Real Estate Market Intelligence July 2025

Real Estate Market Intelligence

July 2025

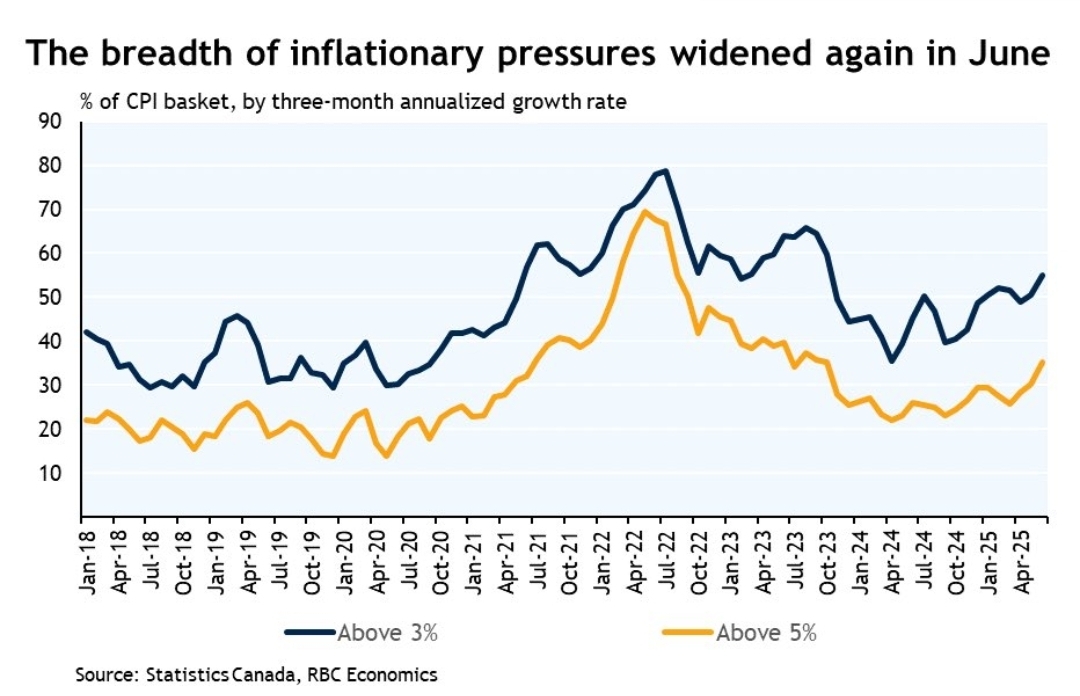

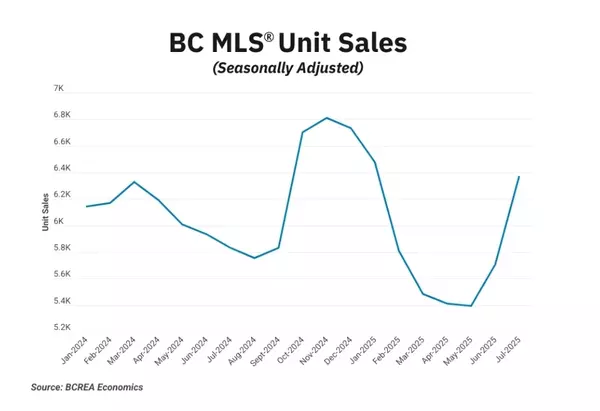

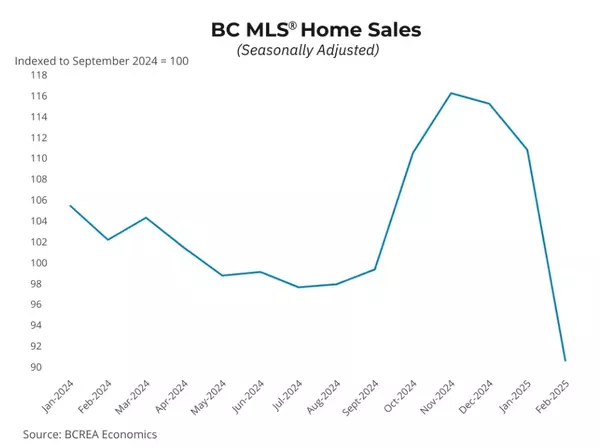

No matter how active the summer outdoor activities are getting, the Vancouver real estate market remain sluggish in June, with lower sales with high levels of inventory. According to the economics director, Andrew Lis, at Greater Vancouver Realtor (formerly Vancouver Real Estate Board), stating that "there is trended basis that signs are emerging that sales activity is rounding the corner." As much as I would like to believe that, I believe we are still ways off from leveling, especially with the currently inventory level still mounting. With foot on the ground, the first two weeks of June had indeed showed increased sales, but it slowed (as seasonally would) towards Canada Day. Some Buyers came off the sidelines and decided to make a move before the school year starts in September, but this is also segmented. The second week of July started of fwith more sales as activities really picked up. Again, lots to unpack this month as Canada's inflation jumped up slightly to 1.9%, but CPI basket expanded in June and approximlately 55% of the components showing annualized three-month inflation rates exceeding 3%. Stocks and bitcoin is reaching all time highs, and investors confidence seem unfazed by the renewed tariff news. Locally, some BC developers are now advocating to remove the oversea buyer ban in the hopes of saving the pre-construction market. Amid the continuous uncertainty, are the Canadian real estate really turning a corner, and Buyers and Sellers finally adapted to this new norm of volatility and ready to make a move? Let's dive deeper.

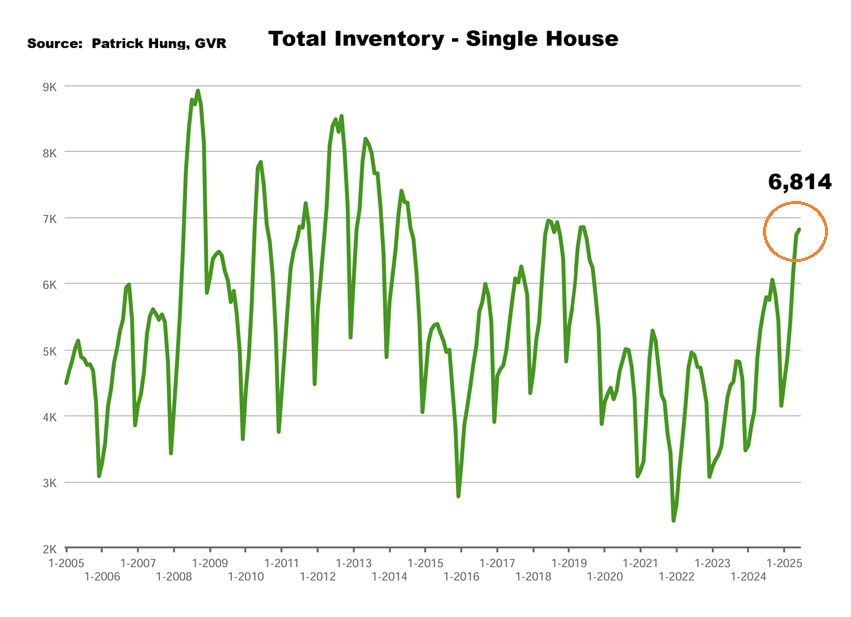

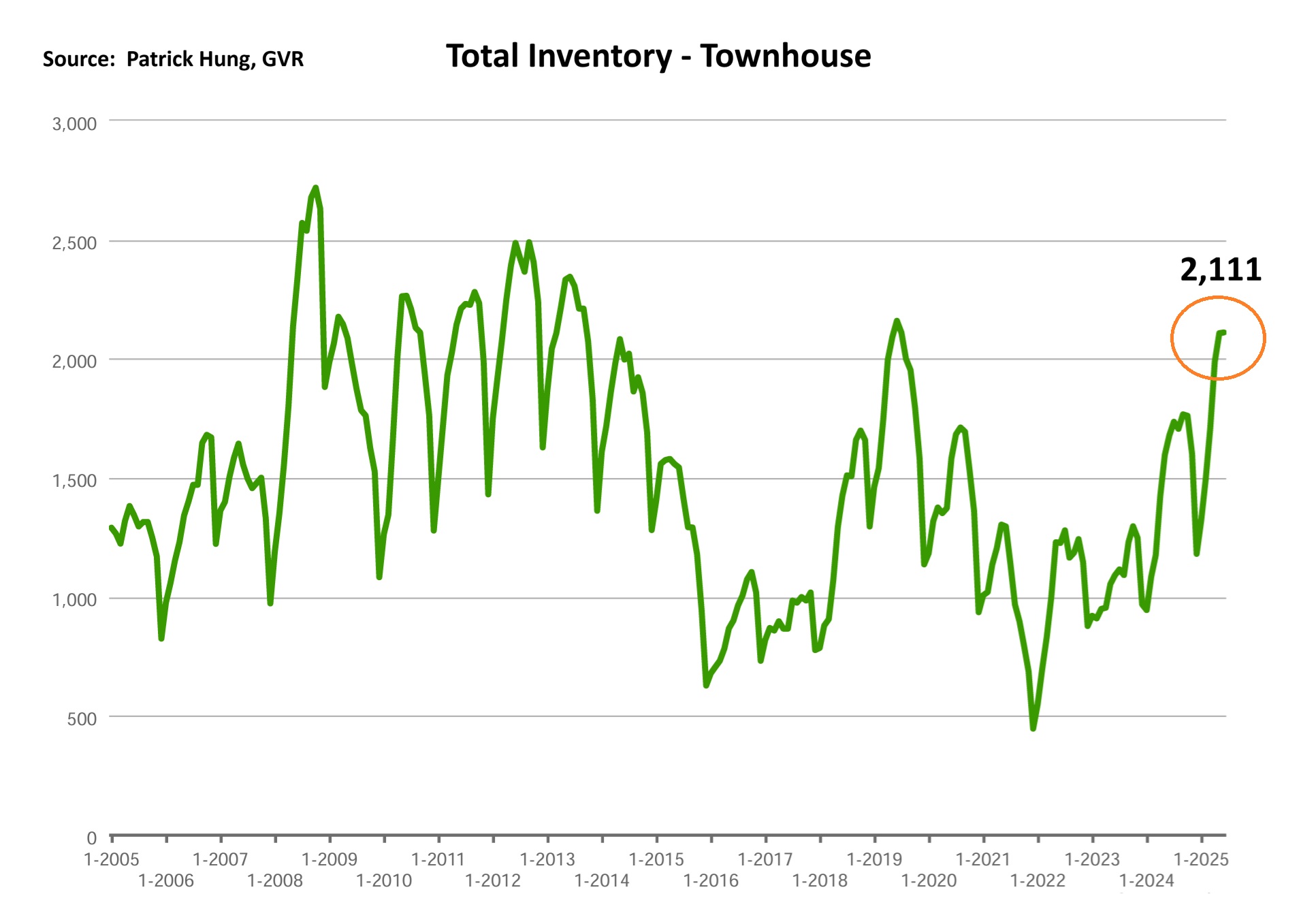

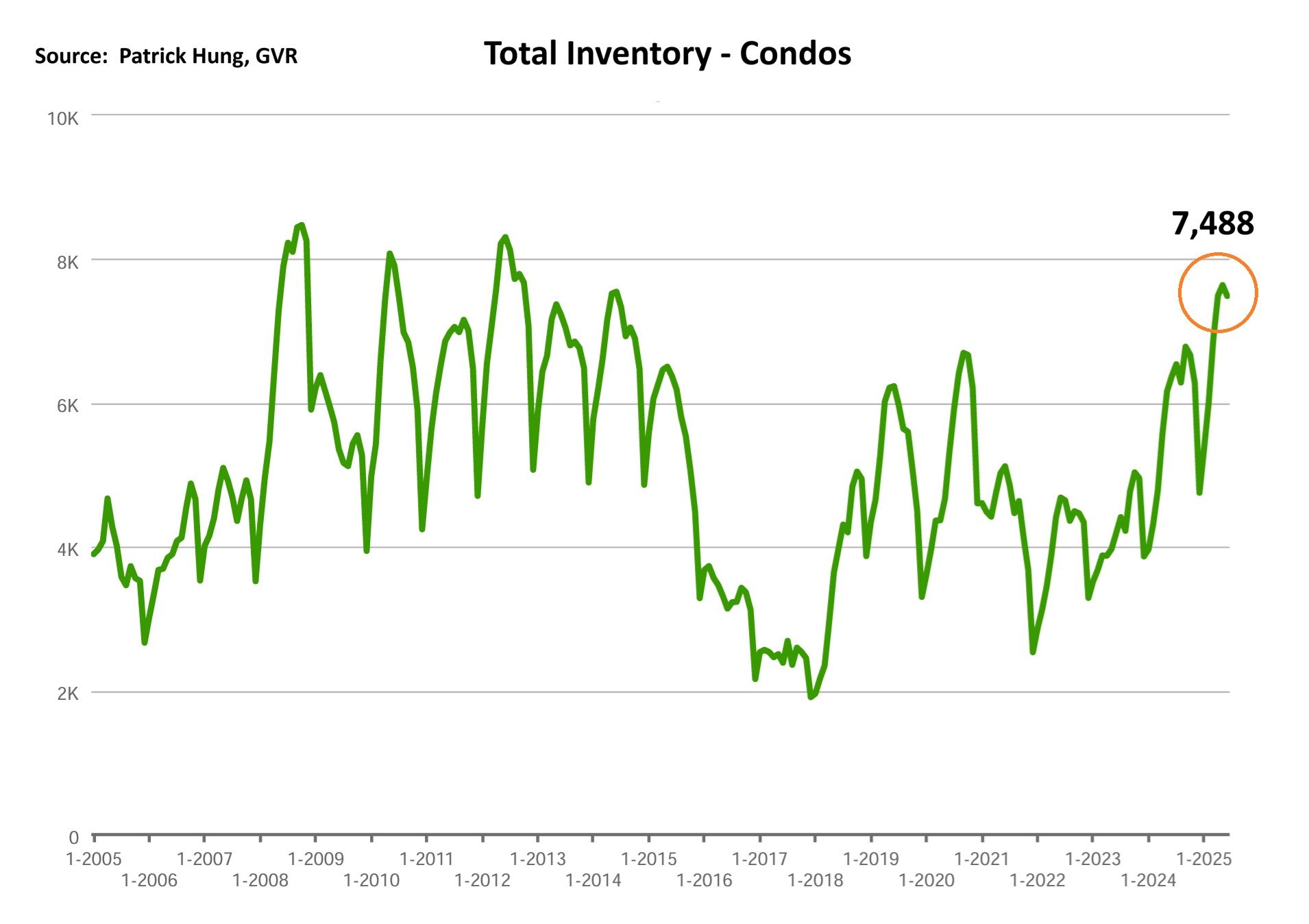

Outside of 2019, the Vancouver real estate in June had the lowest sales in 20 years for the month. Despite the fact that it went up slightly on a month-to-month basis, it is still -25.8% below the 10 year average (compared to May's -30.5%.) Total inventory remain elevated and total listings rose to +43.7% above the 10 year average (compared to May's +45.9%), Some may say this is a turn of events, but I would argue that this is a blip on the map and is still way to early to tell. One month doesn't make a trend, even with the sales-to-inventory spreads has improved slightly last month to 69.5% (compared to the pass 3 months, where at one point it was at 78%). As long as the inventory remain elevated (and mainly driven by the oversupply in the condo segment), I would expect the downward price pressure to continue, with best case scenario of prices flat lining in the next few months. With foot on the ground, I sense that Buyers are indeed returning and becoming more active since July, and sales seem to have picked up substantially (compared to the past 5 months). Perhaps some of these buyers have waited long enough, as we have to keep in mind that real estate is a necessity, so people who go through life transitions such as marriage, having kids, divorce, family deaths, etc, will need to transact. The market continues to be segmented as well, and even when new condo supply fall, the overall total condo listing remains elevated with over 7 months of inventory, which is deeply set into the Buyer's market especially in areas such as Brentwood, Metrotown, and Guildford. The most popular products remain the entry level ones and is driven by end-users such as young families looking to upsize going into townhouses or single houses. These products will always be in demand as developers are simply not building them anymore, and so the price of such homes can reach a price floor much faster than others (i.e condos or luxury homes). The surge in activity in the past two weeks has shown renewed optimism for Vancouver real estate, but it is still too early to tell.

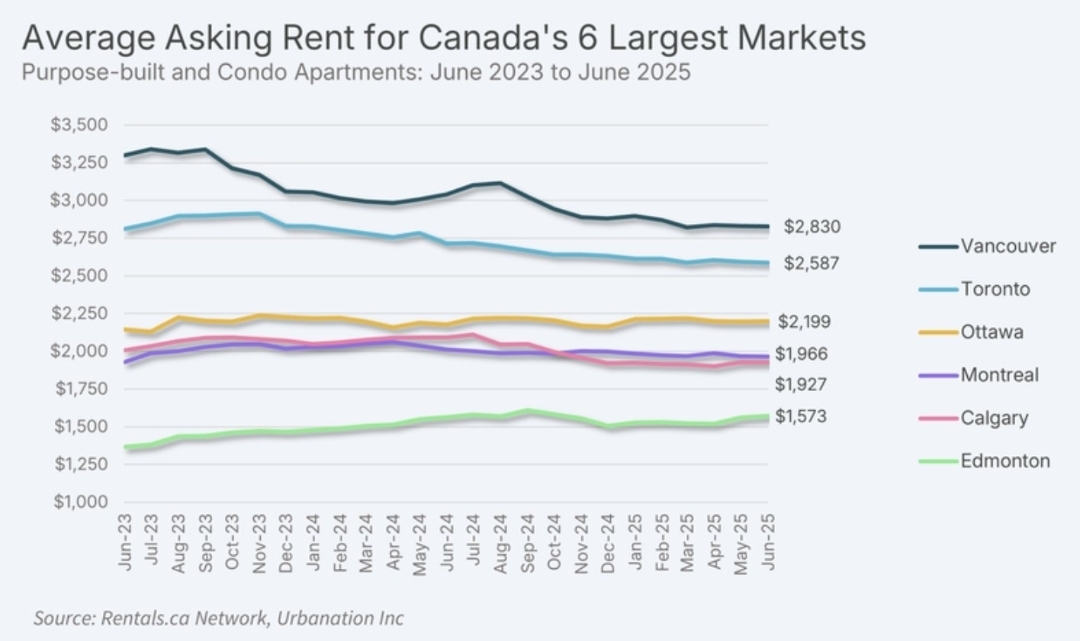

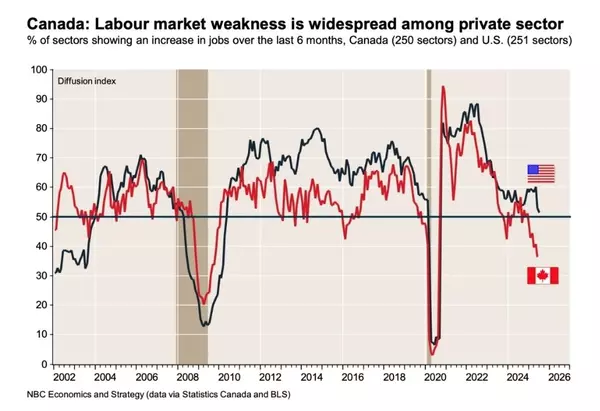

On the economic front, Canada's latest inflation in June ticked up 1.9% (up from 1.7%). Although over 55% of the CPI basket components are showing annualized three-month inflation rate exceeding 3%, one of the bright spots is that shelter costs (i.e rent) remains in check. In fact, Vancouver's rent has gone down -7.1% year-over-year, and despite that, the irony lies with BC still topping the charts with 4 highest rent neighborhoods (North Vancouver, Vancouver, Coquitlam, and Coquitlam) in Canada. Toronto, which was once 2nd on the chart, saw the latest rent drop of -8.4% year-over-year, and has slipped to 5th place. Even if inflation is kept at bay (i.e sub 2%) till September, I think the Bank of Canada is still not in a place in cutting rates. The government and central bank seem to be closely monitoring the ongoing effects the tariff have on Canadians. Some surprising job data, such as June unemployment rate at 6.9% (compared to 7% the month before), is definitely making Bank of Canada's scratch their heads harder. I personally is very skeptical of this latest unemployment data as they credited the job increase mainly in part time jobs . Note that we now have 1.6 million Canadians looking for jobs, and from the way it looks and feels, the unemployment number is still trending higher: permanent job cuts will likely push above 7% in the near future. The worst part is that some of these jobs, such as manufacturing, is gone for good. Steel plants were shut, and workers are struggling to switch to another field of work. We hear stories of the steel and aluminum workers who had worked all their lives in the plant got laid off, or the construction worker now out of job because it's not longer profitable for developer to build. Worst is, copper may be next and more jobs are threatened. On top of that, according to a report by Bloomberg, Mark Carney's government is cutting back spending and is planning to slash jobs at one of the Canadian government's largest departments (Employment and Social Development Canada) that has 36,000 employees in 2024. Even though it may sound doom and gloom, I do believe Canada is on the cusp of a meaningful transformation. There seems to be a mentality shift that the majority of Canadians are now in agreement with being less reliant on the US, and explore alternative trade partners. Liberal government is now considering shifting its focus from its prior dormant energy policies in the hopes of finally becoming an energy powerhouse supplier on the global stage. Inter-provincial trades and talks are ramping up, with Ontario and Alberta premiers, Doug Ford and Danielle Smith, in discussion of energy collaboration. There are times when Canadians are left down and out, but I do believe the tariffs are a one of the best lessons in Canadian history. No doubt the near term adjustments are painful, but such lessons should bring long term opportunities when we bring Canadians together, increase provincial trades and productivity. Perhaps this is a blessing in disguise.

Some of the unique trends I've been observing:

1. Canadian inflation ticked up in June to 1.9% (up from 1.7% in May), as core inflation metrics remain stubbornly high at around 3%. Also, the latest "improved" unemployment rate of 6.9% will make it a stronger case that the Canadian economy is too hot for calls from Bank of Canada to cut rates anytime soon. In fact, RBC economists are already doubling down on no cuts this year. In my opinion, the Bank of Canada really needs the tariffs and rising unemployment rate to trickle through the economy and show up in the data before making any decision. For the real estate Buyers looking for better rates, those days are behind us in March-May. With the bond rates creeping higher, the fixed rates are also adjusted accordingly and we are now seeing nearly all fixed rates starting with 4 in it. But the fact is, real estate Buyers now are not as focused on rates cuts, but on the persistent fear of overpaying.

2. The Vancouver real estate market in June had the lowest sales in 20 years (outside of 2019). The stubbornly high supply continues (mainly in the condo segment) with total inventory remaining at +43.7% above the 10 year average. Meanwhile, sales improved slightly but is still -25.8% below the 10 year average. The candle continues to be burned on both ends. As real estate is hyper local, we see some neighbrhoods such as Ladner single house remained in a Seller's market with sales-to-listing ratio (% of homes sold) at 22%, while the single house market in Richmond and Burnaby are in a Buyer's market at 9% and 8% respectively. July has started off with a quick boost in sales as well, and remains to be seen if that's just a blip on the map.

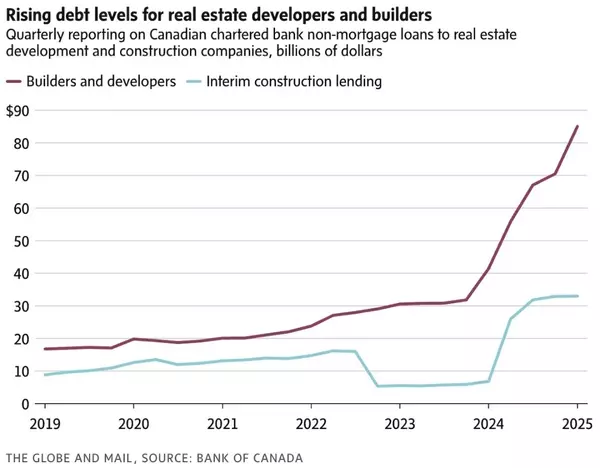

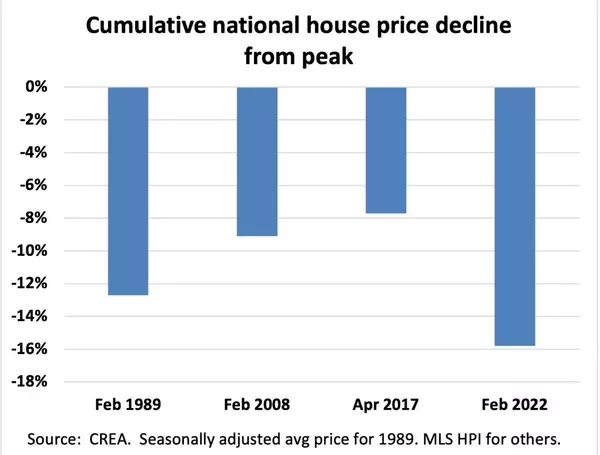

3. The lack of liquidity in the condo segment, in both Toronto and Vancouver, is causing a major strain on the would-be upsizers. Since 2022, condo sales in the Greater Toronto Area has dropped a whooping 75%, while Greater Vancouver dropped by 37% in the same period. With a record number of pre-sale condos that's completing this year and the next, it is almost certain that there would be further downward price pressure ahead. Condo sellers are now stuck with chasing the market along with fierce competition. Simply put, whatever was priced a month or 3 weeks ago may no longer be valid. Condo market is shifting faster than most Sellers know. Thus, either they reduce the price in hopes of attracting an offer and setting the new sale price for the building, or faced with other Sellers doing the same and setting the price for them. With immigration going to zero, falling rent, and investors fleeing the scene, it's hard to imagine how the condos segment would recover before 2026.

4. BC developers has recently asked the federal government to remove the foreigner buyer ban in the hopes of saving the pre-sale sector. With that comes the oppositions voicing their concerns. I believe most British Columbians can rest assured that even without the foreign buyer ban, the current state of the Vancouver real estate market is not attractive to any overseas Buyers. Rent yield are falling, future appreciation is diminishing, operating costs are rising, and government over regulating are just a few things to drive fear into the heart of the investors. If anything, I hear things are going the other way, with local investors exploring options such as real estate in Japan, with their lower currency, less regulations, and post-pandemic booming tourism (think AirBnB) generating higher yields, and their slow and steady real estate price growth.

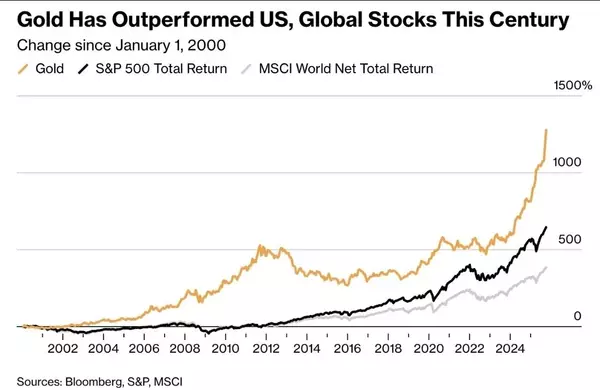

5. Stocks market and bitcoin continue to break records, despite the never-ending tariff news. As these forward-looking markets continue to show renewed optimism, could this simply be market manipulation, or will some of that investor/buyer confidence possibly spill over to real estate and finally spark a turning point?

Here are the 3 highlights for June:

- Total inventory of 17,029 units is the highest June total inventory since 2014.

- First two weeks of June were greeted with increased sales, but has trailed off towards the last week of the June and the first week of July. So far, July looks busier than usual with reportedly more showing requests and sales.

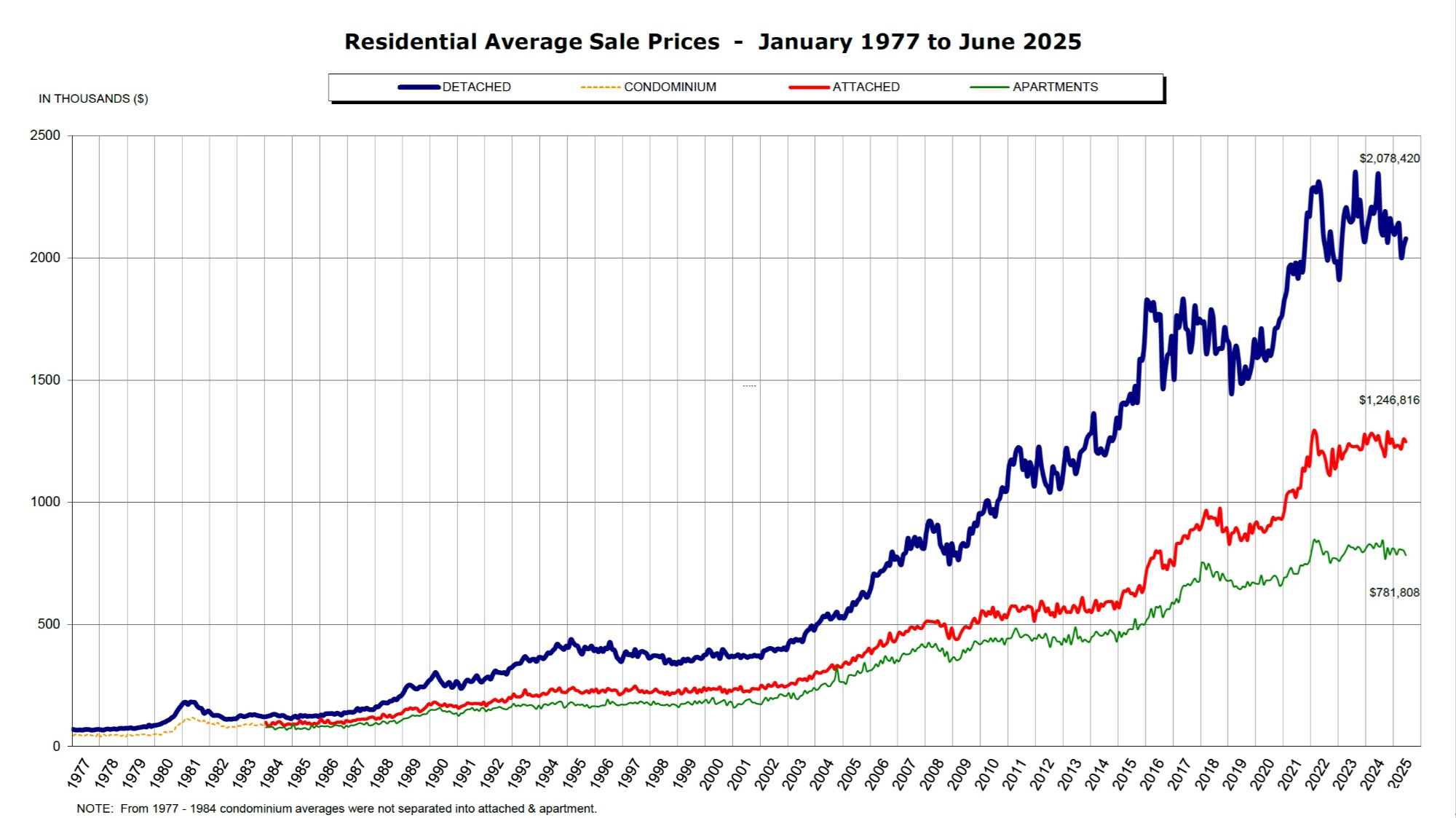

- Prices slipped slightly again last month by -0.4%, and for the past 3 months the average price has slowly come down by -1.5%. The majority of the monthly price drop came from condos by -1.2%, whereas single house was also flat at -0.1%.

Here are the in-depth statistics of the June:

- Last month's sales were -25.8% below the 10 year June's sales average.

- Month by month residential home sales remained nearly flat at -1.8% from May 2025.

- Month by month new home listings dropped by -5.1% compared to May 2025 due to seasonality.

- Last month's price remain nearly flat at -0.4%.

- Sales-to-listing (or % of homes sold) ratio is remained flat at 12.8% (compared 13.4% in May). By property type, the ratio is 9.9% for single houses, 16.9% for townhouses, and 13.9% for condos.

In June, single sound market was the only segment that had an increased inventory, albeit a only a small uptick of +1.2%, compared to townhouse (flat inventory) and apartment (dropped in inventory). Ironically, single house had the least price drop across segments (-0.1%), compared to townhouse and condos, which dropped -0.3% and -1.2% respectively. After 6 months into the current market downturn, I would say the single house market, especially the entry level homes around $1.6m-$1.7m homes in Greater Vancouver, are seeing a price floor. In some neighborhoods like Ladner, the sales-to-list ratio (% of homes sold) is 22%, which has elevated into a Sellers market. However, suburbs such as Richmond, Burnaby, and Coquitlam all remain in the Buyers market, with sales-to-listing ratio at 9%, 8%, and 9% respectively. Month-over-month total sales remained flat, so that defied the typical slip in sales from May to June. Anecdotally, the last week of June and the first week of July was a write off: there were hardly any private showings and traffic through the open house. However, comes the second week of July, and Buyers returned and showing request and offers picked up quickly. However, luxury market remains muted and some Sellers remain frustrated that there's no bite. As Buyers look for more clarity and may have waited for up to 6 months already to see signs, it may not take that much for them to come off the sidelines. In fact, they may just be used to the new norm of uncertainty, bu they just need to overcome their fear of overpaying . Another trend on the rise is the inclusion of subject-to-sale clause from Buyers. This is usually a sign of continuous market deterioration, and while most Sellers were resistant their home being tied down for months, recently we are starting to see Sellers soften up. In a continuously weak market with sales hitting 20 year lows, Sellers can only be firm for so long before reality sinks in (i.e 3 months on the market and no offer). And now, any offer, any price, with any subject, should be considered by the Seller. Yes there are lowball offers and Sellers may be offended, but now really is not a time to be picky. That was in 2021.

For the month of June, the neighorhoods that registered most price growth were Port Moody, Burnaby North and Sunshine Coast, posting +1.9%, +1.8% and +1.5% respectively. Conversely, the neighborhoods registered the most significant price drops were Burnaby South, Pitt Meadows and Port Coquitlam, with -3.7%, -2.4% and -2.1% respectively. The single house market continues to be in a Buyers market for the sixth consecutive month, with average days on market increasing to 36 days (compared to 32 days in May), and month-to-month average price remained nearly flat at -0.1% (compared to -1.2% in May). Sales-to-listing ratio (% of homes sold) remained dropped by to a single digit at 9.9% (compared to 10.2% in May).

Last month, the townhouse total inventory has flat-lined, while sales increased slightly by +4.8%. This was definitely welcoming news for townhouse Sellers as it is showing some signs of inventory stabilization. Anecdotally, showing request has slowed since July and it doesn't seem like it has picked up yet, perhaps due to the fact mainly townhouse Buyers are young families and they may still be on vacation mode. Having said that, there are still groups of upsizers, predominately families with children who want to settle into their new home before the summer. Again, these upsizing plans are contingent on thee sales of their homes (i.e condos), which may take longer to sell. Thus, townhouse market is being dragged down by the much slower condo sales. Good thing is that there the townhouse market remains in a balanced market, with sales-to-listing ratio (% of homes sold) at 16.9%, which is the best across all segments. As mentioned, there is no over-supply of townhouses (unlike condos), and for this same reason, it is much easier for this product to hit a price floor as the absorption rate is much higher and faster. Anecdotally, I do feel that it will still take some time for the Greater Vancouver townhouse market to recover, given how dependent this market is from the condo upsizing Buyers. Another trend that's happening now is that townhouses in newly developed neighborhorhoods, such as Langley where there is more open space, is having a competitive advantage over others areas. This is mainly because of its growing community, easy access to school and highways, community centres and parks, which makes it ideal for young families on a tight budget looking for more space. In the current market where the buyers mainly consists of end-users, the townhouses in Langley offer much more bang for their buck than similar products in Surrey. And the stats show, with Langley townhouses sales-to-listing ratio at 23%, compared to Surrey's at 9.6%

In June, the areas with the most townhouse price growths were all in the outskirts at Whistler, Pitt Meadows and Squamish, registering +1.9% (tied for 1st and 2nd) and +1.5% respectively. Conversely, the neighborhoods with the most significant price drops were Tsawwassen, Ladner and New Westminster, at -5.2%, -4.2% and -3.1% respectively. The townhouse market remained in a balanced market with days on market rising to 29 days (compared to 27 days in May). Month-to-month sale price slipped slightly by -0.3% (compared to +0.4% in May). Sale-to-listing (% homes sold) ratio remained nearly flat at 16.9% (compared to 17.4% May).

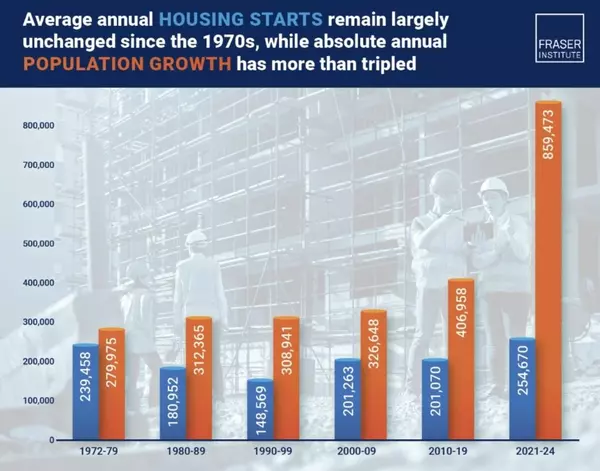

The condo market, despite having stubbornly high inventory, is coming to a seasonality shift in June, which for the first time this year saw a drop in total inventory. While this may be a welcoming news to the condo Sellers, but the fact that the monthly price drop -1.2% was the most significant of all segments really is a sign of things to come: there is still 7.1 months of inventory in Greater Vancouver. For context, anything over 6 months of inventory is a Buyers market with mounting downward price pressure. In Fraser Valley, Surrey is still facing much lower sales-to-listing ratio (% of homes sold, or absorption rate) at 10%, whereas Langley is faring much better at 19%. When the investors fled the condo scene, the micro-homes (sub 550 sf homes) are almost undesirable for end-users, and these are the products that's sitting for a long time. Some Buyers are now moving further East (i.e Langley) where there are bigger units, more affordable and with more choices. Surrey has had its run in the past decade, and with its high rises pre-sale prices over-inflated to a point of no return, the Buyers now decide to look away. As for the Metro Vancouver area, new competition seem to be subsided for the past 3 weeks as new condo listings are gradually coming down. Having said that, there are still a record number of pre-sale completion down the pipeline before 2026. With that in mind, I would suggest the condo Sellers to seriously consider their hard choices. Either is to rent it out, slow bleed and face negative cash flow from falling rent, or to face the new reality of fierce competition and reduce the price to a point where they can get an offer and sold. Either way it's tough, but that's the harsh reality when we have a near-record high of condo inventory due to the regurgitation from the condo investors. Real estate itself is an illiquid asset, and condo Sellers are the worst hit now with increased strata fee and property taxes, combined with falling rent and sale prices. With immigration going to net-zero, which means rental market will continue to fall, I just don't see how the condo market would recover at least for the next 18 months.

For the month of June, the best performing neighbourhoods for apartments were all in the outskirts of West Vancouver, Port Coquitlam and Ladner at +2.7% & +0.3% (tied for 2nd and 3rd) respectively. Conversely, the areas with the most significant price drops were Pitt Meadows, Burnaby East, and Maple Ridge, posting -2.4%, -2.3% and -2% respectively. The apartment and condo segment remained in a balanced market, with average days on market flat increasing to 35 days (compared to 31 days in May). Month-to-month sale price continue to slip at -1.2% (compared to -0.7% in May). Sale-to-listing (% homes sold) ratio also dropped further to 13.9% (compared to 14.7% in May).

1. Inflation Knocking

Inflation across the CPI basket expanded in June, with approximately 55% of the components showing annualized three-month inflation rates exceeding 3%. This has been the broadest inflationary pressure observed so far in 2025. With the economy running hotter than expected, the Bank of Canada really have their hands tied and should hold rates in the near future, and very possibly till end of the year. (Source: Statistic Canada, RBC)

With the exception of Edmonton, rents in major cities in Canada has peaked in 2023 and has been falling since, with Vancouver and Toronto the epicentre of it all. Ironically, these two cities are also the only ones that registered a negative population growth last year. The aftermath of net-zero immigration policy begins to unfold. (Source: Rentals.ca, Urbanation Inc)

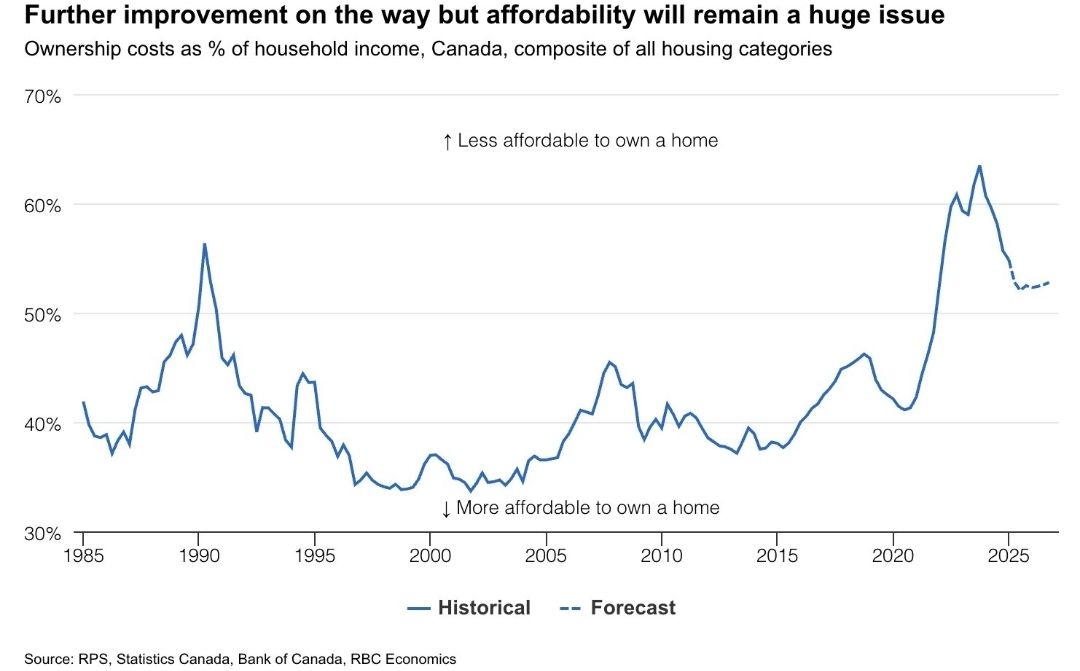

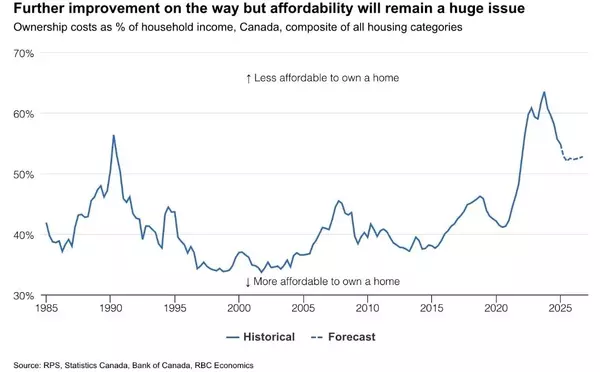

Housing affordability has improved to its best in the past 3 years, but still out of reach for many. For the two most unaffordable like Vancouver and Toronto, the average age of first time home buyers is 39. One can imagine social issues arise easily with this, such as couples putting off plans to have kids. (Source: RPS, Statistic Canada, Bank of Canada, RBC Economics)

Recent Posts

GET MORE INFORMATION