Real Estate Market Intelligence October 2025

Real Estate Market Intelligence

October 2025

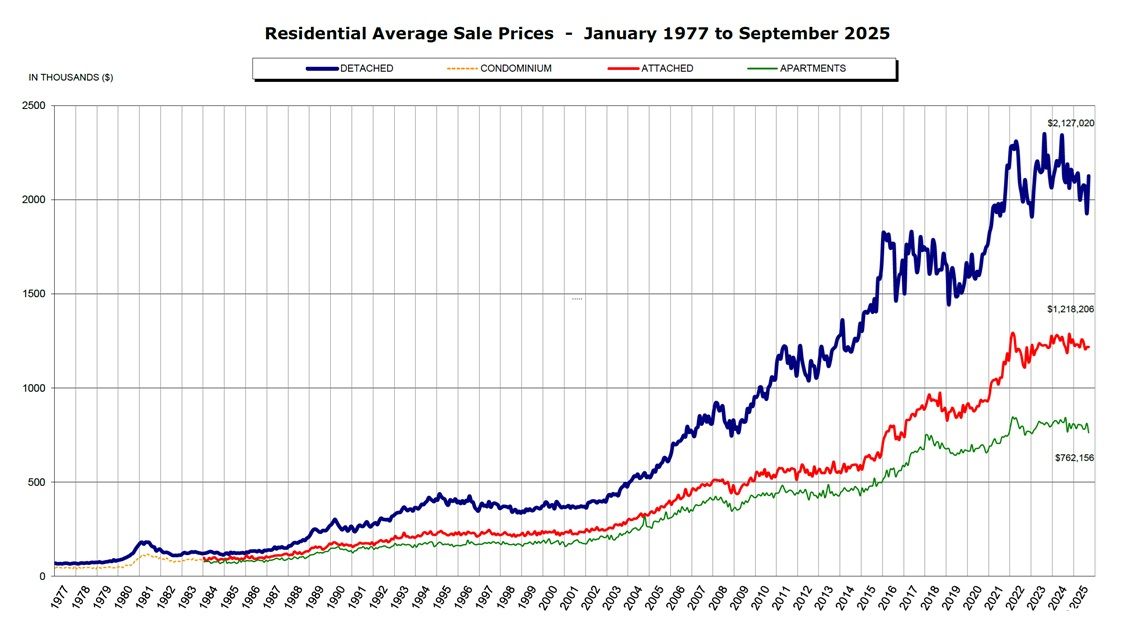

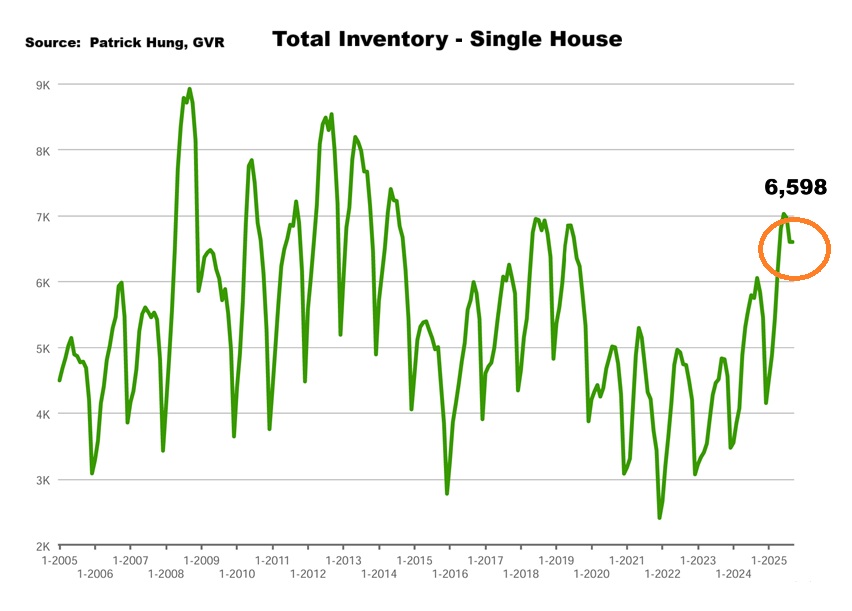

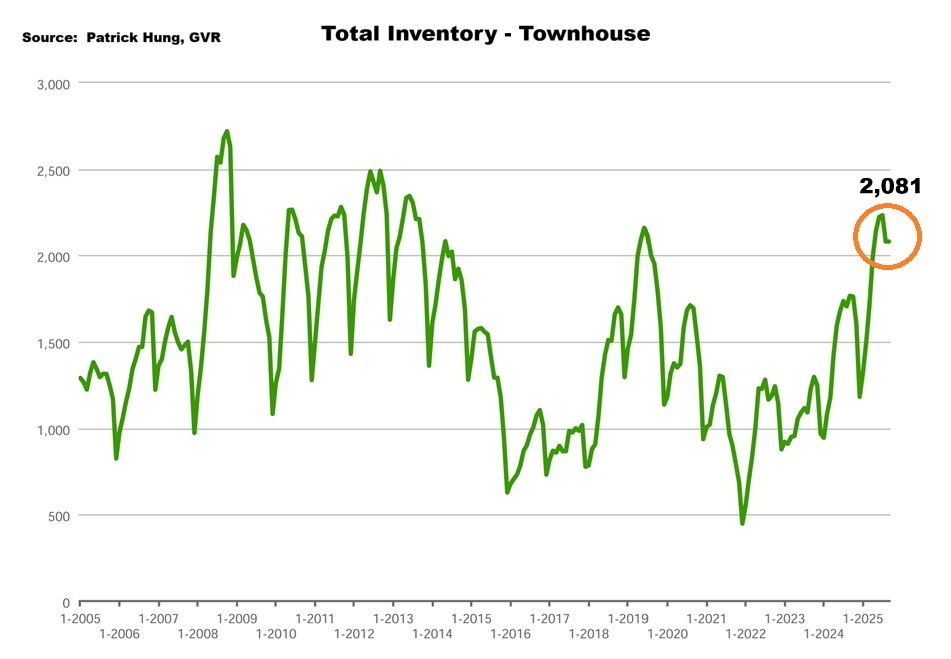

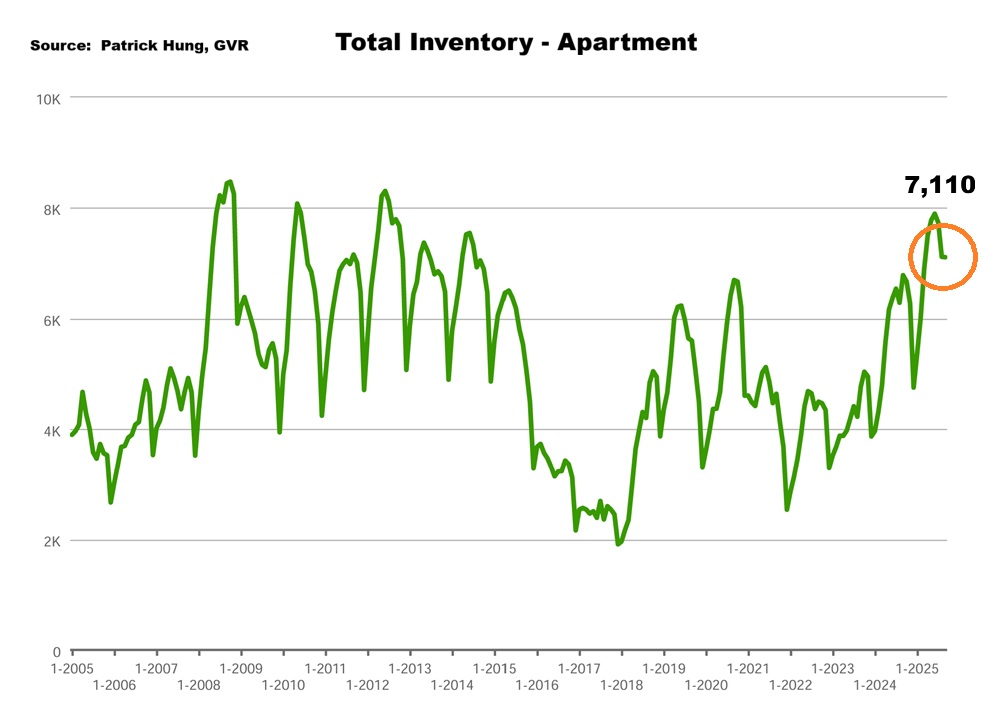

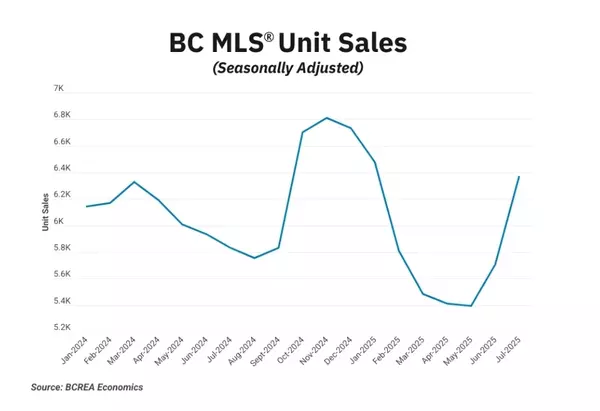

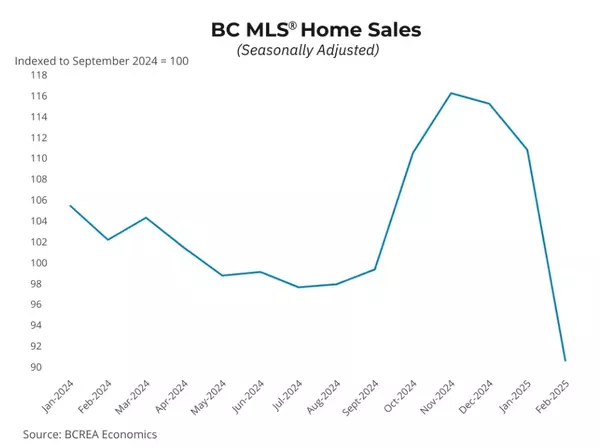

Fall is here and the gorgeous autumn foliage is in the air. As the start of the final quarter begins, the September Vancouver real estate market got off to a similar start to the summer months. News outlet reports improved sales, which again is near 12 year lows, compared to the May-June's 30 year lows. In my opinion, the market is just going from worst to bad. Either way you look at it, it's still horrible. What the publications are not getting into is that the total inventory of 16,500 units in September remains historically high. Again, for context, around 12,000 units is consider the past decade's norm in Greater Vancouver, so we are 4,500 units above that. Having said that, a rate cut of 0.25% didn't move the needle much to the Buyers, and putting that into perspective of the monthly mortgage payment, the rate cut would only slash around $100/month for every $700,000 borrowed. However, the main driving factor was actually the other side of the coin, which is the Sellers' willingness to finally come down in price, that drove the sales up. Some Sellers, who've had their homes listed for a few months now, are starting to get anxious in moving before the end of the year. With that, the window towards the last active market, which ends around mid-November, left them with only 4-6 weeks. If Sellers failed to get it sold before November, then they will most likely have to wait till Spring 2026. And what comes before Spring 2026? The new government assessment value, which will most likely take a heavy hit across the board and will substantially change both the buyers and the sellers mentality. If I were a Seller, I would not gamble on that and rather just take a hit now and move on. Even with another imminent rate cut on the horizon, the elevated inventory will take months to clear, which means more downward price pressure is guaranteed. Again lots to cover this month as Canada's September unemployment rate remained flat 7.1% but suddenly added 60,000 more jobs, rents across major cities in Canada (except Winnipeg) continue to fall for for the 12th straight month, and more of Canada's self-sabotaging policies both local and abroad.

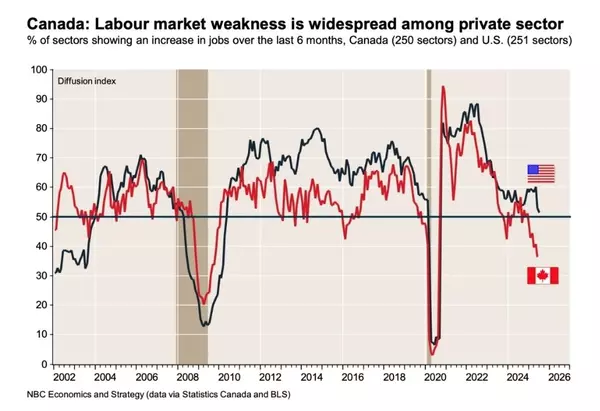

On the economic front, Canada's unemployment remained flat at 7.1% in September (same as August). Diving deeper, there were 60,000 jobs added last month, and the odd part is the month before that, it shed a near-identical 60,000 jobs. Some economist reaffirmed Canada's resilient position in the face of tariff, while others state it as a new norm of volatility. I believe it was the latter and the latest stats felt extremely random. If I were the Bank of Canada, I would definitely be scratching my head as last month's rate cut decision was partially based on job losses, and has now literally meant nothing. How are any decisions supposed to be made now with possibly another rate cut on the horizon? While the unemployment number is all over the map, the rents in Canada seems to be heading in only one direction, as major cities across Canada (except Winnipeg) continue to fall for the 12th straight month. With immigration grinding to a halt and with the two largest provinces, Ontario and BC, both registering negative population growth, there seems to be more bleeding ahead. As for Canada's national and international policies, it looks like we are limping from more self-inflicted wounds, from immigration to the travelling Prime Minister. Parliament has resumed the Fall session on Sept 15, but prime minister Mark Carney has been on a tour to Mexico, UK and US looking for deals and collaborations, which still zero deal has been reached. Meanwhile, more US tariffs (such as lumber, furniture, kitchen cabinets) have been imposed. What's more ironic was that Carney is looking to "deepen ties" with Mexico, while exports there only accounts for 1.05% and imports at 6.56% as a whole. The honeymoon phase may soon be over for Carney as the much-delayed fiscal budget is set to be announced on November 4. The financial bomb drops as many economist anticipates the annual budget deficit to eclipse $100 billion mark. A friendly reminder that it was only earlier this year that Justin Trudeau resigned due to the $70 billion deficit announced by then-finance minster Chrystia Freeland. So what's changed? Nothing, except it got worse. Lastly, Canadian immigration asylum claims spiked to historic high and just shy of 500,000 cases in total, or 1.2% of the population, which is 1 in 83 people in Canada. The aftermath of one of the worst Canadian immigration policies is unfolding, and Canadians are paying the price for it.

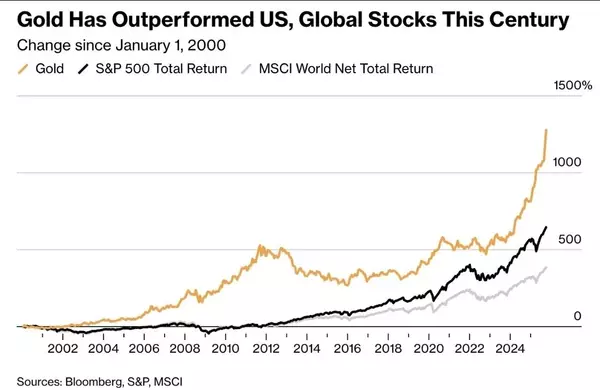

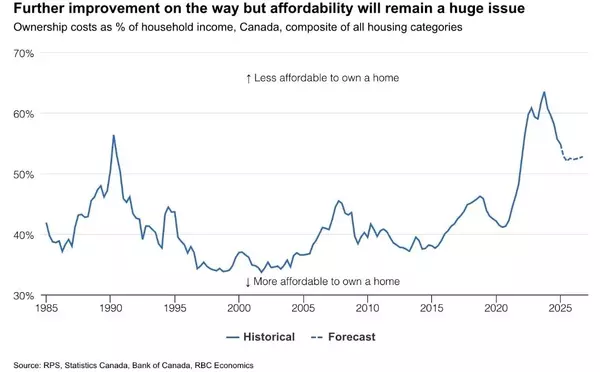

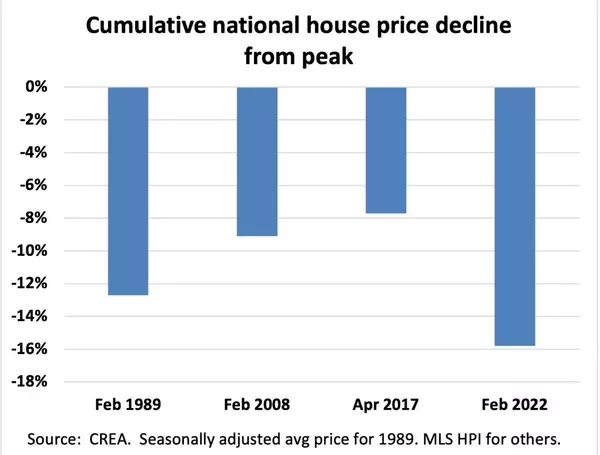

Globally, we are now faced with one of the wildest markets in a long time. Stock market continue to rip higher, and so is bitcoin and gold prices. In other words, currencies are being debased rapidly. And just how will that affect real estate? Historically, real estate was a great tool to hedge against inflation, but this formula has been proven wrong since real estate prices peaked in 2022. The last quarter of the year is always a seasonally slow for real estate. However, this year has been anything but typical. Would we see another increased sales to close the year with a bang, or would we be hit with another new low? Your guess is as good as mine.

Some of the unique trends I've been observing:

1. The Vancouver real estate market in September was flat but performed better than expected, with +1.2% increase in monthly sales year-over-year. Despite the optimism, sales are still performing -20.1% below the 10 year average. As the overwhelmingly amount of Buyers now are end-users, a lower interest rate by -0.25% was more of a psychological boost than financial. While Buyers' FOOP (Fear of Over-Paying) remains high, it was the Sellers' willingness to come down price that really have boosted the sales. Anecdotally, many Sellers want to liquidate before end of year. We are now facing one of the wildest markets in recent memory, and would the elevated stock market prices (which many Buyers' down-payment portfolio sit in) increased their purchasing power, especially for first home buyers? This lateral movement may prove to be a stronger motivation than the interest rate cuts.

2. Canada's latest unemployment was flat at 7.1% (same as August) and saw 66,000 jobs added. Suddenly, the economy is booming again? Ironically, the month before that saw a near-identical 60,000 jobs slashed. With more tariffs (i.e additional +10% on lumber) being imposed, there will be much more hurt in store. BC forestry will be hit hard, from furniture (now 25% tariff on Canadian furniture) to kitchen cabinets, the damage is far reaching; mills across the nation is shutting down indefinitely, with workers and truck drivers laid off. BC Premier, David Eby, is already calling for the federal government's support.

3. Canada's rental trend continue to take a deeper dive, with major cities (except Winnipeg) registering falls for the 12th consecutive month. Calgary takes the cake, with the most significant year-over-year rental drop of -8.7%, with Vancouver and Regina behind at -7.8% and -3.2% respectively. Winnipeg was the outlier, with +2.3% gain year-over-year. Digger deeper, Vancouver led with the largest drop in the country at -16.9% in the past two years, and is currently at a 41-month low, with a Vancouver one bedroom rent down $500 a month since 2023. Worst part is, it doesn't look like it has hit the bottom yet.

4. In one of the rare good news, the City of Vancouver confirmed there is 0% increase in property tax for 2026. Finally, they did it. Now let's see other municipalities follow suit.

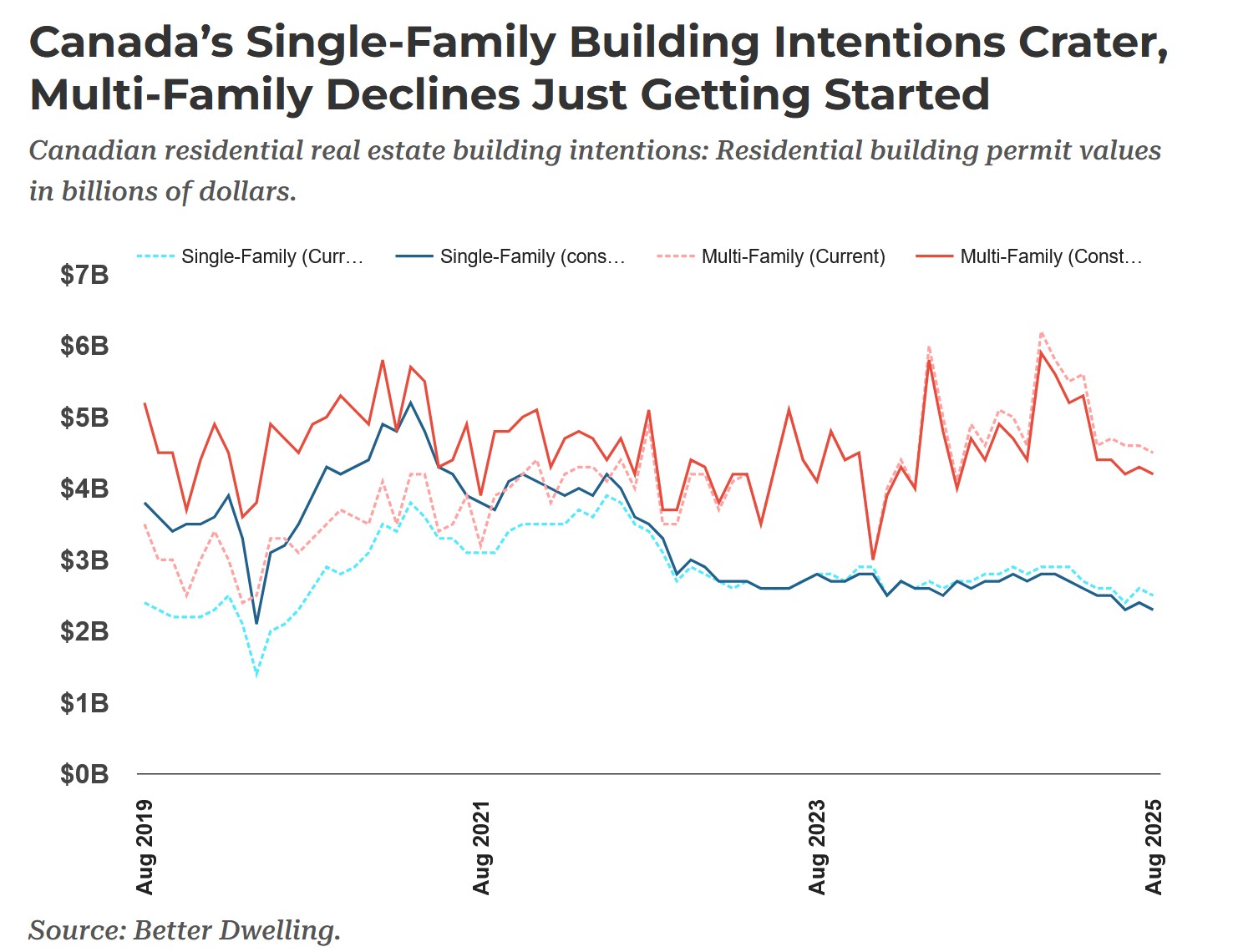

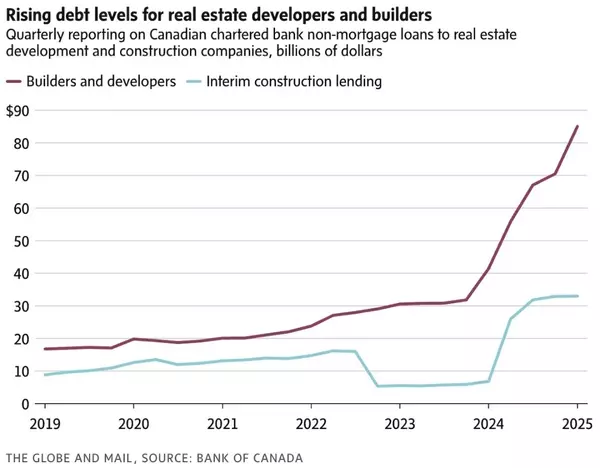

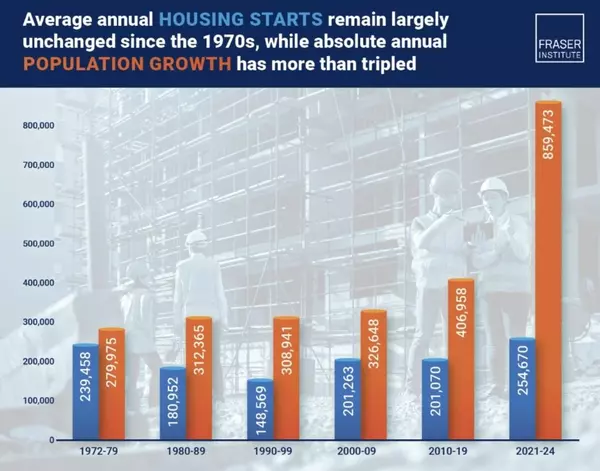

5. In Metro Vancouver, there are now 2,500 developer condos sitting unsold, and this number is double of that last year. Last time we saw this level of developer-owned unsold inventory was 24 years ago. As developers fail to clear these inventory, there are now ZERO new projects in August and September. The appetite to build has reached a multi-decade low.

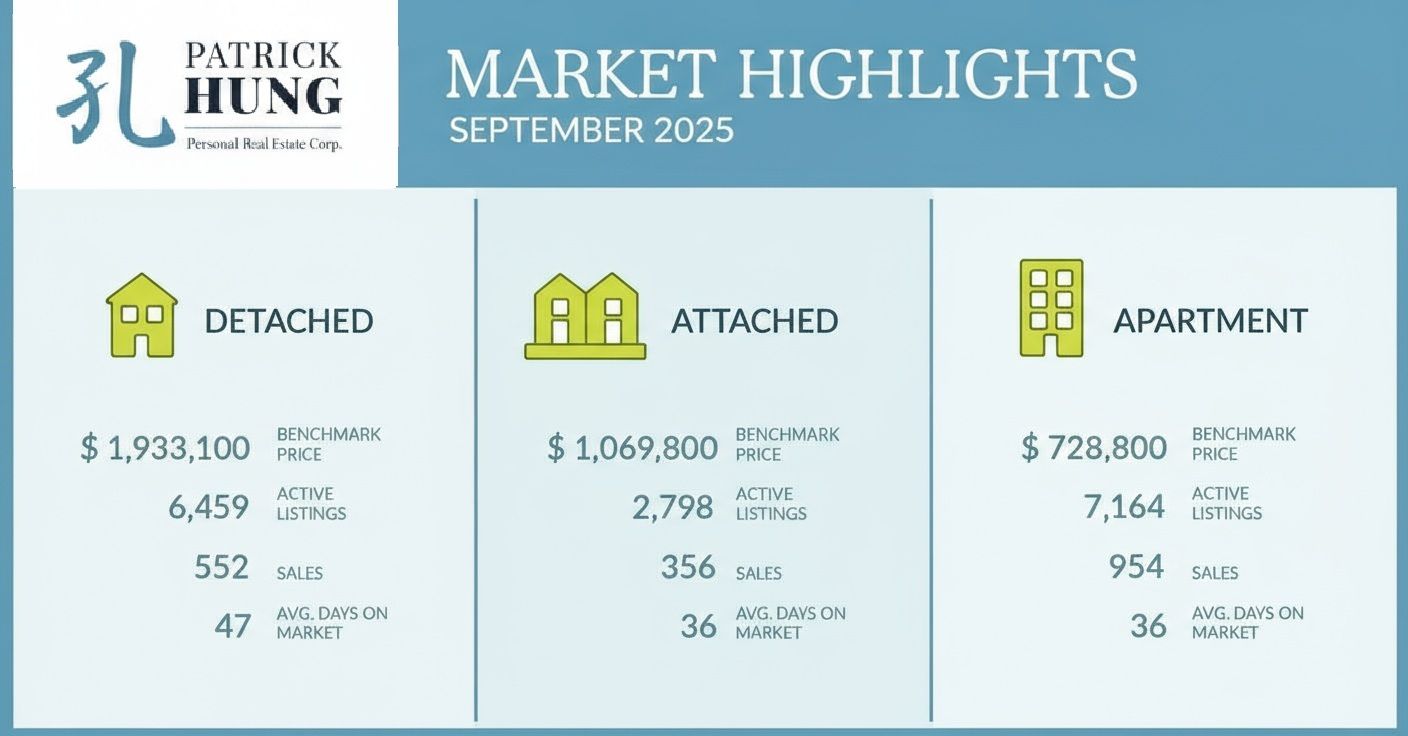

Here are the 3 highlights for September:

- Total inventory of 17,079 units is the highest September total inventory since 2013. Sales and demand has increased, but inventory and supply is still outpacing the demand.

- The last two weeks of September and the first week of October remained active in terms of sales and supply, but the second week of October is starting to slow.

- Home prices continue to slip, with average prices month-to-month dropped by -0.7%, and by a total of -2.93% in the past 3 months. The 3-month price drop came from apartment (-2.6%), townhouse (-3.1%) and single houses (-3.1%).

Here are the in-depth statistics of the September:

- Last month's sales were -20.1% below the 10 year September's sales average. (compared to -19.2% in August)

- Month by month residential home sales dropped slightly by -4.1% from August 2025.

- Month by month new home listings shot up significantly by +35.1% (compared to -33.8% compared to July 2025.) Many listings were relisted at a lower price in September in an attempt to make a final push for a sale before end of year.

- Last month's price dropped further by -0.7% (compared to -1.3% in August)

- Sales-to-listing (or % of homes sold) ratio is increased slightly to 11.3% (compared 12.4% in August). By property type, the ratio is 8.5% for single houses, 12.7% for townhouses, and 13.3% for condos.

In September, the single house market sales dipped -3.6%, while prices dropped -0.9%. New inventory spiked for the first three weeks of the September, then it started to slow down two weeks after that. As the September market is all important to dictate the tone going into Q4, I did notice that many of the "new" listings were actually old ones relisted at a lower price: a sign that Seller's attempt to liquidate before end of the year. Anecdotally, I feel that single house market has been stuck since the summer, mainly because some of these Buyers (who are also townhouse Sellers) failed to move their property. Some of these Buyers have tried, but failed, with a subject to sale of their townhouse, which is only performing slightly better than the single house market. Again, homes that are in pristine condition, freshly renovated, and have a good layout are still getting sold. It's actually the poorly kept older homes that sit on the market months on end and are dragging down the entire market. Such homes can only resort to the steep price cuts to make a sale, which we are starting to see more often as these older homes prices reversing back to 2021 levels. Open houses in Surrey, Ladner, Burnaby and Richmond seem to have decent traffic but again has not translated into heightened offers and sales. Buyers are still circling around but as long as their own home (i.e townhouse) has not been sold, they cannot pull the trigger, so the domino effect continues and dragging the sales-to-listing ratio (% of homes sold) to 8.5%, which is the lowest for the year. Having said that, there are truly some amazing deals to be had as buyers continue to sharpen their swords to slash prices.

For the month of September, the neighorhoods that registered most price growth Burnaby South, Tsawwassen, and Port Coquitlam, posting +1.4%, +1% and +0.7% respectively. Conversely, the neighborhoods registered the most significant price drops were Burnaby East, New Westminster, and Richmond, with -5.7%, -4.7% and -1.8% respectively. The single house market continues to be in a Buyers market for the ninth consecutive month, with average days on market remaining flat at 47 days (same as August), and month-to-month average price dropped to -0.9% (compared to -1.2% in August). Sales-to-listing ratio (% of homes sold) dropped further down to 8.5% (compared to 9.3% in August).

On the surface, the townhouse market seems to be performing the same as single house market, with identical price drop of -0.9%. Diving deeper, the townhouse sales are very sluggish and has the greatest month-to-month sales drop at -12.7% among all property types. The monthly sales-to-listing ratio (% of homes sold) also had a significant hit to 12.7% (from 15.8% in August). Report of traffic at open houses were slow, even when prices are coming down and are very reasonable. In other words, the rate cut didn't had nearly no effect on the townhouse Buyers. Townhouse Sellers who are serious in getting their home sold before the new year have to have both superior product and price, and missing either one of them won't cut it. On top of that, townhouse buyers are becoming increasingly picky and continue to hunt for the best deal. It is hard to believe the townhouse market, which was once the darling and most popular type of home for upsizers, have now been relegated to an afterthought. On the upside, the townhouse Sellers who have successfully upsized and bought single house, is having an blast they have taken advantage of the great price cut from the bigger home purchases. In fact, now is one of the best time to upsize in a decade, but this opportunity is only for those with the financial muscle. With unemployment rate still soaring at 7.1%, families are struggling to put food on the table, and upsizing is a luxury many Canadians now just cannot afford.

In September, the areas with the most townhouse price growths were all in the outskirts in Sunshine Coast, Whistler and Squamish, registering +2.3%, +2.2%, and +2.1% respectively. Conversely, the neighborhoods with the most significant price drops were Coquitlam, Vancouver East, and Maple Ridge, at -3.2%, -2.7% and -2.1% respectively. The townhouse market remained in a balanced market but is tipped very close to a Buyer market, with days on market remaining flat at 36 days (same as August). Month-to-month sale price dropped significantly by -0.9% (compared to -1.8% in August). Sale-to-listing (% homes sold) ratio slipped slightly to 12.7% (compared to 15.8% in August).

In September, the condo market looked like it had the least monthly price drop at -0.7% (compared to -0.9% for both townhouses and single houses). Sales and inventory were flat like other sectors, but the feeling on the ground is that the rate cut in September had the most profound effect in the condo market , especially among first time home buyers. It may only take a little nudge to get these buyers off the sidelines. In some cases, competitively priced apartments in Burnaby, Richmond, and North Vancouver had unintended multiple offers. This came as an unpleasant surprise for condo Buyers who have been looking for a good deal since the summer, but once they spotted one, they faced competition. The Fraser Valley, especially Surrey and in Guildford, remain the most over-supplied area, with another mesmerizing 10 months of inventory (normally 4-6 months is considered balanced). On top of that, news report of developers having 2,500 units of unsold "shadow inventory" is piling up. Note that these shadow inventory are not captured by the Real Estate Board, so in reality, the condo supply is much greater than reported. Vancouver's condo and pre-sale scene pales to that of Toronto, which is the epicenter of the condo meltdown, and had only seen 1,300 units of new condos sold this year. That is running 90% below their long term average. With rents falling sharply in both Vancouver and Toronto (-7.8% and -2.4% year-over-year), retail investors had all but fled the scene, leaving only end-user for condos who would prefer more space. Of all the different types of condos, the prices of micro-unit (sub 500 sf) have fallen the most, approx. 10% this year in Greater Vancouver. Let's face it, who really wants to live in one a 400 sf studio on the 40th floor? Perhaps international students or new immigrants, whom have limited budget and choices. However, as net immigration is also heading to zero, there seems to be no recovery for these units in sight. Even with likely another interest rate cut ahead, it still can't save the falling condo prices until the over-supplied inventory clears.

For the month of September, the best performing neighbourhoods for condos were in Burnaby East, Maple Ridge and Richmond, at +0.7%, +0.1% and 0% respectively. Conversely, the areas with the most significant price drops were mainly in the outskirts in Sunshine Coast, Whistler and Squamish, posting -8.8%, -7.5% and -5.8% respectively. The condo segment remained in a balanced market, with average days on market dropping to 36 days (compared to 42 days in August). Month-to-month sale price slipped slightly at -0.7% (compared to -1.2% in August). Sale-to-listing (% homes sold) ratio also slipped slightly to 13.3% (compared to 14% in August).

1. Reverse Course

Canada's rental trend continue to take a deep dive, with major cities (except Winnipeg) registering falls for the the 12th consecutive month. Vancouver led with the largest rent drop in the past two years at -16.9%, and is currently at a 41-month low. A Vancouver one bedroom rent has been down $500 a month since 2023. Factors such as rising unemployment, near-zero immigration, and federal government rental housing supply increase, the rental rates are bound to drop further. (Source: Rentals.ca)

Gold, stocks, and bitcoin were the talk of this year. With all the global economic uncertainty, gold continues to break higher and has eclipsed $4,300 per ounce (as of Oct 17, 2025). While many decide to take refuge in this precious metal, keep in mind that the landscape is shifting beneath our feet. The silent currency debasement is creeping up on us faster than we think. (Source: Bloomberg)

For Canadian developers, the profit margin is shrinking mighty fast, especially for the multi-family ones like condos. For this same reason, Greater Vancouver saw zero new condo development applications for August and September. Simply put, the pre-sale market is dead. Developers in municipalities like Surrey and Langley are having their building permits on hold to avoid these project's death on arrival. (Source: Better Dwelling)

Recent Posts

GET MORE INFORMATION