 in Surrey by Bosa Properties, has generated enormous interest. Most Buyers let their emotions get the better of them and may have forgotten about the Canadian economic outlook, such as the rising unemployment (currently at 5.7%) that will soon hit 6%. I believe hitting 6% is expected and normal, and that's what the Bank of Canada intended to do all along is to have more people get laid off so discretionary spending would go down in the hopes of taming inflation. Having said that, our US neighbours are faring much better than us, as their recent job data came in much hotter than expected by adding 353,000 jobs in January, and NASDAQ is near an all-time high. On a cautionary note, the US consumer spending slipped -1% in January compared to December. What we may see is a divergence in the US-Canada rate policy, as Canada will highly like cut rates before the US. Once again, this year remains highly volatile and extremely hard to predict. Perhaps with the Buyers coming off the sidelines is the first sign that the Vancouver real estate market is starting to heat up again. Key is, inventory remains low. Will we be seeing a repeat of the Sellers tightening the housing supply, causing another price floor? Let's see.

Some of the unique trends I've been observing:

1. January sales are up while prices are down. Good products are still flying off the shelves, while mediocre products are sitting around longer.

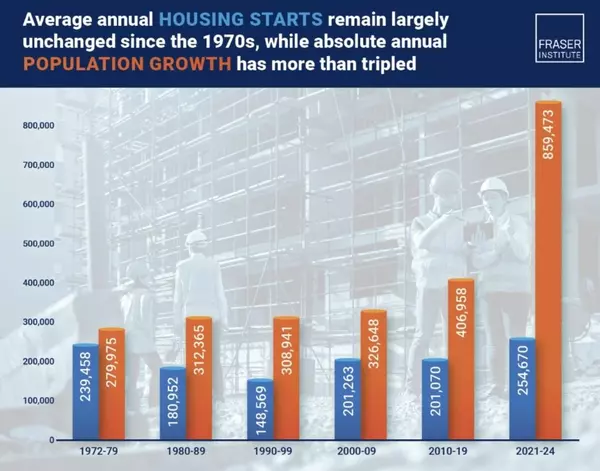

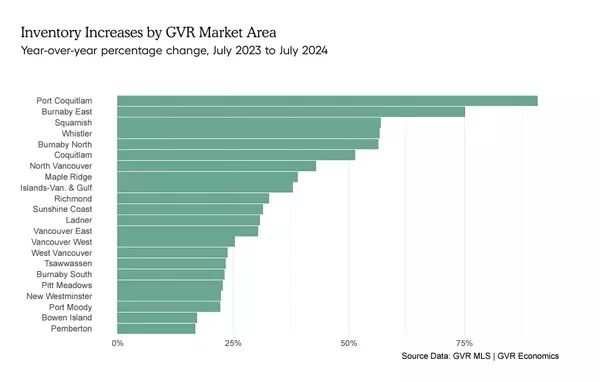

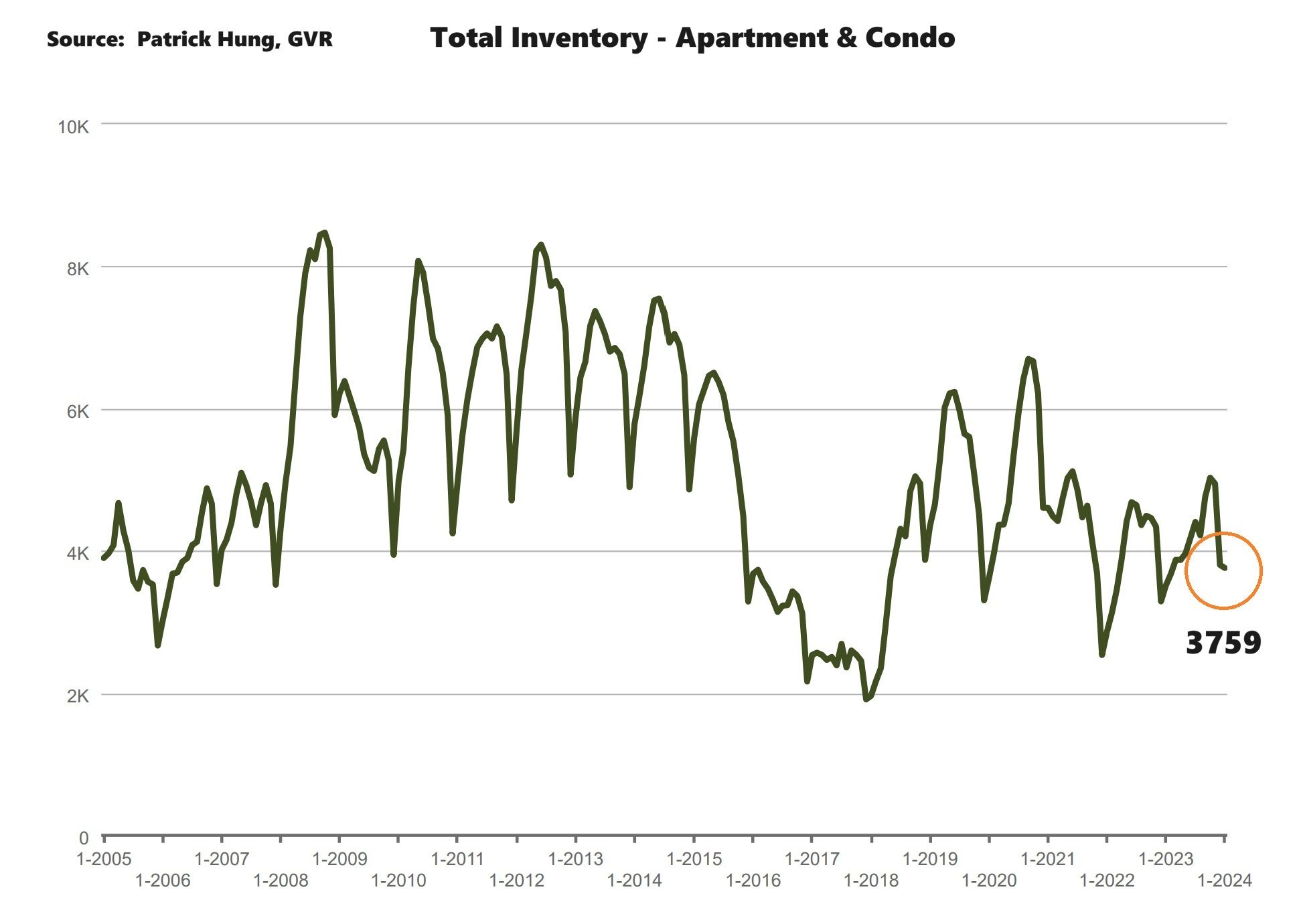

2. Total inventory in the month of January 2024 is actually lower than December. This has never happened before. Buyers continue to have limited selection as Sellers remain sidelined.

3. Pre-sale scene is picking up steam, with a few recent projects in Surrey and Langley reportedly sold out 70% of their inventory. Surprisingly, investors are back too. It is very possible the investors, some of whom have chosen to sit on the sidelines on their one-year term deposit of GIC's around 5%, are aware that their term is maturing later this year. The optimism in real estate market bounce back may provide more reason for them as a better leveraged option than GIC term renewals.

4. Speaking of pre-sale, there is a developer in Vancouver downtown indicating that every home purchase "receives" a Porche. Yes you read that right, and the catch is that they're selling at $2300+ per square feet.

5. The Canadian job data, gaining +37,300 jobs recently, may "look" good, but if we dive deeper it's not healthy at all. Of all the job gains, there are a total of -11,600 (full time jobs), and +48,900 (part time jobs). Unemployment rate being masked by part time jobs with new immigrants.

6. Canadian federal government announced it will extend the ban on foreigners buying housing in Canada for two more years. Back when the policy was launched, it was reported that foreign buyers consist of less than 1% of the pool. Is it me or does it it seem like the federal government is focused on that 1% rather than the 99% of problem?

Here are the 3 highlights for January:

- Sales continue to remain significant below (-20.2%) the 10 year average, while total inventory has increased slightly (+14.5). Inventory still remain low in historical terms.

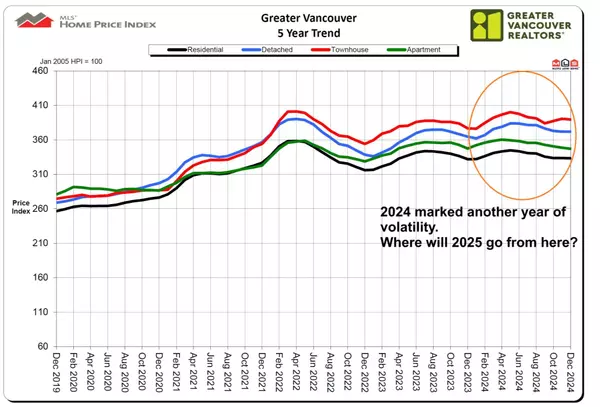

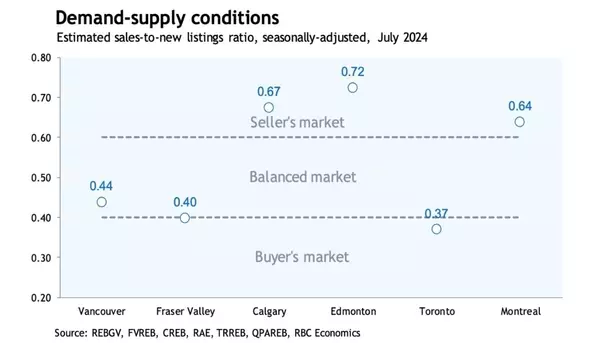

- Polarity in the segments are showing, with single house market at the borderline of Buyer's market, while townhouse and apartments entering the Seller's market. Balance market is missing in January.

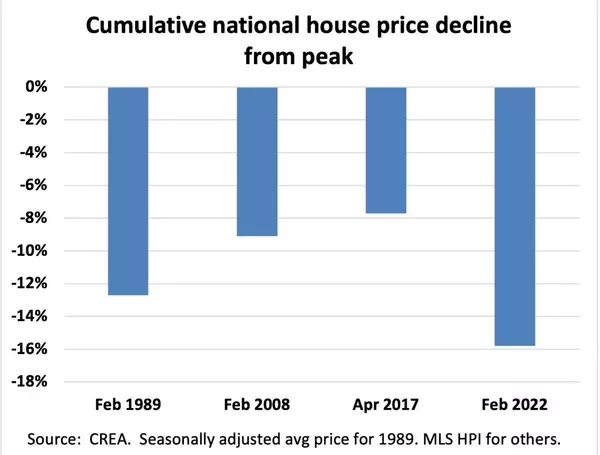

- Prices have dropped for the sixth month in a row, with January's price at -0.6%. (December's price drop was -1.4%). Note that sales are picking up, which is a lagging indicator for price, and price may have hit or is near a bottom already for this cycle.

Here are the in-depth statistics of the January:

- Last month's sales were -20.2% below the 10 year January's sales average.

- Month by month residential home sales increased by +5.7% compared to December 2023.

- Month by month new home listings increased by +180% compared to December 2023. Note that is not a typo as old listings usually "expire" at end of year and gets relisted into new listing, and thus skewing the numbers. In reality, the actual new listings are much less than that.

- Last month's price adjustment was -0.6% compared to December 2023.

- Sales-to-listing (or % of homes sold) ratio is 17.2%. By property type, the ratio is 11.9% for single houses, 22.9% for townhouses, and 19.9% for apartments/condos.

Download Greater Vancouver Real Estate Report Jan 2024

Single House Market

For the month of January, the areas with the most price gains are in Bowen Island, West Vancouver, and Burnaby East at +3.8%, +2.9% and +2.2% respectively. Conversely, the neighborhoods registered the most significant price drops are in Vancouver West, Squamish and Burnaby North, with -4.7%, -3% and -1.9% respectively. The detached home market continues to stay in a balanced market but is on the edge of a buyer's market, with average days on market at 54 days (same as last month), and month-to-month average price was accelerated its drop at -1.1% (compared to -0.9% last month). Sales-to-listing ratio (% of homes sold) has remains nearly unchanged at 11.9% (compared to 11.1% last month).

In January, the areas with the most townhouse price growths are Pitt Meadows, Vancouver West, and Coquitlam, at +2.9%, +1.5% and +0.7% respectively. Conversely, the neighborhoods with the most significant price drops are in all in Burnaby South, Sunshine Coast, and Burnaby North, at -4.2%, -3.6% and -3.3% respectively. The townhouse market shifts to a Sellers market, with average days on market dropped slightly at 37 days. Month-to-month sale price dropped slightly by -0.6% (compared to -1.8% last month). Sale-to-listing (% homes sold) ratio jumped up to 22.9% (compared to 18.7% last month).

The apartment segment has been the only one that did not register a drop in price (+0.1%) in January. However, it remains highly polarized like other segments. On one hand, the entry level homes between $500-$600k continue to fly off the the shelves. On the other hand, the more expensive 2+ bedrooms (i.e downtown apartments) remain on the market much much longer. What is surprising is to see the investors returning to the scene in droves, in both pre-sale and resale. As such, they are now cramming in with the first time home buyers. Buyer confidence seem to be roaring back in the pre-sale segment as well with renewed optimism prior to Spring. Many pre-sale projects were active in delivering promotions, such as a new Porche with a home purchase in downtown, or up to $50k credit for buyers during Lunar New Year . There is definitely excitement in the air as Buyers try to get ahead of each other. However, this craze has just started, so it could just be a blip on the map and may fizzle just as fast. If this craze were to persist into the Spring market, then entry level apartment prices will be driven up further. As mentioned before, apartment buyers has a high concentration of first time home buyers and investors. As such, they are most sensitive to rates. Thus, even if there was the slightest hint of a rate drop (most likely in mid year), I would expect this market to take off, if it hasn't already.

For the month of January, the best performing neighbourhoods for apartments are Vancouver West, West Vancouver, and Burnaby North, posting +1.7%, +1.3% and +0.8% gains respectively. Conversely, the areas with the price drops were Port Moody, Tsawwassen and Richmond, with -5.4%, -1.6%, and -1.4% respectively. Similar to the townhouse market, the apartment and condo segment are hoovering around the Sellers and balanced market, with average days on market remained flat at 42 days. Month-to-month sale price has improved at +0.1% (compared to -1.5% last month). Sale-to-listing (% homes sold) ratio remained flat at 19.9% (compared to 19.6% last month).

1. Stampede

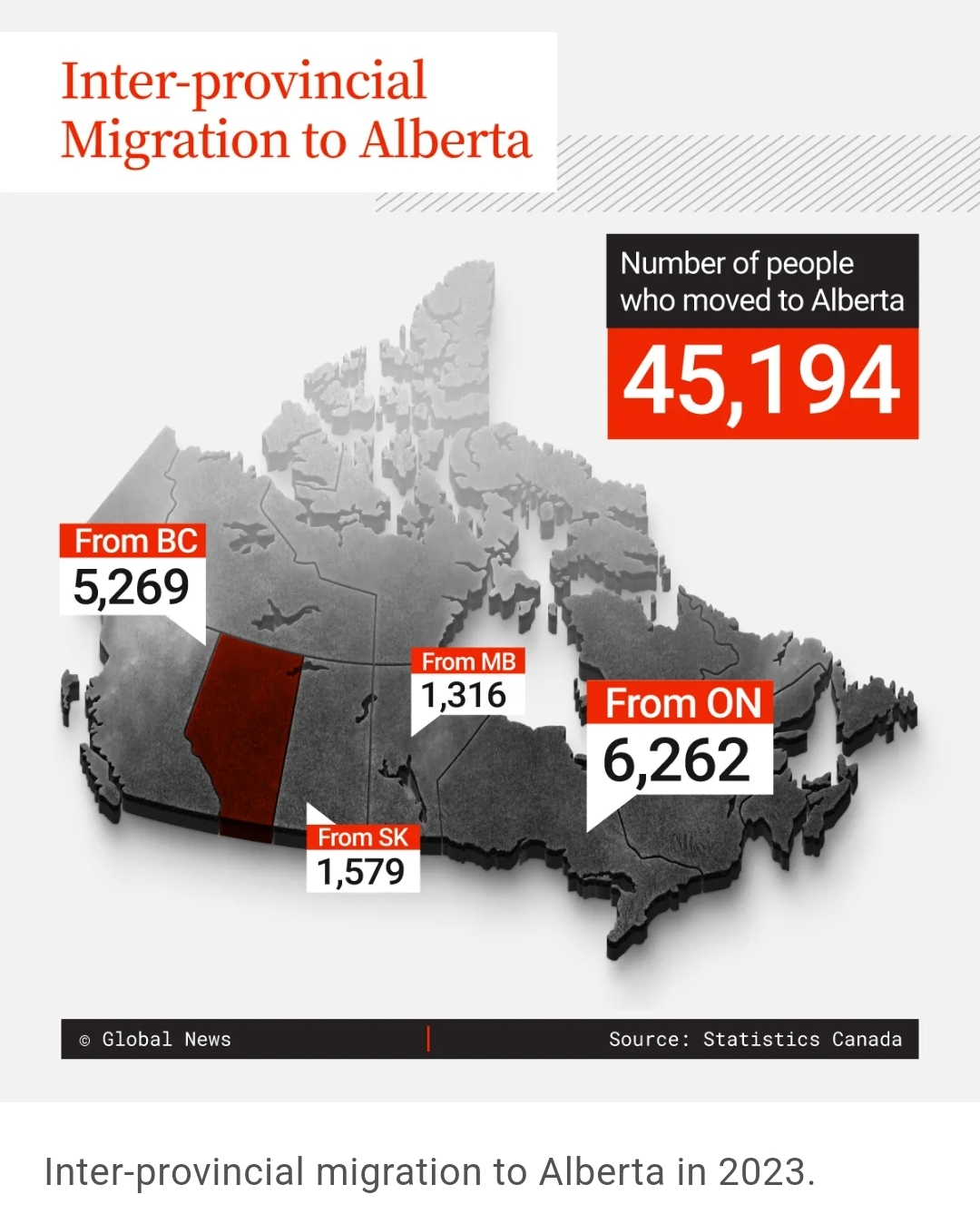

As Canadian housing and living cost continue to rise, many in Vancouver and Toronto have chosen a better life in Alberta. The tax benefits, such as no Province Sales Tax and no Property Transfer tax, definitely make life easier for Alberta first time home buyers and young families alike. This trend has becoming more and more common in the past two years and I expect to continue growing for years to come. Meanwhile, Calgary real estate housing supply cannot keep up with the surging demand. (Source: Statistic Canada)

2. Moving the Goal Posts

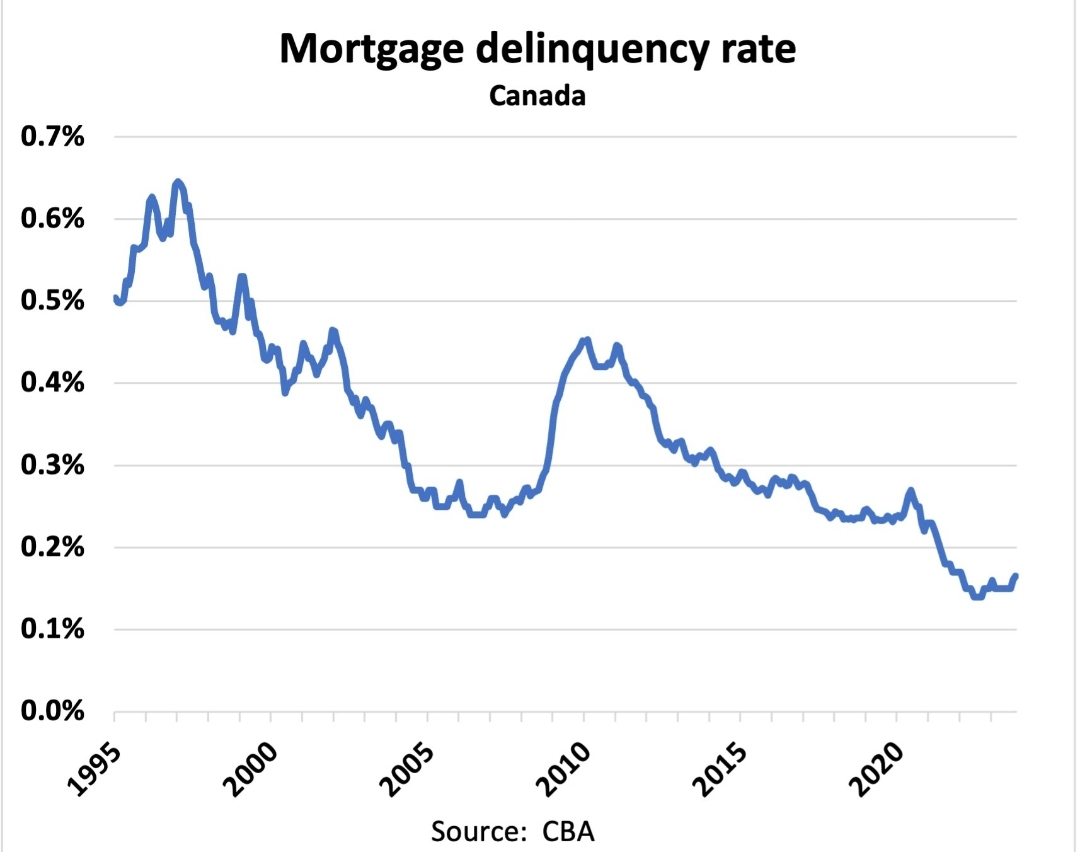

Mortgage delinquency rate is on the rise but is still low in historic terms. Key is, Canadian major banks have moved the goal posts by stretching the mortgage amortization period to 50+ years. Banks continue to rescue the housing sector to keep the Canadian economy afloat. (Source: CBA)

3. No New Roads

As Canada continue to absorb over 1 million new immigrants every year, the Environment Minister, Steven Guilbeault, has insisted that there will be NO investment of new roads and networks. Say hello to more traffic nightmares. (Source: Western Standard News)

Recent Posts