Real Estate Market Intelligence March 2024

Real Estate Market Intelligence

March 2024

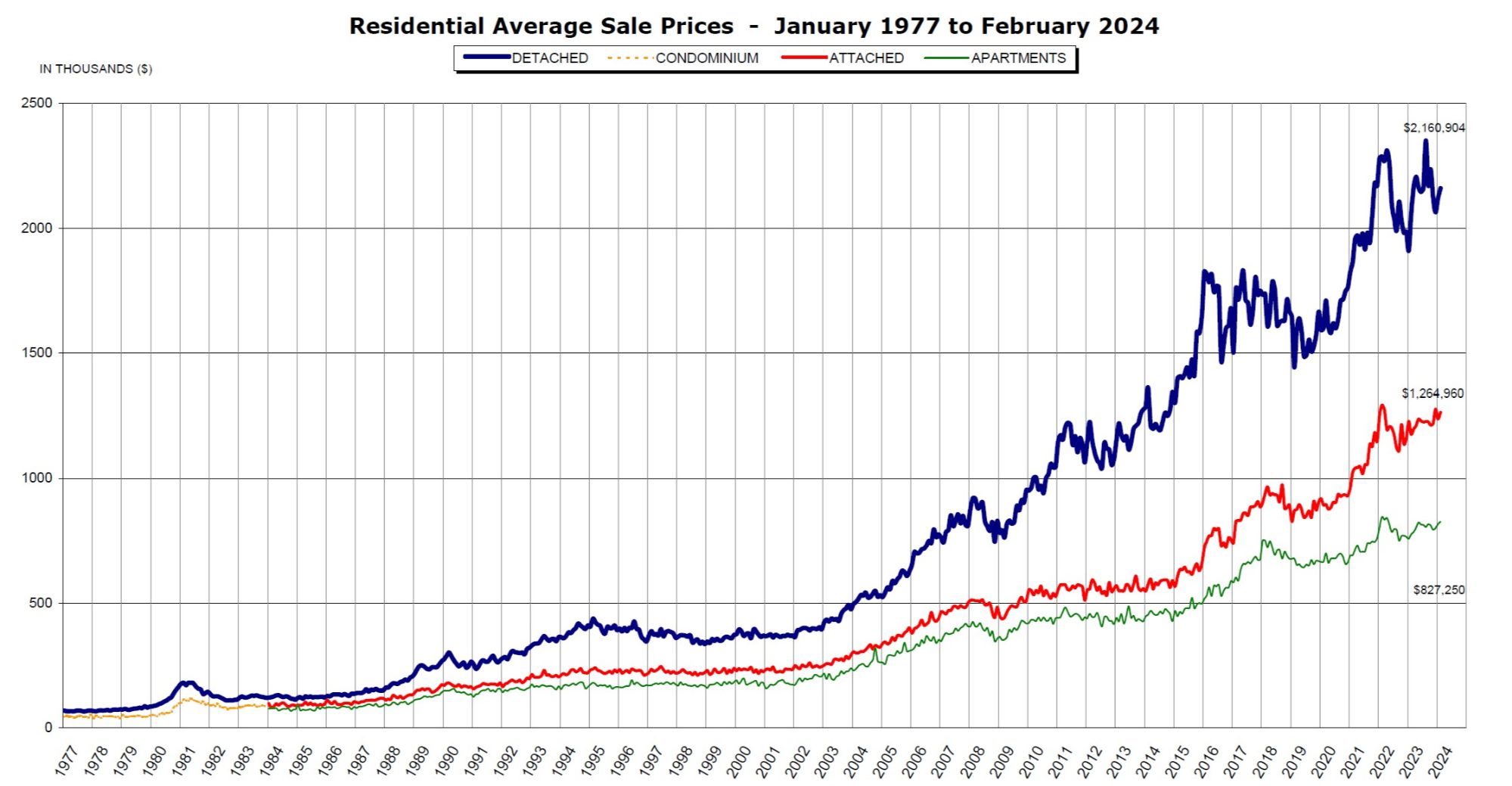

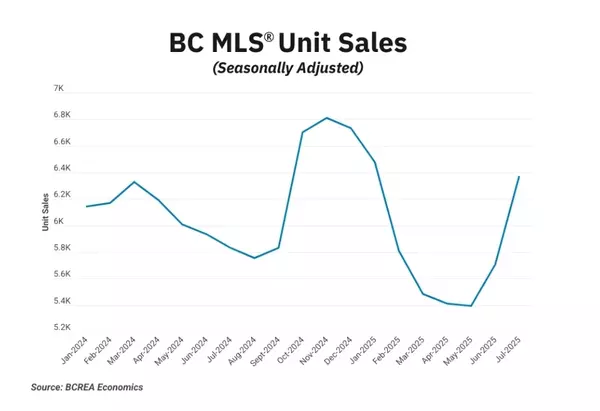

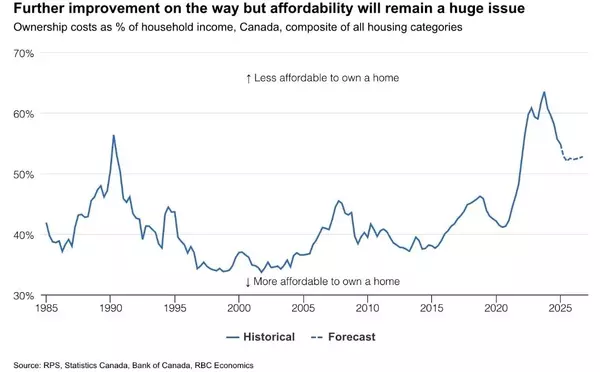

Spring has sprung, flowers are starting to blossom, and as usual, the Vancouver real estate market is starting to kick into gears again. February was filled with real estate headlines, such as the anti-flipping tax, the the foreigner buyer ban extension, and the increase for first time home buyer exemption bracket (more on these policies later). Markets are definitely more active with Buyers coming out of hibernation, and open house traffic has increased drastically. Noteworthy is that market polarity is still evident. For example, the hottest products remains the entry level priced homes, such as apartments below $700k, townhouses below $1.4m, and single houses below $2m in Vancouver. Multiple offers happen on a weekly basis for such entry level priced homes, as buyers continue to beat others to the market before any hint of interest rate cut. With affordability remaining elevated, we see the apartment and townhouse segment monthly price gains (+2.5% and +2.6%) outpacing the single house segment (+1.6%). While overall sales also increased and Buyer confidence is boosted, the average February sales remain -23.3% below 10 year seasonal average. In other words, the current market is more active but is only average, neither that good nor that bad. For all the housing bubble doomsayers out there, despite nearly two years of elevated interest rate, the Canadian housing market remains resilient. Whether we like it or not, the Vancouver real estate prices will continue to climb steadily as the increased demand (absorbing another 1 million immigrants this year) and limited inventory will create a price floor.

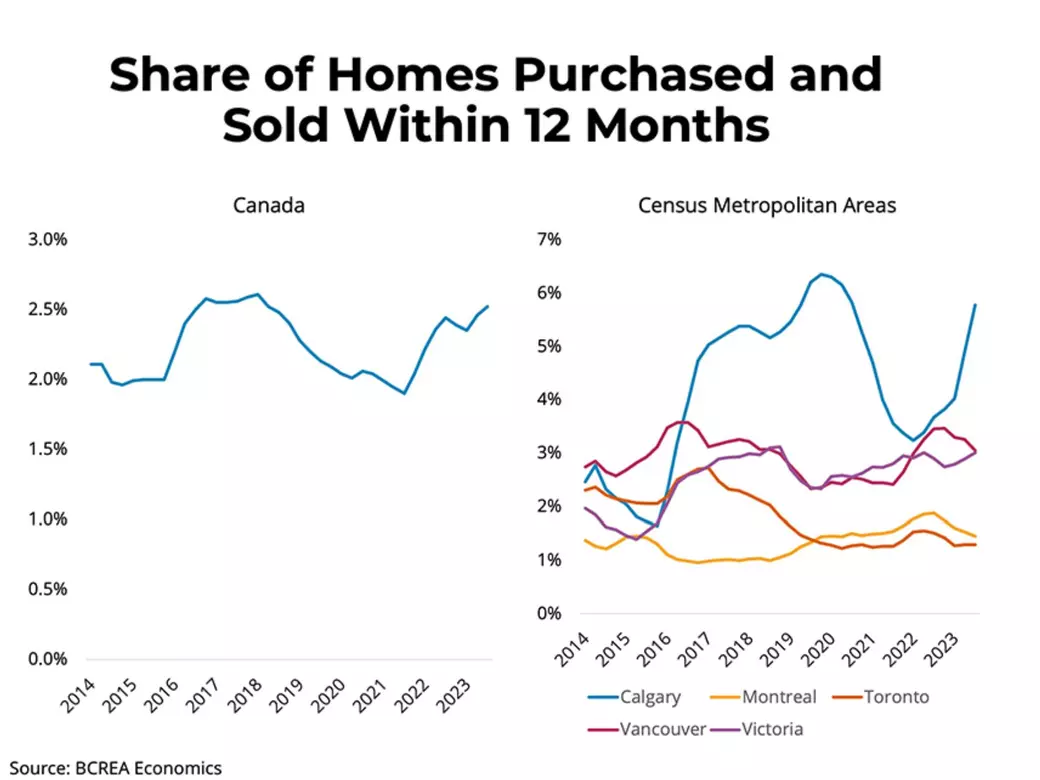

As for new policies, the BC government's introduced two latest moves. Firstly, the anti-flipping tax, which imposed 20% tax on profits sold within the 12 months, and a sliding scale from 12-24 months. Upon observing closely, homes that were flipped within a 12 month span only made up of 3% of tall transactions. Again, we see such government policy as another political vote-grabbing move and nothing will be solved. As for the second policy, it was great news that the Property Transfer Tax for first time home buyers max exemption bracket has been raised from $525k to $835k (sliding scale between $500k-$835k.) Once this was announced, homes under $700k began to sell quickly, usually within the first 2-3 weeks, if not in multiple offers. Some of the first time home buyers I'm helping now are stressed out solid as they've been in multiple offers nearly every week since the announcement. I believe this will continue in the near future as the problem may exasperate if inventory doesn't keep up, or if rates comes down sooner than expected.

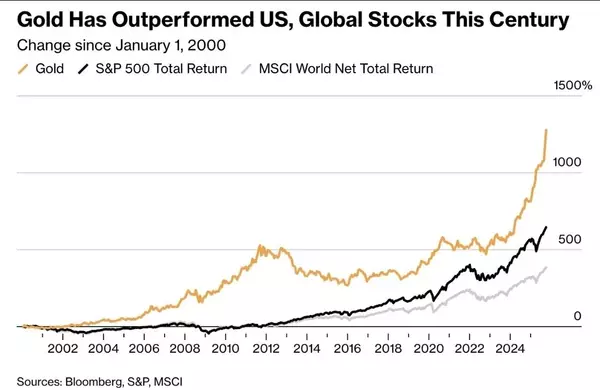

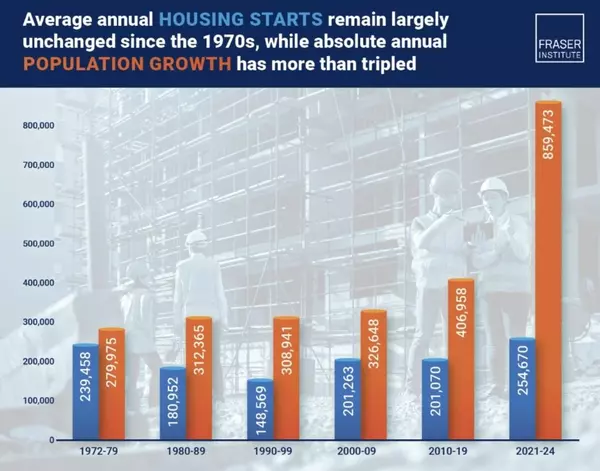

As for the economy, the Bank of Canada has decided to hold rates for March as widely expected. Current markets are pricing in July for rate drops, and I personally think this may get pushed out further towards end of summer as recent economic data such as February unemployment rate of 5.8% (compared to 5.7% in January) reminds us that the Canadian labour market is not all doom and gloom. We are in mild recession as restaurants and retail report weaker sales, but overall, the Canadian economy is holding up. Our neighbor, the US economy, is still running hot, with inflation jumped to 3.2% in February, and unemployment rate at merely 3.9%. The US stock market continue to be hoovering around the all-time high. As the divergence between Canada and US continues, the strong US economy will have a positive upward effect on Canada, as US remain the biggest trading partner of Canada. Canada, much like rest of the world, will soon need to cut rates to keep the economy above water, as our national debt has soared to $47 billion last year. The elevated home prices will remain the biggest headache the Bank of Canada will have, no matter if rates were high or low. One way or another, March will be a busier month for real estate. Expect more Buyers to come out of the woodwork and to beat others before rate cuts.

Some of the unique trends I've been observing:

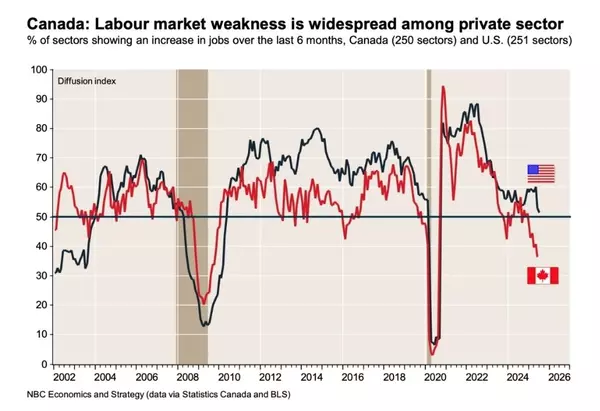

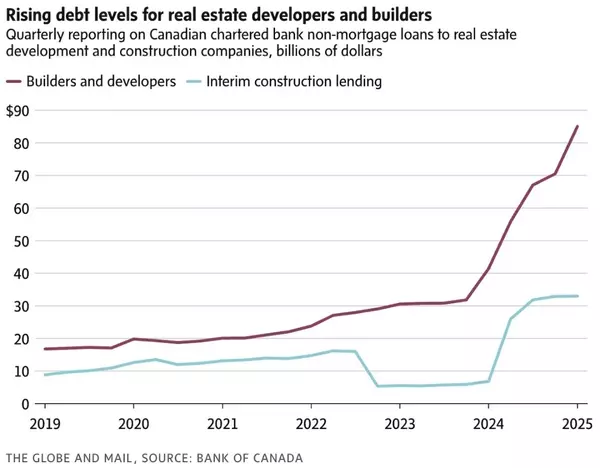

1. Canada added 41,000 jobs in February, thanks to the population growth of adding $1m new immigrants last year. Hourly wages were also up 5% from a year ago. On the surface, it may look like the economy is chugging along, but small to medium sized business are struggling as rising wages and talent retention start to drive profit margins lower. By the same token, Canadian business insolvency rate shot up 41% last year.

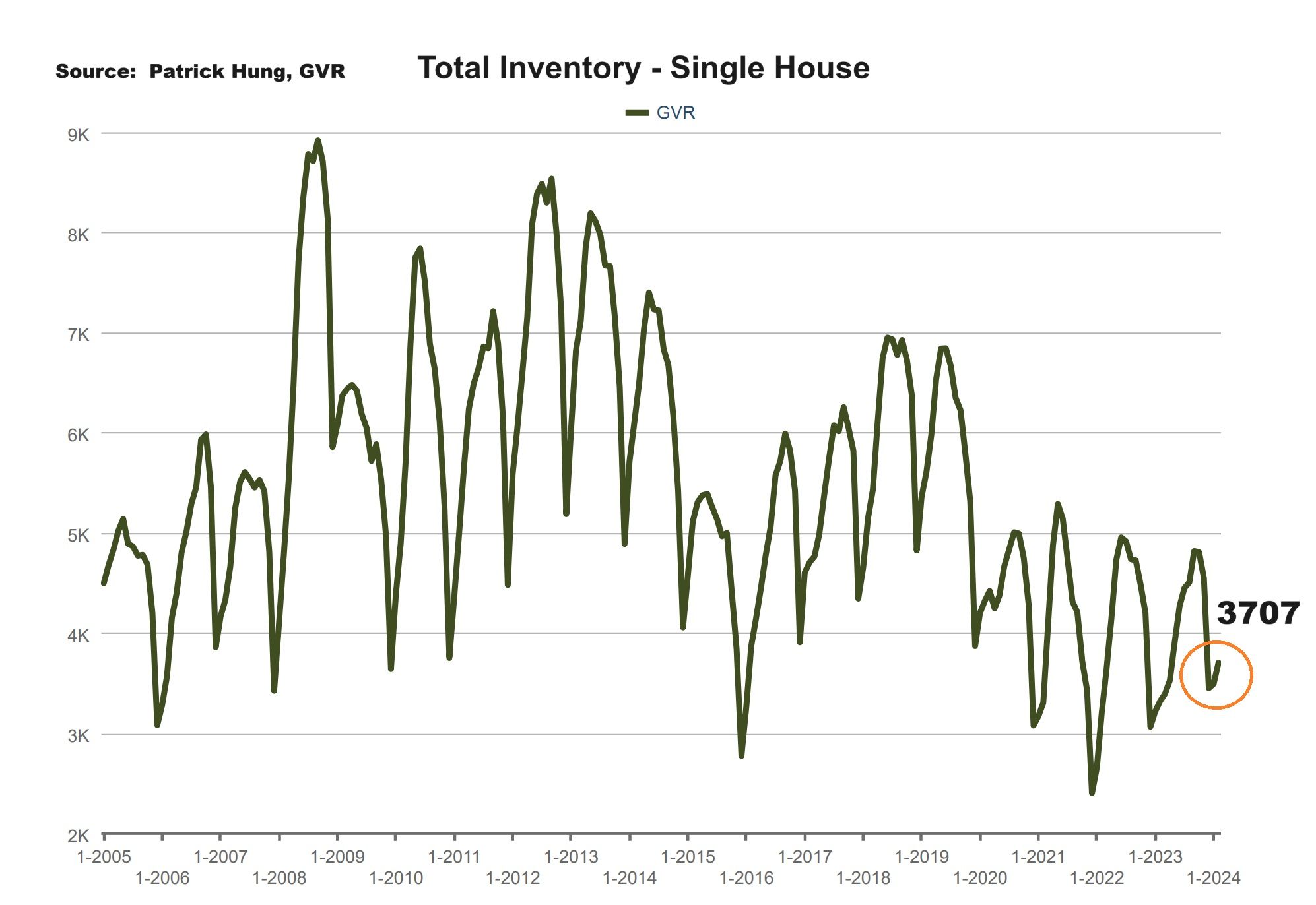

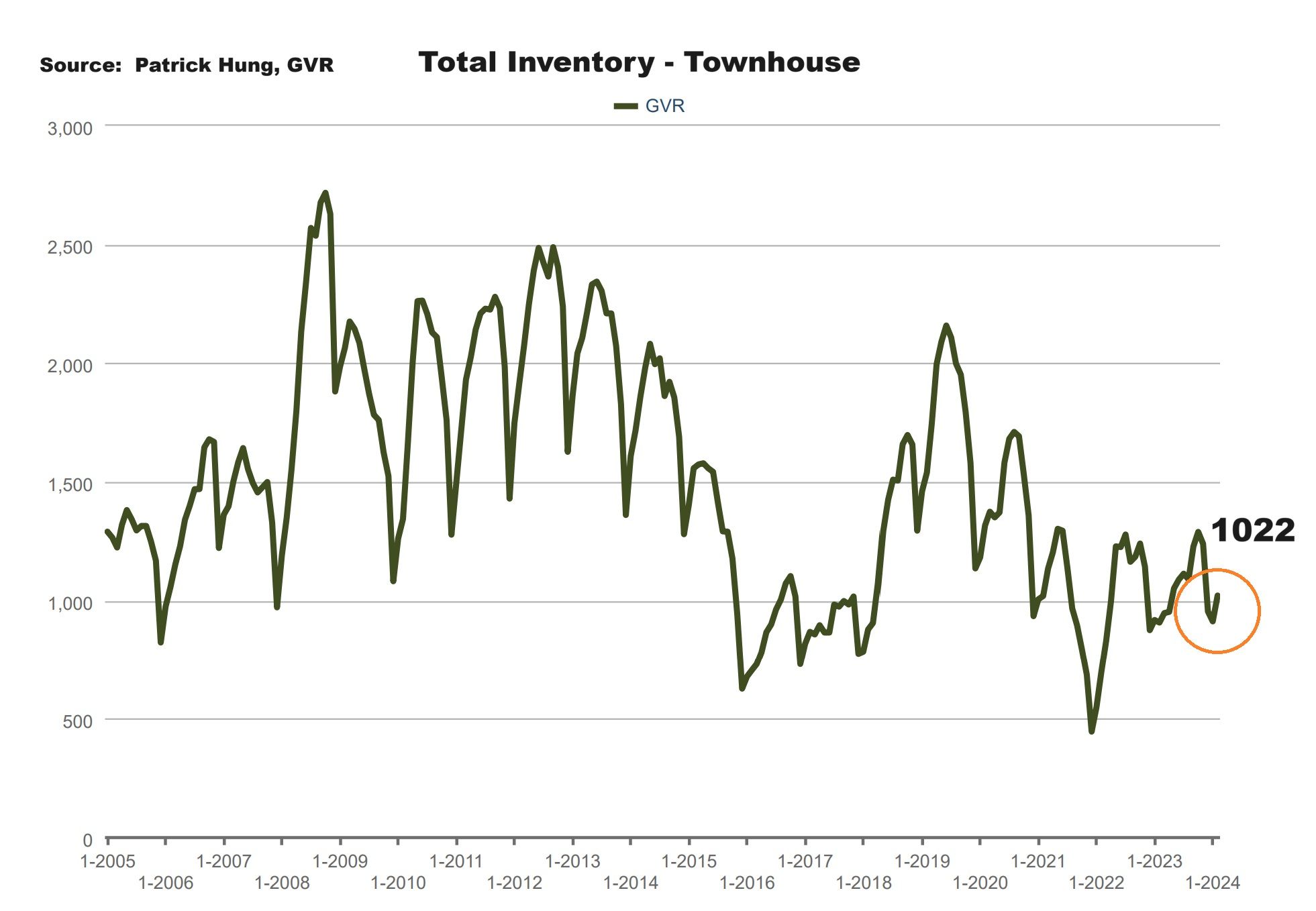

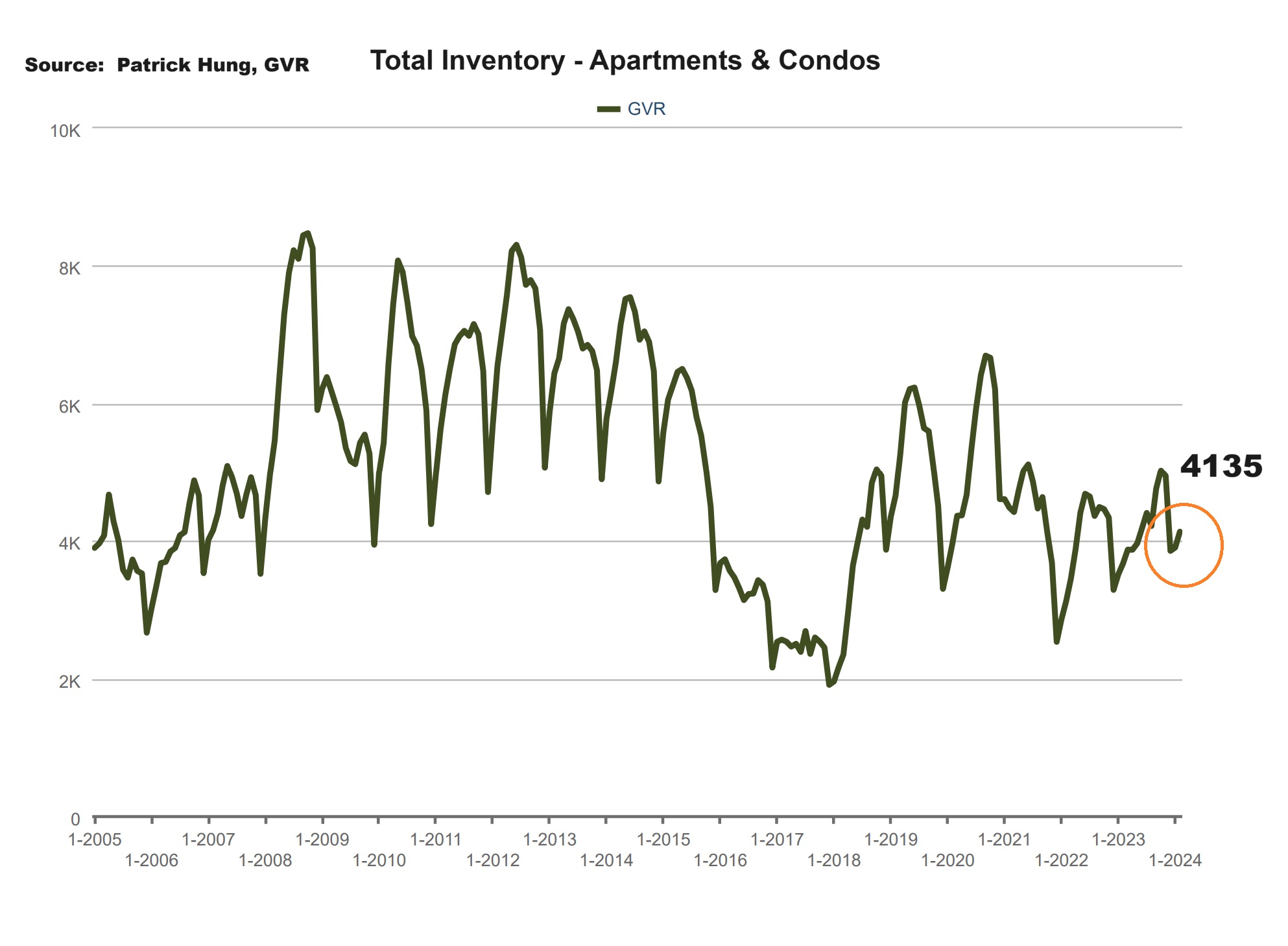

2. Last month, the Greater Vancouver total housing inventory had 9,222 units, the highest for the month since February 2021. Keep in mind that this is still in an under supply level, especially for single houses. Combine that with Vancouver's push for increased in multifamily (i.e four to six-plex policies), and we shall expect single houses to become a more rarer breed.

3. The real estate market is still in a mixed bag, with entry level priced properties getting weekly multiple offers, while the premium market remain in the cooler market. In my opinion, demand is still quite weak as interest rate remains elevated, but Buyer sentiment has definitely improved compared to a 3 months ago.

4. The two new policies, the anti-flipping tax, and the increased max exemption for Property Transfer Tax, both added fuel to the February spring market, especially for homes under $700k. It was great news for boosting the Property Transfer Tax for first time home buyers to $835k. However, the anti-flipping tax was anything but a political move. Accordingly to the Real Estate Board, there are only 3% of Buyers who would sell within 2 years of purchasing. So this new policy by the BC government focus on only 3% of the issue but ignored 97% of the problem.

5. Canadian have over $300 billion in GIC (Guarantee Income Certificate) invested in banks by end of 2023. As the noises of rates cut become lounder and these GIC term matures, I cannot help but wonder where these investors will deploy their capital next. More importantly, how much of that will flow into the real estate sector? Since the beginning of 2024, I have been seeing much more real estate investors returning to the scene.

Here are the 3 highlights for February:

- Sales continue to remain significant below (-23.3%) the 10 year average, while total inventory has increased slightly (+6.1%). Inventory still remain low in historical terms.

- Market polarity in the segments remain, with many Greater Vancouver single house markets at a balanced market, while townhouse and apartments entering the Seller's market. Again, there is not enough inventory to service the growing demand.

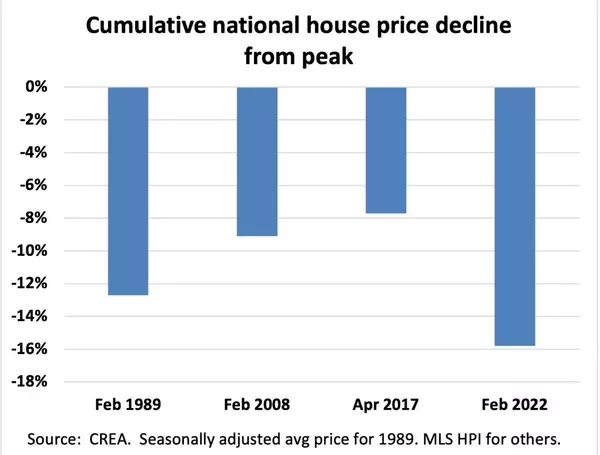

- Last month was the first time in the past 6 months that home prices have registered a gain, with February's price at +1.9%. (January's price drop was -0.6%). As mentioned, the most recent price cycle has likely reach it's bottom back in January 2024.

Here are the in-depth statistics of the February:

- Last month's sales were -23.3% below the 10 year February's sales average.

- Month by month residential home sales increased by +31.1% compared to January 2024. Mainly this was due to seasonality.

- Month by month new home listings increased by +17.5% compared to January 2024.

- Last month's price adjustment was +1.9% compared to January 2024.

- Sales-to-listing (or % of homes sold) ratio is 22.4% (compared to 17.2% in January 2024). By property type, the ratio is 16% for single houses, 27.9% for townhouses, and 25.9% for apartments/condos.

Download February 2024 Greater Vancouver Real Estate Report

Single House Market

For the month of February, the areas with the most price gains are in Pitt Meadows, Vancouver West, and Port Coquitlam at +4.5%, +4.1% and +3.6% respectively. Conversely, the neighborhoods registered the most significant price drops are in West Vancouver, Port Moody and Bowen Island, with -4.8%, -1.5% and -0.6% respectively. The detached home market remains in a balanced market, with average days on market at 47 days (compared to 54 days last month), and month-to-month average price was rebounded by +1.6% (compared to -1.1% last month). Sales-to-listing ratio (% of homes sold) has increased to 16%. (compared to 11.9% last month).

Townhouse Market

In February, the areas with the most townhouse price growths are Vancouver West, Vancouver East and Ladner, at +5.5%, +4.8% and +3.3% respectively. Conversely, the neighborhoods with the a few price drops are in Burnaby East, Pitt Meadows, and Port Moody, at -1.7%, -0.3%, and +0.6% respectively. The townhouse market shifts to a Sellers market, with average days on market dropped slightly at 32 days (compared to 37 days last month). Month-to-month sale price shot up by +2.6% (compared to -0.6% last month). Sale-to-listing (% homes sold) ratio jumped up to 27.9% (compared to 22.9% last month).

Of all the segments, apartments are the most polarized. On one hand, the affordable units below $700k with good long term value are flying off the shelves with multiple offers. On the other hand, downtown apartments, which has not recovered and rebounded, and those that are priced over $1m are sitting on the market much longer. Thus, it is very hard to gauge the apartment price due to the extremes. This time around, the Buyers are much more selective. Since the apartment segment is the playground for first time home buyers and investors, we are seeing both of them returning to the market this spring. Of the two groups, the first time home buyers are much more likely to make a move due to the boost in the Property Transfer Tax exemption. Going forward, the apartment segment remain a mixed bag in Spring and may continue to be so in the summer.

For the month of February, the best performing neighbourhoods for apartments are Port Coquitlam, Port Moody and Richmond, posting +6.1%, +5.9% and +4.9% gains respectively. Conversely, the areas with the most significant price drops were Sunshine Coast and Squamish (tied for 1st), and Ladner, with -3.8%, -3.8% and -3% respectively. Similar to the townhouse market, the apartment and condo segment have shifted back into the Sellers market, with average days on market jumped up to 34 days (compared to 42 days last month). Month-to-month sale price has further improved at +2.5% (compared to +0.1% last month). Sale-to-listing (% homes sold) ratio remained also went up to 25.9% (compared to 19.9% last month).

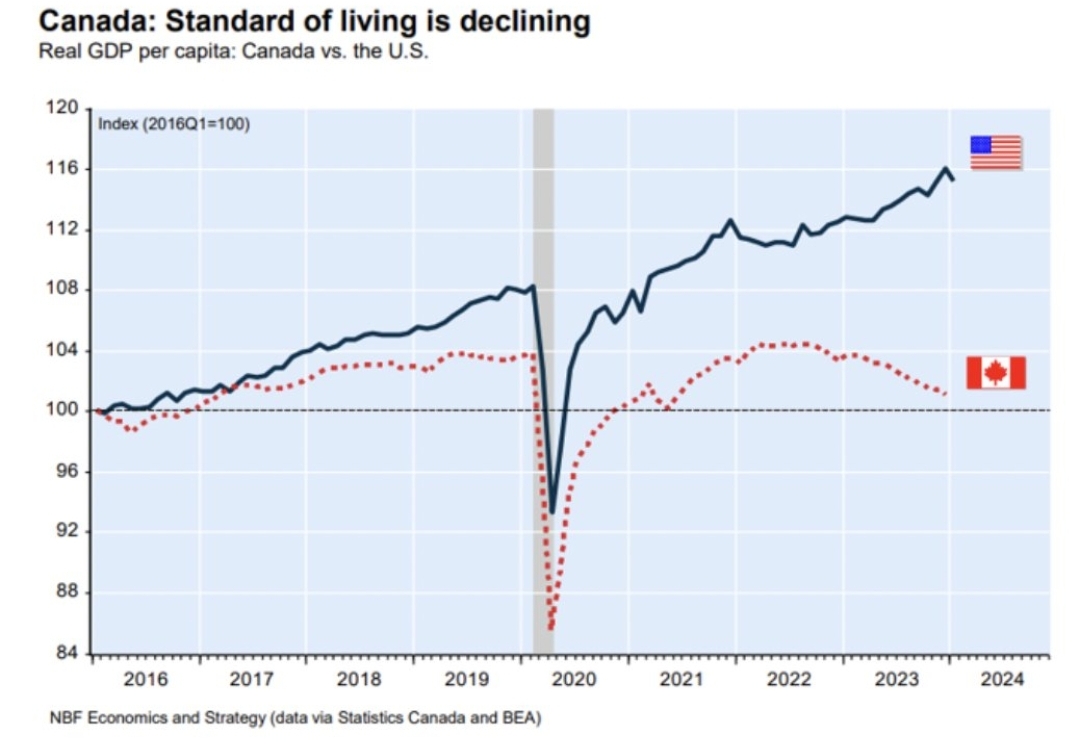

1. Lower Standard

Compared to the US, the Canadian standard of living continue to deteriorate due to the gap between inflation, wage, and housing prices. As the Canadian's immigration doors are widely open and somewhat solving the labour shortage, the Canadians living standards has not improved. Housing and affordability remain the top concerns, and they are not going away anytime soon. (Source: NBF Economics, Statistic Canada)

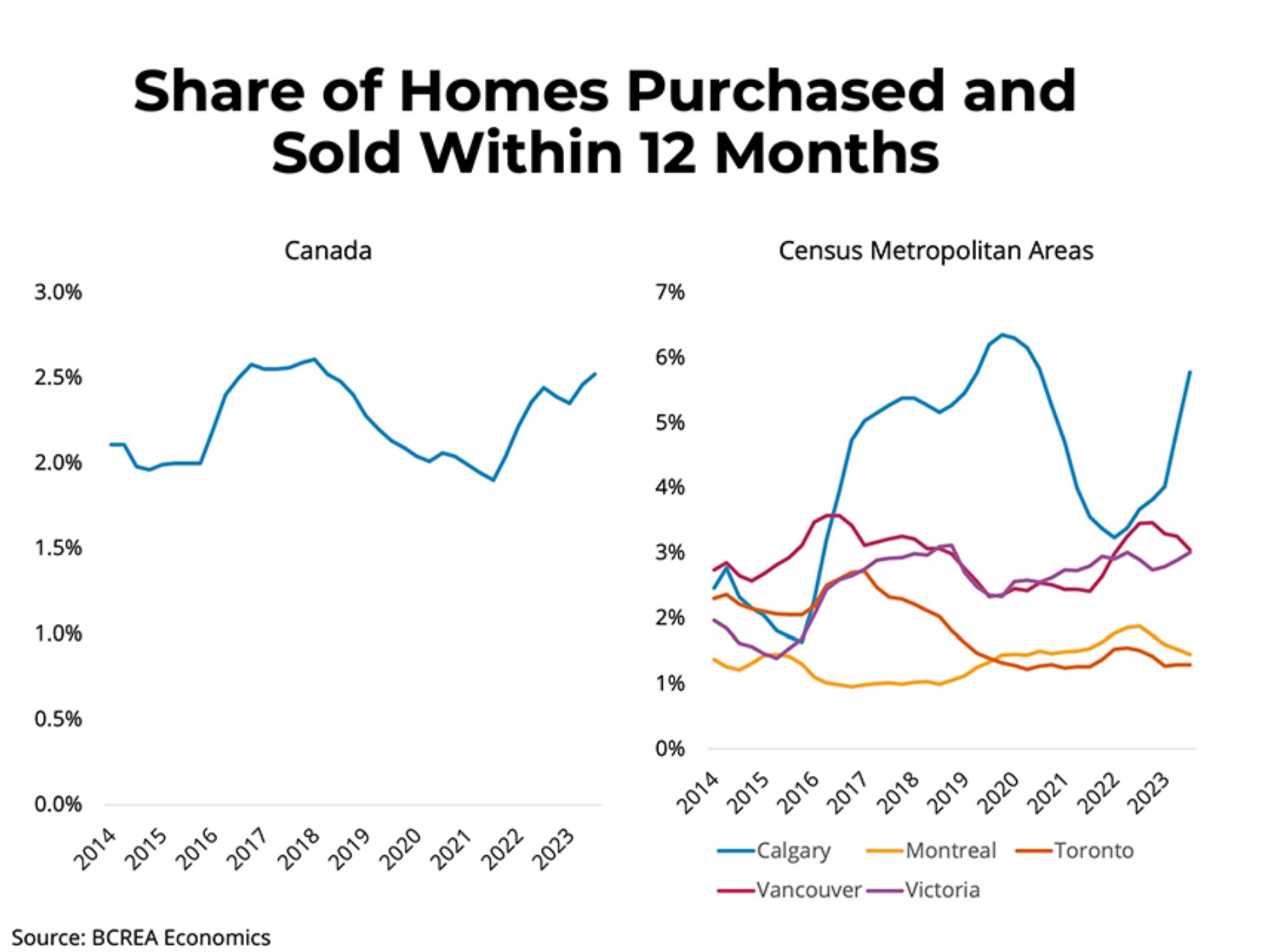

2. Flipping Tax

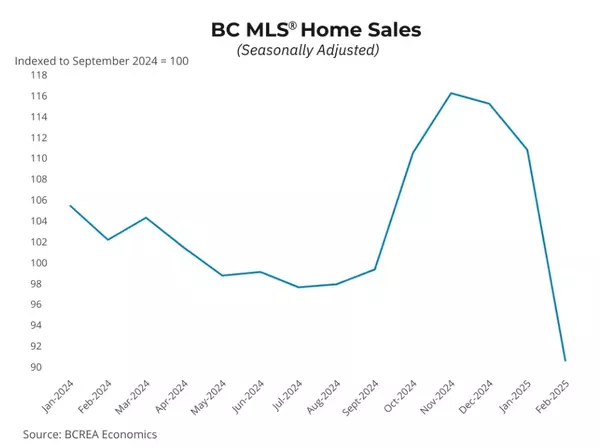

BC government new anti-flipping tax, which levies a 20% tax on homes sold within 12 months and then a sliding scale on 12-24 months, would prove to hardly affect the market. Why? There is only a mere 3% of homes sold with a 12 months span. As Greater Vancouver home value is no longer in a exponential growth era, it would take 3-5 years for any gains to be realized. Pre-sale buyers may be affected the most as their funds are stuck for a longer period of time. Once again, this policy is another political vote-grabbing move that addresses 3% of the issue but ignored 97% of the problem. I believe that this tax will actually reduce supply (as pre-sale investors commit for longer) and may inadvertently drive up the price. (Source: BCREA Economics)

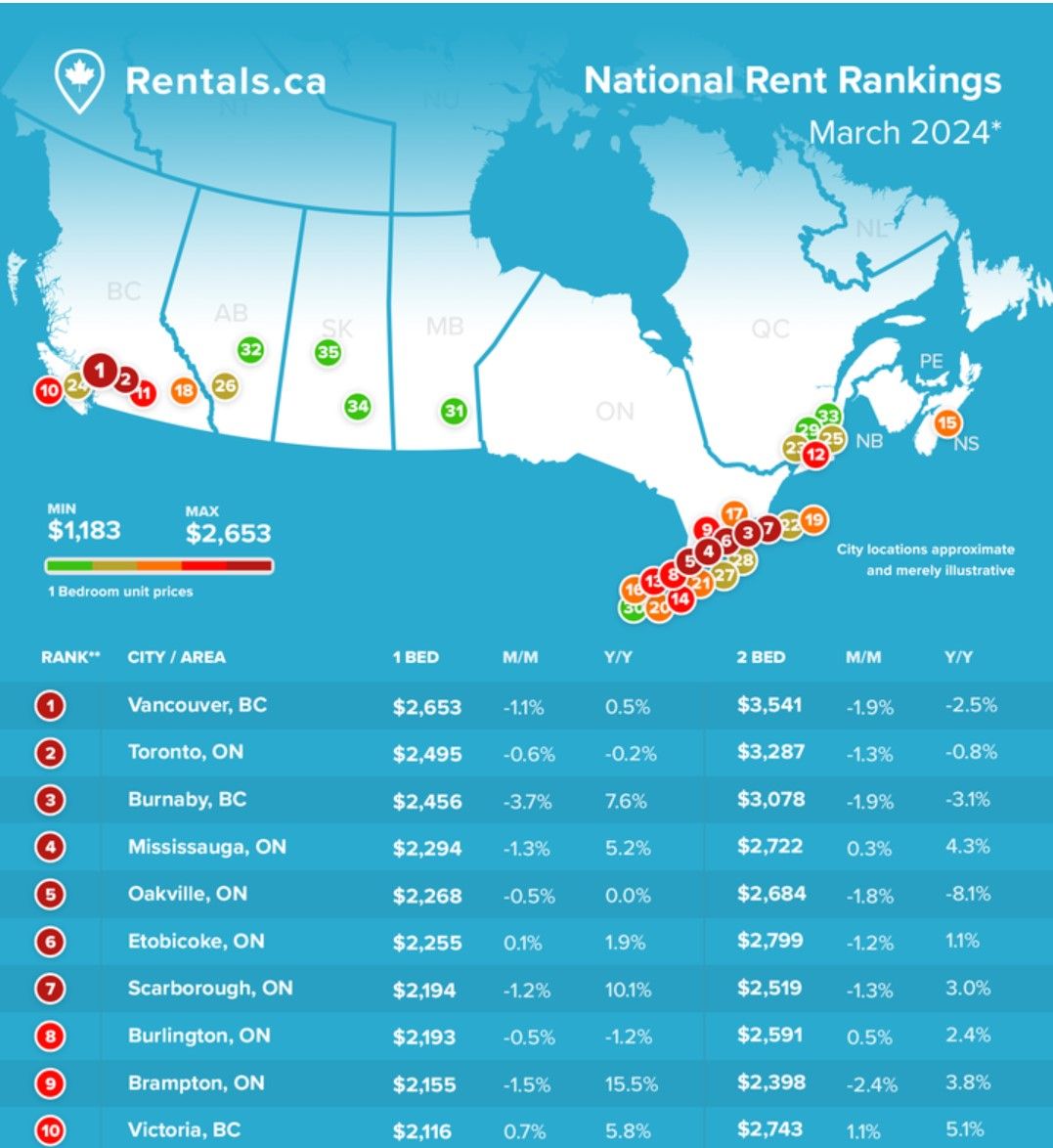

3. Slowly And Surely

While Greater Vancouver home prices climbed 4.8% year over year, rental rate have only increased by 0.5% over the same period at $2,653 for a 1 bedroom. This can be partly attributed to the banning of AirBnb's in BC, causing short-term rentals to move into long-term rentals, allowing more supply and temporarily putting a lid on the upward rent increase. As Canada continue to allow over 1 million immigrants in annually until 2026, expect the the rental rates to continue to climb. Summer will typically be the hottest season for rentals. Let's see. (Source: Rentals.ca)

Recent Posts

GET MORE INFORMATION