Real Estate Market Intelligence October 2023

Some of the unique trends I've been observing:

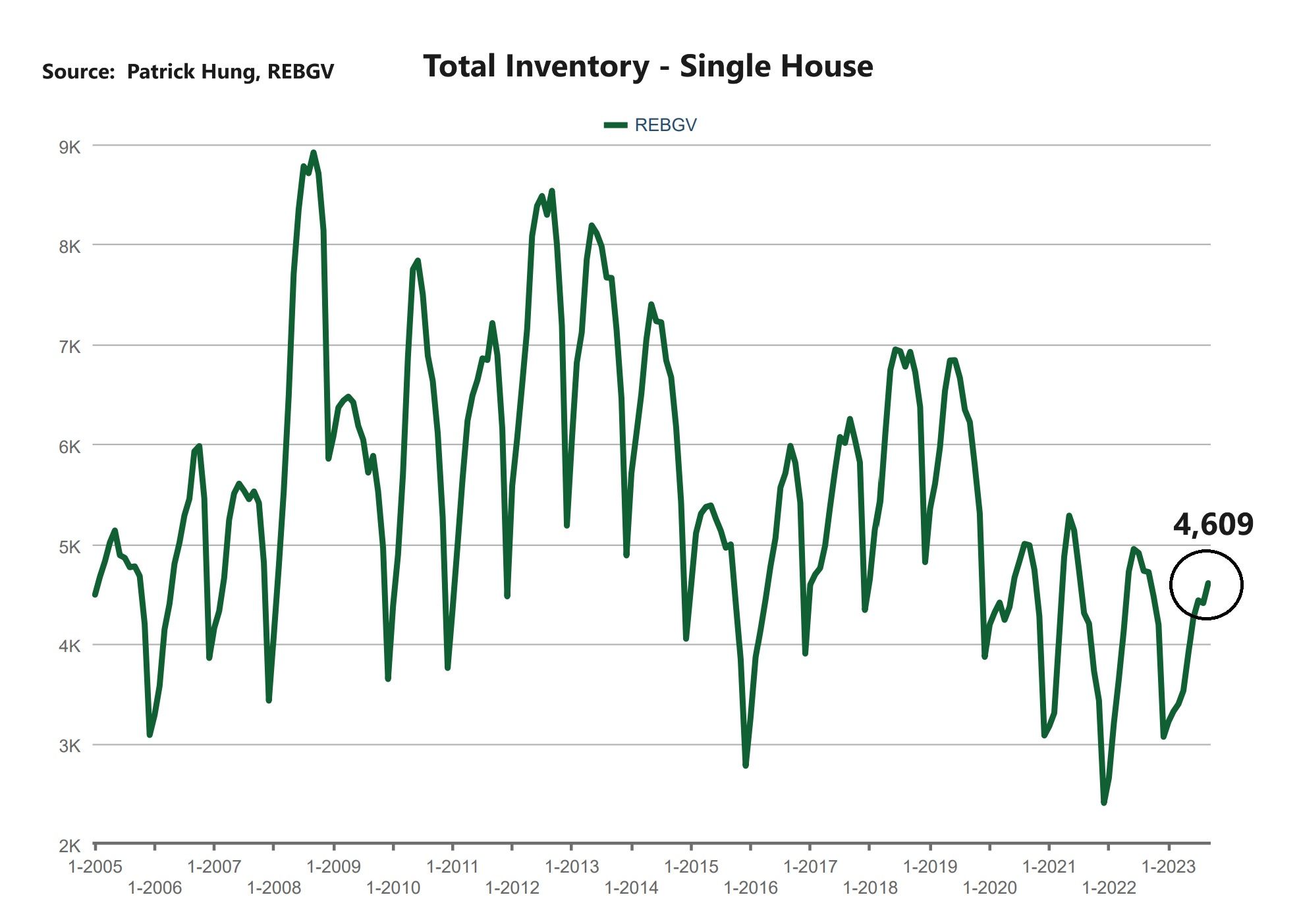

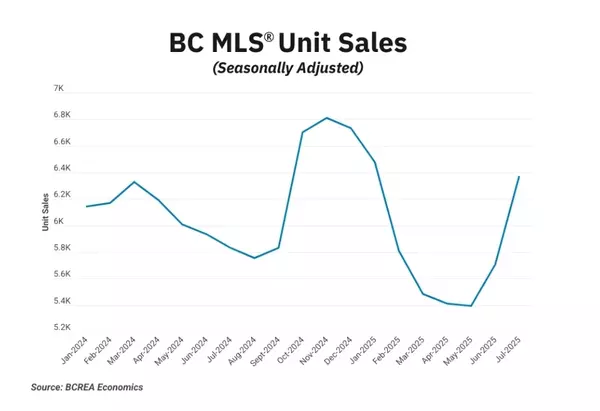

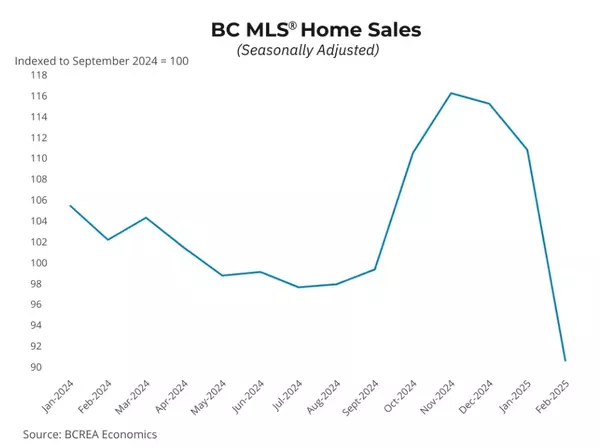

1. September real estate was certainly a turning point. Total inventory went up +11% (the highest level in 3 years), and is significant higher considering the same August-September average is only +1.2% (more than 9 times the average). On the other hand, sales is down and is -26.3% below the 10 year average. These opposing forces pulling the market will continue to shift the landscape onto the Buyer's side.

2. The chorus of rate being "higher for longer" is already translating into an uptick of foreclosures in the Vancouver real estate. Perhaps this is a sign of more to come.

3. Canadian bond rates, which is tied to the mortgage rates, was going wild in September, causing major banks to react by hiking rates to nearly 7% Good news is that the October bonds rates are starting to calm, but it remains to be seen how volatile this can be.

4. Despite the rate environment, Vancouver luxury market is performing relatively well, and homes around $3m-$5m are seeing increased sales. Such trend is polarizing between those who have and the have-nots.

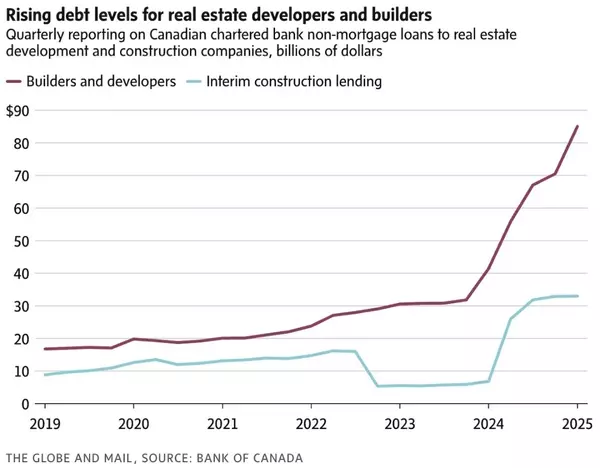

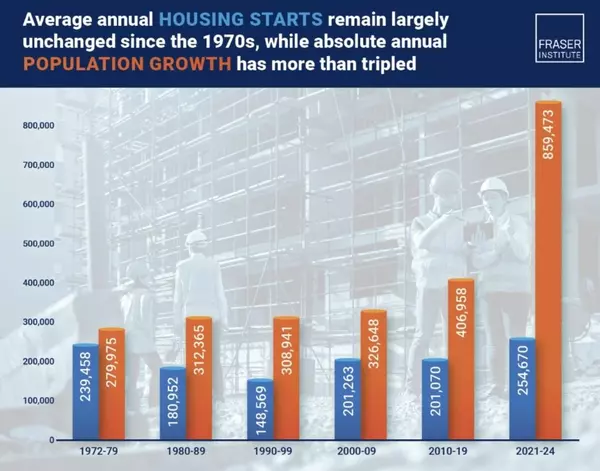

5. City of Vancouver has launched a top 10 "Naughty" list of neighbourhoods that needs to meet the expected new housing units to be built by 2028. This is nice in theory, but if the developers have no incentives (i.e razer thin profit and high uncertainty), how would they be able to build?

6. Nearly a month after the City of Vancouver finalized the details of the four-plex rezoning plans, we are starting to see these prime development single house land inventory go down. This trend is also spilling over into neigborhoods such as Burnaby and Richmond, where the former has recently announced allowing lane-way (back lane) homes. Small to medium sized developers are either going on land-grabbing or holding mode.

Here are the 3 highlights for September:

- Sales are significantly below the 10 year average, while total inventory has shot up.

- Single house market is in a balanced market but is very close to a Buyer's market, while townhouse and apartments are starting to enter the balanced market.

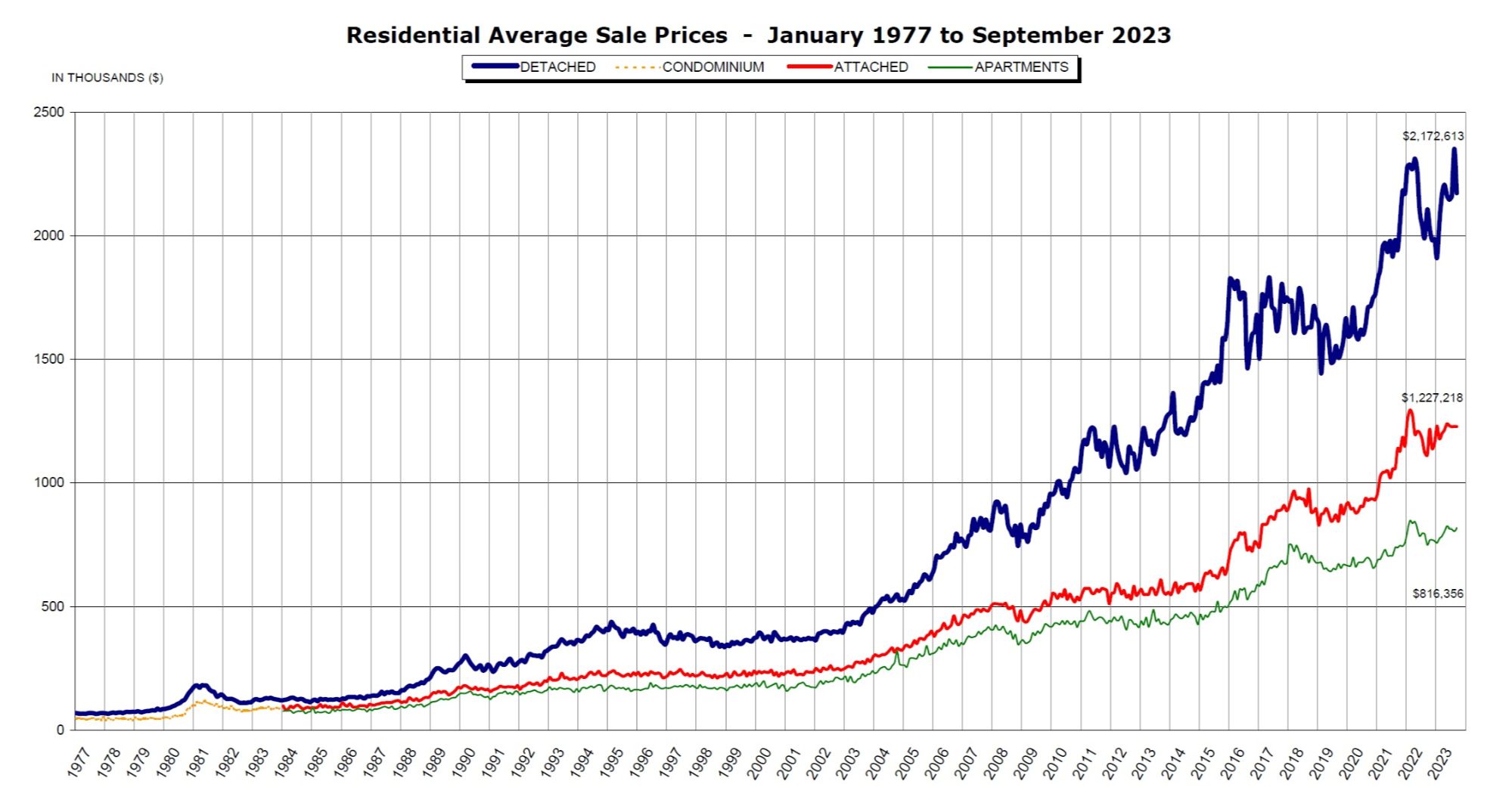

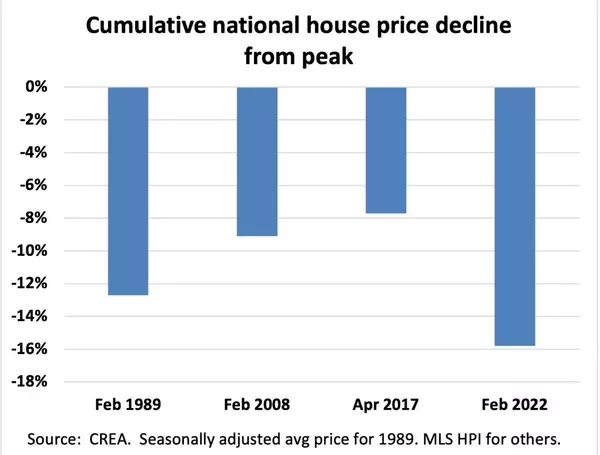

- Prices have dropped for the second month in a row, with September's price at -0.4%. (August's price drop was -0.2%). Albeit minor, these drops may gain momentum towards the end of the year.

Here are the in-depth statistics of the September:

- Last month's sales were -26.3% below the 10 year September's sales average.

- Month by month residential home sales dropped by -19.5% compared to August 2023.

- Month by month new home listings increased by +7.2% compared to August 2023.

- Last month's price adjustment was -0.4% compared to August 2023.

- Sales-to-listing (or % of homes sold) ratio is 17.7%. By property type, the ratio is 12.6% for single houses, 21.6% for townhouses, and 21.3% for apartments/condos.

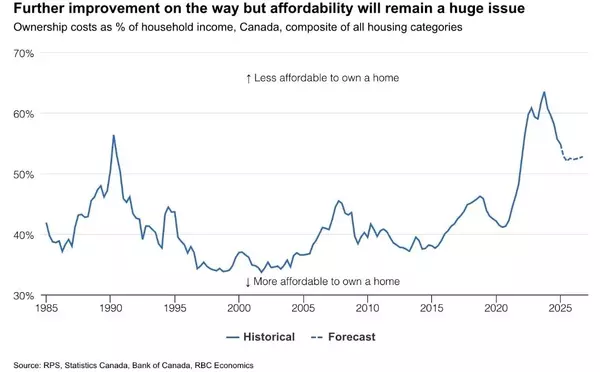

When it comes to single houses, the word "affordability" rings loud and clear to the average Canadian household. Last month, we continue to see the single house sales ratio (% of homes sold) drop to 12.6% (compared to 14.2% in August). Albeit this is a minor drop, this segment is starting to edge closer to the Buyer's market. Noteworthy is that single houses has been one of the most polarizing segments across the board. Currently, the average Greater Vancouver single house price sits at $2m, and needless to say, the average family has a hard time qualifying for that in the current environment. At the same time, we saw in September the luxury market rebounding, with three single houses sold in last month between $15-$20m in West Vancouver. Was this just the seasonality, or was it a sign of things? I believe it was the latter, as the wealthy are once again proven to be beyond the constraints of such high interest environment. When the right opportunity presents itself, they will capitalize on it. By the same token, average Buyer looking for for homes under $2m in Greater Vancouver is still quite active. I've been to open houses where the home was competitively priced, and there were many groups showing up. That tells me the Buyers have not left the market but are simply in a observing/holding pattern. They may have their down payment sitting in a one-year GIC making 6%, and when the right home at the right price comes up, they will make a move. The long term confidence in the Vancouver real estate market is there, although it may not look like it at the moment. For the month of September, the areas with the most price gains are all in the outskirts at Tsawwassen, Bowen Island and Sunshine Coast, at +3%, +2.1% and +1.1% respectively. Conversely, the neighborhoods registered the most significant price drops are all in Burnaby East, New Westminster, and Burnaby South, with -3.2%, -3.1% and -2.3% respectively. The detached home market continues to stay in a balanced market but is on the edge of a buyer's market, with average days on market remain nearly unchanged at 32 days (compared to 33 days last month), and month-to-month average price was also nearly unchanged at -0.1% (compared to +0.3% last month). Sales-to-listing ratio (% of homes sold) has dropped to slipped further to 12.6% (compared to 14.2% last month).

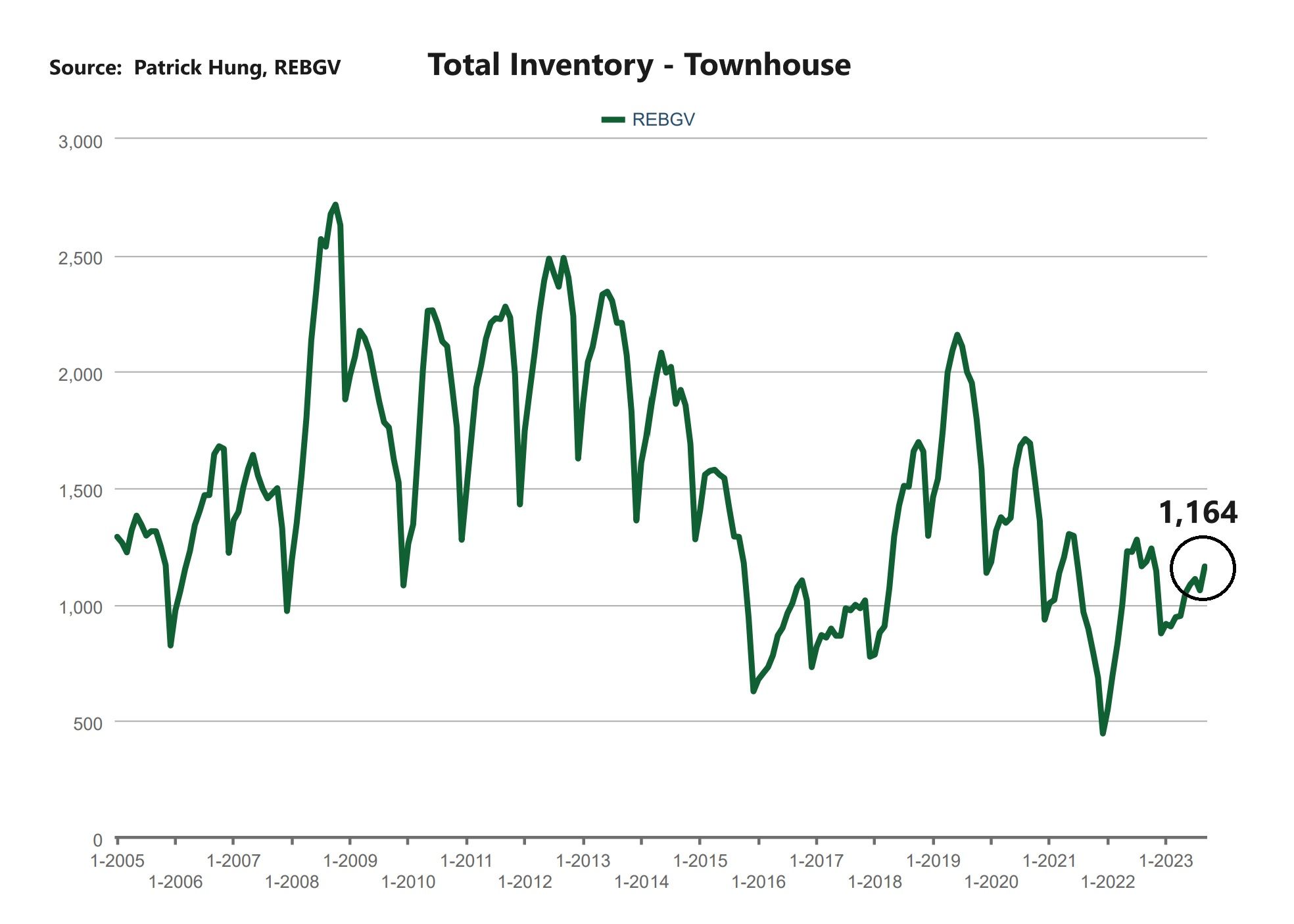

Surprisingly, the highly sought-after townhouse "missing middle" market has cooled down the most last month, with monthly price change of -0.5% in September (the most among all property types). Could it be that the high interest rates are finally catching up to the Buyers and upsizers? Possibly, and it's not hard to understand. The recent rate hikes in June-July had the Buyer's locked in their rates at 4.99%, with the 90 day expiry. In September, that was when they have either made the purchase, or these favourable rates have lapsed. The latter would've pushed these would-be buyers to the sidelines, as the latest rates are north of 6.5%. Having said that, inventory has increased significantly, going +9.2% last month, which is the most monthly increase in the past 18 months. These signs are pointing towards a balanced market as Buyers continue to hold off their plans. For the first two weeks of October, we saw less inventory coming onto the market, and that may be due to seasonality. The townhouse market may be slowing as inventory surge, but I wouldn't underestimate this segment as it has proven to be the most popular of all property types. In September, the areas with the most townhouse price growths are Tsawwassen, Ladner and Maple Ridge, at +2.4%, +2.1% and +1.5% respectively. Conversely, the neighborhoods with the most significant price drops are in all in the outskirts in Whistler, Squamish and Sunshine Coast, -3.7% and -3.5% (tied 2nd and 3rd) respectively. The townhouse market remains in the Sellers market but is on the edge of a balanced market, with average days on market increasing slight at 23 days (compared to 22 days last month). Month-to-month sale price dropped by -0.5% (compared to -0.1% last month). Sale-to-listing (% homes sold) ratio also dropped significantly to 21.6% (compared to 30.3% last month).

Apartment and Condo Market

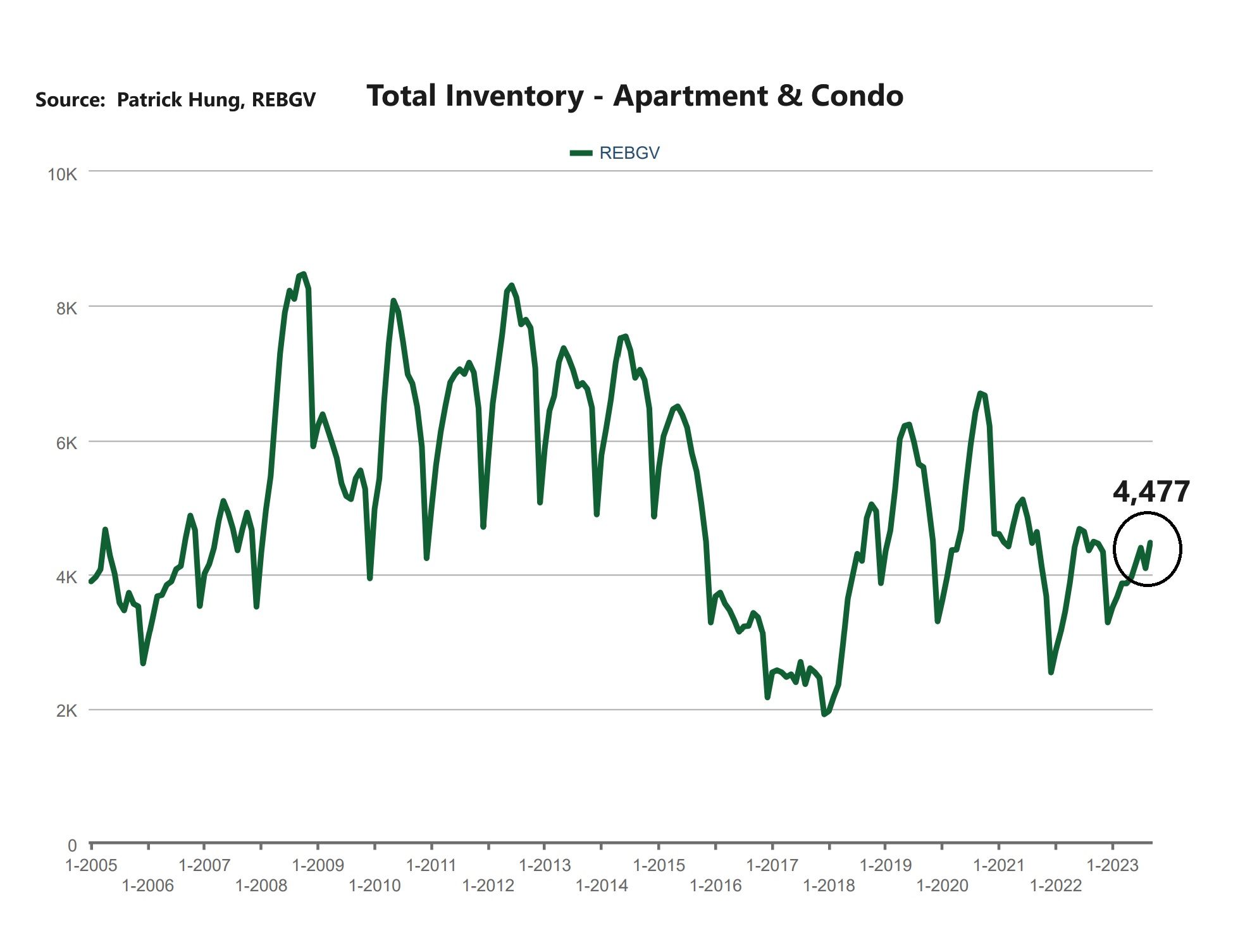

The apartment market was caught in an awkward spot last month, where most area registered price drop (although minor) and inventory has increased by +8.9%. With that in mind, the first-time home buyers in this segment has been anything but squeezed out by the higher rates. The Sellers, who needs to sell in order to upsize, face with the same dilemma where if they can't sell, they can't buy. Plans A and B are as stuck as they can be. Investors in this sector have all but vanished, and that is expected given the average real estate ROI (return on investment) is 3-4% annually, but these investors can now simply put their cash in 1 year GIC for 6%. By the same token, month-to-month apartment sales in Vancouver have plummeted by a whooping -29%. It is evident that there are far fewer first time home buyers and investors, which make up for a good portion of apartment purchasers. For this reason, the downward price pressure remains high for apartment in the months to come. I do believe that once the rates starts dropping, the prices of apartments will be the first to shoot up. For the month of August, the best performing neighbourhoods for apartments are all in Tsawwassen, Ladner and Richmond, posting +1%, +0.6% and +0.4% gains respectively. Conversely, the areas with the price drops were Sunshine Coast, Whistler, and West Vancouver, with -2.7%, -21%, and -1.9% respectively. Similar to the townhouse market, the apartment and condo segment remains a Seller's market but is very close to a balanced market, with average days on market increasing slightly to 25 days (compared to 24 days last month). Month-to-month sale price is nearly flat at -0.2% (same at -0.2% last month). Sale-to-listing (% homes sold) ratio dropped significantly to 21.3% (compared to 31.9% last month).

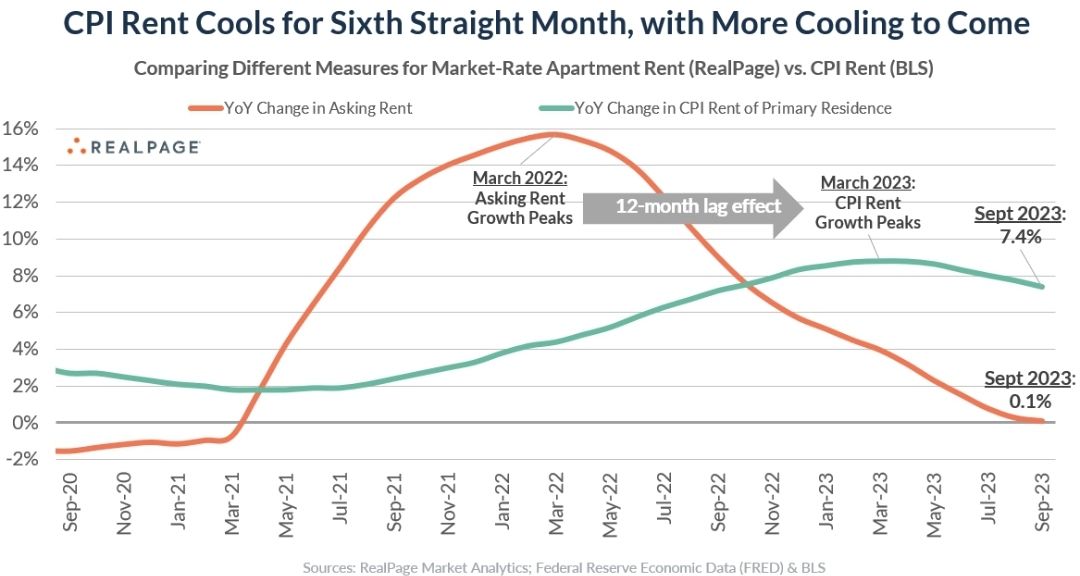

1. Cooling Shelter

Sheltering cost, including rent (but not mortgage), make up for largest category (34%) of the Canadian CPI. As rental rates go down, so will the CPI, just that it's lagging in nature. Note that CPI shelter is unique in that its primary variable (rent) is not real time like food, gas, etc. As we are witnessing that rental cost is starting to shift down, we should be expecting a lagging indicator that the CPI would also go down. However, given the open-door immigration policy Canada has, I wouldn't hold my breath for this rental drop pattern to persist for long. Overall, sheltering cost may drop but will most likely come back up shortly. (Source: RealPage Market Analytics, Federal Reserve Economic Data)

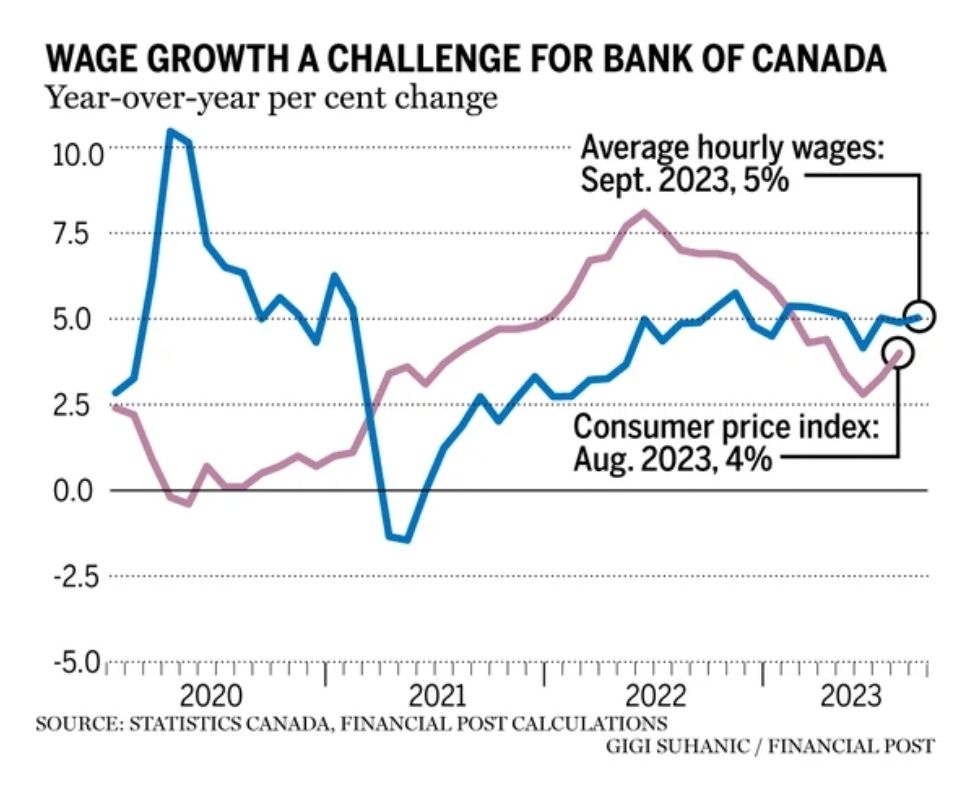

2. Still Sticky

The latest unemployment rate ring in at 5.5%, which is still considered low. Looking ahead, most companies continue to trim budget and stay lean, and one may expect the unemployment would gradually climb higher. Diving deeper, average hour wage gain remain sticky at +5%, which is above CPI's +4%. The vicious cycle between rising wages and inflation continue to ravage the Canadian economy. (Source: Financial Post)

3. Dirty Work

Canadian bonds, which is linked with the mortgage rates, has spiked nearly .50% in a matter of 18 days. Such volatility has caused major banks to increase their lending rates upwards of 7%, which is the highest in 22 years. Even if the Bank of Canada doesn't raise rate, the bond market is already doing the dirty work for them. The good news is that bond rates has since dropped, but it remains to be seen how volative it can be. (Source: Investing.com)

Recent Posts

GET MORE INFORMATION