Real Estate Market Intelligence November 2023

Real Estate Market Intelligence November 2023

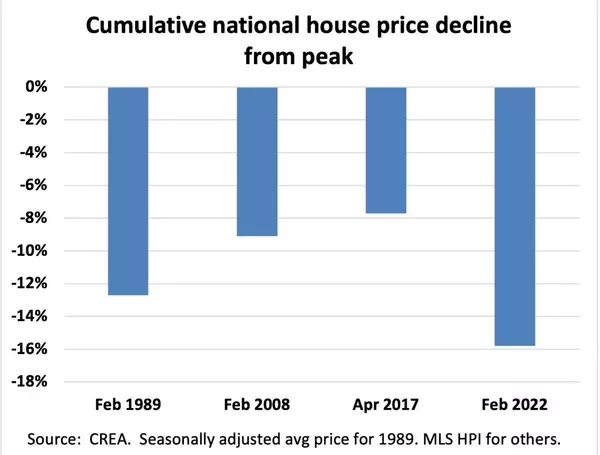

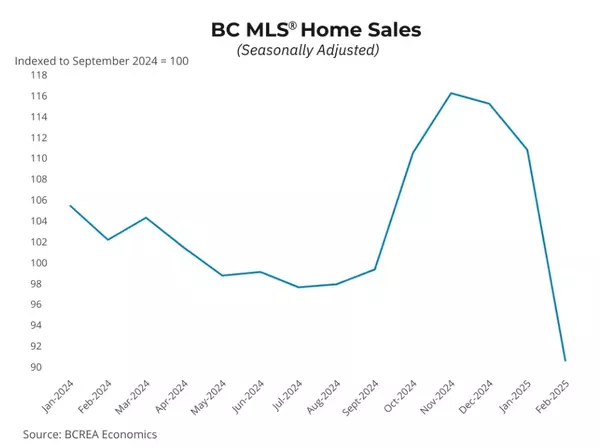

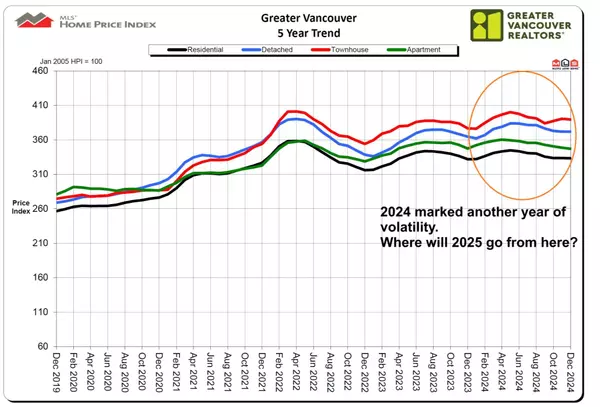

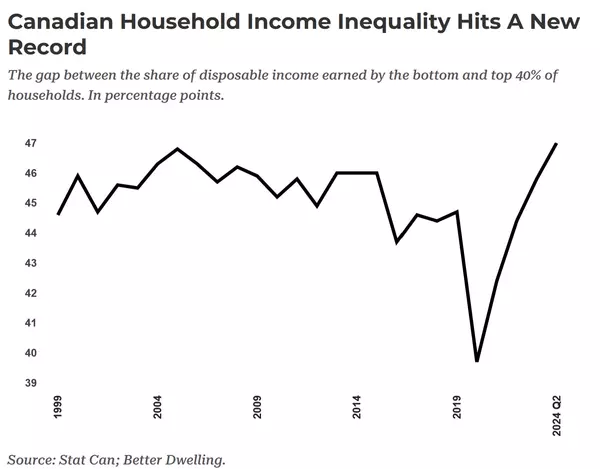

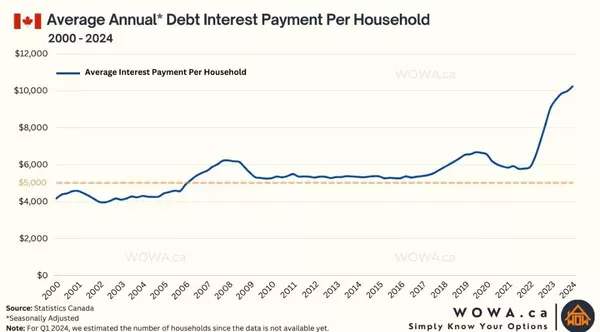

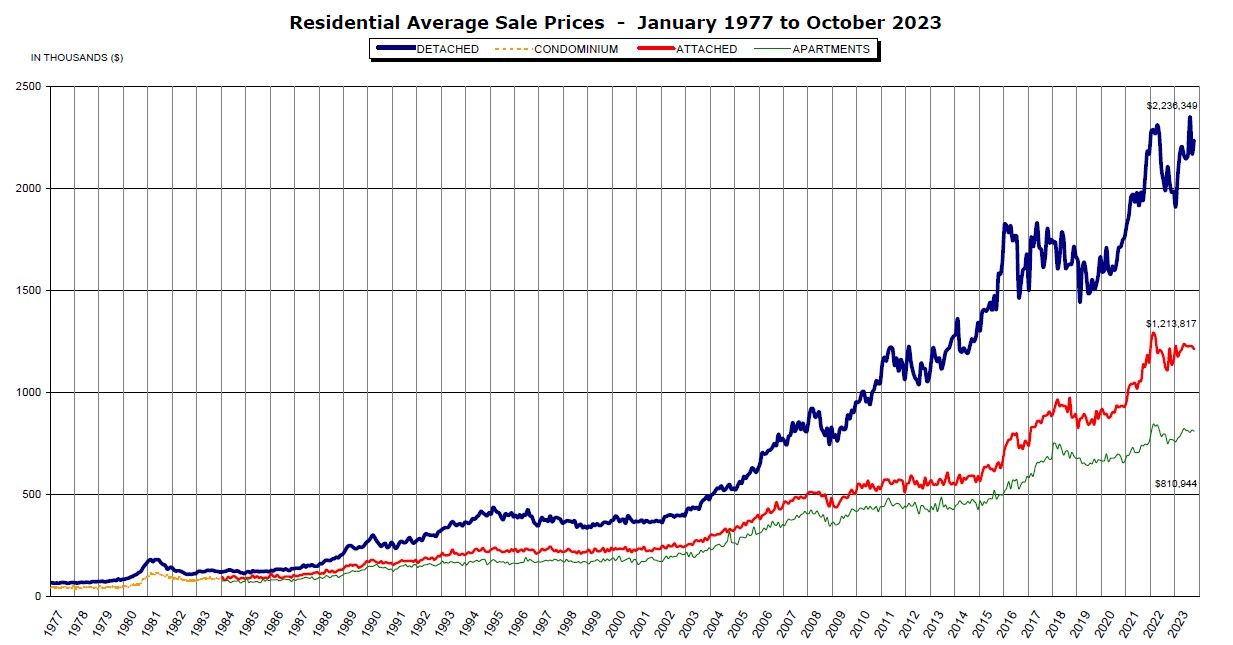

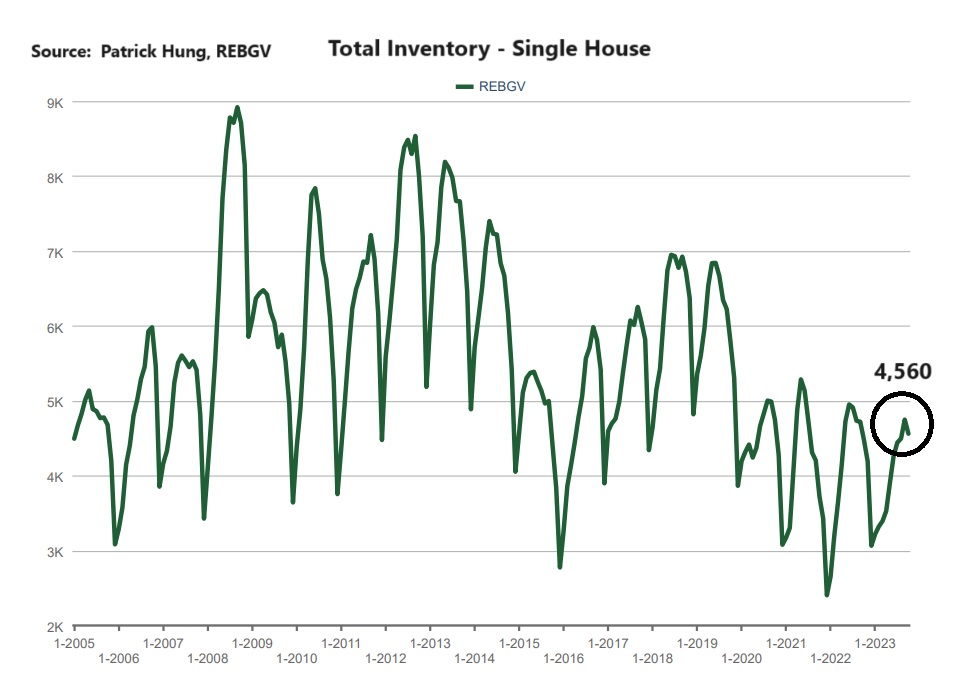

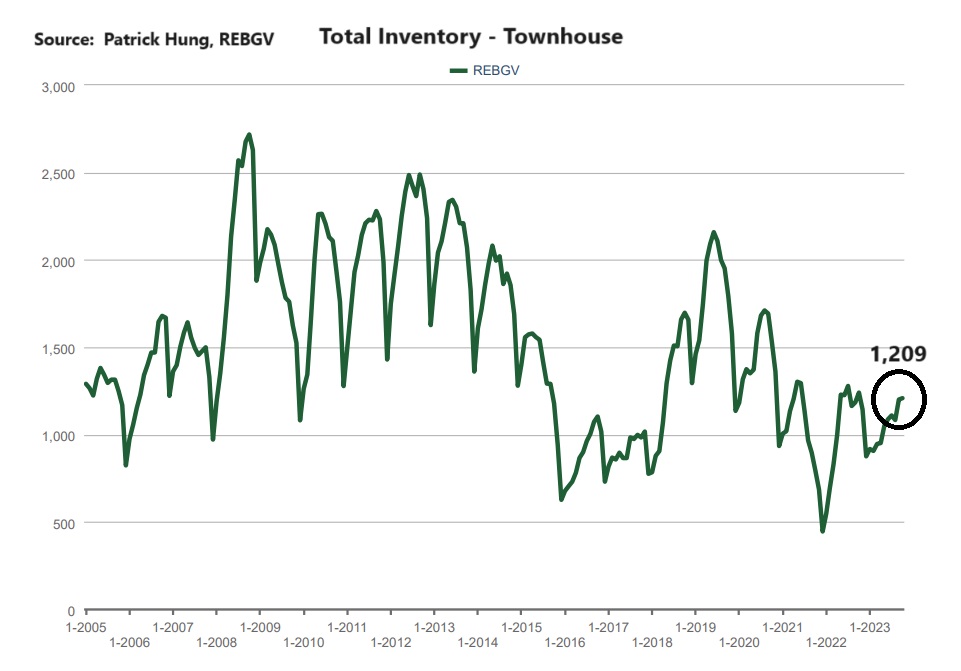

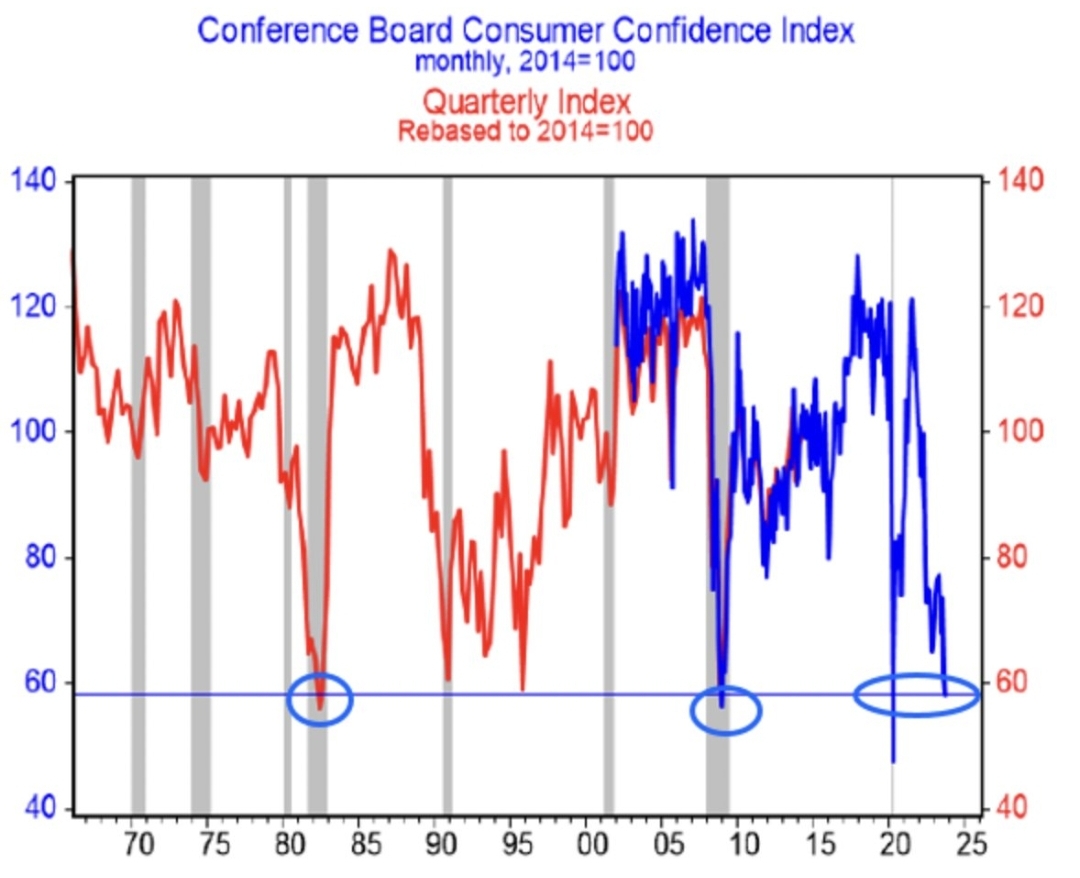

Winter is in full swing, and much like the weather, the Vancouver real estate market enters into an early cooling period. The month of October has following a similar trend of increased supply with +5% above average. Demand has weakened substantially as well, with October sales at a whooping -29.5% below 10 year average. Price drops are lagging behind at -0.6% last month, and as we are aware that sales will slow first before prices drop further. Currently we are witnessing the real effect of the high interest rates running through the economy, and this has been delayed for some time. From real estate to grocery shopping to dining, Buyers are pulling back on discretionary spending, and consumer confidence is dwindling. There is no doubt that recession has arrived, and the odds of a hard landing is increasing by the day, even though the Bank of Canada continue to tip-toe around this matter. Car dealerships are reporting less sales, restaurants are seeing less customers, major banks are cutting back expenses, and unemployment rate has been climbing in the last few months. The latest Canadian consumer confidence has fallen to the fourth all time low in the past 45 years, only behind 2020 pandemic, 2008 financial crisis, and 1982 recession. The above message may sound doom and gloom, and I believe things will get worst before it gets better, namely when Canadian have their mortgage renewal upcoming in 2024 as they are in line for a rude awakening. The reality is, Bank of Canada need more people to lose their jobs, to spend less, and to have home prices come down further in order to reach their all-elusive inflation goal of 2%. This has been their intention all along when they first hiked the rates 18 months ago, just that now it is starting materialize. Since the summer, we have been seeing more Sellers coming off the sidelines and investors jumping ship. However, in the last 2 weeks, we are seeing that the Sellers are not getting the prices they want, and some of them have chosen to start again in Spring. Such is typical of the Vancouver market. Meanwhile, we continue to see the higher for longer interest rate environment hurting many industries, especially real estate developers, some of whom are leveraged to the brim and may not be able to hold on for much longer. If you were a developer, can you imagine paying hundreds of thousands or millions of dollars in interest rates per month, while pre-sales slows to a halt? Recent news of the Toronto pre-sale building, The One, with a $1.7 billion debt that had gone under. In Vancouver, news are circulating that a renowned developer, Westbank, is running into financial difficulties with many Buyers failing to complete. In fact, this is happening to many Vancouver developers and projects (i.e Brentwood) that are near completion in the next 3-4 months. For sure this will have ripple effects as creditors come knocking on the developers' doors. Expect the pre-sale drama to continue at least into late 2024. On the provincial level, the BC housing bylaws and rules are also going through drastic changes, from AirBnb regulations, to Premier David Eby's mandatory change of high-density zoning on all areas nearby skytrain stations, bus stops, and transit hubs. In short, the current market remains highly volatile. While many Canadians are trying to stay afloat in this unprecedented times, there are also equally great opportunities. On one hand, we have first time home buyers being squeezed out of the market, and on the other end, we have luxury buyers snatching up deals millions of dollars below market value. The night is darkest before dawn, and the hurt will deepen before any signs of rate cuts, which many economist predict to be around mid 2024. Until then, it is crucial to positions ourselves accordingly and get accustomed to the highly volatile environment. Historically, whenever there was recession, it was followed by a recovery within 12 months. There are lots of uncertainty in the market, but there is light at the end of the tunnel.

Some of the unique trends I've been observing:

1. October sales have slumped to almost -30% below the 10 year average. If we factor in the immigration growth and demand over the past 10 years, this would've been one of the slowest Octobers in recent history.

2. Canadian bond rates, which is tied to the mortgage rates, continue its wild ride from September into November, with volatility veering between plus/minus .50 basis points before settling at nearly 4% recently. For the same reason, major banks are having a hard time updating their rates accordingly.

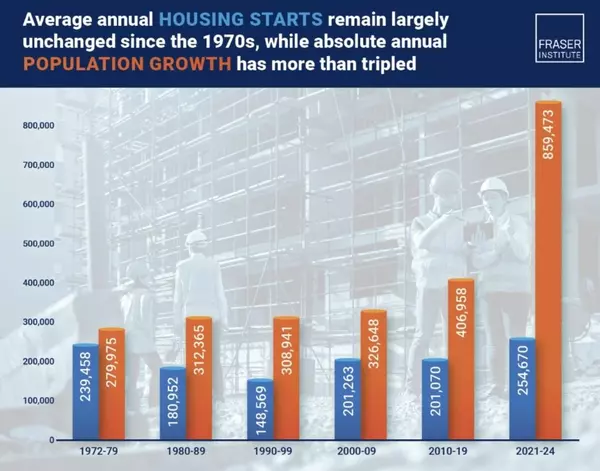

3. BC Premier David Eby has recently announced another boldly housing plan, making high-density, transit-oriented development land mandatory in BC. In short, the new legislation to require minimum residential building height of up to 20 storeys for sites within 200 meters of skytrain stations, 12 storeys for site between 201 and 400 meters, and up to eight storeys for sites 401-800 meters from a station. Residential parking stall requirements will also be removed. This mandate will definitely eliminate discrepancies between cities and reduce process times. A welcoming move that will have an immense impact on housing supply 5-10 years down the road, but will upset those neighbourhoods resistant to change.

4. For AirBnB owners, October was a nightmare month as BC government announced that AirBnB will only be allowed on their principal residence. Also, definition of the short term rentals has been updated to anything less than 90 days. This will impact investors who have multiple AirBnB units, and at the same time crunching the supply for industries reliant on using AirBnBs such as movie production, carnivals and concerts where staff are in town for only 2-3 weeks. Where are they going to rent? As far as I can see, I haven't seen many new hotels being built in the past 10 years in Greater Vancouver. Meanwhile, we are absorbing millions of immigrants every year. This will for sure benefit one place, which are the existing hotels. If demand goes through the roof with no new hotel rooms, I can't help but wonder if the hotels would increase their rates?

5. Canadian unemployment rate is at 5.7% and has accumulative +0.6% on the past 6 months, while the national GDP has been flat since May. Again, if we factor in the the immigration growth and inflation in the past year and the GDP still hasn't grown, in my eyes that is economic contraction.

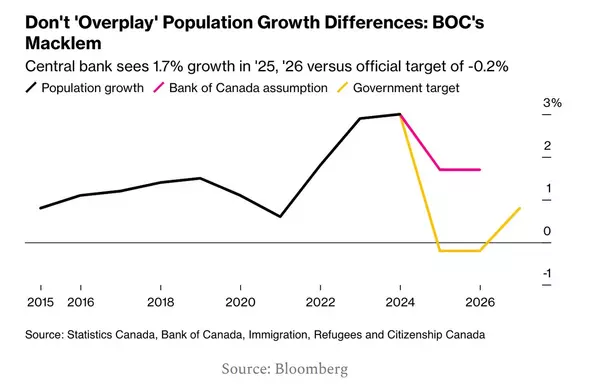

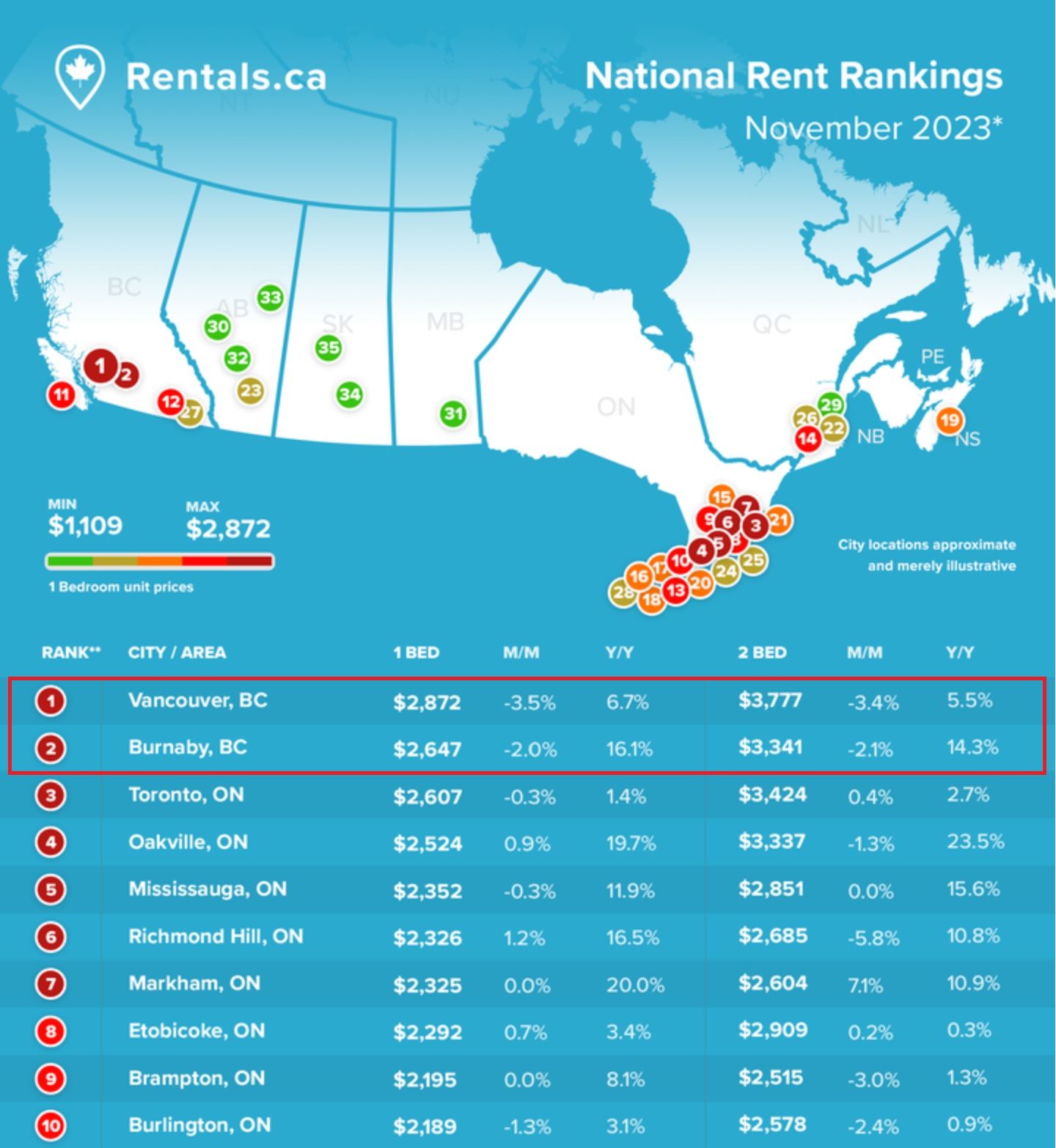

6. Canadian immigration minister, Marc Miller, stated that he sees no reason to slow down immigration until 2025: that means we will either match or surpass our last year's record of 500,000 immigrants. An important side note, are there any limitations on the intake of international students? If there weren't, then housing the students will be an enormous strain on the rental market. For this reason, I believe rental prices will stay elevated for as long as the immigration doors remain wide open.

Here are the 3 highlights for October:

- Sales are again significantly below the 10 year average, while total inventory has increased slightly.

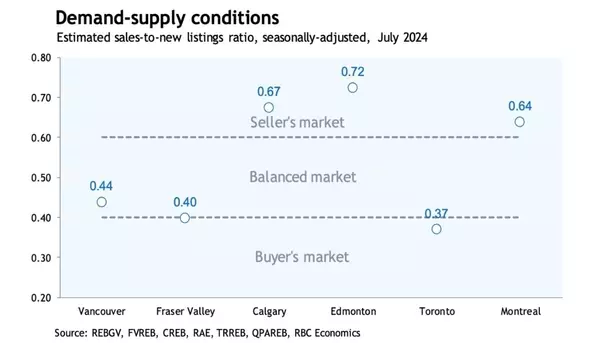

- Single house market is very close to a Buyer's market, while townhouse and apartments are starting to enter the balanced market.

- Prices have dropped for the third month in a row, with October's price at -0.6%. (September's price drop was -0.4%). Expect these price drops to accelerate if total inventory continues to rise.

Here are the in-depth statistics of the October:

- Last month's sales were -29.5% below the 10 year September's sales average.

- Month by month residential home sales increased by +3.3% compared to September 2023.

- Month by month new home listings decreased by -17% compared to September 2023.

- Last month's price adjustment was -0.6% compared to September 2023.

- Sales-to-listing (or % of homes sold) ratio is 17.9%. By property type, the ratio is 12.9% for single houses, 20.9% for townhouses, and 21.5% for apartments/condos.

Download October 2023 Greater Vancouver Real Estate Report

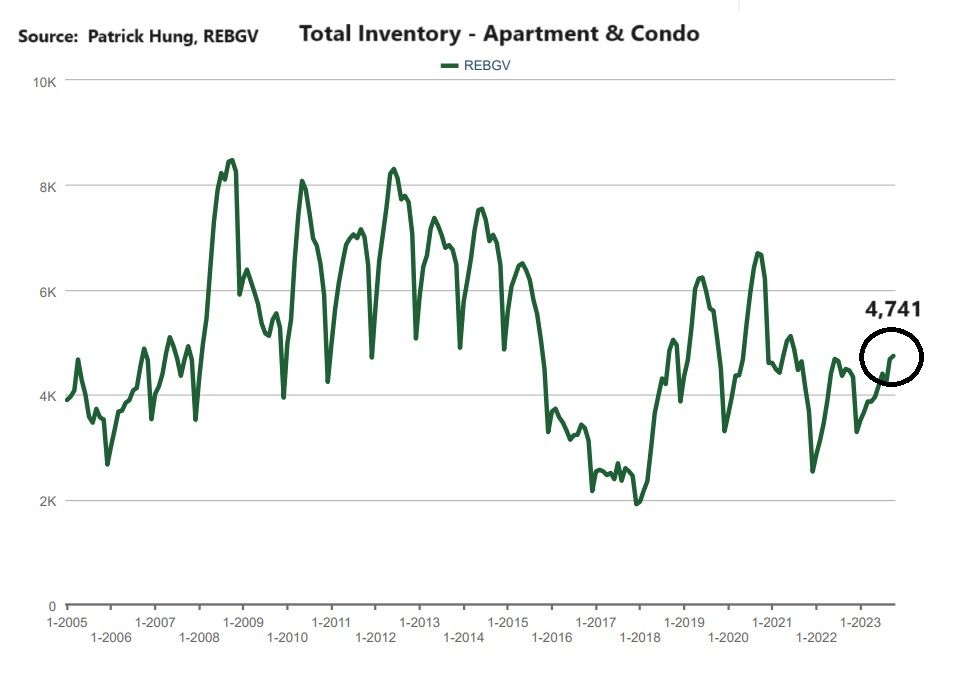

In an economic downturn, the most affordable items are usually the most resilient. By the same token, entry level apartments, such as those 1 bed 1 bath under $500k in the Metro Vancouver area, are still very active, especially North Vancouver, with condos under $600k selling at a whooping 90% sales ratio (% of homes sold). There were also legitimate concerns with news reports stating that existing AirBnB owners may be forced to sell due to the new regulations limiting rentals to 90 days. In October, I have seen a few of these such properties listed, but not a huge wave of them. However, we may expect more to come onto the market as the regulation deadline approaches on May 1, 2024. In general, the market will have no problem absorbing such 1 bedrooms apartments on sale as they are in high demand. It is actually the 2+ bedrooms units that will be hit the hardest as they take longer to liquidate. Whether we like it or not, the push-out of existing AirBnb's should generate a bit more supply, both on long term rental and the re-sale basis. As for the pre-sale, it has been rather quiet for the past two months. As pre-sales are speculative in nature, Buyers are really purchasing a contract guaranteeing certain amount of price in the future. When the market was roaring last decade between 2012-2022, lots of profit to be made and developers and Buyers were happy. However, we are starting to see things crashing down from top down. Projects in Burnaby Brentwood and Downtown Vancouver, within 3-4 months near completion, are having a substantial amount of Buyers walking away from their contract. Needless to say, these Buyers took a loss, and now so are the developers. There are also reports stating one of the renowned Vancouver developers, Westbank, are in financial deep water. Cracks are showing in the economy, and developers and Buyers who are highly leveraged would be the first to sink. Be mindful that if development slows now, we will face an even greater supply shortage 2-3 years down the road when there are no new builds. For the month of October, the best performing neighbourhoods for apartments are Port Moody, Whistler, and Richmond, posting +3.8%, +2.3% and +1.8% gains respectively. Conversely, the areas with the price drops were Tsawwassen, Ladner, and West Vancouver, with -4.5%, -3.7%, and -3.2% respectively. Similar to the townhouse market, the apartment and condo segment remains a Seller's market but is very close to a balanced market, with average days on market remained flat at 25 days (same as last month). Month-to-month sale price is nearly flat at +0.2% (compared to -0.2% last month). Sale-to-listing (% homes sold) ratio dropped remained flat at 21.5% (compared to 21.3% last month).

Here are the Three Trends I'm Observing:

1. Same Storm, Different Boats

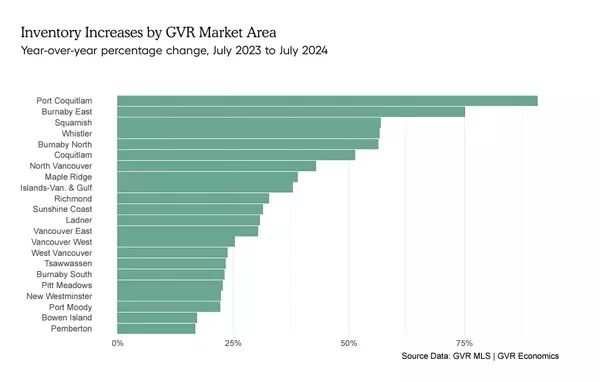

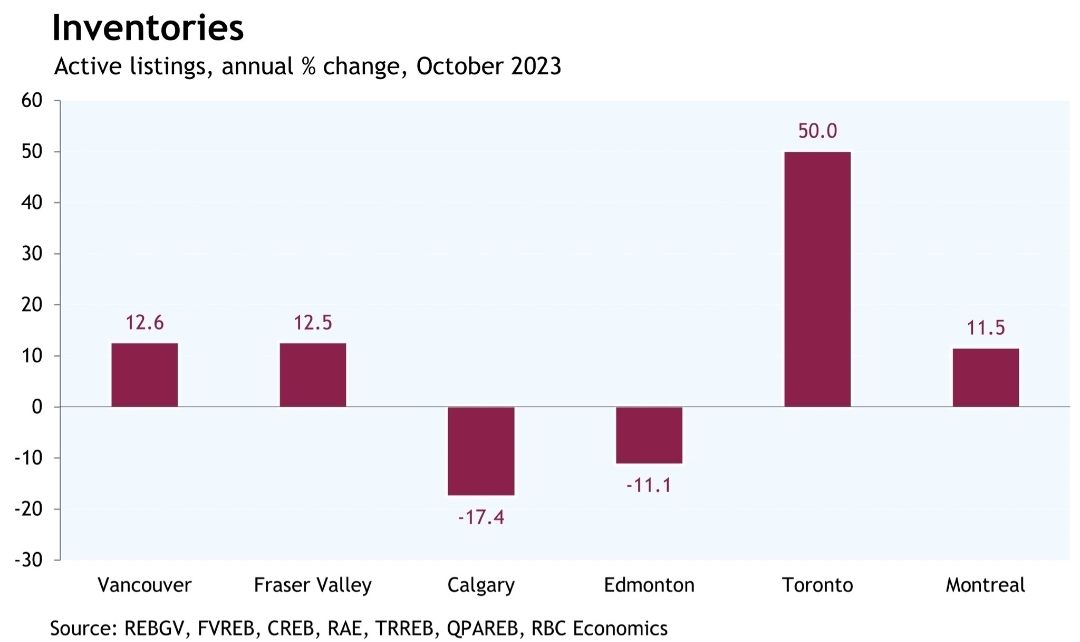

When we hear about Canadian real estate, be mindful that there is a glaring difference between regions. On one end, we have Toronto's housing inventory increased a whooping +50% over last year, while Calgary's inventory has shrunk by -17.4%. Vancouver is somewhere between the two and remains in a balanced market. We are in the same high interest rate storm, but on very different boats. (Source: REBGV, CREB, TRREB, APAREB, RBC Economics)

2. Bye Bye Confidence

The latest Canadian Consumer Price Confidence has come in a fourth all time low, only behind 2020 pandemic, 2009 global financial crisis, and the 1982 recession (with overnight rate at 17%). While this may be alarming, it is also a sign of tremendous opportunities ahead. For every time in history that has posted a significant drop in confidence, the market rebounded quickly within the next year. There is light at the end of the tunnel. (Source: Conference Board of Canada)

3. Seasonal Rent

Rentals prices have dropped -3.5% in Vancouver last month. Partly seasonal? Maybe. This may also coincide with the recent drop in Vancouver real estate prices. (Source: Rentals.ca)

Recent Posts