Real Estate Market Intelligence September 2023

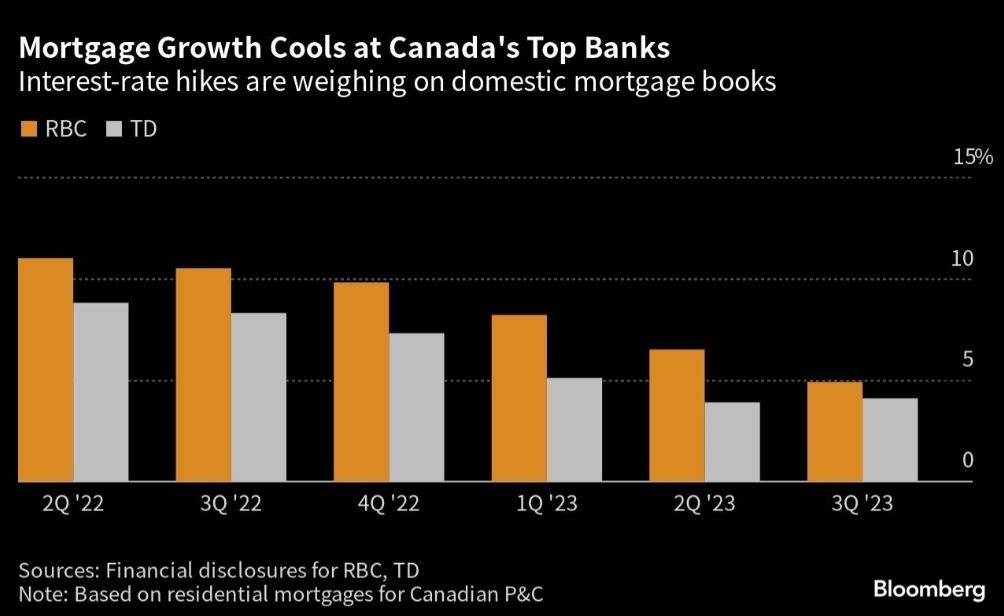

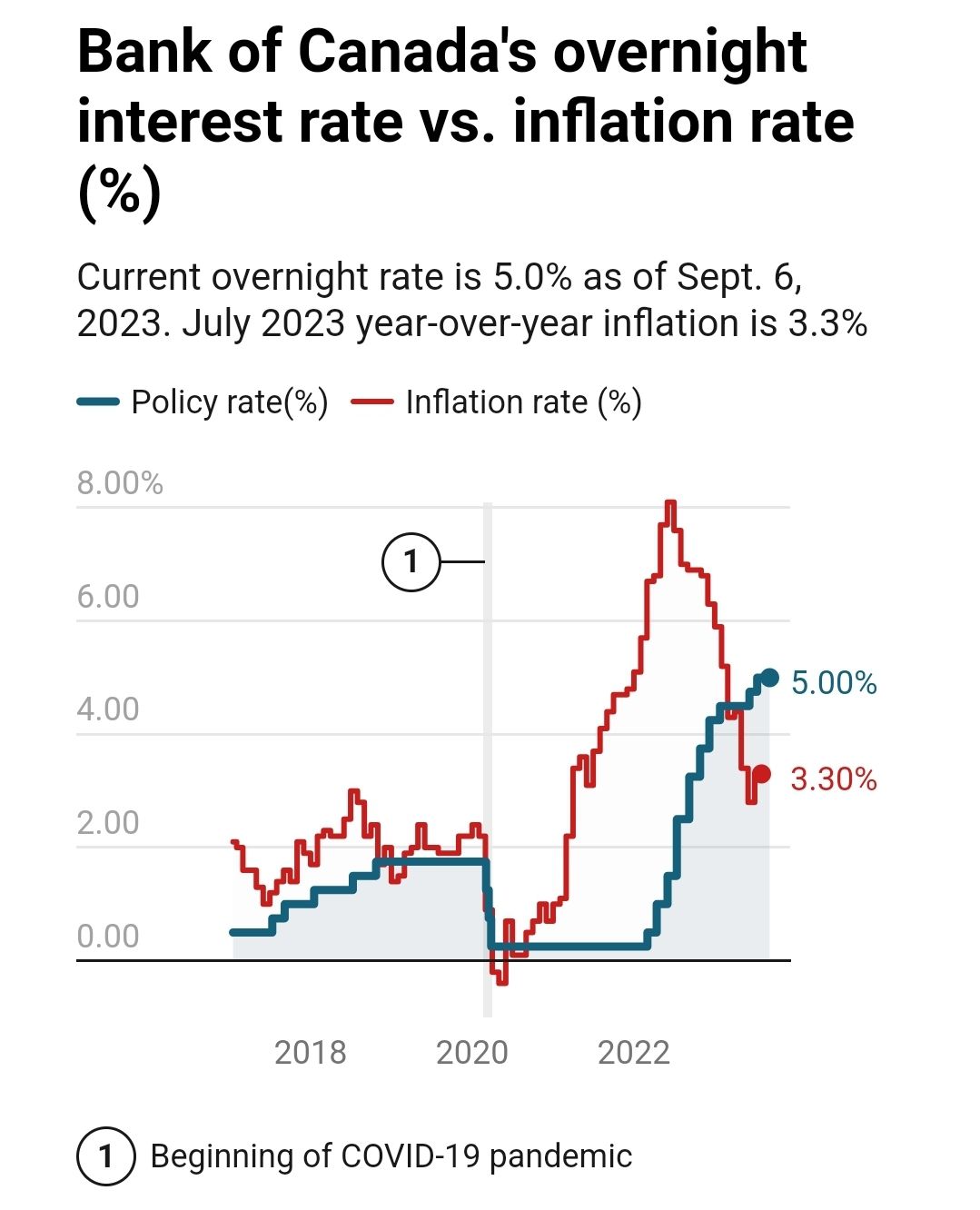

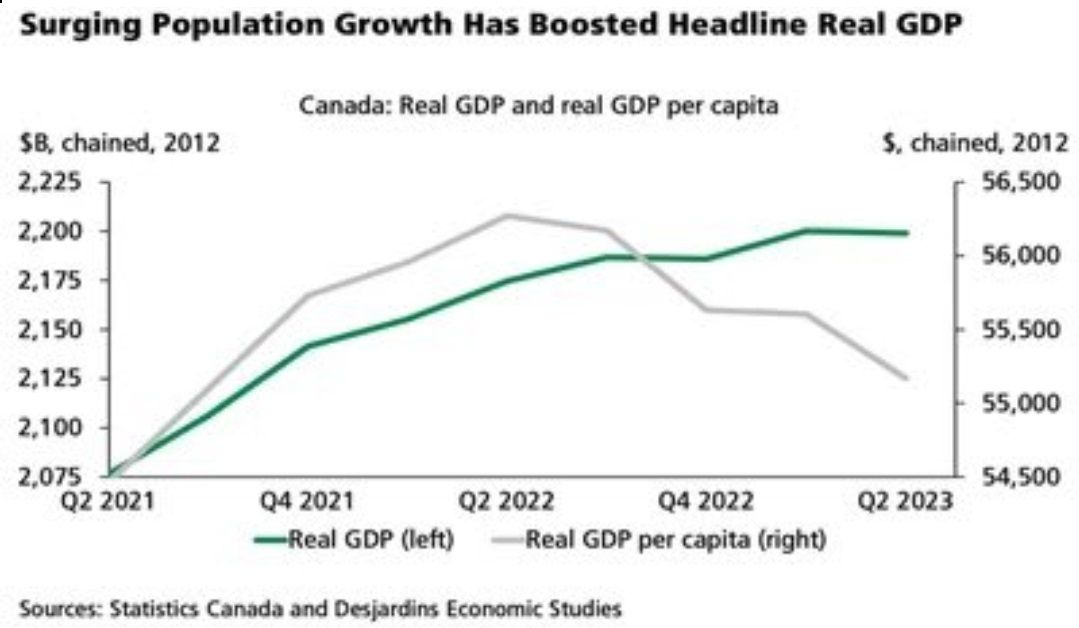

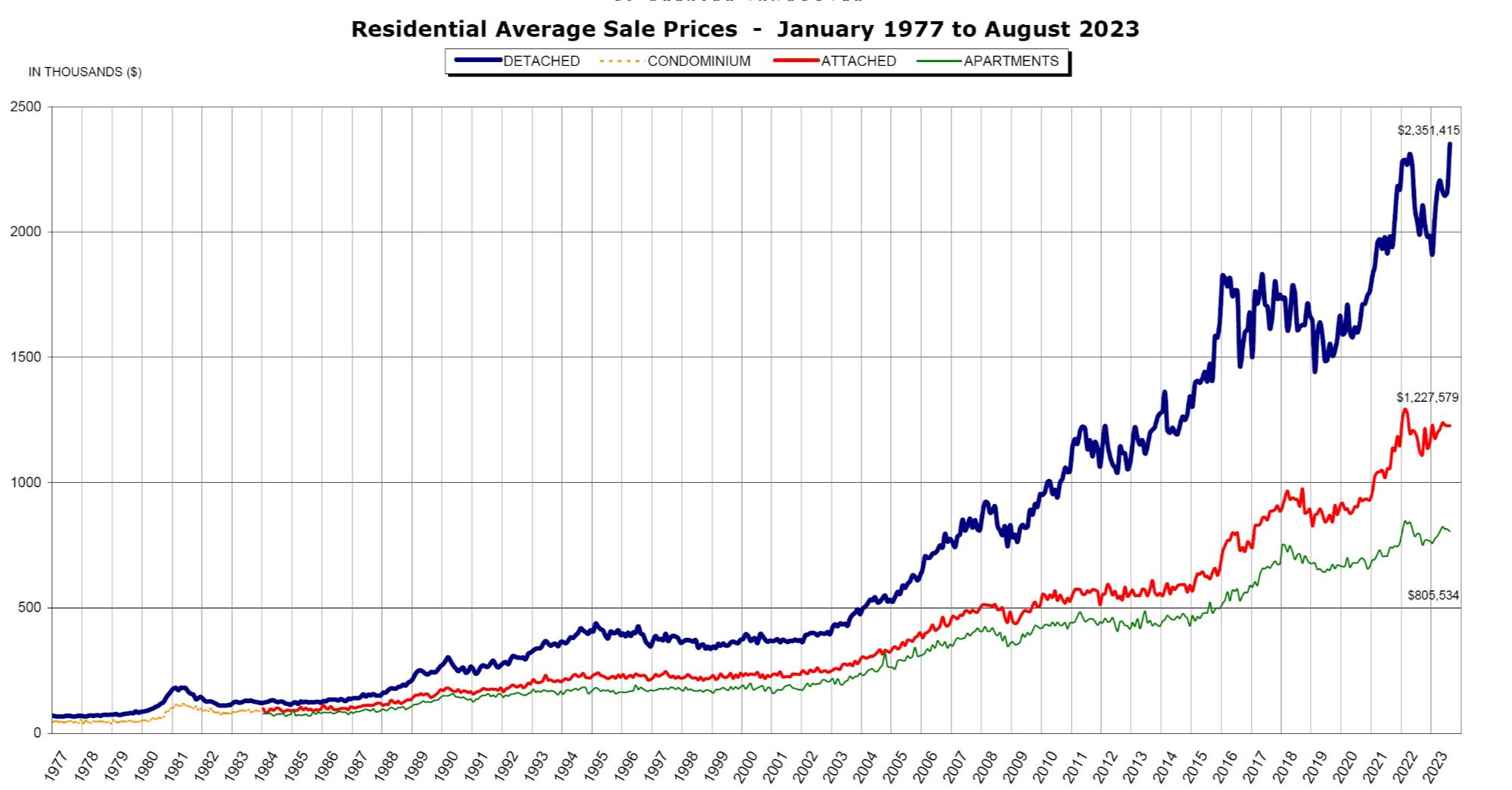

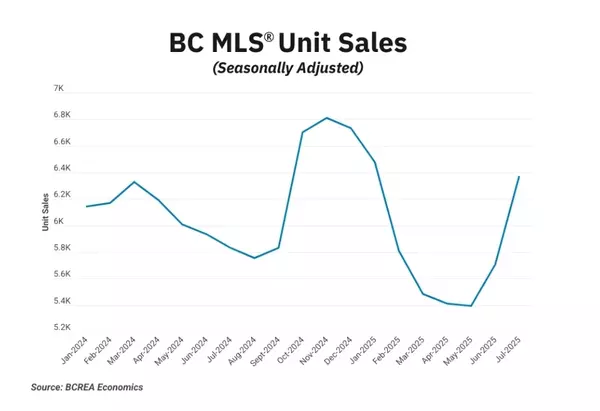

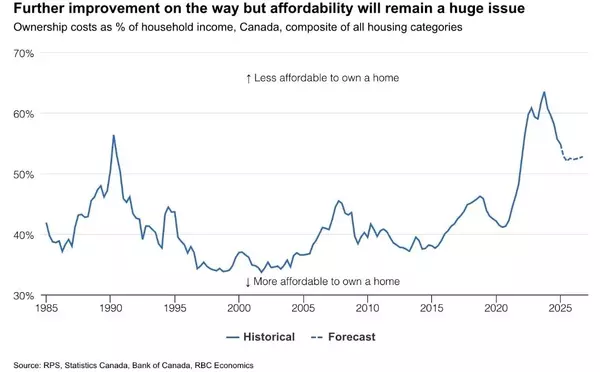

Hope you're enjoying the tail end of summer. From hindsight, the summer market has been a volatile one. From June to July when the Bank of Canada's hiked rates, Buyers sentiments shifted quickly in a market that was already losing steam. In August, prospective Buyers and Sellers ghosted the market or entered into vacation mode. This could be due to seasonality, and it has caused the market to normalize a bit, with supply catching up to demand and prices started to level off. Since September, we are seeing the market continue to polarize under the interest rate vice. On one hand, Sellers cannot sell because they, too, cannot find anything to buy, and they won't sell unless they find something that they can move into. On the other hand, Buyers struggle with the higher rates as well with the limited supply. The high interest rate environment has got many stuck in their homes. Prices gains are starting to fade, with August's being the first month in 2023 to register a price drop of -0.2%. Noteworthy is that this year, we have already seen prices jumped over +8%. I believe the upward cycle for this year is over, and I expect the price trend downwards till end of this year or early next year. With the latest Bank of Canada's rate hold announcement, we are starting to see Buyers returning more cautiously this time around. With most mortgage rates upward of 6% or higher (8% qualifying rate), there is no doubt that mortgage growth at it slowest since 1990's. On the streets, open house traffic are starting to pick up in September, and multiple offers starting to pop back up with many listings priced very competitively. We are witnessing a turn of winds as some Sellers are looking to others to the market. As for new listings, the first week of September we saw many "new" listings that were expired and relisted. Comes the second week of September, and we saw a lot of true new inventory that has not been seen in a long time. A cautious note that more listings does not translate into more sales. It seems that for the rest of the year, sales would be approx 15% below 10 year average. Sellers who has the ability to weather the high interest rate environment may elect to hunker down till the Spring market. On the economic front, based on the inflation data and its base-rate effect from last year, we will most likely be seeing 3.7% to 4.5% of inflation by end of this year. Also, Canada's August employment data came in stronger than expected, remaining steady at 5.5%. With these factors in mind, I believe the Bank of Canada will be holding rates for the remainder of the year, unless something drastic happens. As we know, the Vancouver real estate market remains highly volatile, but one thing is for sure is that when the Bank of Canada does cut rates (expected to be sometime next year), Buyers demand will roar back. But for now, we can take a breather.

Some of the unique trends I've been observing:

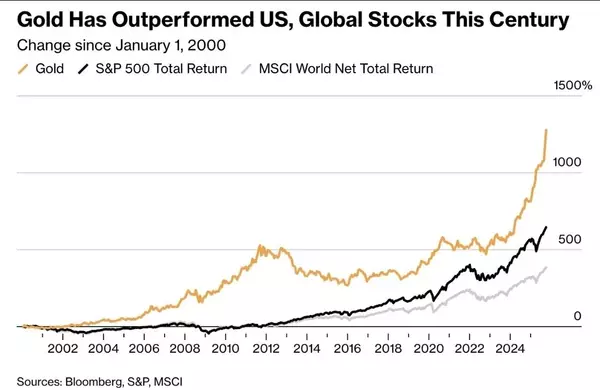

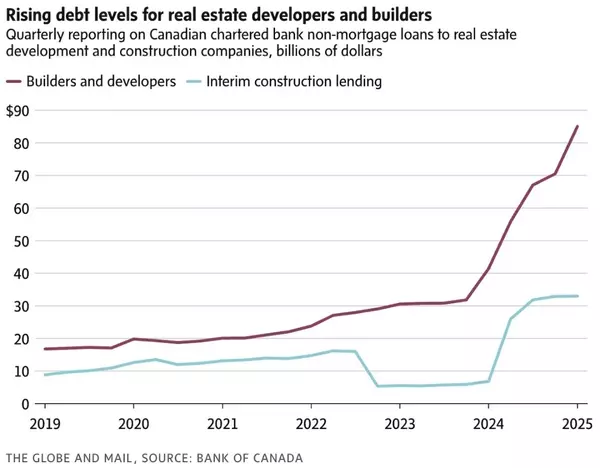

1. Real estate investors has pretty much fled the scene as they choose to stay liquid, and banks offering 1 year GIC's close to 6% are helping them achieve just that.

2. BC rent increase rate capped at +3.5% for 2024, while the 12-month average inflation is +5.6%. Tenants will rejoice as their grand-parented rates are protected, while landlords will scream foul as their monthly negative cash flow continues. Should the government let the free market dictate how much rent should be?

3. On Thursday Sept 14, the City of Vancouver had a public hearing with more details for the newly-proposed four-plex and six-plex zoning. Zoning density will depend on how many rental units, size of the land, back-lane, along with and other considerations. Many questions remain, but we know that new rules will be rolled out on Jan 1, 2024. Investors and developers, who recently have moved to the sidelines, are paying very close attention as the landscape continue to shift quickly.

4. For the first time this year, real estate prices have dropped in August, going -0.2%. Some sellers are starting to list their homes below market value (with multiple offers) in the hopes of getting it sold before the winter season. Expect downward price pressure to continue towards the end of the year.

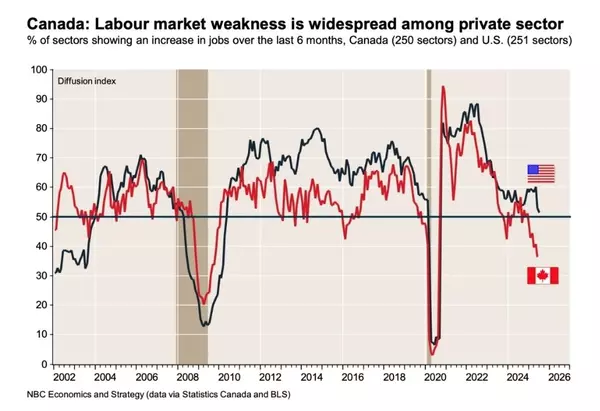

5. August unemployment rate is holding steady at 5.5% (up slightly from 5.4% the month before). Having said that, major firms and banks has had their layoffs, and they will continue tightening their belts as the economy deals with higher rates longer.

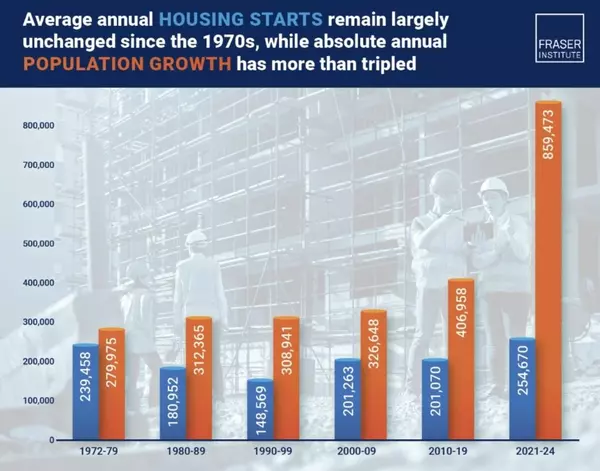

6. Benjamin Tal, one of the CIBC's Chief economist, has stated that over 1 million non-residents in Canada has not been reported by Canadian Immigration. This was later confirmed by the government as a mistake in their calculations by not taking into account the non-residents who overstayed after their visa had expired. This may be one of the most embarrassing miscalculations by a developed country.

Here are the 3 highlights for August:

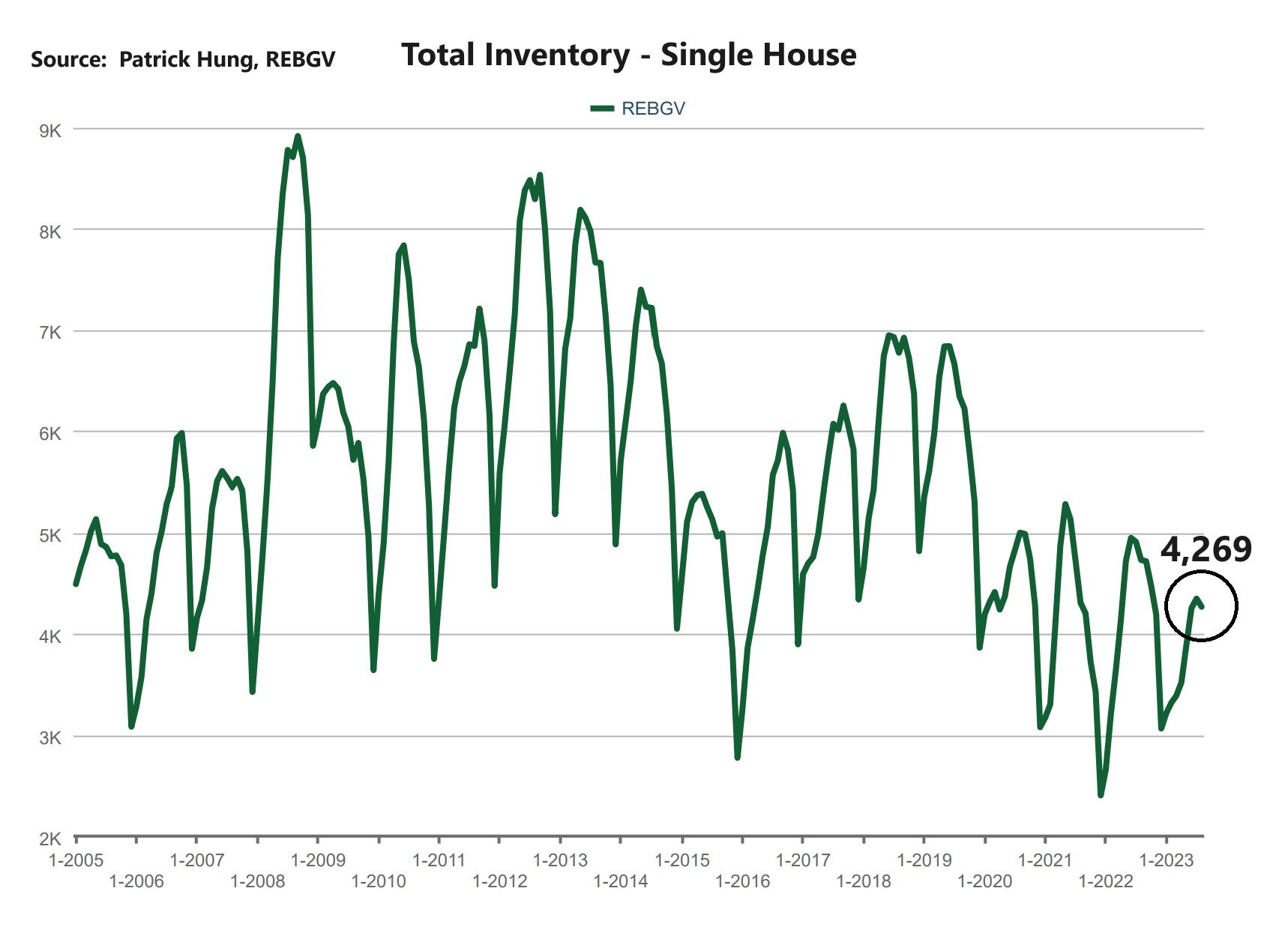

- Sales are slightly below the 10 year average, while total inventory remains low.

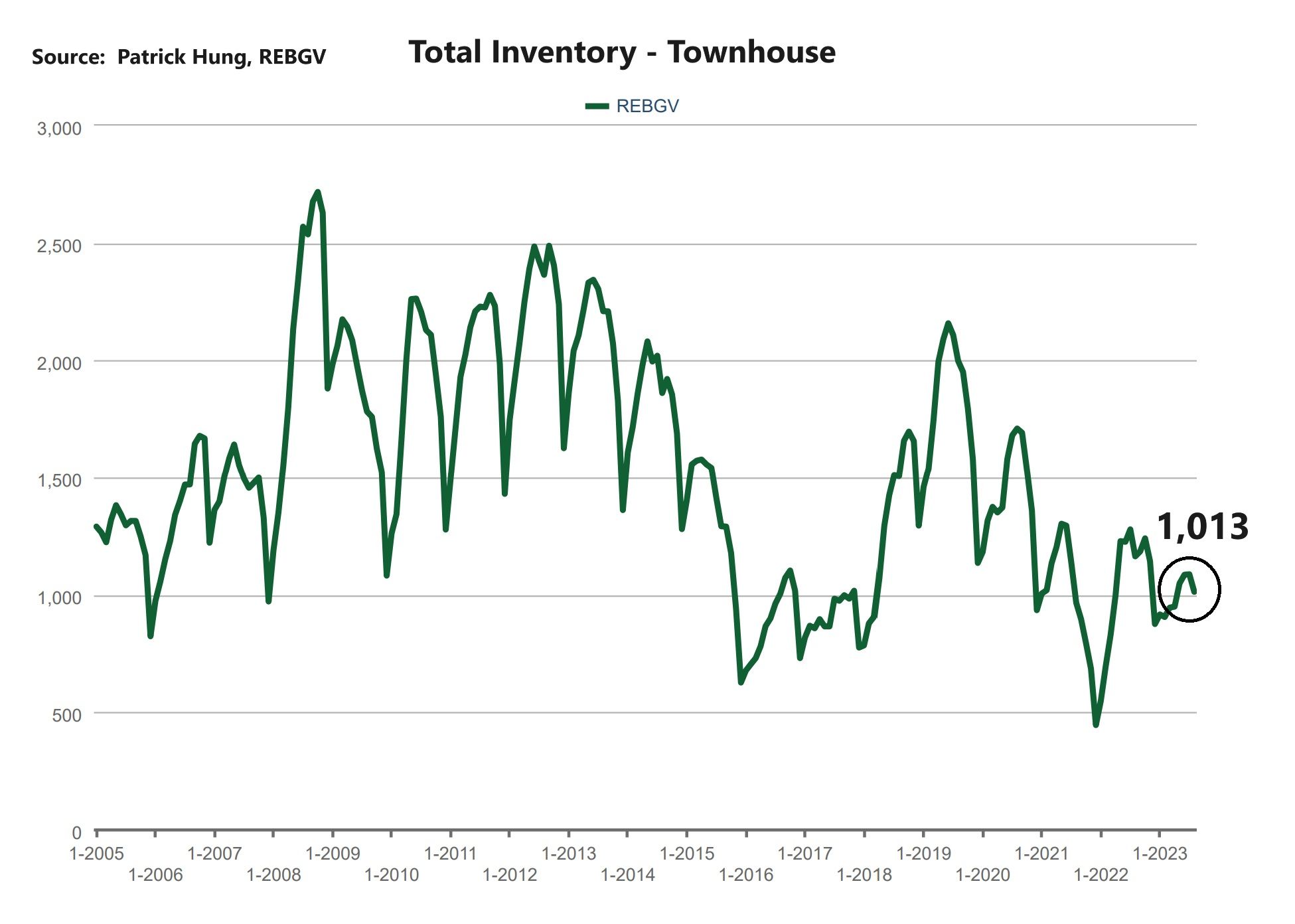

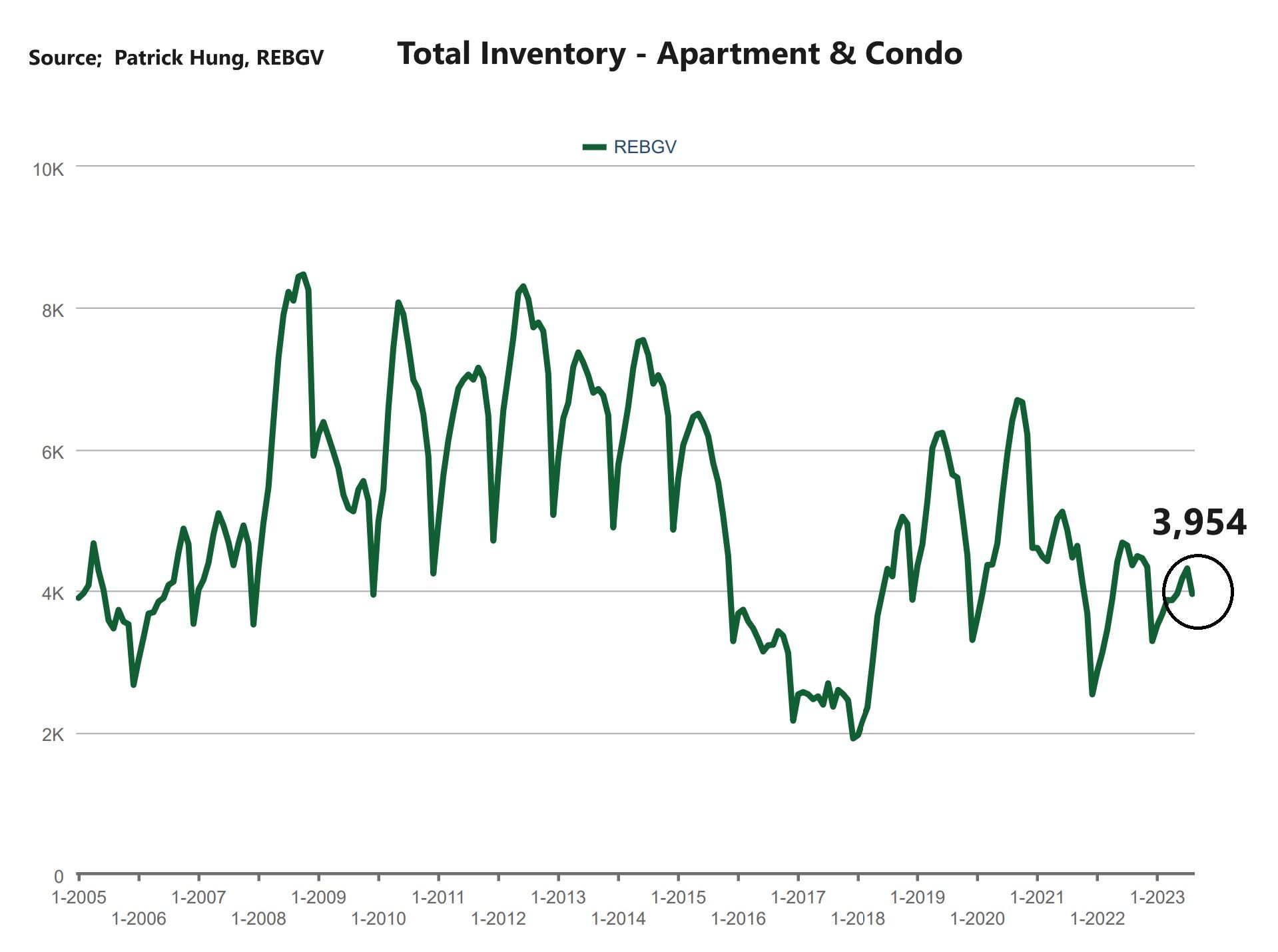

- Supply is slowly replenishing. Single house market is entering into balanced market and edging close to the Buyer's market, while townhouse and apartment remain firm in the Sellers market.

- For the first time this year, monthly price has dropped in August by -0.2%. (July's price increase was +0.6%)

Here are the in-depth statistics of the August:

- Last month's sales were -13.4% below the 10 year August's sales average.

- Month by month residential home sales dropped by -6.1% compared to July 2023.

- Month by month new home listings decreased by -17.8% compared to July 2023.

- Last month's price adjustment was -0.2% compared to July 2023.

- Sales-to-listing (or % of homes sold) ratio is 23.9%. By property type, the ratio is 14.2% for single houses, 30.3% for townhouses, and 31.9% for apartments/condos.

Even when Bank of Canada held the rates, single houses remain the most unaffordable (yet most desired) property type, so it doesn't come as surprise that this segment is at a standstill and is the first to be in the balanced market. The sales ratio (% of homes sold) for single house in August is 14.2% (compared to 16.5% in July), and continues it's downward trajectory. This means single house inventory is starting to accumulate, but where are the Buyers? Last time when the there was a rate hold announcement 9 months ago, the market responded with feverish activity. Well, that was heading into a Spring market. This time around, the rate hold has given the Buyer somewhat of a confidence boost, albeit very little. In August, single house open house traffic was slow, and that was expected as this is the first summer for full global travelling to resume. Buyers and Sellers alike has taken their real estate plans to the back-burner. It is safe to say that this latest price jump cycle for single house has come to an end, and we are already seeing price polarity shows in different neighborhoods. For example, Burnaby East had their minor first minor price drop by -1.1%, whereas Vancouver West sees at +1.8% increase. As one would expect the single house market price to trend downward till the end of the year, the main question is, how much? For the month of August, the areas with the most price gains are Vancouver West, West Vancouver, and Port Coquitlam, at +1.8%, +1% and +1% respectively. Conversely, the neighborhoods registered the most significant price drops are all in the outskits at Whistler, Squamish and Sunshine Coast, with -6.1%, -5.3% and -3.8% respectively. The detached home market continues to stay in a balanced market, with average days on market dropping further to 33 days (compared to 29 days last month), and month-to-month average price are up slightly at +0.3% (compared to +1.1% last month). Sales-to-listing ratio (% of homes sold) has dropped to slipped further to 14.2% (compared to 16.5% last month).

Townhouse market, similar to apartments and condos, are holding firm in the Sellers market. New listing is coming but there remains very little to choose from, mainly because this is where all the young and growing families crowd into. There are hardly any new construction for townhouses, and that will remain in the same in the near future. August month-by-month inventory dropped by -6.7%, and that could be contributed to seasonality. Townhouse new listings continue to dip, going -16.7% on a month-to-month. With the City of Vancouver's new four-plex policy's public hearing on Sept 14th, details has been hashed out and the townhouse and 4-plex to 6-plex homes will solving the missing middle crisis in Greater Vancouver. We will have to wait till Jan 1, 2024 for those to be fully implemented. On the street, entry level townhouses such as $800-900k in Fraser Valley, remain active. As for other regions, price ranges in the $1m in Ladner/White Rock, $1.1m in Burnaby/Richmond/Coquitlam, and $1.5m-1.6m in Vancouver, were getting little traffic in August but is starting to creep up starting September. Price polarity between neighborhoods (Whistler +3% vs. North Vancouver -2.9%) are also showing signs that market is starting to turn. However, expect the townhouse market to stay in the Sellers market in the foreseeable future. In August, the areas with the most townhouse price growths are Whistler, Sunshine Coast and Port Moody, at +3%, +2.9% and +2.8% respectively. Conversely, the neighborhoods with the most significant price drops are in North Vancouver, Port Coquitlam and Richmond, at -2.9%, -2.2% and -2% respectively. The townhouse market remains in the Sellers market, with average days on market increasing slight at 22 days (compared to 18 days last month). Month-to-month sale price stayed nearly flat at -0.1% (compared to +0.5% increase last month). Sale-to-listing (% homes sold) ratio also slipped slightly as well to 30.3% (compared to 32% last month).

|

Here are the Three Trends I'm Observing:

2. Payback

3. Masking

|

Recent Posts

GET MORE INFORMATION